How one man can fix Australia’s mountainous problem

AUSTRALIA has been warned again and again. If we don’t stop repeating the same mistake, the consequences will be dire.

AUSTRALIA, we are arriving at a fork in the road. Before us are two paths. One is smooth, runs downhill, and eventually shoots off a cliff. The other road is bumpy and a bit difficult, but we need to turn onto it urgently.

We need a way to fix private debt so we don’t get a house prices disaster.

Interest rates in Australia have been low for a long time and that has been quite fun for borrowers. We’ve accumulated a great big mountain of private debt.

This is not like Mount Kosciuszko, a mountain that barely counts. This is a proper mountain. A big one that has international observers worried. The OECD released yet another big warning last week and it just gets thrown on the pile.

Australia has had low wages growth for years now. Despite that, we’ve been loading up on debt for houses. Mortgages have been cheap.

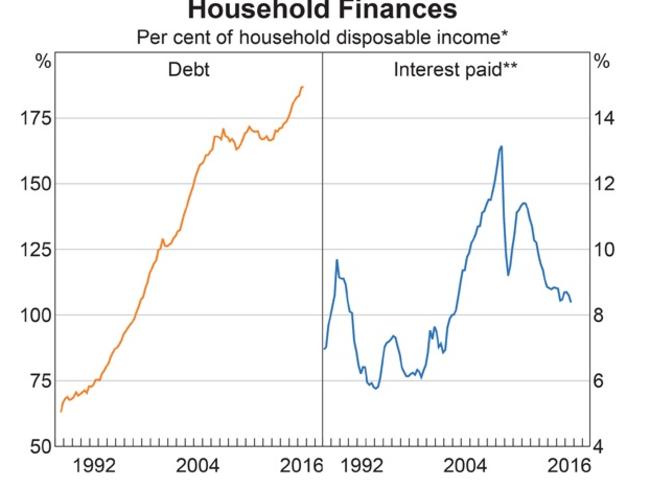

In fact, low interest rates have made these economically difficult times feel OK. As you can see in the graph above, the interest paid on these loans is not too high. There’s a great quote from The Big Short:

“How do you make poor people feel wealthy when wages are stagnant? You give them cheap loans.”

In The Big Short (a book about the GFC which later became the movie starring Brad Pitt), that’s a thought that comes from Vincent Daniels. He’s one of the traders who sees the crash coming. He figures out that banks are lending vast sums to people who won’t be able to pay them back.

Australia’s household debt is becoming a problem that could go wrong in a similar way. (We don’t have the exact same subprime lending problems as America, but things are far from perfect here. In fact, one of our major banks is now being taken to court for allegedly breaching responsible lending practices.)

But we have a problem. And we need to take action.

The threat in this story is a big housing crash and a great reckoning. The price we pay to avoid the crash is to get interest rates back to normal, soon. That’s a two step process.

THE STICKING POINT: INFLATION

Before we can act on interest rates we have to fix inflation.

Analyst Christopher Joye was in the financial press last week begging for the RBA to raise interest rates immediately. He’s delusional. They can’t. The RBA has one job it must do before all others, and that’s to keep inflation in line.

Inflation is supposed to be between 2 and 3 per cent each year. At the moment though it is too low: 1.5 per cent.

Interest rates help control inflation. Raising official interest rates will make inflation even lower. So the RBA cannot possibly raise rates until inflation comes back.

Let’s put inflation in context: It is pathetic right now. Tiny. At its lowest level ever.

If we want to get the higher interest rates we need, first we need slightly higher inflation. That doesn’t sound fun, sure. But we don’t need runaway prices. Just normal steady inflation between two and three per cent a year. That is the price we must pay to avoid the mounting disaster.

ONE MAN

I can’t make higher inflation happen. You can’t make higher inflation happen. The RBA could make it happen, but not without blowing up house prices. There’s one man who can help raise inflation safely: The Treasurer of Australia.

The man they call ScoMo is in perfect position to fix our economy. He can raise inflation by spending a bit more money. Unfortunately, he, like many of Australia’s politicians, has got the wrong ideas about spending money.

Our current generation of representatives learned the wrong lesson from the famous government of Howard and Costello, which paid back Australia’s debt.

Howard and Costello are not Liberal heroes because they paid down Australia’s debt. They are Liberal heroes because they paid down Australia’s debt at the right time.

They paid it off when times were good. In the glory days. Trying to pay off your loans in the bad times is not clever. It will wreck you. If you can’t tell the difference between saving for a rainy day and saving on a rainy day you’re not fit to be Treasurer.

Australia has plenty of room left to borrow and spend a bit more, to get inflation up and unemployment down.

This is the message that the RBA keeps trying to convey to the government. We can’t fix this by ourselves, it says. You need to pull your weight. The government has been busy ignoring the RBA, (and the OECD, IMF, etc) and instead banging on about debt and deficit.

It thinks that saving a bit of money now, having low inflation and high house prices is a good mix.

In fact that is proving to be a road to disaster.

But there is a fork in the road just ahead, in the shape of this year’s Budget. This May, if ScoMo uses the Budget to spend a bit of money — on rail, on roads, on health, on a proper NBN, we can get a bit of inflation.

That should eventually permit interest rates to start to rise. Which in turn will help keep the housing market in check.

The good news is that in a couple of recent comments to the press, ScoMo has indicated he’s not going to make this another tight-fisted budget.

He’s indicating that the government won’t cut services and that it might do something about housing affordability.

That might be what we need to allow all of us to breathe a sigh of relief.

Jason Murphy is an economist. He publishes the blog Thomas The Thinkengine. Follow Jason on Twitter @Jasemurphy