Reserve Bank says Mortgage arrears rate at highest rate since Global Financial Crisis

The stream of worrying economic news has continued as new figures show more than $170 billion has been wiped off the property market in three months.

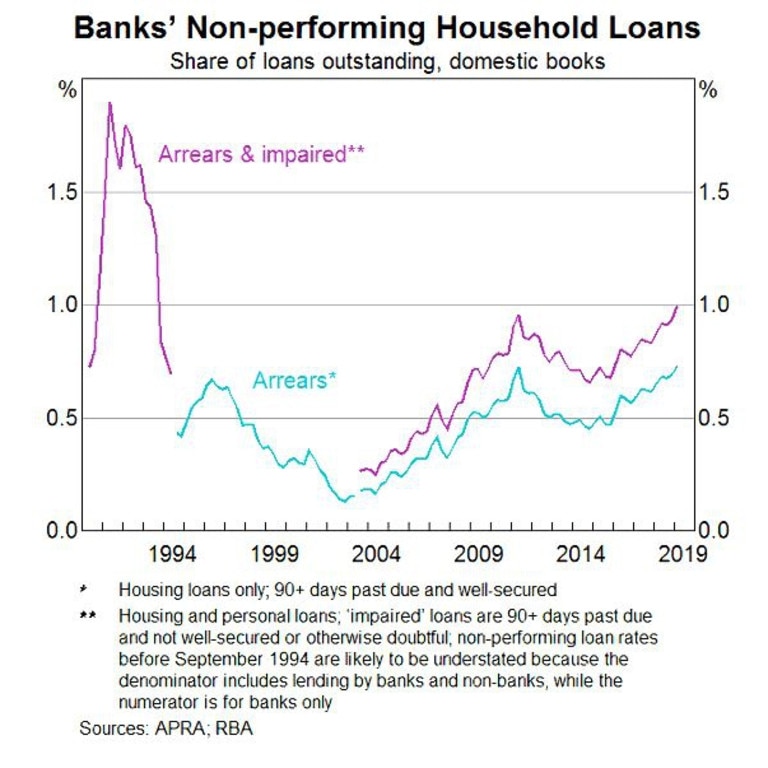

The number of Australians falling behind on their mortgage repayments is at its worst since the Global Financial Crisis, the Reserve Bank says.

RBA head of financial stability Jonathan Kearns told a property summit in Canberra that the number of people in arrears on their home loans was increasing.

He says the proportion of those falling behind was still low at just 1 per cent but admitted it was an indication the economy faces tough times.

“Several factors have been interacting to drive the rise in housing arrears. Economic conditions are undoubtedly part of the story,” Mr Kearns said in his speech on Tuesday.

“Weak income growth, housing price falls and rising unemployment in some areas have all contributed. But they have not acted alone, interacting with earlier weaker lending standards, and the more recent tightening in lending standards.

RELATED: Will you get the rate cut? Big banks announce plans

RELATED: Delaying rate cut will allow big four to pocket $110 million

RELATED: Australians should expect another rate cut

“Recognising the greater risk of interest-only lending, banks continue to charge higher interest rates for these loans and more carefully scrutinise their suitability for borrowers.

“As a result, some borrowers who may have anticipated being able to roll over an interest-only period are finding they cannot.”

The data comes a day after ratings agency Moody’s reported mortgage delinquency rates are rising in Australia, with borrowers struggling under weak house prices and the high level of debt.

The agency’s senior analyst Alena Chen says household debt of 200 per cent of annual disposable income meant a huge number of homeowners are financially exposed.

“The increase will be because of record-high household debt levels, the conversion of a large number of interest-only mortgages to principal and interest loans and falling house prices,” she said as reported by the Sydney Morning Herald.

A steady flow of weak economic and employment data have stirred fears a recession is likely, but AMP Capital chief economist Shane Oliver says there are plenty of factors that will steer Australia through the trying conditions.

“Australian growth is likely to be weak over the next year or so and this will prompt further monetary easing and fiscal stimulus,” Mr Oliver said in a note.

“However, several positives suggest recession is unlikely.”

Those include the Aussie dollar, the drag from falling mining investment is over, there is scope for extra fiscal stimulus, infrastructure spend is strong and there is no sign of panic property selling.

FURTHER RATE CUTS ‘MORE LIKELY THAN NOT’

RBA board members agreed that further reductions to the cash rate were “more likely than not” when they cut it to a record low 1.25 per cent this month.

Minutes from the RBA’s June 4 meeting show members agreed that a further easing in monetary policy would be likely as the central bank tries to stimulate the economy through lowering the exchange rate, reducing borrowing costs for businesses, and lowering interest payments on loans to households.

The minutes confirmed the RBA will monitor the jobs market as it mulls the timing of any further cuts.

“A lower level of the cash rate would assist in reducing spare capacity in the labour market, providing more Australians with jobs and greater confidence that inflation will return to be comfortably within the medium-term target range in the period ahead,” said the minutes released on Tuesday.

“Given the amount of spare capacity in the labour market and the economy more broadly, members agreed that it was more likely than not that a further easing in monetary policy would be appropriate in the period ahead.”

Capital Economics economist Ben Udy said the comments suggested the RBA was on track to cut again in August, and possibly as soon as July, before making a third reduction to leave the cash rate at 0.75 per cent by the end of 2019.

The central bank’s first move in any direction since August 2016 followed another month of weak economic data, most notably an unexpected rise in the unemployment rate for April to a seasonally adjusted 5.2 per cent.

The minutes showed the RBA expects unemployment, which turned out to have remained steady in May, to decline just “a little” over its forecast period.

PROPERTY PRICES DOWN IN EVERY CAPITAL

Home prices fell in every Australian capital city in the three months to March, slicing off more than $170 billion from the total value of the country’s dwellings.

Average prices across the eight capitals dropped 3.0 per cent in the quarter and 7.4 per cent in the year, according to the Australian Bureau of Statistics’ Residential Property Price Index, released on Tuesday.

The March quarter drops were greatest in Sydney and Melbourne as home prices fell 3.9 per cent and 3.8 per cent, respectively, while the smallest dip was in Adelaide at 0.2 per cent.

The total value of Australia’s 10.3 million residential dwellings fell $172.7 billion between January and the end of March, to $6.56 trillion, a heftier decline than the $133 billion lost in the December quarter.

The statistics agency said 42,900 homes were added during the first three months of 2019.

“A continuation of tight credit supply and reduced demand from investors and owner occupiers has contributed to weakness in property prices in all capital cities this quarter,” ABS chief economist Bruce Hockman said.

Average property values on a 12-month basis fell 10.3 per cent in Sydney, 9.4 per cent in Melbourne, 4.2 per cent in Darwin, 2.7 per cent in Perth and 1.3 per cent in Brisbane.

Home prices over the year were up 0.8 per cent in Adelaide and 4.6 per cent in Hobart, while values in Canberra remained unchanged.

According to the figures, the total value of Australian residential dwellings peaked at $6.96 trillion in the March quarter of 2018 and has since fallen for four consecutive quarters.

The ABS calculated that the average Australian home cost $636,900 by the end of March 2019, with NSW having the most expensive meant $806,800 and Tasmania recording the lowest at $412,700.

With AAP

Continue the conversation on Twitter @James_P_Hall or james.hall1@news.com.au