Federal Budget 2020: Mums working for $1 an hour under childcare rebate ‘cliffs’

A new report proves that it’s not worth many Aussie women working more than three days a week. But could a radical plan fix the problem?

Mums are working for $1 an hour or less when they go back to work four days a week as a result of “cliffs” in current childcare rebates.

And the bizarre disincentives to increase the number of days worked is the big reason why Labor leader Anthony Albanese has unveiled a radical new plan to treat childcare like Medicare and move towards a universal 90 per cent rebate for all parents, regardless of income.

In the short term, the 90 per cent rebate would be offered to families earning under $80,000 but the plan is to extend it to all.

And while not strictly speaking “free”, the idea of every family in Australia having 90 per cent of their childcare costs covered would represent a huge shift.

WORKING PARENTS FACE CHILD CARE CLIFF

A McKell Institute report released on Thursday night provides three examples to argue for universal child care rebates and explains why many women say it’s not worth going to work more than three days a week.

“Men earning high incomes complain about a top marginal tax rate of 47 per cent,” the report states. “Yet a KPMG analysis has demonstrated that working mothers commonly face ‘Work Disincentive Rate’ of 75-120 per cent from working a fourth or fifth day per week.”

The reason is that the phasing down of the Child Care Subsidy is based not on the working mother’s income but on the combined household income of mother and father.

“If a couple with two young children in long day care both earn the minimum hourly wage rate, the family is only $2.50 an hour better off from the mother increasing her working days from three to four per week,” the report states.

For middle income families, if the father earns $80,000 per annum and the mother earns the part-time equivalent of a $40,000 per annum full-time wage, by increasing her working days from three to four per week the mother would gross an extra $8000 per annum, but only $294 per annum in net terms.

“She would be working for less than $1.00 an hour on her fourth working day,” the report states.

RELATED: Were you happy with the Budget? Have your say in our poll

RELATED: Haven’t got your head around the Budget? Here’s what’s in it for you

In the case of a professional couple where the father earns $100,000 per annum and the mother earns the part-time equivalent of $100,000 per annum, if the mother increase her weekly working days from four to five, she costs the family budget more than $4000 per annum, losing $85 every extra day she works.

As the McKell Institute notes, if the annual family income is greater than $186,958, the Child Care Subsidy is capped at a fixed amount of $10,190 per child. At this family income level, an extra dollar of family income for a couple with a child in long-day care for four or five days per week would send the family over a cliff that would cause the Child Care Subsidy to plunge by more than $4000.

And while there‘s unlikely to be much sympathy for a family earning $350,000, a mum earning $1 more could cost the family $5000.

“If the mother earned just one dollar more, the family would go from receiving Child Care Subsidy equal to 20 per cent of the cost of childcare fees to receiving no Child Care Subsidy at all. This could cost the family more than $5500 for earning one extra dollar,” the report states.

UNIVERSAL CHILD CARE REBATE JUST LIKE MEDICARE

That‘s why Labor wants to start a debate about a universal child care rebate for all workers.

“Some will ask: don’t we usually have needs-based government support?,” the McKell report asks.

“Well no, not in many cases, and that’s how Australians prefer it. Consider some important examples. Medicare, introduced by the Hawke Government, is a universal system. The wealthiest person in Australia can walk into a bulk-billing GP’s surgery, present his or her Medicare card, and walk out after seeing the doctor without paying anything.”

RELATED: ‘Disgrace’: ScoMo’s budget antics slammed

In theory, the idea of taxpayers footing the bill for 90 per cent of childcare costs sounds amazing for parents.

But how would Labor pay for such a stunning pledge? One answer is price controls on the fees childcare centres can charge.

Labor first flagged price controls at the last election when it pledged more generous subsidies for all families earning under $175,000.

By comparison, the first stage of Mr Albanese‘s approach is far more generous to high income earners because it takes the benefits right up to families with a combined family income of $500,000.

HOW FIRST STAGE OF CHILD CARE PLAN WORKS

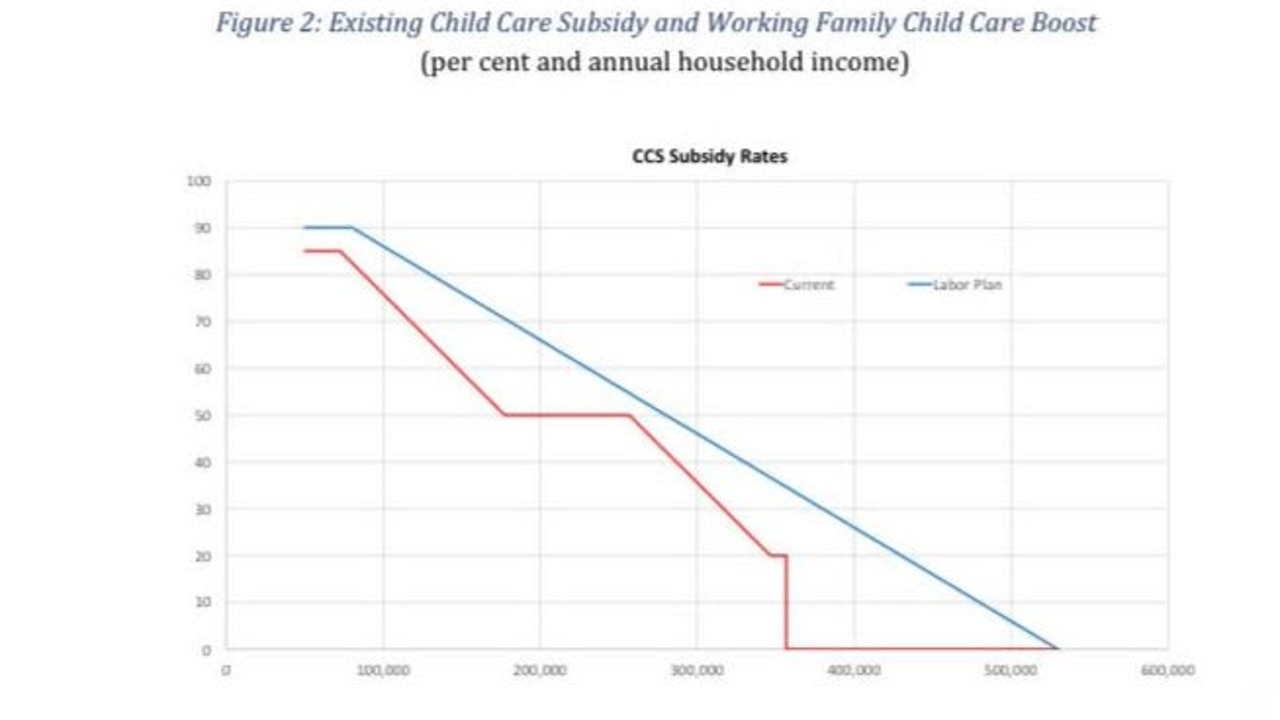

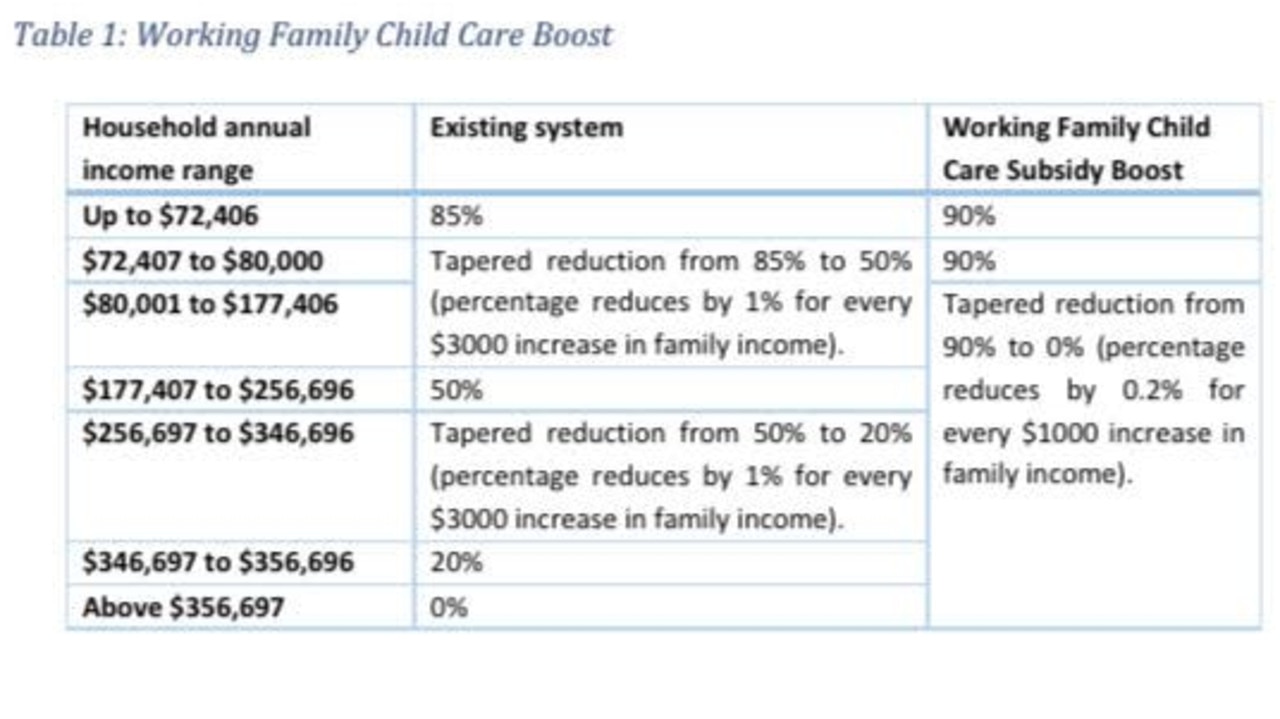

But the promise of a universal childcare centre is down the track. As an interim measure Labor wants to lift the childcare subsidy from 85 per cent to 90 per cent for families earning under $80,000.

Under the plan announced in the budget-in-reply speech an Albanese government would also:

• Scrap the $10,560 child care subsidy cap which often sees women losing money from an

extra day’s work;

• Lift the maximum child care subsidy rate to 90 per cent; and

• Increase child care subsidy rates and taper them for every family earning less than

$530,000.

“This means 97 per cent of all families in the system will save between $600 to $2,900 a year. No family will be worse off,” Mr Albanese said.

“Women are the key to kickstarting our economy again. In the worst recession in a hundred years, we have to make sure women aren’t forced to choose between their family and their jobs.”

RICH WINNERS UNDER ALBO'S CHILDCARE PLAN

But is it good Labor policy if the vast majority of benefits would flow to high income families living in rich suburbs and using boutique childcare?

Under the current system, a cap on the hourly rate the subsidy will cover means that families using expensive care don’t get the full amount covered.

The changes proposed by Labor on Thursday night don’t change those arrangements but they do promise more cash for the rich.

In fact, while low income families on average get just $600 a year extra from increasing the rebate to 90 per cent the benefits for higher income earners are much larger.

In fact, a family earning $300,000 a year will secure an extra $2900 on average as a result of changes to the taper rate when benefits cut off.

But if Labor moves to a 90 per cent subsidy for all that raises even bigger questions.

Wealthy parents in exclusive suburbs can pay $200 a day or more at private centres offering yoga and organic meals.

As Australia‘s elderly languish in nursing homes where some operators spend $6 a day to feed residents meals including a plate of cold mini pies, why should taxpayers subsidise 90 per cent of the cost of boutique childcare in Sydney’s eastern suburbs?

That‘s the question Labor Leader Anthony Albanese hasn’t answered yet.