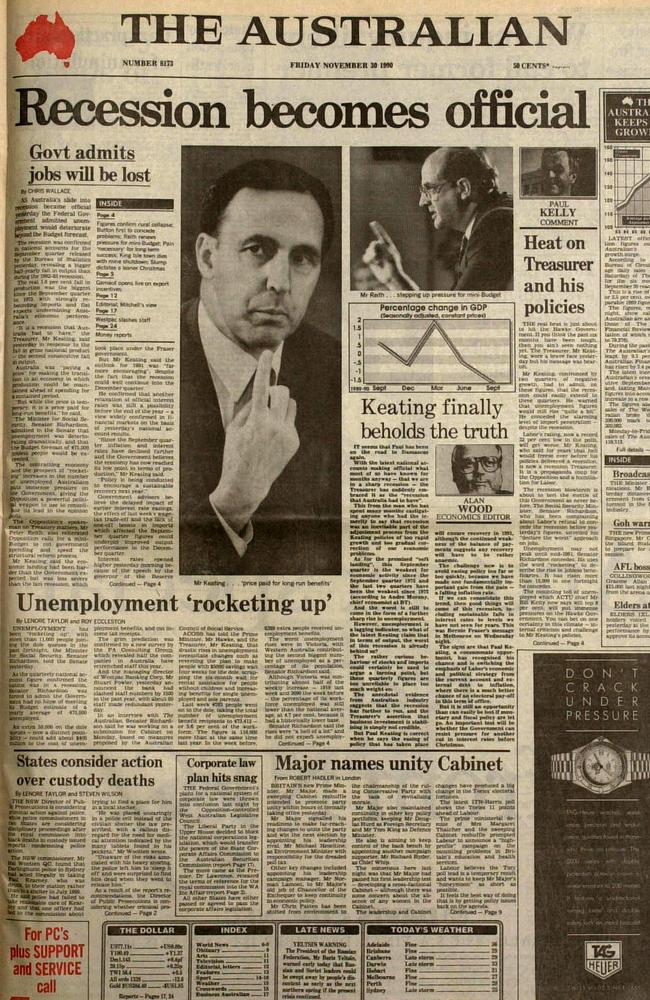

The good, the bad and the bumper sticker as Australia faces ‘20-25 per cent chance of recession’

Australia is now facing a “20 to 25 per cent chance” of a recession in the next 12 months as the US-China trade war heats up.

Nearly three decades ago, radio station Triple M used to hand out bumper stickers that read, “Triple M rocks to recession.”

AMP Capital chief economist Dr Shane Oliver still has one next to his desk.

“I put it aside thinking one day when the next recession comes along I’ll put it on the bumper of my car,” he said.

He seems amused that he may finally have a chance to slap that baby on his ride and confuse everybody — not least the under-30s, who have experienced neither recession nor rock music in their lifetimes.

“The risk (of recession in the US) has gone up but I’d say it’s probably around 30 per cent in the next 12 months,” Dr Oliver said. “The risk of recession in Australia is lower, probably 20 to 25 per cent.”

Nearly four in 10 Australians were not even born in 1991, and while sky-high house prices and cost-of-living pressures mean it’s not exactly the land of milk and honey for millennials, after three decades without a recession — defined as two consecutive quarters of negative economic growth — they don’t quite know how good they’ve got it.

“It was a pretty dark time,” Dr Oliver said.

“A lot of financial institutions were running into trouble, a lot of the smaller ones went bust, particularly in Victoria. There was a run on the Bank of Melbourne. Two of the big four had to be bailed out. Unemployment shot from around 6 per cent to above 10 per cent.”

House prices collapsed and vacancy rates in some cities shot up to 20 per cent. At the same time, the manufacturing industry was massively downsizing in Victoria and South Australia.

“They were often referred to as the ‘rust belt states’,” Dr Oliver said.

“That led to a situation where a lot of Australian men were taking redundancy payments at 55 and would never get a job again. Once the redundancy ran out they would go on social security and ultimately the pension.”

RECESSION RISK GROWING

Global stock markets were sent into chaos this week after a key recession warning light flashed red — that is, the so-called “yield curve” between 10-year and two-year US government bonds briefly inverted.

In normal circumstances, an investor looking for a safe place to stash their cash should be able to get a better return, or yield, on a 10-year bond than a two-year one — you’re locking up your money for longer, so naturally you want a better return.

If investors believe a financial crisis is just around the corner, however, everyone wants to buy ultra-safe 10-year bonds. Supply and demand drives up the price, just like a company’s shares, which means you’re getting a lower return per dollar on the same bond.

On Wednesday, the yield on the 10-year US Treasury briefly fell below the two-year for the first time since 2007 — an indicator that has correctly predicted recessions for the past 50 years — sparking a bloodbath on world markets.

S&P this week calculated the odds of a US recession in the next 12 months at 30 to 35 per cent, up from 25 to 30 per cent last quarter.

“Unpredictability on the trade front and deteriorating global backdrop — led by industrial weakness — are the key reasons for high alert,” the ratings agency said on Friday.

According to Dr Oliver, however, the yield curve as a recession predictor “has several issues”. “Sometimes it’s a false lead — it might invert and you don’t get a recession, like in 1998,” he said.

“Secondly the gap between the inversion and a recession actually occurring can be quite long. The average lead is 19 months, so if it inverts now it wouldn’t give us a recession until the start of 2021, a fair way off.”

Other factors may mean it is a less reliable predictor than in the past, he said, including the US government’s quantitative easing program pushing down yields, and very low bond yields in Japan and Europe further increasing demand for US bonds.

He concedes US-China trade tensions have increased the risk, but “just because America has a recession doesn’t mean we will”.

“The last 20 years we’ve managed to avoid US recessions,” he said.

That has been due to a combination of factors, but particularly the floating Australian dollar and more recently China’s demand for our natural resources.

“Typically when the rest of the world gets in trouble the Australian dollar goes down, that makes us more competitive,” he said. “We saw that in the 2000s, it almost got to parity (prior to the GFC) then it collapsed.”

Dr Oliver argued that while Chinese government stimulus was nowhere near 2008-2009 levels, it would still be enough to support demand for Australian coal and iron ore.

In a speech to the annual Risk Australia Conference in Sydney on Thursday, RBA deputy governor Guy Debelle had a similar assessment, predicting Australia would be insulated by China.

“We export resources, not microchips,” he said.

“While the Australian economy is often regarded as a proxy for China, the primary exposure of the Australian economy is to the Chinese domestic economy, not the Chinese external sector. The external sector has been the part of the Chinese economy most affected by the trade dispute.”

As that external sector has come under pressure, China’s government has responded with stimulus to the domestic economy “directed to the parts of the Chinese economy that are steel intensive, most notably infrastructure”.

“This has boosted demand for coal and iron ore,” Dr Debelle said.

“The domestic stimulus in China to offset the trade dispute has contributed to a short-term boost to the Australian economy and significantly mitigated the impact of the trade disputes on us. How long this lasts will depend on the effectiveness and longevity of Chinese domestic stimulus.”