Cash rate rise could see mortgages rise by whopping $1250 a month

The inflation spike has left many Aussies in a precarious position – and the knock-on effect is truly worrying for mortgage payments.

ANALYSIS

With inflationary pressures rising across Australia, almost every economist in the country expects the Reserve Bank of Australia (RBA) to soon begin lifting Australia’s Official Cash Rate (OCR) from its current record low level of 0.1 per cent.

My best guess is that the RBA will hike in June after the federal election once it has received all of the March quarter Consumer Price Index (CPI), wage growth and national accounts data.

Regardless, Australian interest rates are on the cusp of rising, which will have significant implications for household mortgage repayments and house prices.

How far will interest rates rise?

Australia’s bank economists expect the RBA to lift the OCR by between 1.15 per cent (CBA) and 2.25 per cent (NAB), whereas the futures market is tipping a jumbo rise in the OCR of 3.4 per cent by August 2023 – the sharpest pace of increase in the world.

Accordingly, it would be safe to assume that the RBA’s monetary tightening would land somewhere within these two extremes – i.e. between the CBA’s 1.15 per cent forecast rise and the market’s 3.4 per cent forecast.

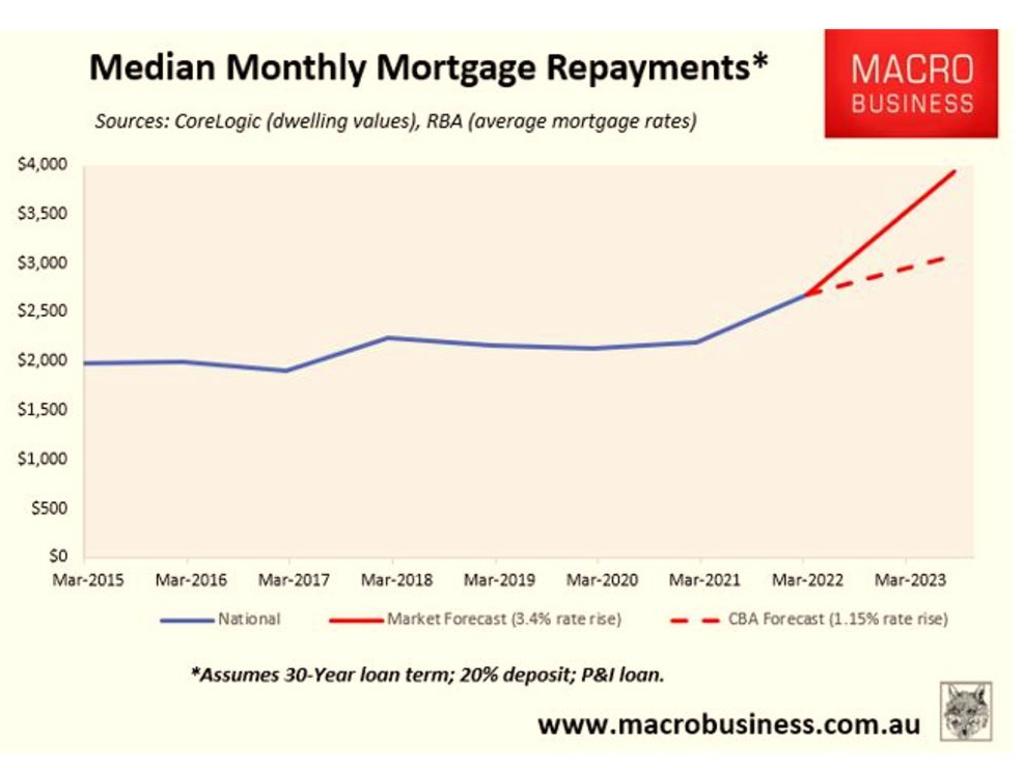

The next chart shows how monthly mortgage repayments on the median priced Australian home would be impacted if rates rose by the low-end (CBA’s) and high-end (futures market’s) forecasts, assuming a 30-year principal and interest mortgage and a 20 per cent deposit.

If the discount variable mortgage rate was to rise by 1.15 per cent to 4.75 per cent, as predicted by the CBA, then mortgage repayments would lift by 15 per cent from their current level, adding $400 a month in repayments on the median priced Australian home.

However, if the discount variable mortgage rate was to rise in line with the futures market’s projection (i.e. 3.4 per cent by August 2023), then average mortgage repayments would soar by 46 per cent, adding a whopping $1250 to monthly mortgage repayments on the median priced Australian home.

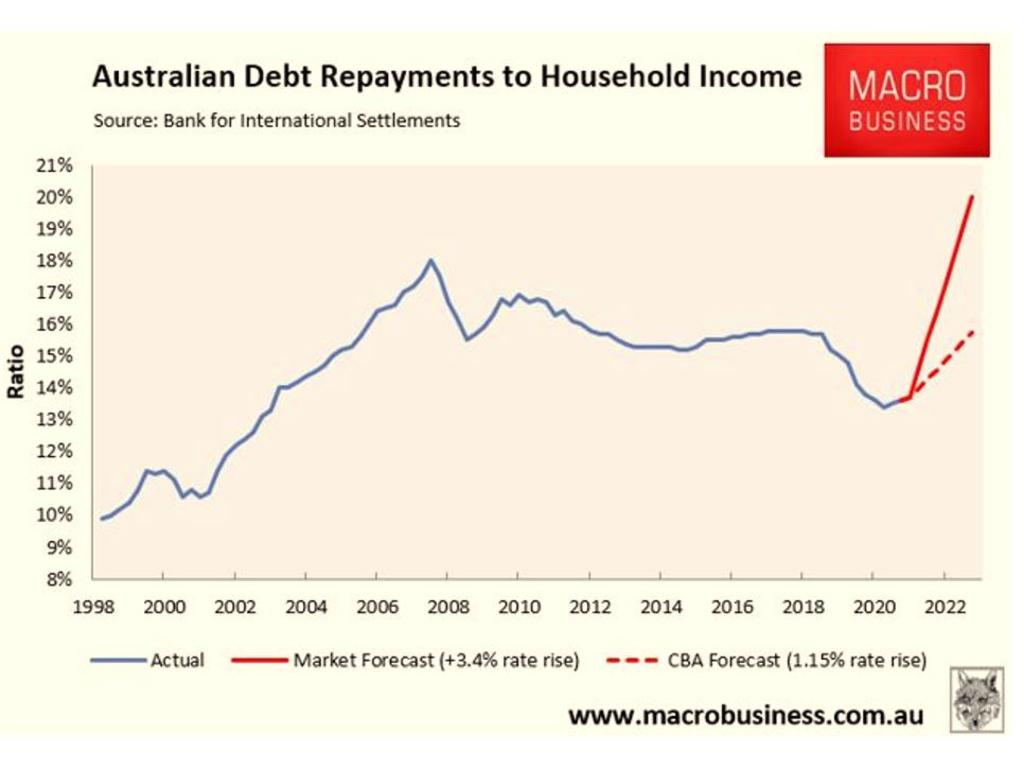

The CBA’s interest rate forecast would see Australia’s Debt Servicing Ratio (DSR) – defined as the percentage of household disposable income going towards principal and interest debt repayments – rise to its pre-pandemic level. Whereas the futures market’s projection would see the DSR soar way above the 2008 Global Financial Crisis peak.

How far would Australian house prices fall?

In its latest Financial Stability Review, released earlier this month, the RBA estimated “that a 200-basis-point increase in interest rates from current levels would lower real housing prices by around 15 per cent over a two-year period”.

Using the RBA’s modelling as a guide, the CBA’s 1.15 per cent projected rise in interest rates would lower real Australian housing prices by around 8.5 per cent over two years, or by around 15 per cent in nominal terms assuming average annual inflation of around 3.5 per cent.

The futures market’s 3.4 per cent projected increase in the OCR would ‘crash’ the housing market, with real housing prices falling by around 25 per cent in real terms and by more than 30 per cent in nominal terms, under the RBA’s modelling.

Trust the CBA on rates, not the market

I am firmly in the CBA’s camp on interest rates for the simple fact that Australians are carrying huge debt loads and are so sensitive to interest rate rises that any larger increase risks crashing the housing market and pushing the economy into an unnecessary recession.

Irrespective, Australian mortgage holders should brace for significant increases in repayments and potentially sharp house price falls. The only question is how far and how quickly.

Leith van Onselen is Chief Economist at the MB Fund and MB Super. Leith has previously worked at the Australian Treasury, Victorian Treasury and Goldman Sachs.