NSW Government Intergenerational Report predicts bumper pay rises, but a growing fiscal gap

A new government report has said on average, we could all be paid $50,000 more annually in the years ahead. But the cash will not be splashed evenly.

In four decades’ time, the average wage will be more than $50,000 higher than today, many of us will have graduated with “micro degrees”, houses will be more affordable and we’ll be living into our ninth decade.

But our cities will be heaving with millions more people and there will be fewer workers to pay for the growing number of retirees. That’s led to warnings of a widening “fiscal gap”.

And if you’re not in the right industry, you won’t be getting that fat pay rise.

That’s the conclusion of number crunchers who were tasked by the New South Wales government to paint a picture of the state, and a typical resident – who they have dubbed “Sophie” – in 2061.

“The way things will look for the people of NSW in 40 years will be vastly different to the world today,” Treasurer Dominic Perrottet said on Monday at the launch of the 2021-22 NSW Intergenerational Report.

“If we are to ensure the next generation enjoys the same levels of prosperity and opportunity that we have today it is vital we identify future challenges and work to overcome them.”

Population to rise by 3.3 million

Produced every five years, the Intergenerational Report is designed to be a crystal ball on how the state will develop, looking at everything from population to industry, fertility to climate change.

By 2061, a further 3.3 million people are forecast to squeeze into NSW, taking its population from the current 8.2 million to 11.5 million.

Of that jump, 40 per cent will come from “natural increase” – births minus deaths – with 60 per cent from migration.

But that’s not as high as was projected in the last such report back in 2016. Then it was projected that the NSW population would grow by 1 per cent each year. That’s now been downgraded to a 0.8 per cent growth rate.

“Short-term migration losses and lower fertility rates resulting from the Covid-19 pandemic will have ongoing impacts on the NSW population over the long term,” stated the report.

“By 2061, the NSW population will be older and around half a million people smaller than it would have been without Covid-19.”

The NSW fertility rate is forecast to decline from 1.67 to 1.63 by 2032, reflecting the trend towards starting families later in life and having fewer children overall.

Life expectancy will go up, from an average of almost 86 for women to 91.7 years and for men from 82.2 to 89.4.

RELATED: Sydney’s population growth to shrink due to Covid-19

Average wage will be $139,000 per year

Productivity is expected to grow by 1.2 per cent a year. But getting that to 1.3 per cent would add $53 billion to the NSW economy which was equivalent to $11,000 more annual income per household.

Talking of cold, hard cash, the report predicts we’ll have more of it.

The NSW economy is forecast to expand to $1.4 trillion (in 2020 dollars) by 2061, more than double the $558 billion it’s worth now.

That in turn will see wages go up. The average salary will go from $86,000 today to the equivalent of $139,000 in the 2060s.

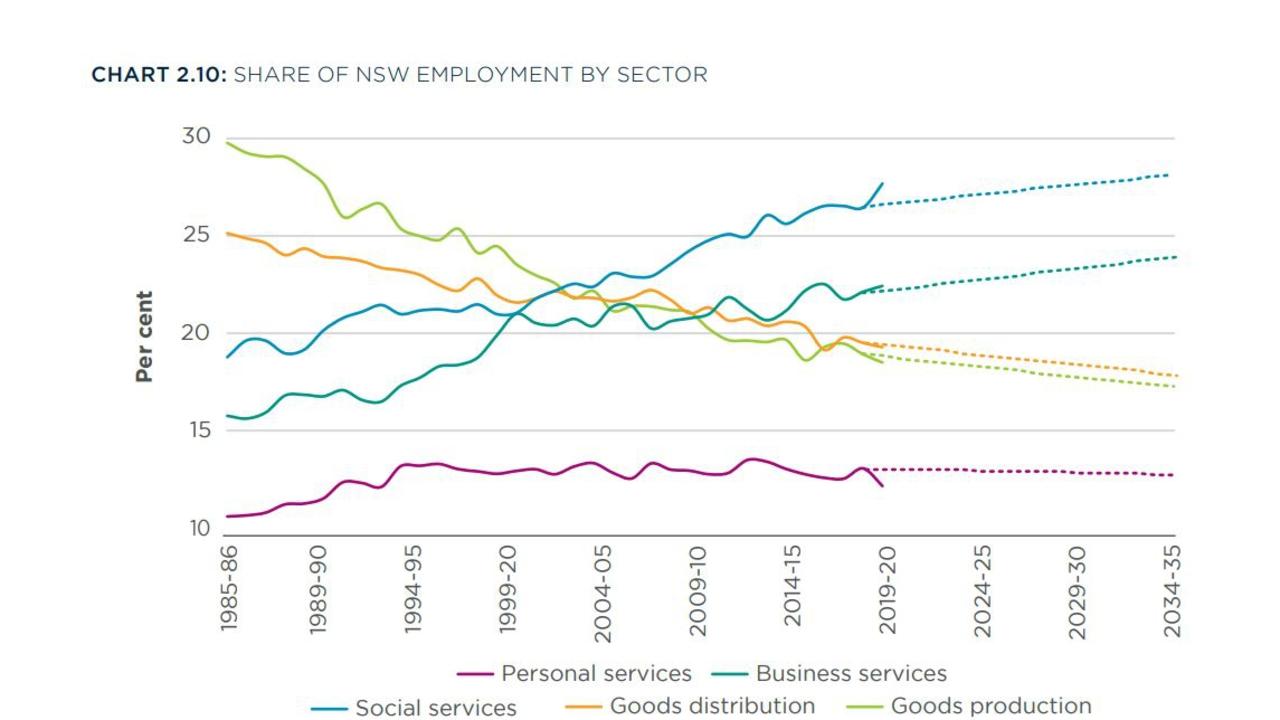

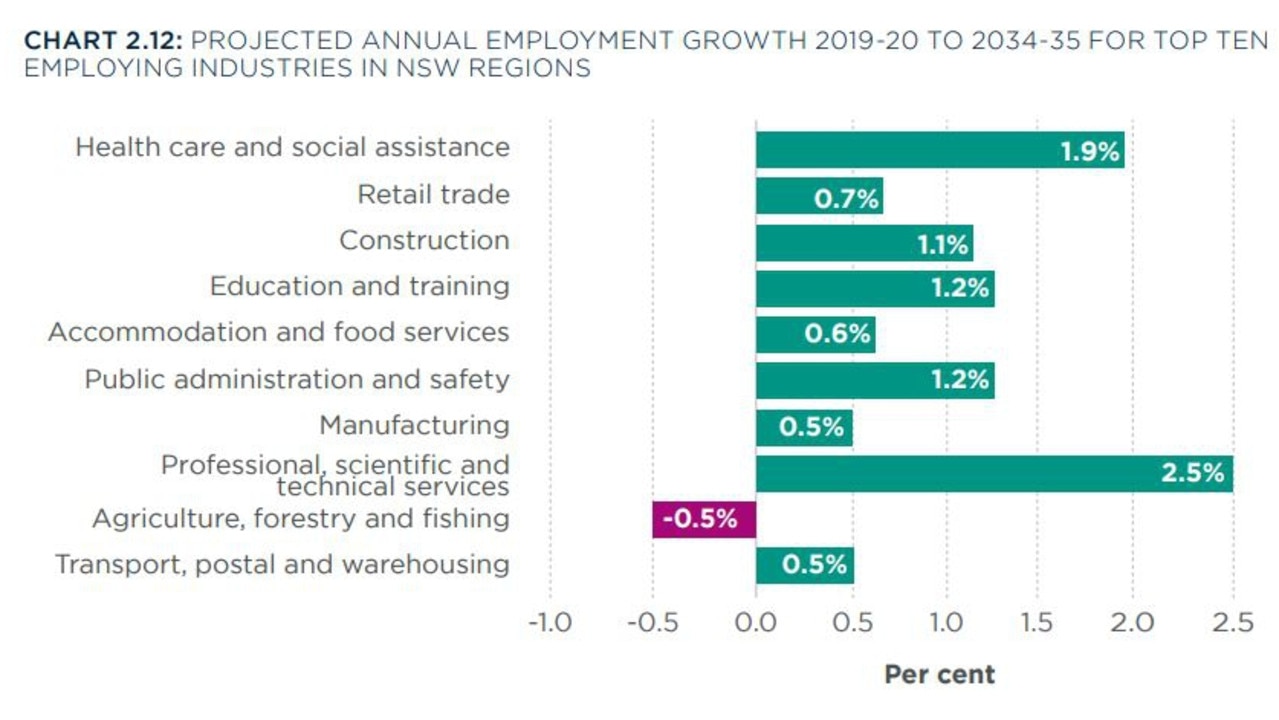

More of us will be employed in the service sector, health, education, administration and finance roles.

Many of these jobs such as nursing and teaching which can’t be automated will be better paid.

But you may not get much of a pay rise if you’re in agriculture, manufacturing and retail – or even mining – all of which are expected to decrease as a share of the overall workforce. Although there will of course be specialised roles in most areas that will remain lucrative.

“This growth, however, is not guaranteed”, stated the report, citing risks from an ageing population, climate change, geopolitical shifts, and technological changes among others.

Climate change impacts alone, such as increased bushfires and floods, could cost the bottom line up to $17 billion annually in 2061.

Fewer people working to support retirees

As the population ages, more people will no longer be of working age. The participation rate, which measures those working or available for work, is set to go down from more than 65 per cent today to 61.6 per cent in 2061.

Right now, for every one person over 65, there are 3.9 working. In the 2060s there will be just 2.4 people per retiree.

“This shift underscores the importance of migration to the economy,” the report stated.

“People coming to the state from overseas are typically younger and of prime working age. “Having more people migrating to live in NSW acts as a balance to support rising costs and health care needs of people as they age.”

The average age of a person in NSW will rise from 38 to 44. Without migration, the average age would be almost 63 by 2061.

Day in the life of ‘Sophie’, the average 2061 citizen

The report paints a picture of an average NSW resident in 2061 which it calls “Sophie”.

She is 40, and lives near the new airport in the city’s west. The apparent plane spotter only works face-to-face one-third of the time. When she does commute she has a 30 minute drive to work, in a self-driving car she rents.

“She studied applied artificial intelligence at university and has worked in a few different fields using advanced IOT (internet of things) sensor analysis,” the report says of the super smart Sophie.

“With her broad experience and a later microdegree from TAFE on agritech, she has been able to stay creative about applying ever-evolving sensor techniques for her clients.”

Sophia has also moved four times since buying her first home in her twenties. Optimistically, the report suggested buying a home could become easier.

It currently takes on average 12 years to save up enough for a deposit. That’s because low interest rates has meant people have been able to borrow more to get into the market.

But interest rates are expected to rise. Together with building 42,000 new homes per year, that could bring the years needed to save for a deposit down to 10 – but that’s still over a year longer than in the early 2010s.

Getting rid of stamp duty would be another benefit, the report stated, which adds 1.8 years to that wait.

“This would make it easier for people to move home, whether for a new job, to be closer to friends and family, or to move into housing more suitable for their stage of life.”

RELATED: House prices now ‘unaffordable’ for many average Australians

Fiscal gap a worry

A big problem, however, will be how to pay for everything.

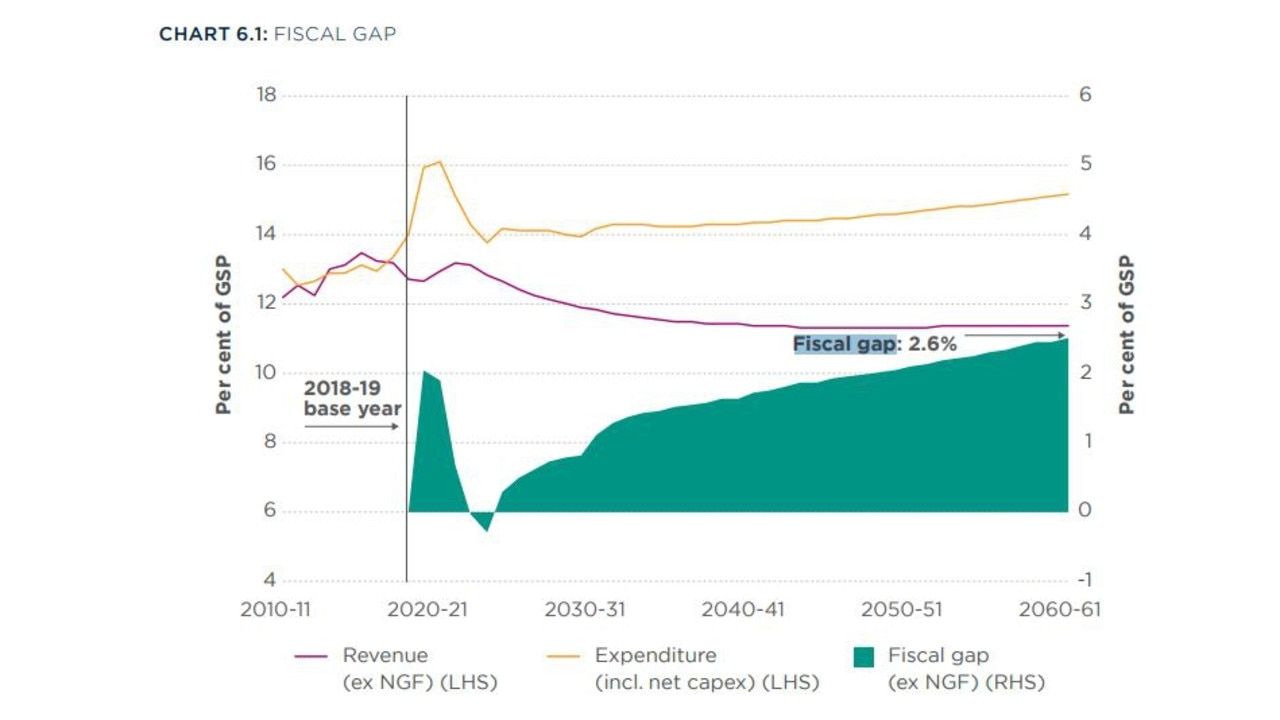

NSW is heading for a “fiscal gap”. This is the gap between the rise in expenditure and revenue measured by a percentage of gross state product (GSP).

Increased health spending will be a key factor behind the fiscal gap in NSW, reaching 2.6 per cent of GSP in 2061.

“Unless corrective measures are taken, government expenditure is projected to grow faster than government revenues by around 0.5 percentage points on average each year,” it said.

The NSW government has said some of that gap will be reduced by the state’s sovereign wealth fund, which is projected to reach $43 billion (in today’s money) by 2061.

It was created in 2018 as a buffer against rising debt. But it won’t get rid of the gap completely, suggesting more drastic action is warranted.

“We have already taken steps such as setting up the (fund) to help secure the future for future generations but there is still much more work to be done and the report will help ensure we make the right decisions at the right time,” said Mr Perrottet.