Things are looking up, but don’t be fooled by the latest economic growth

AUSTRALIA has had a great few days, but don’t be fooled. The benefits aren’t flowing to your pocket.

AUSTRALIA has notched up a great few days. Things look good — better than good.

First we saw business conditions shoot up and business profits looking very healthy: Up 20 per cent in the latest three months.

Next, we saw our best balance of payments position in five years. Instead of our normal massive deficit of over $13 billion, it shrank to a petite $4 billion.

Then on Wednesday, the economic growth figures came in and they were like an explosion. Growth of 1.1 per cent in the latest three-month period. Massive.

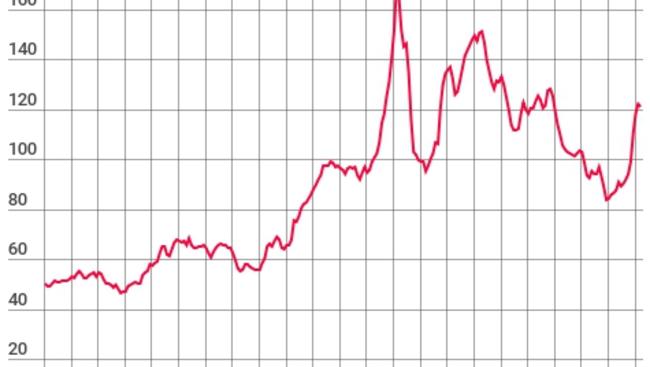

But there are signs that we might be getting caught in a trap. What looks like a great big boost to our economy might just be the effects of another bunch of crazy swings in the prices of commodities.

We’ve been here before and it gave us all a headache. First, China buys up big in coal and iron ore and prices go up. Then all the measures of our economy light up.

We are seeing plenty of evidence this is the same pattern. Commodity prices have been spiking, but they can easily turn down again.

High prices lift our GDP and our terms of trade. The spreadsheets look great, but only so long as the markets for coal and iron ore stay strong.

When those prices fall, our economy stops looking so shiny. And there’s no reason for prices to stay high for a long time. Lots of supply is now flowing from all around the world, and China is running out of new things to build anyway. That combination of high supply and wobbly demand could see commodity prices fall again.

High commodity prices help us only very indirectly. They are mostly effective at lifting the statistics without actually changing our lives. Our actual wages aren’t moving much, yet.

For evidence of this, check out our wage growth. It is still decrepit, moribund and stagnant.

So why is spending shooting up? This is the big mystery in the statistics, and possibly the one reason to have hope.

Since the global financial crisis, Australians have spent less and saved more. We’ve been cautious and careful.

But now, the savings rate is falling, for real. It is back down to around five per cent, closer to 2007 levels than to its post-crisis peak.

What the heck is going on here? Are we misreading the signs and spending up even though things are still bad? Or is this a sign people are finally getting their confidence back?

If we are getting confident again, that could be enough to lift the economy on its own. Spending in shops and restaurants will make the economy tick over, and give business owners confidence to hire more people.

Part of the reason for the low wages growth we have suffered in the last few years is a trap of our own making. Low confidence hinders the economy from sparking up and providing the kind of growth we need.

An economy needs people to believe in it to grow strong, and if we’re ready to believe, then the future might be bright no matter what commodity prices do.

Jason Murphy is an economist. He publishes the blog Thomas The Thinkengine. Follow Jason on Twitter @Jasemurphy