Aussies will feel pinch later this year with Treasurer revealing one key figure

As Jim Chalmers handed down his “bread and butter” budget, he revealed the horror figure your electricity prices will rise by.

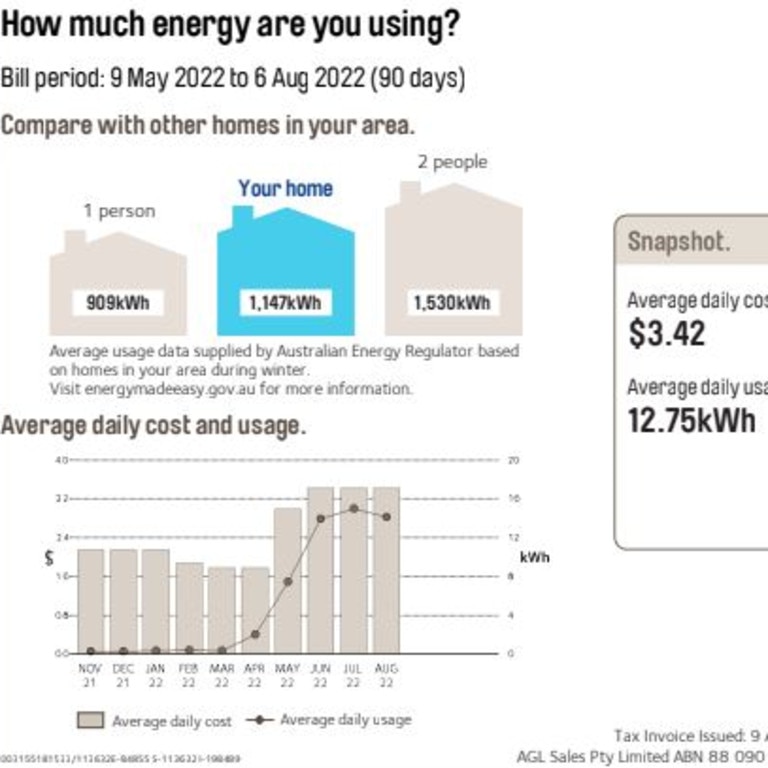

Australians have been warned to brace for energy price hikes of up to 20 per cent as the cost of living crisis is expected to peak in December.

But grim Treasury modelling has suggested the hip pocket pain could last longer than initially expected as extreme weather events, the war in Ukraine and the global outlook continue to cause economic pain.

Treasurer Jim Chalmers warned there would be “hard days to come” as he handed down his first budget on Tuesday.

The budget said those tough times will include a major increase in energy prices.

By the end of the year, Treasury estimates retail electricity prices will increase by 20 per cent nationally.

In 2023-24, that figure will blow out to 30 per cent.

Retail gas prices are also estimated to increase by up to 20 per cent in both 2022-23 and 2023-2024.

The budget said electricity prices were expected to directly contribute between 0.75 and 1 percentage point to inflation in 2022-23 and 2023-24.

Speaking to reporters ahead of the budget’s release, Mr Chalmers flagged further action to keep prices down.

“Any responsible government facing these sorts of price hikes needs to consider a broader suite of regulatory intervention than they might have considered in times gone by,” he said.

The rapid rise in energy costs has left Labor’s promise to cut power bills by $275 dead in the water.

The high energy costs will mean the December inflation peak of 7.75 per cent will last longer than originally expected.

Food prices will be a major driver of the price pinch, with costs forecast to contribute 1.5 percentage points to the inflation peak in December.

Asked if Australians hoping for a cost of living relief in the budget will be left disappointed, Dr Chalmers said it was important to do the “right thing by people and the right thing for the budget”.

The budget papers warned if inflation was to peak a percentage point higher than 7.75 per cent, Australians could be hit with a double whammy.

Households would be flogged with “second round” effects as business pass their own cost pressures onto consumers.

“Under this scenario, more persistent inflation is assumed to lead to a higher peak in interest rates than currently expected. Higher inflation and interest rates would lower real household disposable income,” the budget read.