Big four bank’s shock home loan call

With yet more interest rate rises expected from the Reserve Bank, one of the country’s largest lenders has announced it will buck a “big four” trend.

Despite the likelihood of yet more interest rate rises by the Reserve Bank, one of Australia’s largest financial institutions has decided to reverse a recent course of action adopted by the “big four” banks.

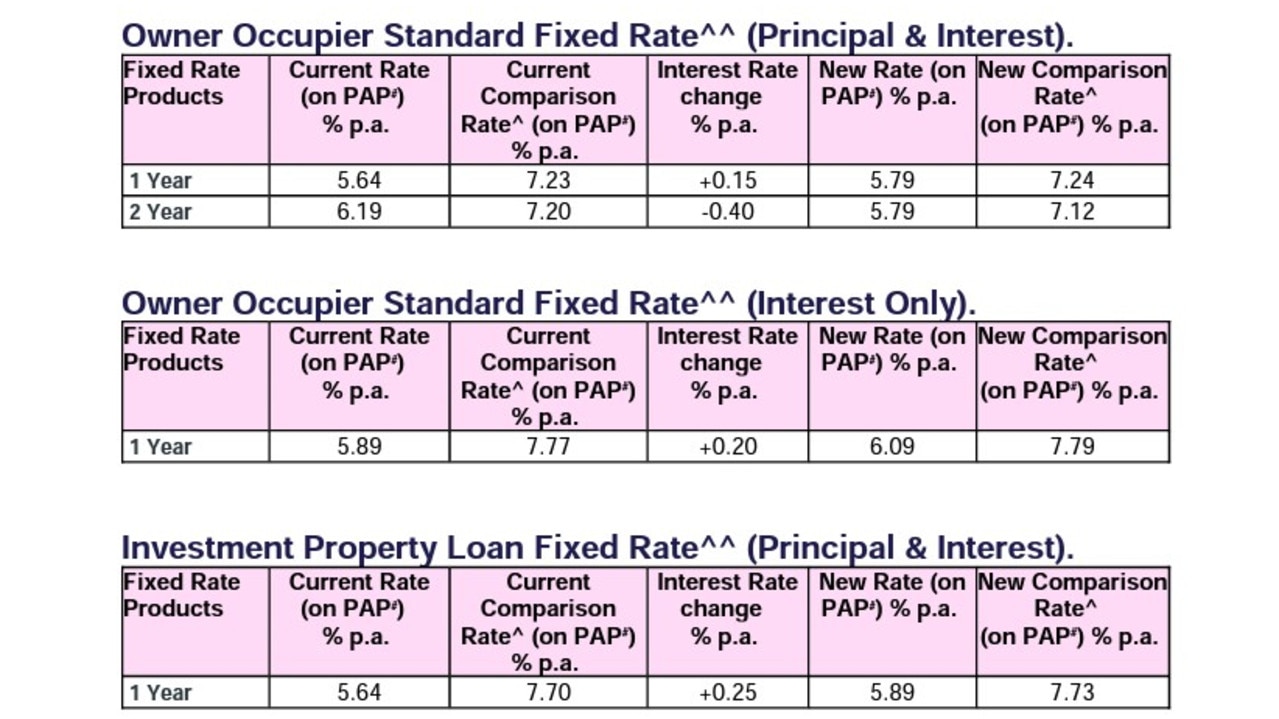

Westpac on Thursday announced it has decreased its two-year fixed interest rate owner-occupier home loans with principal and interest repayments.

However, it has also increased rates on its one-year fixed owner-occupier home loans and investment property loans.

Westpac’s two-year fixed rate is now 0.40 per cent lower at 5.79 per cent per annum, while its one-year rate has risen 0.15 per cent to also sit at 5.79 per cent.

“Effective today, the new rates are applicable to new fixed rate home loans and existing variable rate home loans for customers looking to fix part, or all, of their loan,” the bank wrote in an email to mortgage brokers.

“Customers need to consider their own financial situation and seek independent advice when considering the option to fix their loan.”

The changes come ahead of Tuesday’s RBA board meeting and follow comments from RBA governor Philip Lowe at a senate estimates hearing on Wednesday in which he wouldn’t rule out further rate rises.

“I know the higher interest rates at the moment are very unpopular and are hurting people. I know it’s really tough, but, you know, the board discussions think of the alternative,” he told the hearing.

“If we had not increased interest rates … inflation will be higher for longer.

“So what we’re doing now is difficult, but it’s necessary to avoid more pain and even higher interest rates later on.”

He also suggested Australians will need to increase the number of people living in their homes in the future to address the ongoing rental crisis.

The RBA has opted to raise interest rates at 11 of its past 12 meetings as it tries to rein in soaring inflation.