Federal budget 2022 calculator: Find out what you’ll get

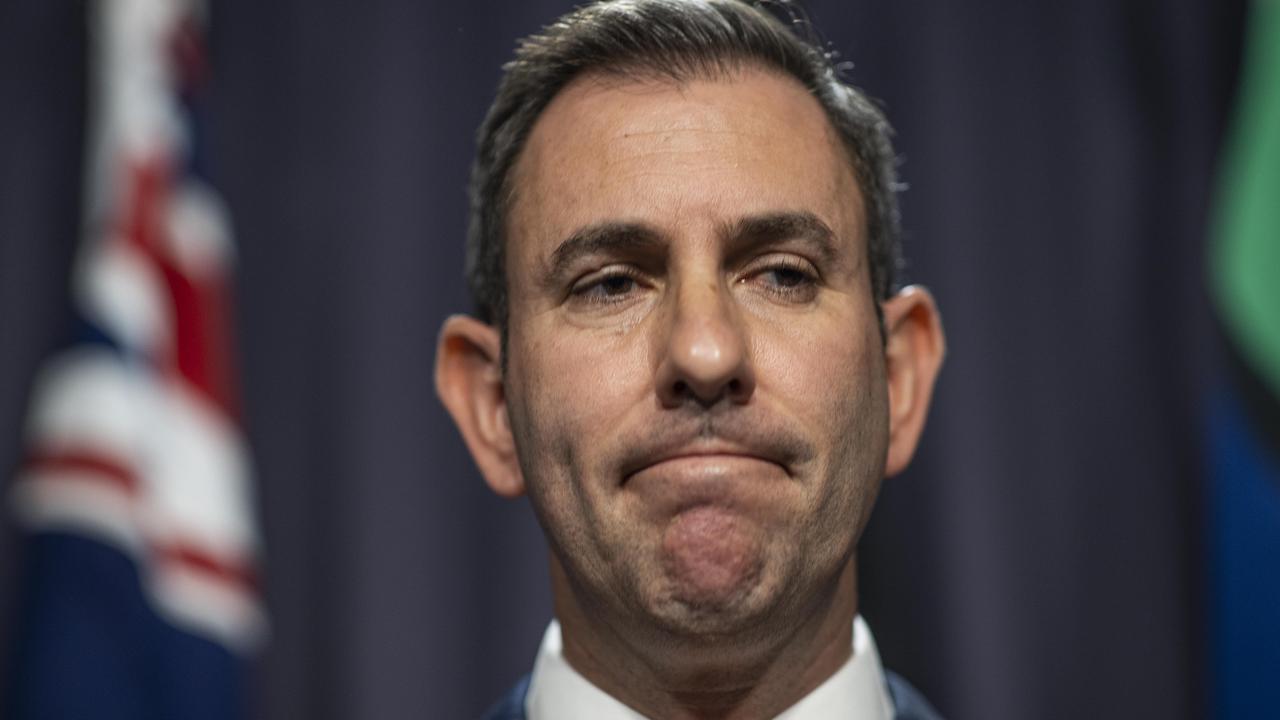

Treasurer Jim Chalmers’ first budget isn’t exactly brimming with benefits or handouts. Find out how it will affect you using our budget calculator.

Delivering his first federal budget and the first “re-do” budget Australia has ever seen, Treasurer Jim Chalmers has handed down a very different economic plan to the one his predecessor left us with earlier this year.

The March federal budget was all about easing cost-of-living pressures and trying to help Scott Morrison win an election — so it was filled with benefits and handouts.

This time around, without the motivation of a looming election to deliver vote-winning treats, and with the inheritance of a budget Dr Chalmers describes as “stuck in structural deficit”, Labor’s take-two budget for the 2022-23 financial year is less of a crowd-pleaser.

In his speech on Tuesday night, Dr Chalmers reflected on the past decade of Coalition leadership as one of “wasted opportunities and warped priorities”. He described Labor’s budget as doing three things: providing cost-of-living relief that is “responsible, not reckless”, targeting investment, and “beginning the hard yards of budget repair”.

But what all Australians really want to know is, what does that mean for us?

While there are few obvious handouts or goodies up for grabs in this budget, some Australians will do better out of it than others.

Parents of young kids are among the big winners, with an expanded paid parental leave scheme meaning families will be able to access government paid leave for longer — up to six months by 2026. About 180,000 additional famlies will soon be able to access those benefits thanks to a more generous income test.

Cheaper childcare also benefits this group with higher subsidies coming in, which the government says will increase workforce participation among women to the tune of 1.4 million hours a week in its first year.

High income earners also come out on top with no changes to the former government’s stage three tax cuts, which were introduced back when Mr Morrison was treasurer and are due to come into full effect next year.

There was some discussion about the Albanese government scrapping the plan, which will see the 37 per cent marginal tax bracket removed and the 32.5 per cent marginal tax rate lowered to 30 per cent.

Australia Institute analysis shows high-income earners making more than $200,000 will receive a tax break of $9075 per year under the stage three tax cuts, which are estimated to cost the budget $243 billion in lost revenue over a decade.