Rich families could be $11,000 better off under Labor’s childcare plan

Rich families could secure a huge windfall from Labor’s childcare plan equal to the $11,000-a-year tax cuts that have been slammed as “offensive”.

Australia’s richest families could secure windfall savings from Labor’s new childcare policy that are equal to the $11,000-a-year tax cuts that have been slammed as “offensive”.

New modelling prepared by the Department of Education claims a couple on $360,000 with two children in childcare could secure an extra $11,000 a year in taxpayer-funded childcare rebates under the changes.

Under the Morrison Government’s legislated tax cuts, workers with a salary of more than $200,000 score a tax cut worth more than $11,000 a year from 2024.

But those tax cuts have been described as “offensive” by Labor’s treasury spokesman Jim Chalmers and attacked by colleagues as a windfall for millionaires.

RELATED: Labor’s radical childcare plan

RELATED: The Aussie mums working for $1 an hour

Labor leader Anthony Albanese is now promising a new childcare rebate offering savings for families earning up to $500,000 who are currently cut off from claiming any childcare rebates.

He’s also promising to consider moving to a Medicare-style universal childcare subsidy for all workers, regardless of income, that would cover 90 per cent of childcare costs.

In the medium term, he’s promising 90 per cent for low income earners and a more generous rebate for all that will deliver savings to 97 per cent of families.

While the Labor Party released a table last night suggesting the “average” gain for families earning high incomes was $2900, for some families under these changes that amount could be much larger depending on the number of days in childcare.

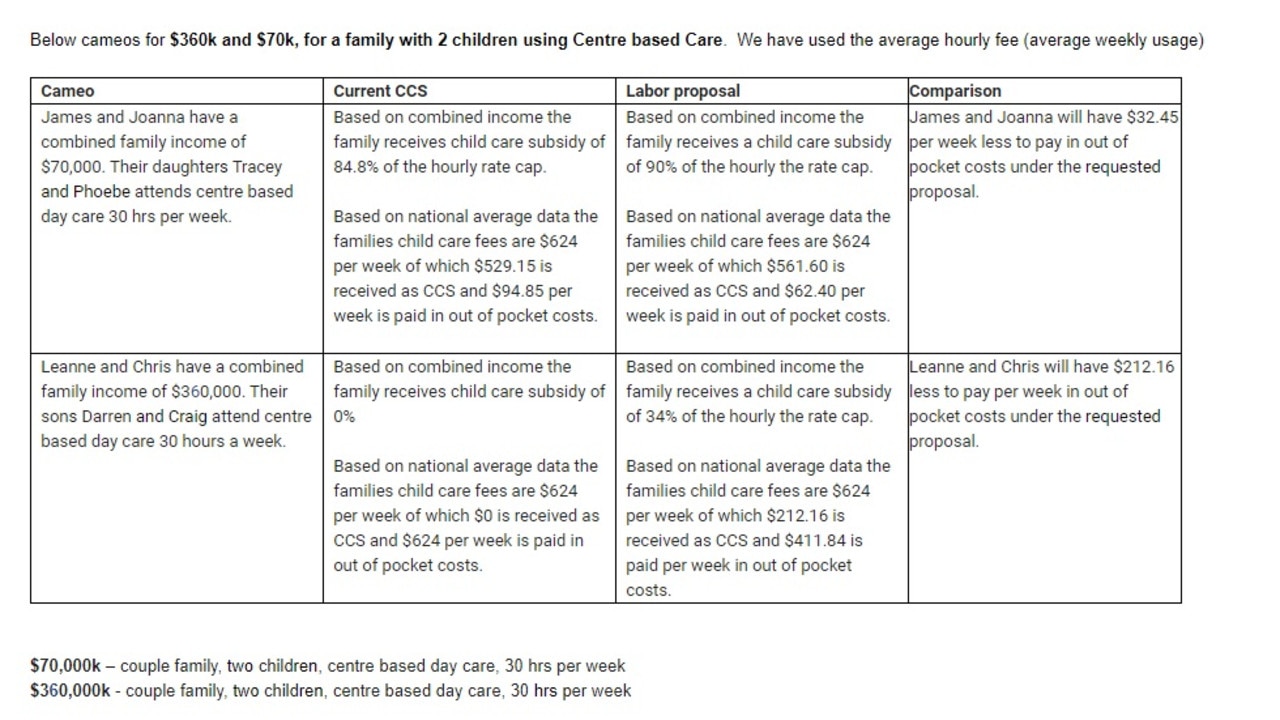

The Department of Education compared two families under Mr Albanese’s proposed changes.

Under the first example, ‘James and Joanna’ have a combined family income of $70,000. Their daughters Tracey and Phoebe attend centre based day care 30 hours per week.

Based on combined income the family receives a child care subsidy of 84.8 per cent of the hourly rate cap under the current system.

Based on national average data, the family’s child care fees are $624 per week of which $529.15 is received as CCS and $94.85 per week is paid in out of pocket costs.

Under Labor’s proposal the family would receive a child care subsidy of 90 per cent of the hourly rate cap.

As a result, James and Joanna would have $32.45 per week less to pay in out of pocket costs under the requested proposal or save $1678.

But for a high income family the benefits are nearly seven times higher.

‘Leanne and Chris’ have a combined family income of $360,000. Their sons Darren and Craig attend centre based day care 30 hours a week.

Based on combined income the family receives child care subsidy of 0 per cent under the current system.

Based on national average data the family’s child care fees are $624 per week of which $0 is received as CCS and $624 per week is paid in out of pocket costs.

Under Labor’s plan, based on combined income the family would receive a child care subsidy of 34 per cent of the hourly rate cap.

So from the family’s child care fees of $624 per week, $212.16 would be received as CCS and $411.84 in out of pocket costs.

As a result, Leanne and Chris will have $212.16 less to pay per week under the requested proposal and save $11,000 a year.

Over the course of a year that means the benefits could be over $11,000.

A spokesman for Labor’s childcare spokeswoman Amanda Rishworth said that the ALP’s own modelling suggested the high income family would get even more than $11,000 suggested.

Under the current system the family earning $360,000 with two kids gets no childcare rebates but under Labor’s they would get an extra $13,222 a year.

In the second cameo of a family earning $70,000 a year with two kids in are three days a week the family would secure $32,276 in rebates currently and $34,258 under Labor.

In other words they would be around $1500 a year better off while the rich family would be $13,000 better off.

The Labor Party has repeatedly shamed the Morrison Government for offering the same amount to high income earners as tax cuts.

Just last year, former Labor leader Bill Shorten said “investment bankers” would “pocket more than $11,000 a year”.

“We will not be signing-up to the Liberals’ radical, right-wing, flat-tax experiment, way off in the future. A scheme which would see a nurse on $50,000 paying the same tax rate as a surgeon on $200,000. We won’t back a plan that gives a retail worker on $35,000 less than $5 a week, while an investment banker pockets more than $11,000 a year,’’ he said.

“This is not a tax plan, it’s a ticking debt bomb. And it is neither fair nor responsible to lock-in these billions of dollars in tax giveaways flowing disproportionately to a relatively few Australians – and so far into the future.”

Labor frontbencher Tanya Plibersek said “millionaires” would score $11,000 under the tax cuts.

“It says everything you need to know about the Liberals when they’re willing to see workers’ wages be cut - but giving millionaires at the top end of town an $11,000 a year tax cut,’’ she said.

Labor did however ultimately vote for the tax plan after the election to ensure low income earners were not forced to wait for tax relief.