CBA accused of ‘gouging’ thousands of customers on interest rates

A Boomer has hit out at one of Australia’s big four banks for causing customers a “huge” amount of financial pain, while it rakes in record profits.

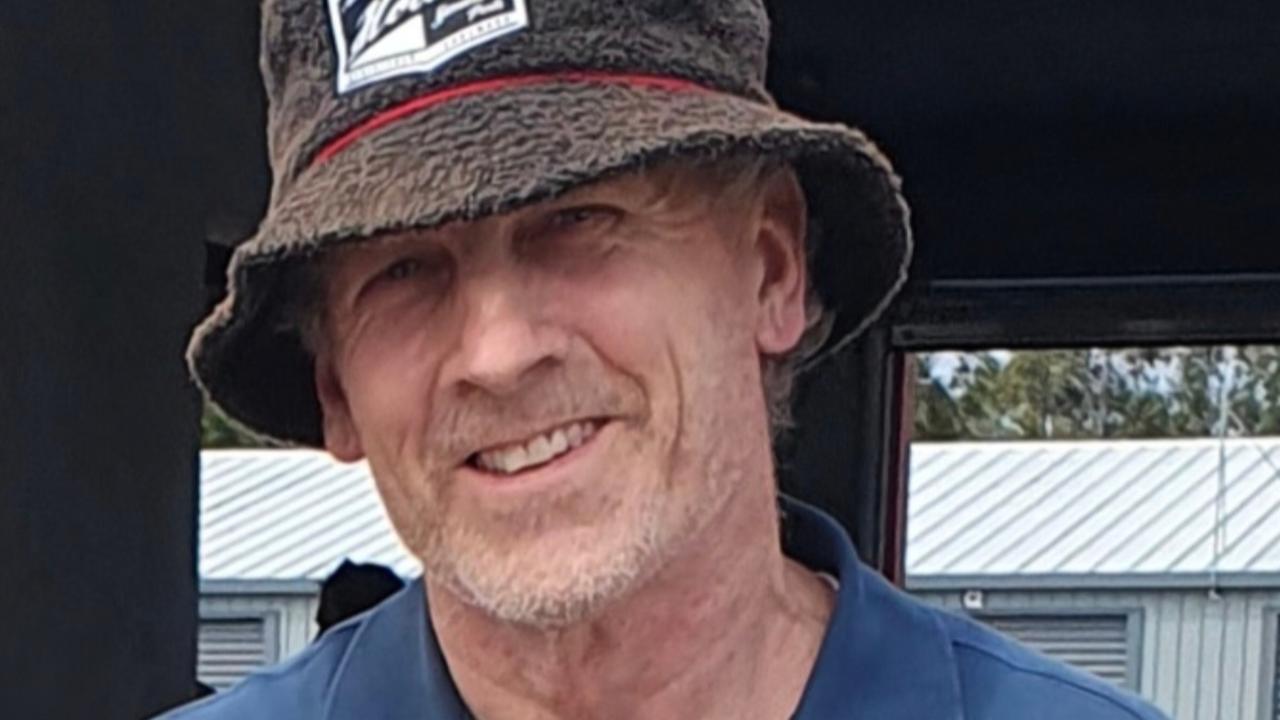

A Boomer, who owns two properties worth $3 million, has hit out at the Commonwealth Bank for “gouging” customers with skyrocketing interest rates after making record profits — with concerns many homeowners would be in a “much worse” situation compared to him.

Bryan O’Donnell purchased a house in Melbourne in 1996 for $560,000, which is now worth between $3 million and $3.2 million, he said.

He also owns an investment property that he purchased in Brisbane in 2006 for $2.1 million, which is valued at around $3 million now.

The 61-year-old is highly critical of the Commonwealth Bank, which reported a record $5.15 billion in first half profits, for the “horrific” practice of “overcharging” existing customers on their home loans.

Mr O’Donnell said he had lost his job during Covid and spent 18 months out of work, which he said was a “big shock” and “depressing” – and is sure many other Australians were in a similar situation.

While he was able to pause his mortgage repayments when he was without work as his “debt to equity ratio is really good”, he said CBA told him the repayments would be added back on to total cost of his loan balance.

But he said his situation turned into a nightmare, which has also impacted his current interest rates.

He claims he had “huge problems” with CBA demanding that $150,000 worth of interest be repaid, which was “very stressful”.

Mr O’Donnell said he initially refused to sell other investments to pay off the outstanding interest.

“We have been fighting about that for 12 months now … and they constantly put late fees on my loans … Then one of my investments that I wasn’t prepared to sell, I got to a point where it was acceptable to think about selling and I sold it recently and ended up paying back the money they were chasing,” he said.

“It’s been horrific. I can only imagine how bad it’s been for people in a different situation … There would be thousands of people who had gone through the same nightmare as myself but I’m lucky to have enough financial strength and backing.”

The experience had a knock on effect with Mr O’Donnell unable to refinance and change banks with CBA refusing to drop his interest rates, he said.

The Australian said he was “sick” of paying an interest of around 6.12 per cent for the home he lives in when new customers are offered a rate of around 4.4 to 4.6 per cent – something he describes as “exploitation”.

He said he is also paying interest rates of approximately 6.65 per cent on his investment loan, which was “ridiculously high” compared to the market rate of around 5 per cent – claiming he’s paid between $280,000 and $300,000 more for the higher interest rates.

Overall, Mr O’Donnell said his mortgage repayments on the higher interest rates mean the CBA are effectively “getting a third more of out me than I should be paying”.

“If there are thousands of people they are doing that to that’s a huge amount of profit they are making,” he said.

He added there are various reasons why it’s not feasible to switch loans.

“One when I didn’t have a job, it was hard to get a mortgage so CBA have been gouging thousands of customers for that very reason,” he said.

“They know they can’t switch as they don’t have a permanent job and that another bank wouldn’t take on the mortgage and they have taken advantage of that … They have you captive and they will overcharge you on interest.

“I know I’m just one of thousands of people in a similar situation. Some would have caved in and been forced to sell their home. What the CBA has done to people like myself is horrific.”

There are an estimated tends of thousands of Aussie who have become mortgage prisoners – meaning they are struck with their bank – because the value of their house has slumped or the huge spike in interest rates means they do not meet the lending criteria for other banks.

Meanwhile, customers like Mr O’Donnell have to watch as banks court new customers by offering deep discounts on interest rates and cashback offers of up to $6000 – while existing customers are trapped without any chance of special treatment.

The energy industry worker said he wanted banks to be “fair” rather than capitalising on people who are in “the most amount of pain”.

“CBA have been gouging thousands of customers which is why CBA is making massive profits,” he claimed.

“The reason I’ve been able to survive is I had a massive amount of equity, I was up to about 70 per cent of equity and have other investments and I was able to monetise investments but normal regular people don’t have that.

“I’ve been able to accumulate that by investing wisely but regular people have a house and job and make house payments and they, in my situation, would become incredibly stressed because they are in a very precarious financial situation.”

He added that people shouldn’t need to switch banks to be treated “fairly and equitably”.

“Refinancing $2.4 million worth of loans isn’t simple. There is lot of stuff you have to do and a lot of review, it’s not as simple as people make out,” he said.

“Properties have to be valued, banks have to assess the risk of your work situation and if you spent half of last three years out of work you become a risk. It’s not as easy as you think and that’s what CBA are capitalising on.

“There are going to be thousands of people in a similar situation with rising interest rates but in reality they will be in a much more worse similar situation and have much higher stress.

“CBA is immoral as they are gouging people who are least able to deal with it as they aren’t able to switch banks.”

Mr O’Donnell said he was “keen to help thousands of others” who found themselves in a similar situation to him.

“My story is the same as thousands of hard working Australians struggling with home loan rates that are inflated by CBA,” he said.

A CBA spokesperson said they could not comment on a customer’s personal situation but said they are focused on ensuring it provides customers with the support they need to help them navigate the changing economic environment.

“Over the last six months, the Australian mortgage market has become increasingly competitive, delivering better price-based offers to both existing and new customers. At the same time, funding costs have increased significantly and some home loans in the industry are currently written below the cost of capital,” they said.

“When pricing our home loans, we consider a range of factors, including the current monetary policy setting, the funding environment and a customer’s unique lending situation.

“Last year, as part of our ongoing commitment to deliver pricing transparency for all customers, we started proactively highlighting the different interest rates available to customers based on their loan to value ratio for standard variable rate home loan applications.”

In its 2023 half-year result presentation, CBA revealed there was $3.2 billion of homeowners with no mortgage insurance, who could be in trouble with rising interest rates, while there is $2.1 billion in a situation where debt to loan value ratio is between 80 and 90 per cent.

A further $1.1 billion have a debt to loan value ratio of more than 90 per cent, meaning there is no chance of refinancing.

The RBA have estimated there is $400 billion of fixed-rate mortgages set to roll off ultra low fixed rates this year, with almost one million Aussies expected to be impacted.