Sign the rental market is about to blow up across Australia

A new report has put into perspective just how hard Aussies are being squeezed – and come March it could be a lot more painful.

ANALYSIS

PropTrack’s September rental report revealed that property rents nationally surged 10.3 per cent over the past year, with most markets recording double digit growth.

The share of rental properties listed on realestate.com.au for less than $400 also fell to just 19.3 per cent in September 2022, down from 41.8 per cent at the start of the pandemic.

PropTrack’s rental series is mirrored by other data providers, which have each recorded double digit annual growth in asking rents across Australia.

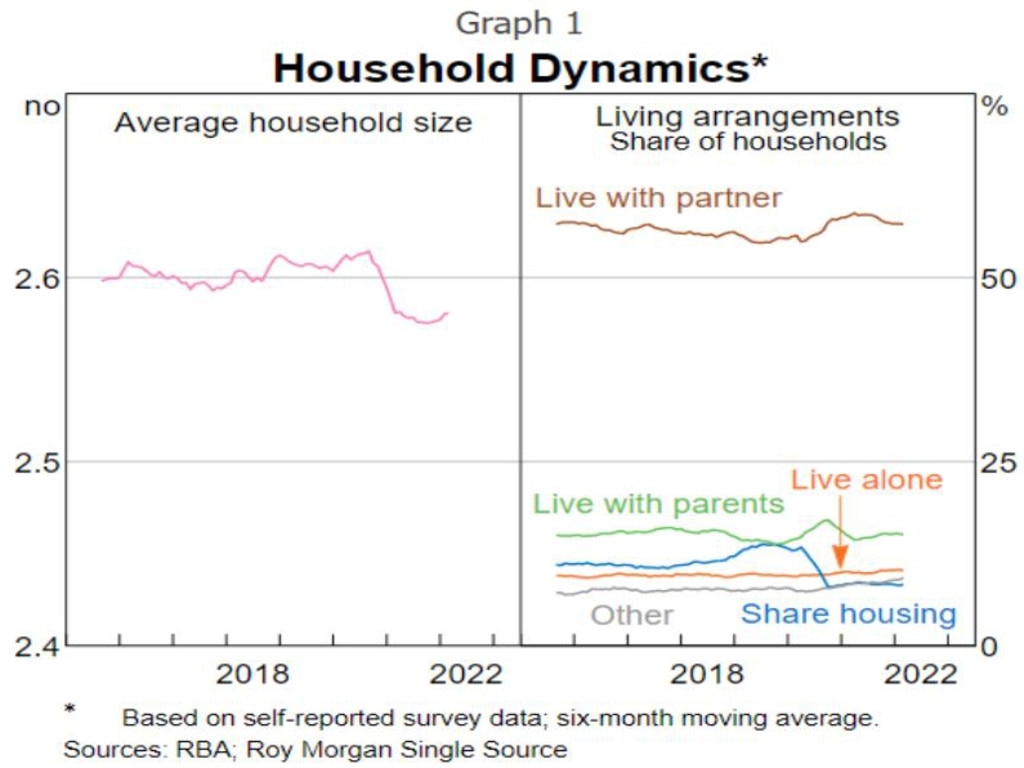

Australia’s rental market tightened over the pandemic due to a desire for more space, the growing trend to working from home and the need for home offices. This has seen the number of people per dwelling fall sharply, in turn lifting rental demand despite sluggish population growth:

Rental supply is also likely to have been eroded through the rise of rental services like Airbnb, which have enabled property owners to pivot to the short-term market.

The latter trend may have been particularly prevalent in tourism destinations across Australia, some of which boomed alongside domestic tourism over the past two years.

Record immigration is a disaster for the rental market

The working from home phenomenon looks like a structural shift that is unlikely to reverse. Therefore, we should not expect the number of people per dwelling to shift back to its pre-Covid level anytime soon.

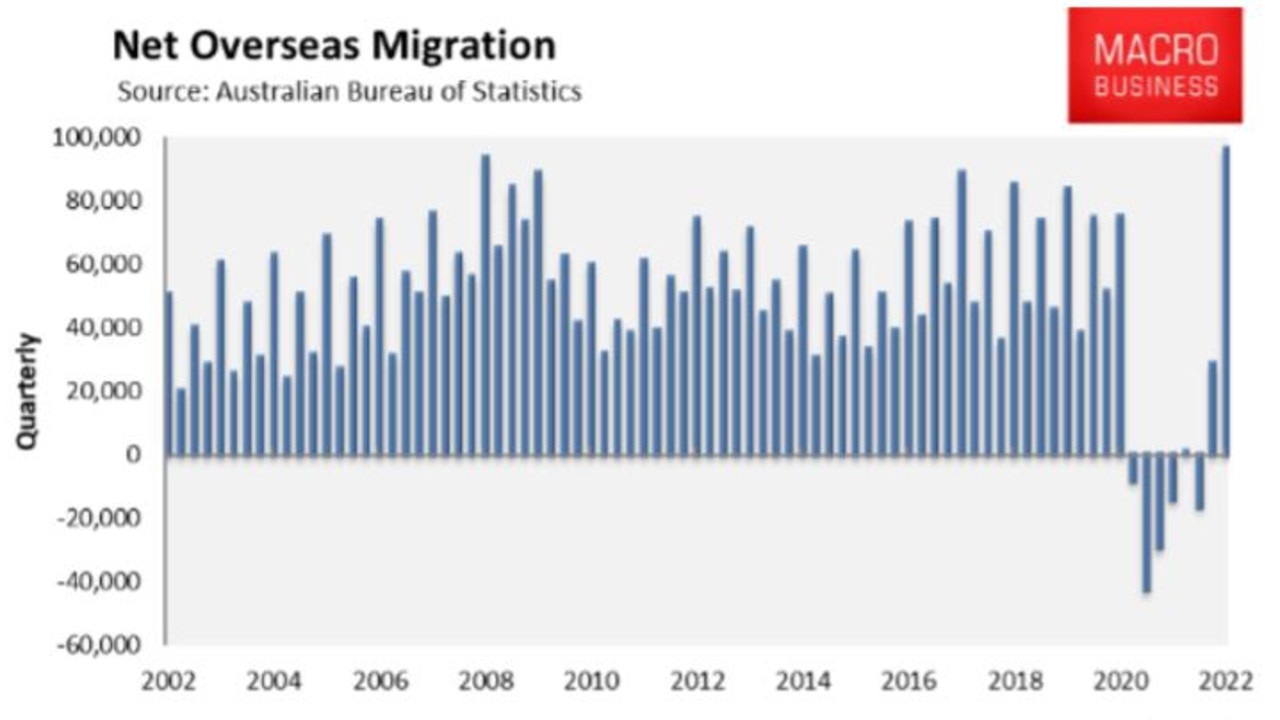

Meanwhile, immigration into Australia is picking up steam with net overseas migration hitting its highest ever level in the March quarter, with 96,200 net arrivals.

Monthly student visa applications in the first half of 2022 exceeded pre-pandemic levels. And analysis of higher frequency visa data by Coolabah Capital shows that international student arrivals rocketed to 500,000 on an annualised basis in the September quarter, with work visas also accelerating.

The rapid acceleration in student visas follows the former Morrison government’s removal of the cap on the number of hours students can work while studying late last year, alongside granting two-year post-study work rights to Vocational Education and Training (VET) sector graduates.

The Albanese Government then used last month’s Jobs & Skills Summit to announce that it would deliver record immigration next year via:

• Raising the permanent non-humanitarian migrant intake by 30,000 to a record high 195,000 a year

• Accelerating temporary migration by:

– Expanding work rights for international students via uncapping the number of hours international students can work while studying for an additional year; and extending the length of post-study work visas by two years.

– Committing to clear the backlog of nearly one million visas awaiting approval.

The Department of Home Affairs has already ruled on more than two million temporary and permanent visa applications in the last four months. Yet there is still a visa ‘backlog’ of 872,000 because applications continue to pour in, which the Government has vowed to clear as quickly as possible.

The soon-to-be record numbers of students and migrants arriving in Australia spells further trouble for the nation’s rental market, especially in the capital cities which attract most of the new arrivals.

Where will they live when there is already a dire shortage of homes for the existing population?

Having hundreds of thousands of additional people seeking rental accommodation will inevitably send rental vacancies to fresh lows, sending rents higher and plunging more people into homelessness.

It also comes as the construction of housing is set to fall on the back of widespread builder insolvencies amid soaring input costs.

Higher rents will fuel inflation, driving up interest rates

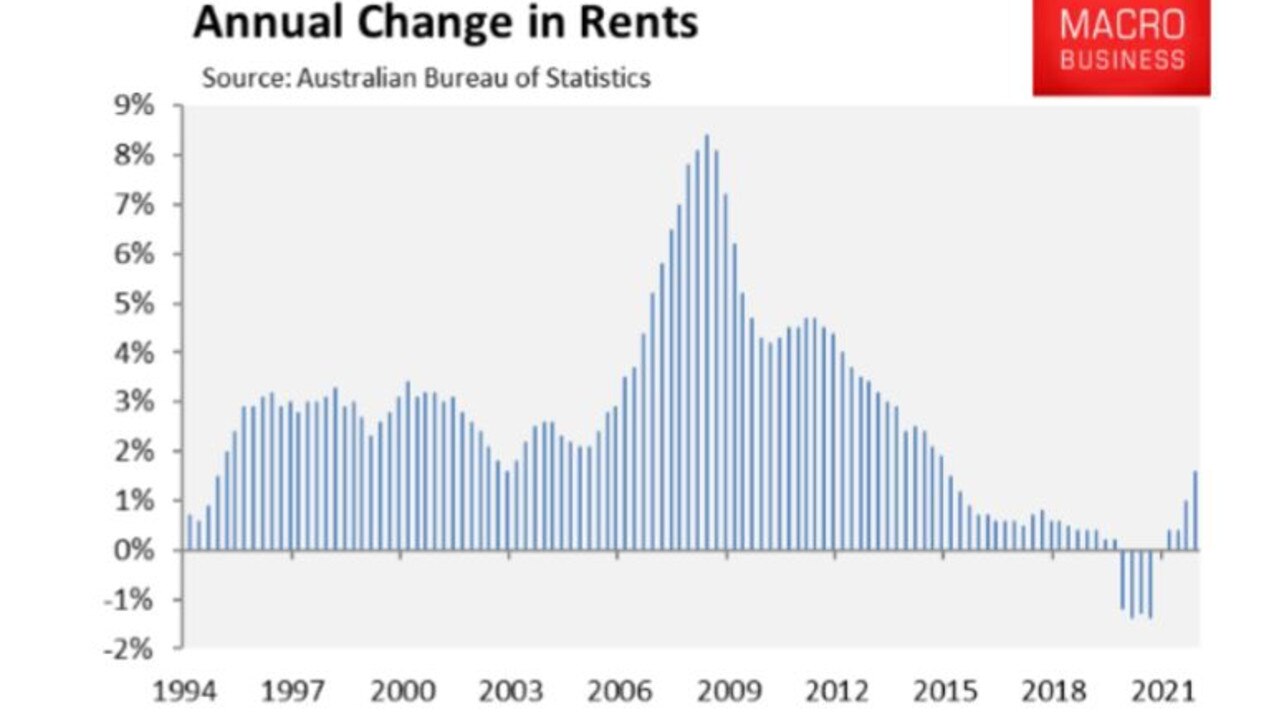

Rents currently account for around 6 per cent of the Consumer Price Index (CPI) – the key inflationary measure that the Reserve Bank of Australia (RBA) uses in setting interest rates.

Curiously, the Australian Bureau of Statistics’ (ABS) rental series – measured as part of the CPI – rose by only 1.6 per cent in the year to June 2022, which was around one-quarter the rate of headline inflation (6.1 per cent).

Therefore, the ABS’ rents measure is badly lagging and does not reflect the true state of the market, as measured by PropTrack and the other housing data providers.

More Coverage

Once the ABS updates its rental series with the actual market, ABS rents will inevitably soar, adding significantly to Australia’s CPI.

In turn, the RBA will come under more pressure to lift interest rates to curb inflation.

Leith van Onselen is chief economist at the MB Fund and MB Super. Leith has previously worked at the Australian Treasury, Victorian Treasury and Goldman Sachs.