How long it takes to save for house deposit in Australia shows scale of problem

Some older Australians claim that young people want too much, but the truth about how many years it takes to save for a house deposit by state is truly shocking.

Never talk about politics, religion and money with friends, so the old adage goes.

But as 2021 unfolds, there may be another topic of conversation that is best avoided depending on the company you keep – rising house prices.

As property prices continue to rise across much of the country, frustration and resentment continues to build among some prospective first homebuyers.

Despite the pandemic taking a wrecking ball to the economy and creating the deepest recession since the Great Depression, the property sector has moved in an entirely different direction, and many have seen their dreams of home ownership evaporate in recent months.

The impact has been especially acute in regional areas where, prior to the pandemic, property turnover was generally quite low relative to the city.

RELATED: City leading the way on house prices rises

Yet again, house prices are acting like a fault line, as the tectonic plates of Australia’s long simmering intergenerational conflict continue to shift.

For those of you who may not be familiar with the intergenerational debate surrounding housing prices, it usually goes a little something like this.

Some older Australians claim that young people want too much, too fast and are impatient to get the things they desire. They claim many prospective first homebuyers spend far more on gadgets, overseas holidays and other non-essentials than they ever did. They then conclude that this unnecessary spending is why home ownership is increasingly out of reach.

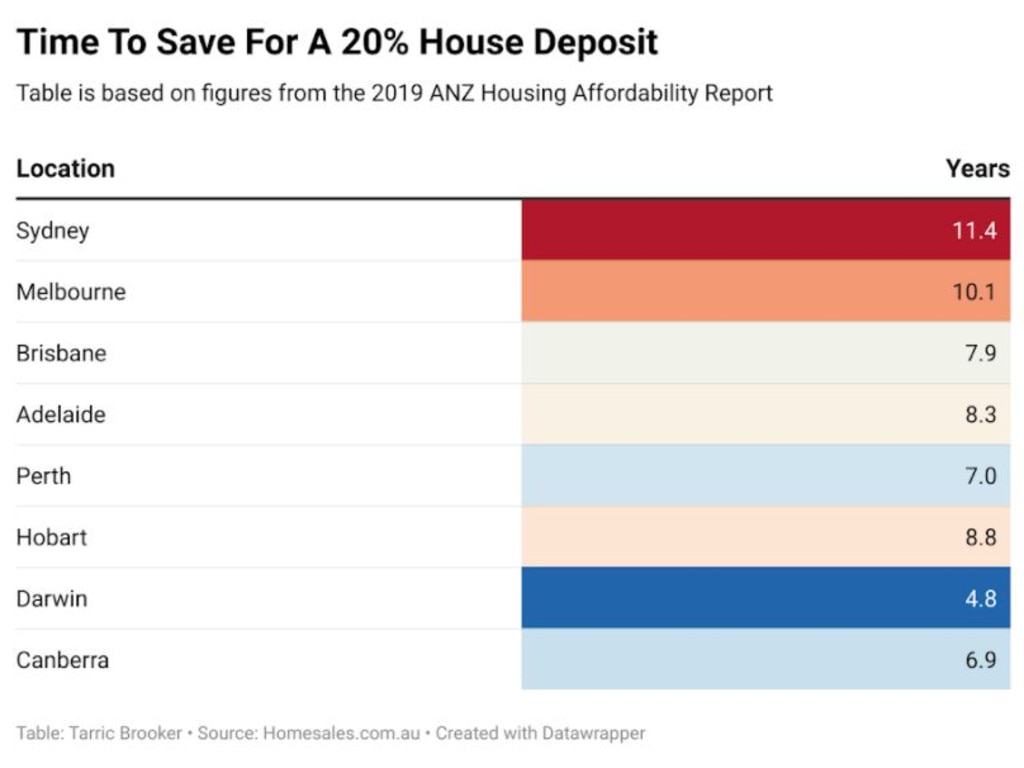

Younger Australians counter this by pointing out that the required size of a home deposit relative to income has never been greater and that the nation’s property prices are extremely high, even by international standards.

RELATED: Sign Aussie house prices could plummet

Like most hotly contested and heavily divisive debates, there is a grain of truth on both sides of the argument.

However, even after all the spending on iPhones, holidays and even the now legendary smashed avocado on toast has been taken into account, the net result is still many young families and individuals are priced out of the housing market.

Unsurprisingly, on social media there is strong sense of frustration and at times the growing belief among prospective first homebuyers, that most Australians want prices to continue to rise because it benefits existing homeowners.

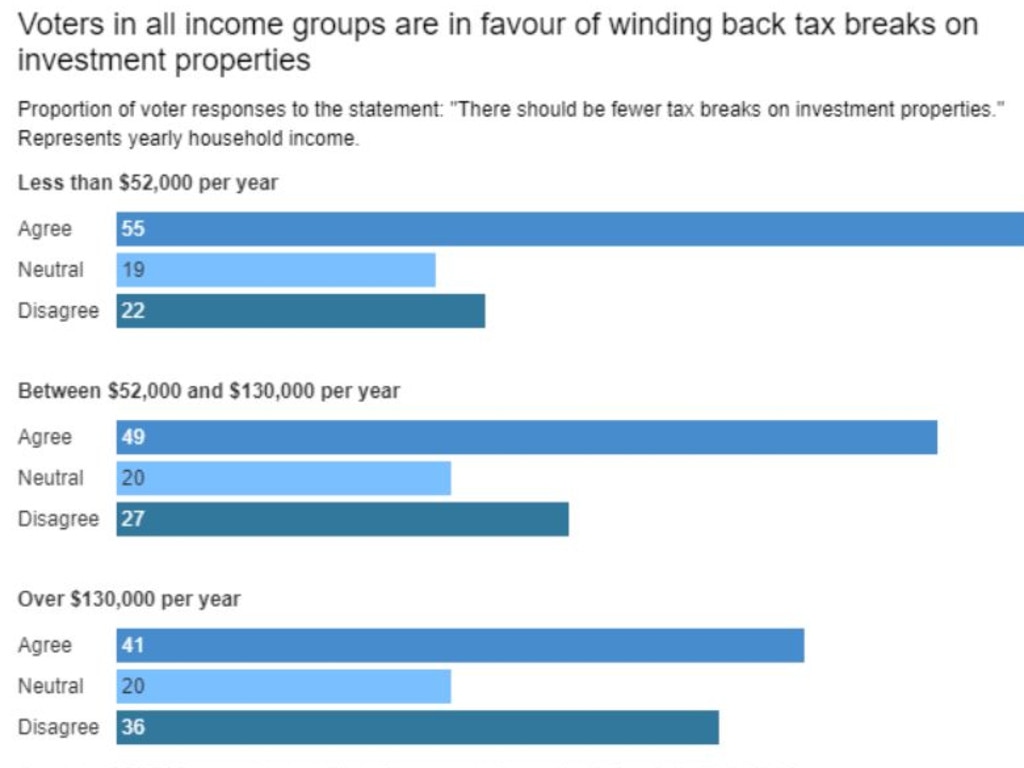

One wonders if Anthony Albanese’s federal opposition has come to a similar conclusion. As part of its 2021 party platform draft, Labor abandoned its proposed changes to negative gearing and the capital gains tax discount.

When Labor under Bill Shorten proposed the changes before the 2019 election, some property analysts saw the reforms as a potential kryptonite to housing prices.

After enduring a shock defeat in the 2019 election, one can see how Labor linked their loss to the proposed tax reforms which could have negatively impacted the home prices of the 67 per cent of Australians who own a property.

But, perhaps Labor is taking the wrong lessons away from the defeat. According to pre-election polling conducted by the ABC, a majority of voters from across the household income spectrum believed that there should be fewer tax breaks on investment properties.

RELATED: Where you can buy a house for $250 a week

Meanwhile a poll here at news.com.au taken by readers, showed that just 20 per cent of respondents wanted to see rising housing prices.

While it’s easy to see rising home prices as a simplistic equation that they are good for homeowners and therefore welcomed, it’s arguably more complex than that. Homeowners also have friends, children and grandchildren who they would one day like to see be able to afford a home, perhaps one close by so they can remain in close touch.

As prices rise, families often find themselves divided, as children and grandchildren are priced out of the areas they grew up in.

And with most Aussies holding a majority of their household assets in property, the debate surrounding property prices is unlikely to go away anytime soon, particularly as prices rise amid an environment of uncertainty and high unemployment.

As the intergenerational fault lines continue their ongoing tremors, the figures we do have suggests that the great divide between the two sides may not be anywhere near as wide as it initially appears.

While people on both sides of the debate seem heavily dug in and set in their views, polling suggests there may be a surprisingly broad consensus that further property price rises are not what the majority of Australians want.

The intergenerational minefield and election losing hot potato issue that is housing prices may not actually be either of those things after all.

Instead, as Aussies see their friends and family struggle, it’s possible that, while coming to a conclusion on the viewpoint of an entire nation is challenging, a majority of Australians are concerned about home affordability.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator