Sign unpopular rent increases could have reached their peak

Australia’s devastating rental crisis could have just about reached its peak as rents in some areas fall, but an alarming number of renters are in trouble.

Since the pandemic first began to significantly impact the Australian economy almost two-and-a-half years ago, events have unfolded quite differently than one would have expected at first glance.

Rather than resulting in falling asset prices and rising unemployment, the nation has instead seen everything from Pokémon cards to used cars skyrocket in value, and the unemployment rate hit its lowest level in almost 50 years.

In this the nation’s rental market has been no different.

Despite net overseas migration reversing over the past two years for the first time since the end of World War II, Australia is facing a severe widespread rental crisis unlike any seen in decades. This is despite the fact that the number of people in Australia is more than 568,000 fewer than it would have been if net immigration had of continued at pre-Covid levels.

Rental crisis – by the numbers

According to figures from analytics firm SQM Research, the national rental vacancy rate was just 1 per cent in June. To put this figure into perspective, it’s the second lowest national vacancy rate recorded in the more than 17 years of data SQM has on this metric.

Prior to the pandemic, in January 2020, the national rental vacancy rate was a much more normal 2.1 per cent. Throughout the 2010s, the national vacancy rate bounced around between 1.4 per cent and 2.9 per cent, with seasonality a major factor.

However, despite the widespread nature of the rental crisis, different regions and cities are experiencing varying degrees of pressure.

For example, in Adelaide the city’s vacancy rate is just 0.4 per cent, the lowest of all the capitals. In Melbourne, the vacancy rate is 1.7 per cent, significantly higher than the national average.

Louis Christopher, managing director of SQM Research, had this to say in the company’s most recent report on the nation’s rental market: “There are now signs of a peak in the rental market in regional Australia with a larger number of regions now recording rising rental vacancy rates and some falls in rents.

“While capital city rents continue to march higher, it’s possible we could be near the peak in the national rental crisis. Outside Brisbane, there was no material decrease in rental vacancy rates over June. Indeed, four capital cities recorded a rise in rental vacancy rates.”

How did we get here?

Since the pandemic began, the way Australians choose to live has changed significantly. Empty bedrooms have become home offices, our CBDs remain a shadow of their former selves and after lockdowns many wanted the freedom of their own place.

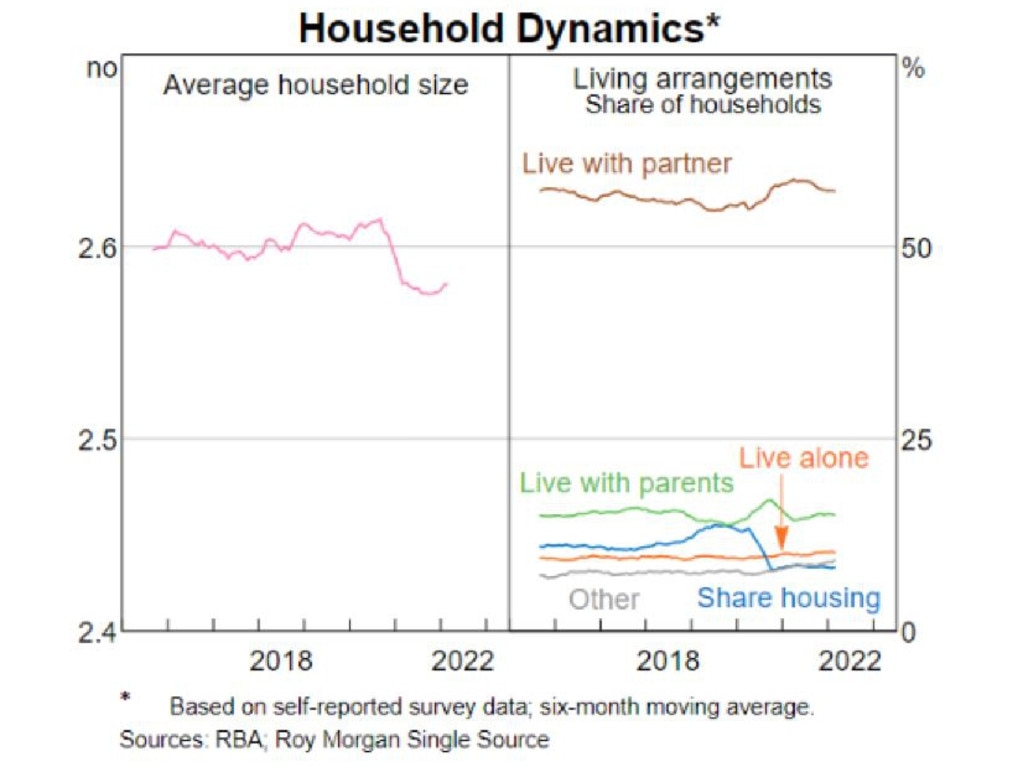

According to figures from Roy Morgan provided to the Reserve Bank, the proportion of Australians living in share houses roughly halved when compared with prior to the pandemic. This has effectively led to more households being created and naturally these new households need a place to live.

Despite over 300,000 new dwellings being completed since the pandemic began, it hasn’t been enough to keep up with the demand for homes from these newly minted households.

But amid this rise in the overall number of households, there are also other regional factors at work impacting the availability of rental accommodation.

According to data from Australian Bureau of Statistics, the number of people leaving regional areas to move to a capital city reduced by over 7000 in the year to March 2021. At the same time the number of people looking to make a move from a capital city to the regions also increased significantly, with 13,000 more Australians choosing to make a move to the bush compared with the prior 12-month period.

Unfortunately the ABS data only covers up until the end of March 2021, but the evidence we do have suggests that this trend continued to be a major factor in internal migration.

This shift in more people moving to regional areas and fewer people leaving has left many regional rental markets in bad shape, as rising demand for rental accommodation drives prices higher amid limited supply.

The outlook

Various cities, regions and suburbs all face very different circumstances going forward. In parts of the country rents are already falling, with rents for properties on the NSW North Coast leading the way, falling by 2.6 per cent and by 1.9 per cent on the NSW Central Coast.

Meanwhile at a national level, the growth in asking rents for houses has decelerated significantly to be broadly flat on a month-on-month basis.

As for units, growth is quite a bit stronger, but is just a small fraction of what it was earlier in the year.

SQM Research recently noted that there were signs that the peak for the rental market nationally could be near. But your mileage will vary considerably depending on the rental market in question.

With over 50 per cent of renting households in rental stress, according to research firm Digital Finance Analytics, and inflation expected to peak at 7.75 per cent in December, it’s still up in the air how much more rents can rise before the market finds an equilibrium.

Ultimately, the outcome for rental markets more broadly will be driven not only by the rising cost of living and household stress levels, but by local factors which could see highly variable outcomes across the nation’s different rental markets.

It’s not the end of the nation’s rental crisis, but with calls from experts rents may be nearing their peaks nationally, it may be the end of the beginning.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator