Insanely high Aussie coal prices hinge on China’s next move

An Australian commodity is a whopping six times higher than it was pre-pandemic. But this huge boom could be about to come to an end thanks to China.

According to the latest trade data from the Australian Bureau of Statistics (ABS), Australia is currently experiencing its largest trade surplus in the nation’s history. This means that now more than ever we are enjoying a time when the country’s exports exceeds the cost of imports.

While there are many factors driving this outcome, arguably the biggest two are sky high thermal coal prices, which are at least partially driven by the war in Ukraine and hopes for a construction driven stimulus program in China.

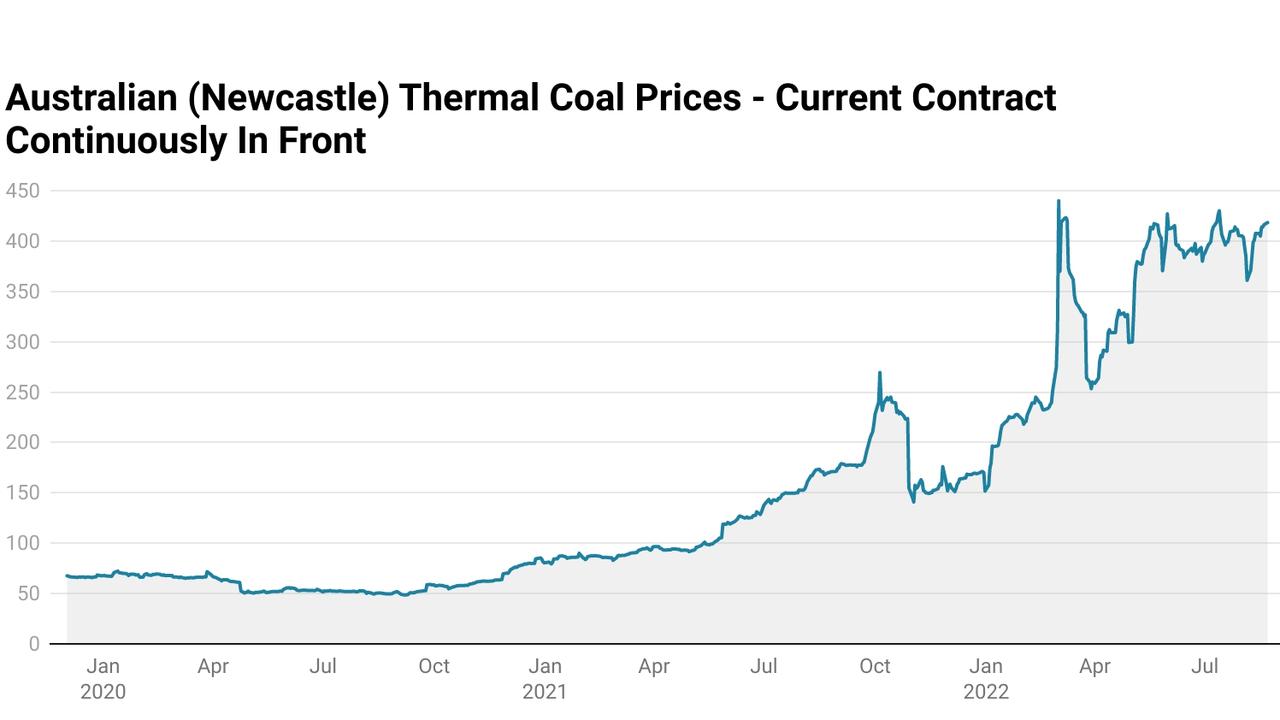

Prior to the pandemic benchmark Australian thermal coal prices were trading at around $65 USD per ton. Today, they are trading at roughly six times that price, as nations around the world attempt to get their hands on as much thermal coal as they can amid the ongoing war in Ukraine and sanctions on Russia.

Meanwhile, the expectation of a construction-driven Chinese stimulus program, similar to the one deployed during the global financial crisis, continues to help support commodity prices, despite deteriorating demand for key commodities such as iron ore.

In recent weeks, Beijing has announced several measures to stabilise its highly stressed property sector through loans of up to $254 billion to developers struggling to complete projects amid serious cash flow issues, but it’s a drop in the ocean for a $7.6 trillion sector.

Of that, $213 billion is meant to be provided by Chinese commercial banks, which raises a rather pertinent question: Would a competent bank manager give a loan to some of the more badly hit Chinese developers unless expressly ordered to do so?

The construction sector and associated industries accounts for almost 30 per cent of all Chinese GDP, yet beyond keeping the property sector on life support, there is yet to be any definitive sign that Beijing is moving to launch anything like the previous rounds of construction driven stimulus spending.

The question stumping analysts around the globe is why? Why is the Chinese government seemingly relatively content to engage in what amounts to the controlled demolition of the riskier elements of its property sector? Particularly while continuing its Covid-zero approach to the pandemic.

There is a laundry list of different theories out there attempting to explain why, but the simplest explanation is that Beijing needs to expend its resources elsewhere.

The elephant in the room

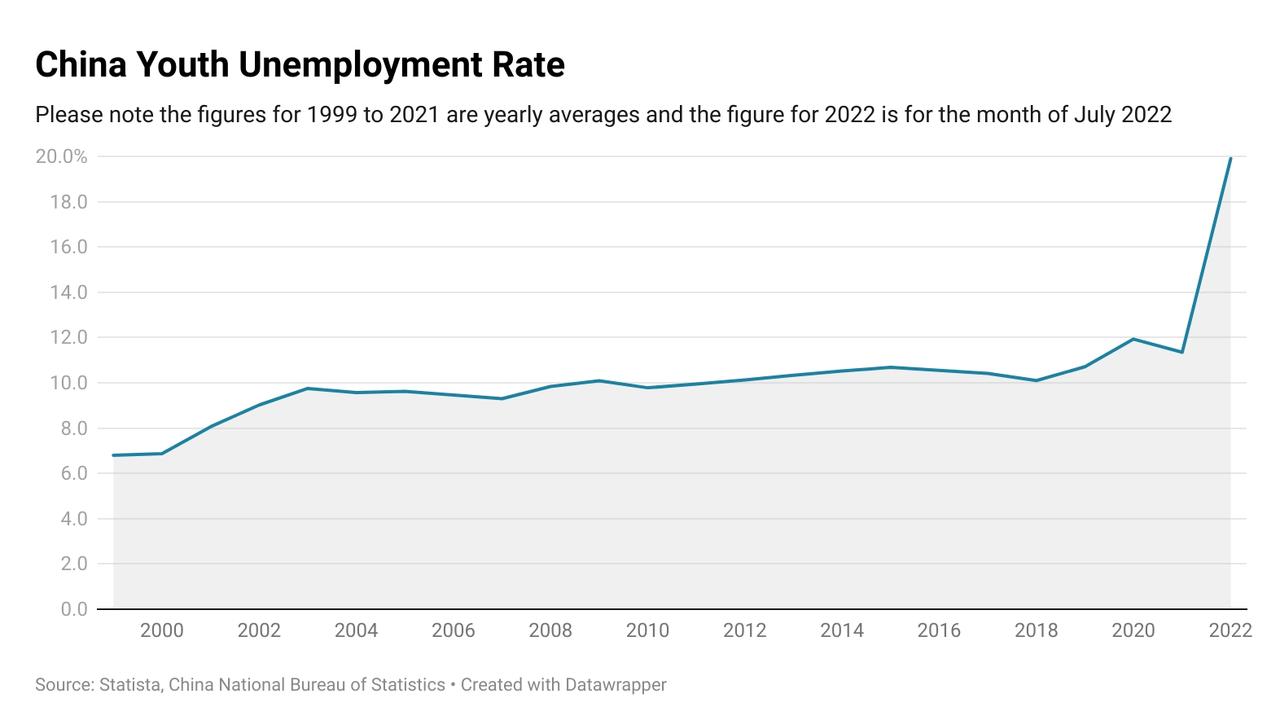

According to a recent report from China’s National Bureau of Statistics, urban youth unemployment recently hit a high 19.9 per cent. To put this into perspective, prior to the pandemic youth unemployment averaged around 10 per cent for almost two decades.

While there are always degrees of difference in the youth unemployment landscape of various different nations, even when taken with a handful of salt the figure is still a concerning one.

In Hong Kong, which is a specially administered region of China, the youth unemployment rate is 7.4 per cent, despite being hard hit by a similarly restrictive strategy for containing the pandemic as mainland China.

When compared with Australia and the United States where youth unemployment is 7.9 per cent and 8.1 per cent respectively, China’s figure is more than double.

A large degree of the current figure is no doubt driven by the ongoing impact of Beijing’s Covid-zero strategy and the economic slowdown associated with it, but there is also another factor that could be of growing concern for the Chinese government.

With many of China’s urban youth staring down the challenge of a slowing economy and extremely high housing prices, some are simply choosing to opt out of pursuing traditional goals wherever possible. On Chinese social media this is called “tang ping”, which loosely translates to lay flat. In essence it basically means letting life pass you by, come what may and just do the absolute bare minimum.

Implications for Australia and the world

Between a rapidly slowing economy, deteriorating local government balance sheets and historically high levels of youth unemployment, Beijing has a level of demand on its resources that hasn’t been seen in decades.

If current trends continue, this means less resources to be dedicated to the traditional construction driven growth model of the Chinese economy and a lot of investors disappointed that the much talked about stimulus didn’t end up eventuating.

Without that expected demand, key commodities to Australia’s fortunes such as coking coal and iron ore may face a more challenging landscape to the one they have become accustomed to since the start of the pandemic.

Meanwhile, on the global stage, tensions over Taiwan continue to be sour point in relations between Beijing and the West. Amid the challenges currently faced by the economy and by Chinese society more broadly as a result of Covid-zero, it’s not hard to imagine saber rattling over Taiwan to continue and potentially even intensify, as the run up to the Chinese Communist Party’s Congress in October continues.

A longer term silver lining

If current trends continue in the coming years, a slowing China that is shifting its priorities may significantly impact demand for bulk commodities and see prices find a new equilibrium.

This could be vastly different to what Australia has enjoyed since the first huge Chinese construction driven stimulus was deployed during the global financial crisis. But there is a silver lining in all this for Australia, despite the potential storm clouds.

In aggregate, Australian iron ore remains some of the cheapest to produce and best quality in the world, so even if prices do fall significantly it will be other nations who are forced to shutter production long before any of the large miners see any real impact.

Income from the mining sector will continue to remain a key factor in supporting the Australian economy and the nation’s trade balance long into the future.

Ultimately, if Beijing begins to dedicate greater and greater resources toward supporting its consumption driven economy and propping up local government balance sheets, Australia will likely face a profound adjustment, but in the end the economy and the Australian people will adapt.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator