Treasurer Dr Jim Chalmers makes grim prediction after IMF shared global recession fears

With the IMF warning the world is “teetering on the edge of a global recession,” the Treasurer has warned the challenges will be long-lasting and “substantial”.

An economist from the International Monetary Fund (IMF) says the world is “teetering on the edge of a global recession,” with Treasurer Jim Chalmers warning Australia is sitting in a precarious financial position and is “less resilient” than it was before.

Releasing their July 2022 Economic Outlook on Tuesday, the IMF’s Economic Counsellor and Director of Research, Pierre-Olivier Gourinchas admitted that global forecasts had “darkened significantly since April”.

Measuring growth, global gross domestic product (GDP) was forecast to slow from 6.1 per cent in 2021 to 3.2 per cent in 2022. This was also 0.4 per cent lower than what was predicted in April’s report.

“The world may soon be teetering on the edge of a global recession, only two years after the last one,” Mr Gourinchas said.

The dire prediction was influenced by a combination of factors, the report stated. Chief among them was higher-than-expected inflation observed in the US, China and major European countries, which occurred in a world economy “already weakened by the pandemic”.

In less stable and more developing economies, Mr Gourinchas said the “destabilising inflation” has been “historically unprecedented”.

The downward risks posed by the war in Ukraine and geopolitical tensions from Russia also continued to put pressure on food insecurity, social unrest, and fears international tensions could lead to a sudden stop in gas imports.

How will this affect Australia?

While the IMF’s predictions have been dour, the impact on Australia will likely be significant, said Federal Treasurer Dr Chalmers.

Referenced under ‘other advanced economies,’ the IMF predicted that Australia’s GDP growth projection was forecast for 2.9 per cent growth in 2022 and 2.7 per cent growth in 2023. This was a drop against our 2021 figures, in which our GDP increased by 4.4 per cent between December 2020 and December 2021, the Australian Bureau of Statistics reports.

Speaking to the Australian Financial Review ahead of delivering his economic statement to parliament on Thursday, Dr Chalmers warned domestic fiscal issues were here to stay.

“This confirms the challenges facing the global economy are substantial, they are growing, they will be with us for some time, and they are impacting us here at home,” said Dr Chalmers.

He also took a swipe at the former Liberal government for the mishandling of the economy during their nine years in power.

“After nine years of wasted opportunities and wrong priorities, we have inherited an economy that is less resilient in responding to these shocks, but we are determined to turn this around and build a better future,” he added.

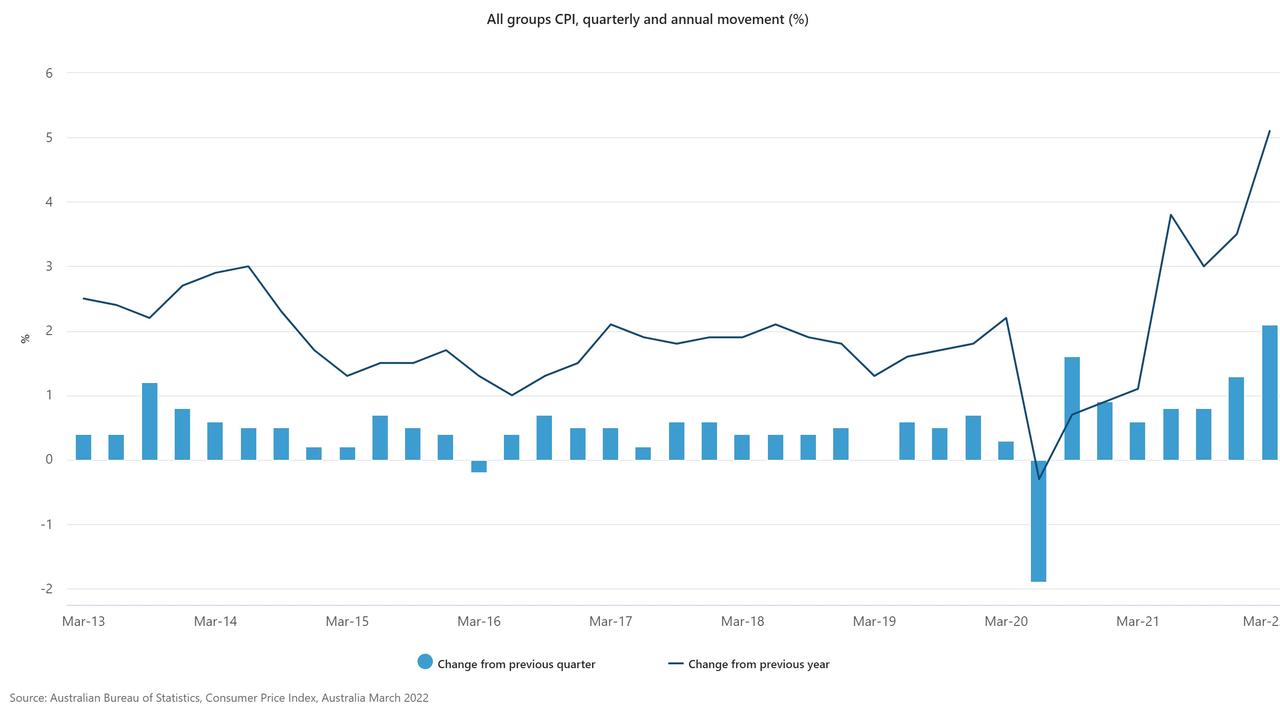

Dr Chalmers’ address to parliament will coincide with the ABS’ official update on the Consumer Price Index (CPI), which is slated for Wednesday, July 27. Currently set at 5.1 per cent, the CPI rose 2.1 per cent between the December 2021 and March 2022 quarter, reflecting an year-on-year increase of 5.1 per cent.

According to The Australian, that figure is expected to hit 6.2 per cent for the June quarter, which would reflect the quickest rise in CPI in three decades.

Needless to say, this is substantially higher than the Reserve Bank of Australia’s (RBA) inflation target of 2 to 3 per cent.

Giving an update in May, Governor of the RBA, Philip Lowe said it would likely take “a couple of years,” for inflation to return to his range.

‘Taming inflation should be the first priority’

As rising petrol and grocery prices continue to put pressure on households and fuel the cost-of-living crisis, the IMF July 2022 update said controlling inflation should be a major priority for governments and policy makers.

This comes as the RBA predicts inflation could hit 7 per cent by the end of 2022.

“Tighter monetary policy will inevitably have real economic costs, but delay will only exacerbate them,” the report stated.

This would include policies like increasing interest rates, reducing money supply (printing less money), and other measures which would reduce the demand for money.

“Policies to address specific impacts on energy and food prices should focus on those most affected without distorting prices,” they said.