Scott Morrison says changing GST distribution is ‘overdue’ but a long way off

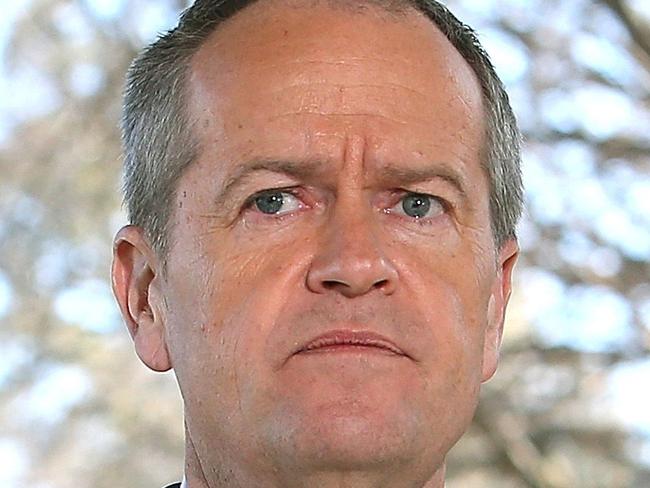

BILL Shorten claims Malcolm Turnbull’s proposed GST changes are merely a way to rescue the Liberal WA Government in the face of a looming state election.

OPPOSITION Leader Bill Shorten claimed Malcolm Turnbull was merely trying to “rescue” the Liberal WA Government, in the face of a looming state election with his proposed GST changes.

“If he’s got a serious proposal to change the allocation, let’s see his detail,” he said.

“I’m just not going to entertain Mr Turnbull’s thought bubbles, which are purely

motivated by state politics in WA.

“Australia is getting fed up with Mr Turnbull’s all-talk, no-action approach to Government.”

Shorten’s comments come as treasurer Scott Morrison said changing the GST carve-up is “overdue”, but won’t be looked at for some time yet.

Following Prime Minister Malcolm Turnbull’s announcement on the weekend he wanted to introduce a GST floor below which no state’s share of the tax could fall, Mr Morrison warned advocates and opponents not to get ahead of themselves.

“You’ve got to wait until you get the system back into a position where it’s more balanced and so therefore you’re not engaging those sorts of discussions,” he told 2GB.

“Where you’re not changing anything to what people are then currently getting and you wait for the system to correct itself and then you have what is an overdue conversation about how you can make sure it’s fair to everyone and you don’t get these sorts of perverse results.”

His comments echo the approach outlined by Mr Turnbull on Saturday.

“Over the next few years, the formula will see Western Australia’s share more than double — considerably more than double from where it is at the moment to a much higher level,” he said.

“We believe that we should take that opportunity — as the Western Australian share of the GST increases under the current system — to change the arrangements so that we set a percentage floor below which no state’s receipts of GST can fall below.

“Setting a floor below which a state’s share of the GST cannot fall, immediately after it has been exceeded in this cycle, means that no other state will be disadvantaged based on their projected GST shares.”

Acknowledging such a change would require approval from the state and territory governments, Mr Morrison said the change would occur “down the track”, saying “we shouldn’t get ahead of ourselves”.

“No-one envisaged that the current way things are done would lead to a situation where Western Australia would just get 30 per cent of the GST their people paid,” he said.

“The system has got to be fair to everyone.

“That was a pretty egregious result and the simple point he is making is down the track, once the system gets to the point where Western Australia’s share gets back to a more normal level then we will have a good yarn about how we can rebalance the system.”

Some states have already expressed opposition to the plan.

Queensland Premier Annastacia Palaszczuk said yesterday it was policy on the run.

Labor’s Helen Polley told the ABC: “certainly the alarm bells are ringing loud and clear.

The WA Government has long been pushing for a change to the way GST revenues are distributed between the states, claiming it is missing out.

Labor’s Michelle Rowland claimed it was “reminiscent of his double taxation thoughts he had some months ago.”

“And it’s also reminiscent of him trying to push for changes to the GST on increasing it,” she told Sky News.

“So he floats these ideas then jettisons them when they all become too hard.”

HOW GST IS CARVED UP BETWEEN THE STATES

* The GST is Australia’s general consumption tax, introduced by the Howard government in 2000.

* The 10 per cent impost on about half purchased goods and services raises about $57 billion a year.

* The commonwealth collects the tax and distributes the revenue to the states and territories using a typically bureaucratic named formula — horizontal fiscal equalisation.

* In plain English it’s a social equity objective that recognises states have different capacity to raise revenue from their taxes and how much it costs each of them to deliver services and infrastructure.

* WA and the Northern Territory, for instance, are better placed to collect mining royalties; NSW and Victoria collect more stamp duty through higher house prices.

* Increasing the share for one state comes at the expense of others.

* WA is complaining now because it’s receiving less than 40 cents for every $ its residents pay in GST — down from 79c in 2009-10 — at a time when its mining tax revenue has slumped.

* Some states and territories receive more GST revenue than their residents pay: NT $5.6 for every tax dollar; Tasmania $1.63; South Australia $1.28; ACT $1.24; Queensland $1.08.

* If revenue was distributed on a per-capita basis NSW would get nearly a third of the pie; Victoria a quarter; Queensland a fifth; WA 11 per cent.

* The PM has flagged a review that creates a floor share — somewhere between 50 and 75 cents for all states. Except for WA, no state or territory’s share has ever dropped below 82c.