Median age of Australia’s first homebuyers shows how radically housing has changed

A lot has changed in Australia, particularly in real estate. Few things sum up how tough things are getting more than this 20-year comparison.

At the turn of the new millennium, Australia seemingly had everything going for it.

The economy was booming – and households were sharing in the nation’s good fortune as they saw their pay packets rising rapidly.

In short, it was a pretty good time to be an Australian.

Looking back on that era, in some ways it’s scarcely recognisable when contrasted with how things have changed over the past two decades. Arguably one of the largest and most notable changes that have occurred is the rapidly rising cost of housing.

In order to explore how that has changed from a real world household perspective, we’ll be looking at the age of the median first homebuyer across more than two decades of data.

Looking to get into the property market? Check out Compare Money's first home buyer guide >

A changing landscape for borrowers

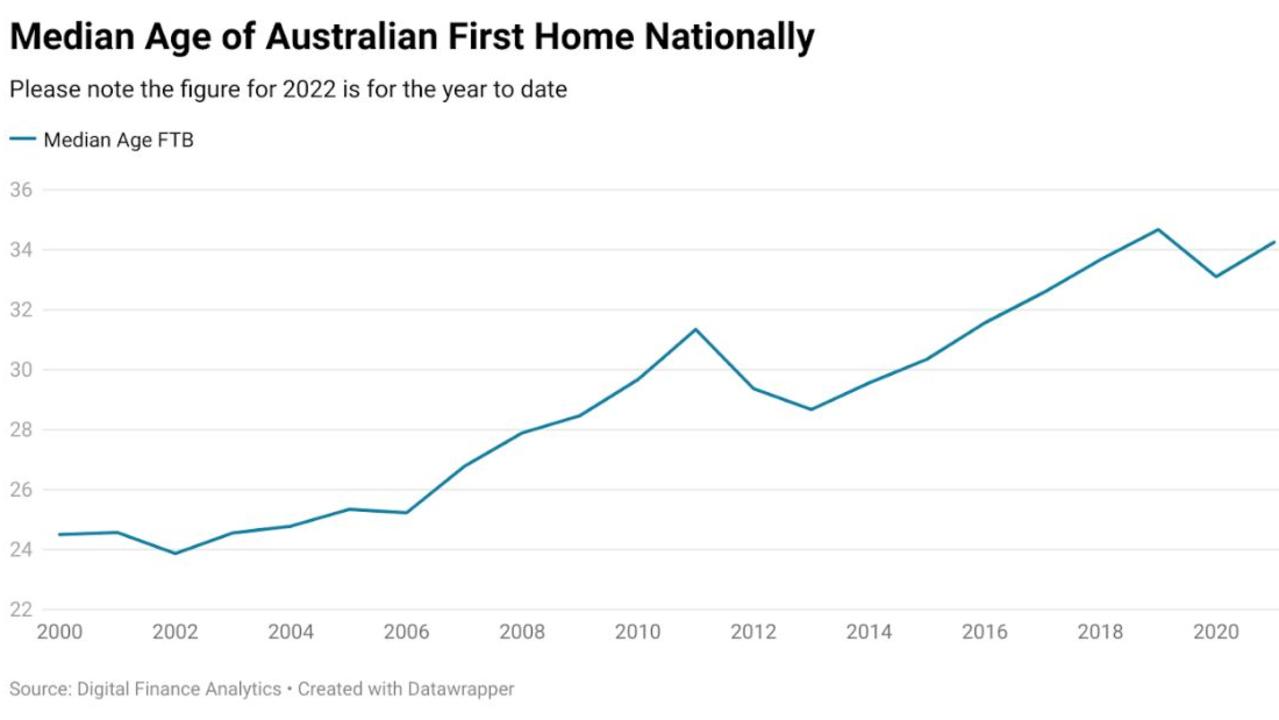

According to figures from research firm Digital Finance Analytics, when calendars clicked over to the 2000s – back when the radio was belting out the top number 1 hit of the year, NSYNC’s Bye Bye Bye – the median age of the nation’s first homebuyers was 24.5. At the time, mortgages were generally taken out on 20-year terms.

Even if this hypothetical median household encountered a few major bumps in the road in terms of illness, family issues or financial difficulties, they could generally work to be mortgage-free by the time they were 50.

This is naturally quite a boon to not only the fortunes of the individual household, but also to the wider economy. With the household no longer forking out for mortgage repayments each month, those funds could now be spent on goods and services at all manner of businesses.

Fast forward to 2022 and things have changed dramatically. The median age of a first homebuyer nationally has risen by a full decade – to 34.5 years of age. With housing prices now significantly higher relative to household incomes, loan terms have been extended, with 30-year mortgages now commonplace.

On paper, this will leave today’s first homebuying households paying down their loans until they hit what was once the finish line for working life, 65.

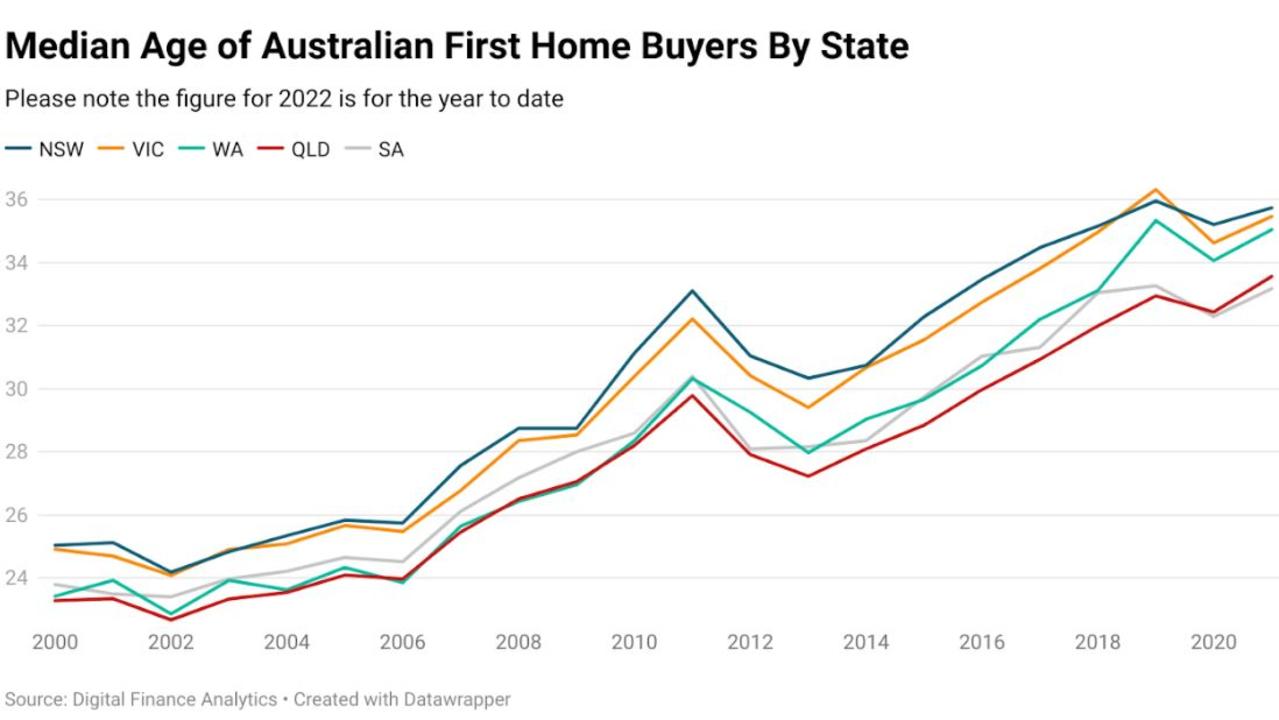

However, outcomes can vary quite significantly depending on what state a first homebuyer lives in.

For example, in South Australia the median age of a first homebuyer is 33.6, compared with 36.3 in NSW.

Perhaps unsurprisingly, the most expensive states of Victoria and NSW have the highest median first homebuyer ages. Meanwhile, South Australia and Queensland have the lowest.

Challenging long-term consequences

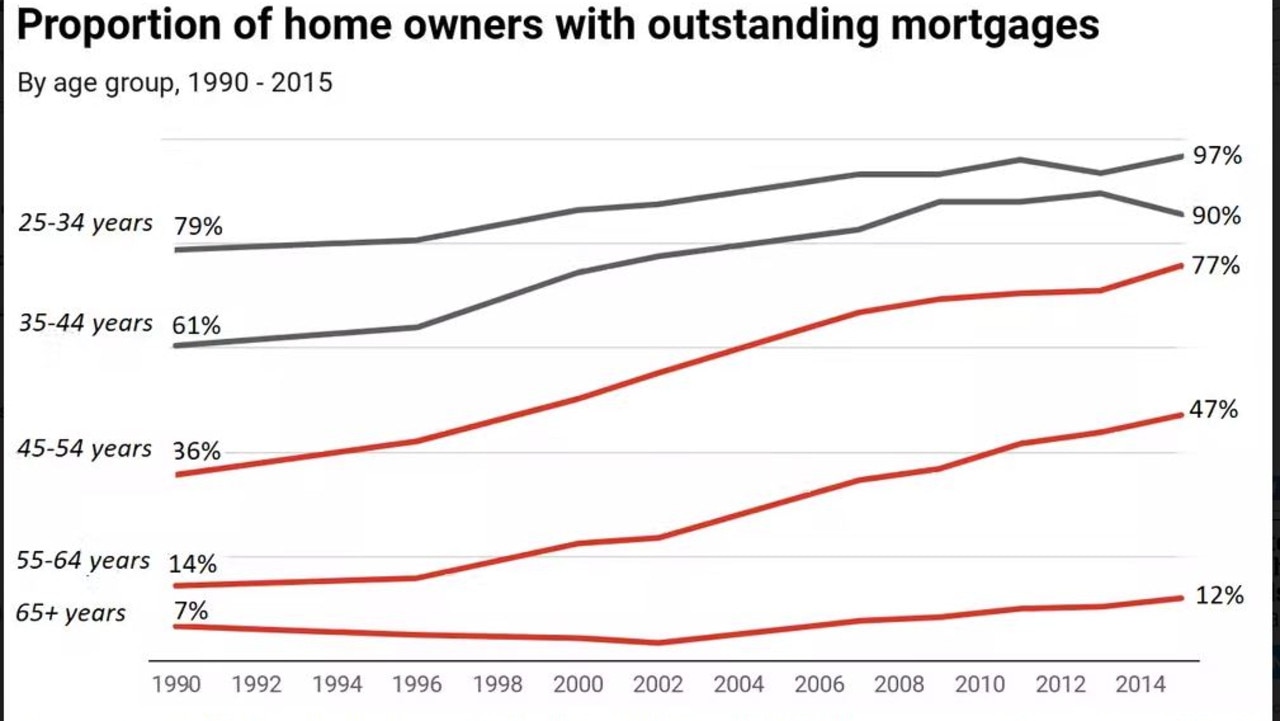

While we may now look back at the early 2000s as a bygone golden era of affordable living and strong real (inflation adjusted) household income growth, even these conditions ended up resulting in some significant changes in how much debt Australians took into retirement.

According to a 2017 analysis by Curtin University Professor Rachel Ong ViforJ and RMIT University Professor Gavin Wood, between 1990 and 2015 the average mortgage debt-to-income ratio for Australians over the age of 65 rose from 72 per cent to 152 per cent.

The proportion of older households carrying debt has also risen significantly, with 7 per cent of homeowning households over the age of 65 holding mortgage debt in 1990, compared with 12 per cent in 2015.

For householders aged 55 to 64, the increase has been even more pronounced, with the proportion of homeowners holding mortgage debt rising from 14 per cent in 1990 to 47 per cent in 2015.

The vast majority of these households would have purchased their homes for a fraction of where prices are today and generally on significantly shorter loan terms. Yet despite these tailwinds, a rising proportion of households were already taking mortgage debt into retirement.

It’s not hard to imagine a larger proportion of today’s first homebuyers carrying mortgage debt into retirement, given that their loans are generally far larger and the median buyer has well over a decade less during which to pay down their loan before retirement.

According to a recent Channel 7 report, some in the world of finance are putting forward the idea of 40-year mortgages. Given the median age of first homebuyers is now 34.5, if a buyer was able to take on a 40-year loan, they would still be paying it off at 74 years of age.

The outlook

The last three years have brought all manner of surprises for Australian households – first the pandemic and now the return of decade’s high inflation. So any sort of outlook well into the future is going to be clouded with extremely high levels of uncertainty.

However, based on trends we have seen in the past and the growing size of mortgages, it could be argued that more and more households face what very nearly amounts to a lifetime of debt. This is a far cry from households who purchased homes at the turn of the millennium, many of whom are now mortgage-free and free to spend their income however they choose.

Ultimately, in time this will have consequences for the economy and consumer spending, as households spend years longer paying down their mortgages and making the necessary sacrifices in order to do so.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator