‘Indicators are flashing red’: ‘Warning signs’ recession is looming

The past 12 months have been a rollercoaster ride for Australia – and all the warning signs suggest things are about to get a lot worse.

COMMENT

2019 felt like a rollercoaster ride. 2020 is almost certain to be even wilder. Australia has never started a year with interest rates so low and with so much uncertainty around.

Doubt is enveloping house prices, wages, and global markets. It’s hard to see how the RBA could possibly get relaxed enough about the future to raise interest rates.

So what will happen in the new year? Here are the four big issues you should be thinking about.

HOUSE PRICES

2019 was a surprising year for house prices. The housing market started the year amid unusual gloom, then did a big U-turn. It ended up in a much more familiar place for Australians – a frenzy of bidding driving house prices up at a record rate.

We all learned something in 2019 – some Aussies were shocked to discover house prices can actually fall. We also learned house prices will bounce back if the RBA cuts interest rates.

This is good news for homeowners in the short run because it looks likely the RBA will cut rates again soon. The official cash rate could hit a new record low as early as February 2020, and the bank won’t mind if house prices rise.

It has said it was surprised by the effects of the recent house price fall and implied it won’t be making that mistake again soon. It likes the way people spend more when their house prices are rising because that spending drives the economy.

But in the longer run the link from housing prices to interest rates raises big questions. With interest rates at record lows, surely they must eventually rise again. After all, the last two decades of rising house prices happened as rates fell from 5 per cent in 2000 to 4 per cent in 2010, then to 0.75 per cent in 2020. If falling rates cause a long positive house price cycle, what happens to house prices if the RBA one day enters a multi-year cycle of rate hikes?

A RECESSION?

In 2019, many global recession warning signs started flashing red.

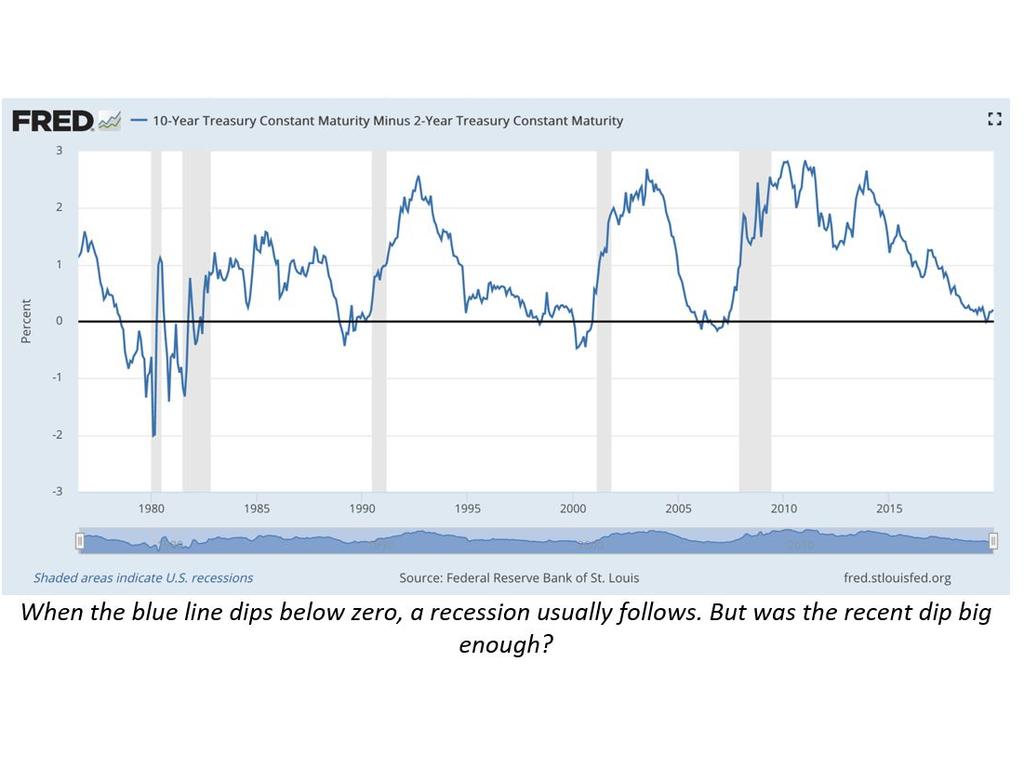

Yield curves briefly inverted in the US, which has been a mostly reliable precursor to recession in the last 40 years, as the next graph shows.

When the blue line dips below zero, a recession usually follows. But was the recent dip big enough?

Google trends data also shows something interesting: a big surge in people searching for information about recessions. This indicator may be less technical than the yield curve, and it has less history to draw on, but it certainly peaked before the GFC, so its accuracy should not be sneezed at.

At home, the biggest indicator of a possible recession may be the Reserve Bank talking about quantitative easing. Their forecasts remain mostly positive, but quantitative easing is a tool for desperate times, and if it’s on the table for use in 2020, we have to ask why.

Interest rates are already at record lows and seemingly having little effect. If a recession does come in 2020, it’s frightening to contemplate how little the RBA might be able to do to reverse it.

JOBS AND EARNINGS

2019 was not a terrible year for jobs, but as the next graph shows, it was not impressive. Underemployment and unemployment both rose, taking us nearly back to where we were at the start of 2018.

Rising underemployment is usually a bad sign for wages. The backbone of the economy is our paycheques. Australians mostly spend what they earn, and our earnings have not been growing well. Wages growth is down to around 2 per cent – barely above inflation. It is fair to ask what will happen in 2020.

One useful sign for the future is the ANZ job ads series. It counts up job ads to try to predict the future of the labour market. But it has bad news about next year. Job ads have been falling, as the next graph shows.

This suggests fewer people will be starting new jobs soon. This is bad news because to get a raise we need a tighter labour market, i.e. lots of people getting hired and not so many getting fired. Instead, the reverse seems to be happening. Accordingly, the Government has downgraded its wages forecasts for 2020 in its mid-year economic and fiscal outlook.

GLOBAL MARKETS

More and more, Australia’s economy depends on global markets. We can be lifted up by policies made in Beijing, but we can also be brought down by mistakes made on Wall Street and Silicon Valley. And there have been plenty of the latter in history.

2019 was the year of the WeWork saga. A hot American real estate start-up funded with way too much venture capital money, it was going to float on the stock market for billions of dollars. Instead it suddenly stumbled and fell. The float was cancelled. The CEO was sacked. A whole lot of dodgy dealing was exposed. The company is now slashing staff and trying to avoid bankruptcy.

WeWork points to a sickness in the American start-up bubble. In 2019, WeWork’s problems looked isolated, but are they? In 2007, the pension funds that were having problems with subprime loans looked isolated too. It was only by 2008 we realised they were a symptom of a big problem that led the whole word into the global financial crisis.

A lot of money has chased the start-up bubble, and if start-up firms turn out to have been a bad investment, a lot of money is going to be lost. How many WeWorks are out there? How many companies pretend to be winners but are actually hollow inside? Is Uber one? Slack? Spotify? Could they be revealed in 2020 and harm the global economy in the process?

And all this is without mentioning Donald Trump, Brexit, impeachment, the trade war and the US election. 2020 is going to be insanely busy. Finding out what happens to global markets is just one of the many reasons 2020 is going to be a hell of a ride.

Jason Murphy is an economist | @jasemurphy. He is the author of the new book Incentivology.