Trade war: How China will derail Australia in 2021

There’s hope for a brighter future but China’s latest moves could cripple the Lucky Country. But there’s one thing we’ve still got up our sleeve.

As 2020 finally begins to wind down toward the conclusion of a year filled with hardship and stress for many Australians, there is a collective hope that 2021 will be better.

That somehow we can take all the challenges and struggles of a 2020 dominated by social distancing, lockdowns and uncertainty, and find a way to put them behind us.

When the clock strikes midnight on New Year’s Eve, Australians will likely breathe a collective sigh of relief, that the lion’s share of the hardship’s we face are behind us.

But even as economic data and household confidence both show signs of a nation on the mend, storm clouds continue to swirl and grow on the horizon, threatening to potentially derail our recovery.

As trade and diplomatic tensions continue to rise between Beijing and Canberra, there is a rather large elephant in the room of our would be recovery, or should I say an angry Panda.

After the Morrison government called for an inquiry into the origins of the coronavirus pandemic, Beijing’s trade actions targeting Australian exports began shortly after in May.

RELATED: ‘Beyond belief’: China blasts Australia

At first it was relatively limited, confined to barley and beef exports. But in recent months the tempo of further trade actions has increased significantly, to the point where scarcely a week goes by without further escalation.

In recent days, Chinese state run news service the Global Times confirmed the biggest hit to Aussie exports yet, Beijing has banned imports of Australian coal. With coal exports to China amounting to $13.9 billion last year, the move is expected to cost the economy billions of dollars.

While the Morrison government has raised the possibility of taking legal action against Beijing through the World Trade Organisation if required, the dispute process can be challenging and take years to resolve.

For these industries hit by Beijing’s various tariffs, defacto import bans and other trade actions, billions of dollars in turnover has already been lost in just a few short months.

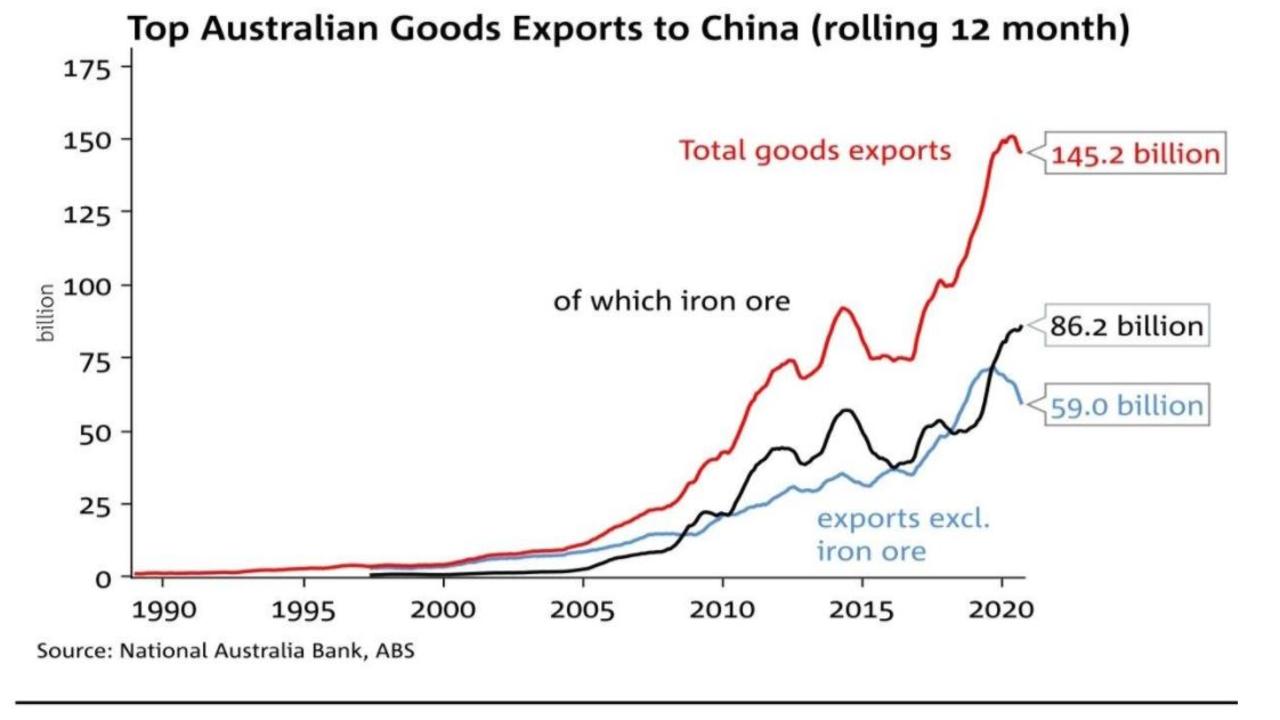

Much of this financial pain has largely been glossed over by record levels of iron ore exports driving a healthy trade surplus and keeping Australia’s export data to China looking strong.

RELATED: Real reason Beijing came after Australia

But behind the positive headlines and rosy iron ore driven data, industries supporting hundreds of thousands of jobs and tens of billions of dollars in economic activity are hurting, in some cases quite badly.

As the trade conflict continues to drag on and escalate, Beijing’s trade actions will really begin to bite and impact our still fragile economic recovery, making the nation’s recovery from the pandemic even more challenging.

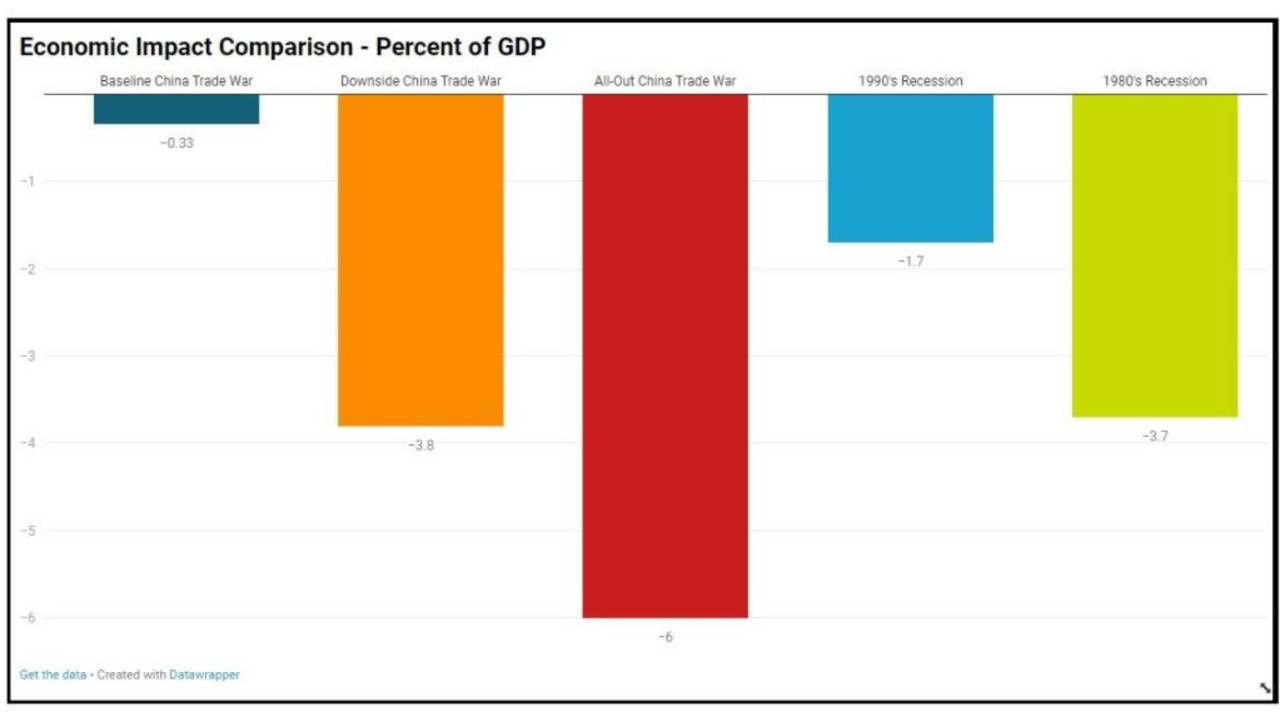

According to an analysis from global bank Citi, under their baseline scenario total Australian exports to China would drop by 10 per cent knocking approximately 0.33 per cent off of GDP.

However, under their downside scenario where the trade conflict continues to escalate to the point where exports to China dropped by 50 per cent and iron ore was impacted, the cost to the economy could be as much as $76 billion or 3.8 per cent of GDP.

With the OECD forecasting the Aussie economy to grow by 3.1 per cent during 2021, a trade conflict of this magnitude would effectively more than wipe out the forecast economic recovery.

An analysis by Professor Rod Tyers of the University of Western Australia and Senior lecturer Yixiao Zhou of Australian National University, recently published in The Conversation concluded an all-out trade war with China could be even more damaging.

If the conflict continued to escalate to the point where trade between Australia and China was reduced by 95 per cent, it could hit the economy for as much as 6 per cent of annual GDP.

To put that into perspective, this would be a larger hit to the economy than the recessions in the 1980s and 1990s combined.

RELATED: Proof Australia cannot win against China

As it stands, with China consuming record amounts of Australian iron ore, the chance of these more severe scenarios coming to pass for any protracted length of time is currently relatively unlikely.

With China’s economic growth now once again heavily reliant on fixed asset investment and real estate construction, any long term reduction in Chinese iron ore imports would effectively represent China shooting itself in the foot with a rather large gun, just to punish Australia.

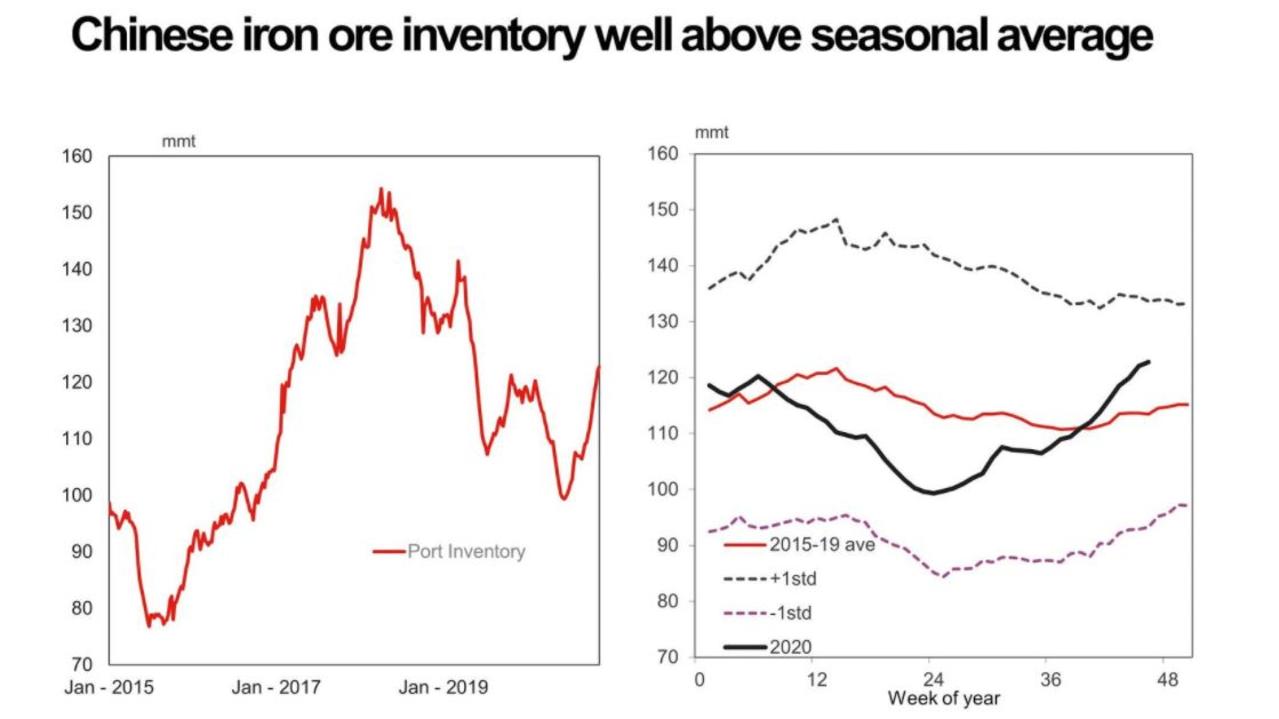

However, with Chinese port inventory of iron ore currently sitting at over 120 million tons or roughly 12 per cent of total annual imports, a temporary go slow or limited import ban once demand has returned to more normal levels cannot be ruled out.

If Beijing was to pursue this type of short-term action, it wouldn’t be the first time Australian exports were targeted in this way. During 2019, long before the wider trade conflict between Canberra and Beijing began, Australian coal shipments were routinely held up in some cases for well over a month.

Unless the Morrison government is willing to significantly escalate the conflict by applying a levy on iron ore exports to China, as suggested by Nationals Senator Matt Canavan, Beijing can and will continue to twist the knife whenever it pleases.

As the Treasurer and Prime Minister continue to celebrate the ongoing run of positive economic data, they must be wary that Beijing could still kneecap Australia’s ongoing economic recovery if they choose to.

For better or worse, successive governments from both sides of federal politics have left Australia at Beijing’s mercy, with China now consuming almost 50 per cent of all Australian exports.

Right now the Lucky Country is once again earning its nickname, as market forces and Chinese speculators drive the price of our iron ore exports to the moon and we enjoy a relatively virus continent.

But ultimately, as trade tensions continue to escalate and China increasingly looks elsewhere for the raw materials to fuel its economy, Australia’s luck may begin to run short.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator