‘Hard landing’: Federal budget documents warn of nightmare scenario as global ‘shocks’ take their toll

The budget papers warn of the risk posed by “a succession of major shocks” around the world - and highlight one awful possibility.

The federal budget papers lay bare the extent to which “a succession of major and interrelated shocks”, including Russia’s invasion of Ukraine, have wrought havoc on the global economy, with grim consequences looming both overseas and back in Australia.

“This is a time of great challenge and change,” Treasurer Jim Chalmers acknowledged in his speech to parliament on Tuesday night.

“The global economy teeters again on the edge, with a war that isn’t ending, a global energy crisis that is escalating, inflationary pressures persisting and economies slowing.

“While we intend to avoid the worst of the turbulence from overseas, we cannot escape it completely. Global challenges, along with high inflation and higher interest rates, will have an impact.”

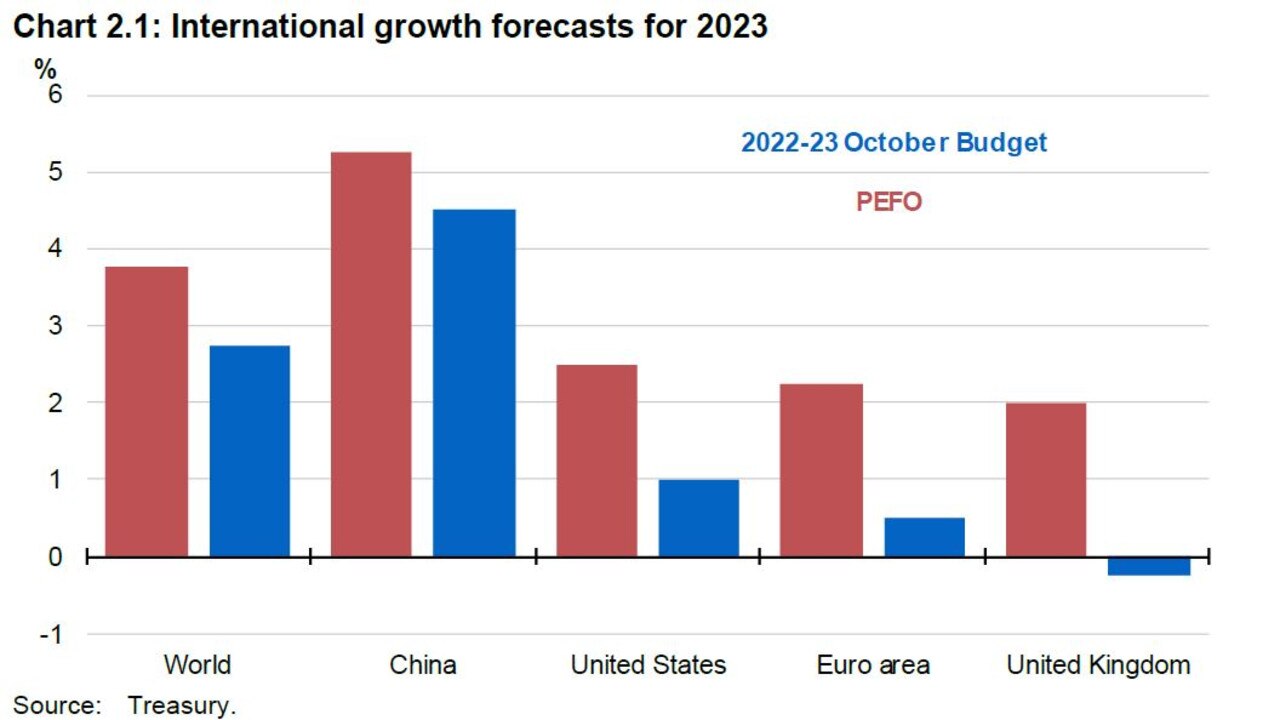

This warning is reflected in Treasury’s forecasts, which show the global economic situation has worsened significantly in virtually every key metric since the Pre-election Economic and Fiscal Outlook (PEFO) was published back in March.

“The global economic environment has sharply deteriorated,” the budget papers note.

“High inflation is sapping momentum and global growth is slowing by more than expected, with some major economies stalling or contracting.

“Higher global interest rates have increased the risk of recession across all major advanced economies, and the outlook for China has weakened.”

As such, Treasury has downgraded its global growth forecast by 0.75 per cent in 2022, 1 per cent in 2023 and 0.5 per cent in 2024, as compared to the figures in PEFO.

The department expects global growth to be 3 per cent this year and 2.75 per cent in 2023.

‘More formidable challenge’ than expected

Inflation is also a worldwide problem, and it’s being exacerbated by both the “after-effects” of the Covid pandemic (particularly the continuing lockdowns in China) and the Russian invasion of Ukraine, which has disrupted the global energy supply.

These two factors are proving to be “a more formidable challenge to global growth” than Treasury previously anticipated, and are now expected to cause “a significant slowing” in household demand.

“Gas prices are a key source of intensifying cost-of-living pressures for many consumers, having risen over sixfold since March of 2021,” the papers note.

“Food prices remain elevated, driven by Russia’s invasion of Ukraine, widespread adverse weather conditions, and several countries placing restrictions on food exports.

“Restrictions to gas supplies have had ripple effects.”

Treasury is also increasingly worried about the economic situation in China, which continues to hobble its growth by imposing extensive lockdowns in pursuit of a Covid-zero policy.

“The prospect of ongoing outbreaks and lockdowns in China will weigh on global growth and poses risks for the recovery of global supply chains,” the budget papers say.

“China’s property market has also entered a significant downturn. This downturn has lasted much longer than expected and will drag on growth more significantly over the coming year than anticipated at PEFO.”

According to Treasury, China’s GDP growth will come in at just 3 per cent in 2022, and then rise to 4.5 per cent in the next two years. That’s a dramatic drop from the 8 per cent growth rate China reported in 2021.

Meanwhile, the nation is wrestling with consumer confidence having fallen to “historic lows”.

“With authorities likely to maintain their approach to Covid for an extended period, Chinese consumer spending is likely to remain weak over coming years,” Treasury says.

Advanced western economies will struggle as well — the United Kingdom most of all, with a forecast -0.25 per cent growth in 2023. The United States will grow at 1 per cent in that year, and the Euro area at just 0.5 per cent.

These forecasts are all significantly lower than they were in PEFO.

While the unemployment rates across advanced economies remain acceptable, the high levels of inflation mean real wages are “lower across the board”.

‘Hard landing’: The nightmare scenario

Central banks around the world have been raising interest rates in a necessary effort to contain inflation, and will continue to do so going forward.

The budget papers identify this as “the most significant downside risk to global demand”.

“The baseline forecast is that central banks can navigate slowing demand sufficiently to return inflation to target without tipping the world economy into recession,” they say.

“However, this is not assured.”

Treasury has modelled a scenario in which global inflation and interest rates both end up higher than expected in its baseline forecast.

Should that happen, “a number of advanced” economies, which would otherwise “narrowly avoid” tipping into recession, instead succumb.

In this nightmare scenario, characterised as a “hard landing” for the global economy, Australia’s growth rate would bottom out at 0.75 per cent in 2023-24 — just half the rate currently forecast.

The other major risk on the supply side of the global economy is “further disruption to energy supply”, which could happen as a direct result of the continuing war in Ukraine.

“The conflict is also complicating the major climate-related energy transition that is underway globally,” Treasury notes.

“This may result in increased volatility in energy prices and financial instability as countries seek to respond to these dual challenges.”

Domestic factors also matter

Dr Chalmers’ budget night speech was packed with warnings about the global conditions outlined above. The Treasurer pledged that the government would manage the budget in a “responsible” fashion.

“We now confront the prospect of a third global downturn in a decade-and-a-half,” he said.

“This time not a financial crisis or a pandemic, but a war driving high prices and higher interest rates here and around the world, and the risk of another global recession.

“This time demands a different response. One that puts a premium on what’s responsible, affordable and sustainable.”

Australia’s economic forecasts are better than those for many of the other advanced economies, but they have still suffered a deterioration.

Treasury expects to see our GDP growth slow from 3.25 per cent this financial year to just 1.5 per cent in 2023-24, a full percentage lower than predicted in March.

Meanwhile the unemployment rate will rise to 4.5 per cent in the next couple of years.

Inflation is forecast to peak at 7.75 per cent later this year, though Treasury expects it to ease to 3.5 per cent in 2023-24 before returning to the Reserve Bank’s target range the next year.

While most of this is framed as a result of global forces, there are domestic factors at play as well, particularly the floods that have devastated communities in NSW, Victoria and Tasmania.

“As we were finalising this budget, floods were once again tragically taking lives, wrecking homes, shutting businesses, disrupting livelihoods, and pushing up the cost of living,” Dr Chalmers said.

“Once again we are reminded of the solidarity that living on this harsh land demands of our people and our communities.

“These are human tragedies first and foremost that come with broader consequences for the economy and the budget.”

He stressed that there “are hard days to come, and hard decisions to accompany them”.

“Getting through this period stronger than we were before will rely on the best of our character — our resilience, our pragmatism, our co-operation and our confidence, and above all, our belief in each other.”