Morrison government scheme had ‘material impact’ on inflation

The Reserve Bank has revealed the eye-watering impact a Morrison government scheme had on inflation.

A wildly popular first homebuyer grant has been exposed as a major contributor to Australia’s soaring inflation rates.

Reserve Bank governor Philip Lowe made the alarming revelation during a major address to the Anika Foundation on Thursday afternoon.

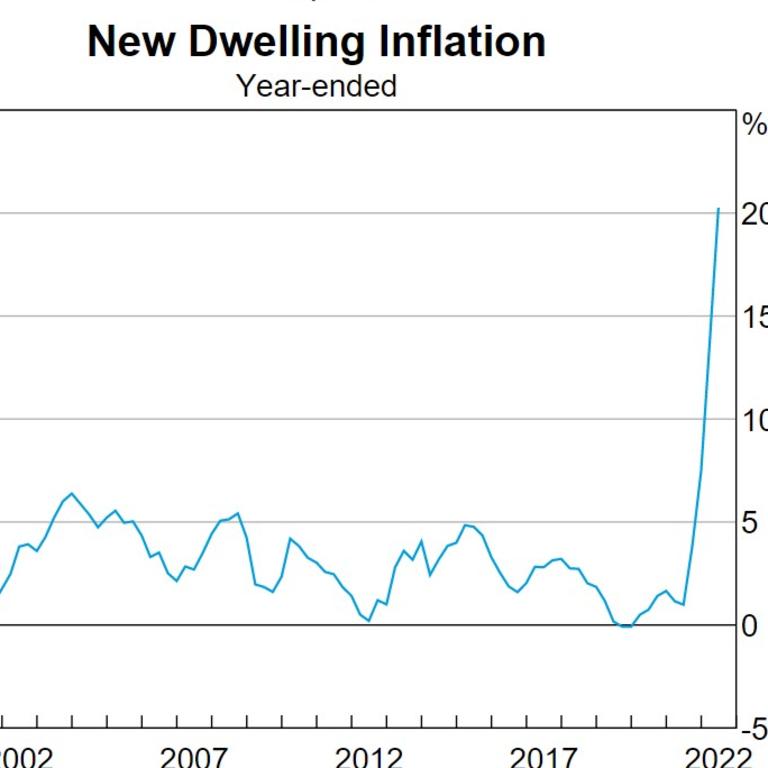

“Over the past year, the cost of building a new home has increased by 20 per cent; this alone has added close to two percentage points to headline inflation,” he said.

Strong demand, government grants of up $35,000 for some first home buyers and supply chain problems added to the inflated cost of building a home.

Under the Morrison government’s program, eligible owner-occupiers building a new home or substantially renovating could apply for the cash handout.

More than 137,000 Australians who signed contracts between June 2020 and March 2021 benefited from the scheme.

Together with low interest rates, which allowed more Australians to borrow money, the scheme was credited with saving the housing industry during the pandemic.

But the RBA governor has now confirmed it had other, unintended consequences.

“The result was a big jump in prices, which has had a material impact on the overall inflation rate in Australia,” Dr Lowe said.

It comes as the under-pressure governor confessed he is doing some “soul searching” after badly misjudging the economic outlook, but says he has no plans to quit.

The headline inflation rate is now expected to tip 7.75 per cent by the end of the year, but Dr Lowe said interest rate hikes are expected to slow down in the near future.

“And we recognise that, all else equal, the case for a slower pace of increase in interest rates becomes stronger as the level of the cash rate rises,” he said.

“But how high interest rates need to go and how quickly we get there will be guided by the incoming data and the evolving outlook for inflation and the labour market.”