Homeowners pin their hopes on the Reserve Bank as banks continue their rate hike frenzy

MORTGAGE pain is looming for even more Australians, as smaller lenders jump on the rate hike bandwagon. But there is hope of a Reserve Bank cut.

THE Reserve Bank of Australia boss has downplayed mortgage rate hikes by the big four banks, but says any move in the cash rate in the near future would be down.

RBA governor Glenn Stevens said benign inflation and Australia’s cooling property market were no impediment to cutting interest rates.

“Were a change to monetary policy to be required in the near term, it would almost certainly be an easing, not a tightening,” he told the Melbourne Institute 2015 Economic and Social Outlook Conference.

The RBA left interest rates on hold on Tuesday at a record low 2.0 per cent, despite expectations it would cut rates to bolster economic growth.

The major banks have blamed the regulator’s new rules requiring them to hold more capital for their decision to hike variable mortgage interest rates, announced last month.

But, although these new regulations do not apply to the smaller lenders that makes up 20 per cent of Australia’s $1.5 trillion mortgage market, many of them have now followed suit.

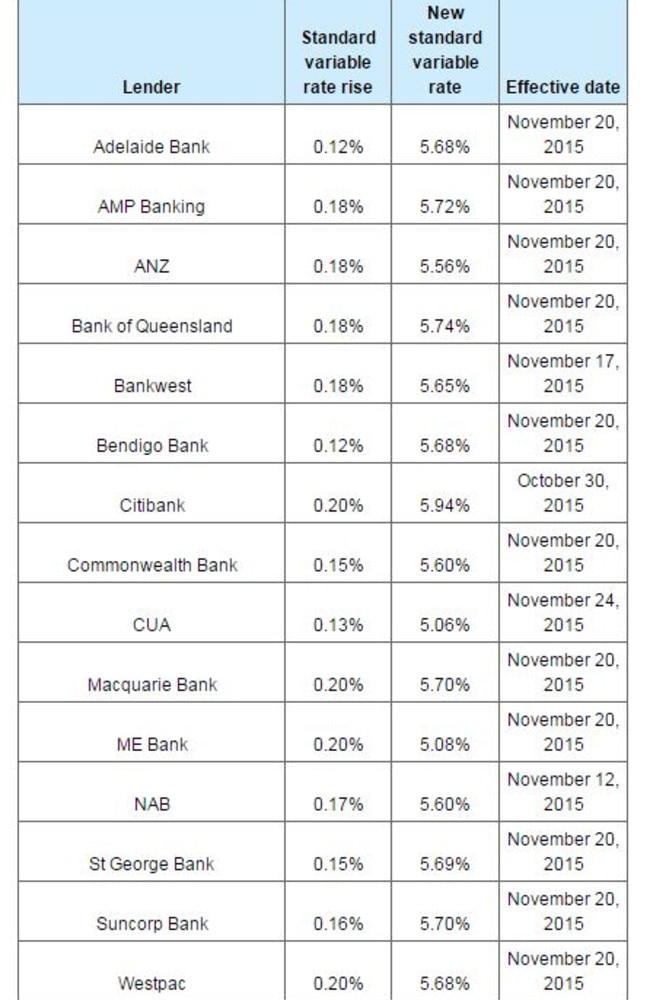

Bank of Queensland, with about $35 billion in loans, yesterday announced plans to hike interest rates on its variable home loans would rise by 18 basis points to 5.74 per cent for owner-occupiers. The changes will be effective on November 20.

Bendigo Bank, Adelaide Bank and Suncorp hiked rates earlier this week, while ING is yet to announce any changes.

Australia’s biggest credit union CUA — which has about $11 billion in mortgages — has also announced a 13 basis point increase to its some of its owner occupier loans.

BoQ’s group executive of retail banking Matt Baxby told The Australian the decision balanced the bank’s “growth, risk and margins over the longer term”.

“Standardised banks like BoQ still carry much higher funding costs and capital requirements than the major banks and we need to get the balance right between sustainable growth over the longer term, risk and margins,” he said.

“These are always difficult decisions but on balance we believe it is the right one in the current environment.”

Consumer Advocate Bessie Hassan, of comparison website finder.com.au said the average rate hike across all lenders was 17 basis points, which would add an extra $33 per month to a $300,000 mortgage.

“We have seen 15 lenders monitored by finder.com.au that have so far announced variable rate owner-occupier home loan increases of up to 0.20 percentage points, with one lender’s move already reportedly effective (Citibank),” Ms Hassan said.

“So far, the biggest increase was 0.20 percentage points by four lenders: Westpac, Macquarie Bank, Citibank and ME Bank.”

She said savers should shop around as banks had also moved interest rates on deposits. Bankwest and Citibank dropped some of their savings account interest rates by as much as 25 basis points, she said, while AMP Bank and Citibank increased some of their rates by as much as 45 percentage points.

“It’s clear that the Reserve Bank is having less of an impact on interest rate movements so there’s no point for borrowers to wait for a cash rate cut and expect lenders to follow,” Ms Hassan said.

“However, the silver lining is that there are hundreds of home loans out there and many smaller lenders are offering very competitive deals ... Ask your lender for a discount or switch to a better deal before the rate hikes take effect.”

Ms Hassan said the cheapest variable rate home loan on finder.com.au was Mortgage House’s 12-month discounted rate of 3.79 per cent by Mortgage House.