‘Exploitative’ big business pricing revealed

A new inquiry has lifted the veil on eight tactics big businesses are using to price gouge everyday Aussies, and how they get away with it.

A new inquiry has lifted the veil on eight tactics big businesses are using to price gouge everyday Aussies, and how they get away with it.

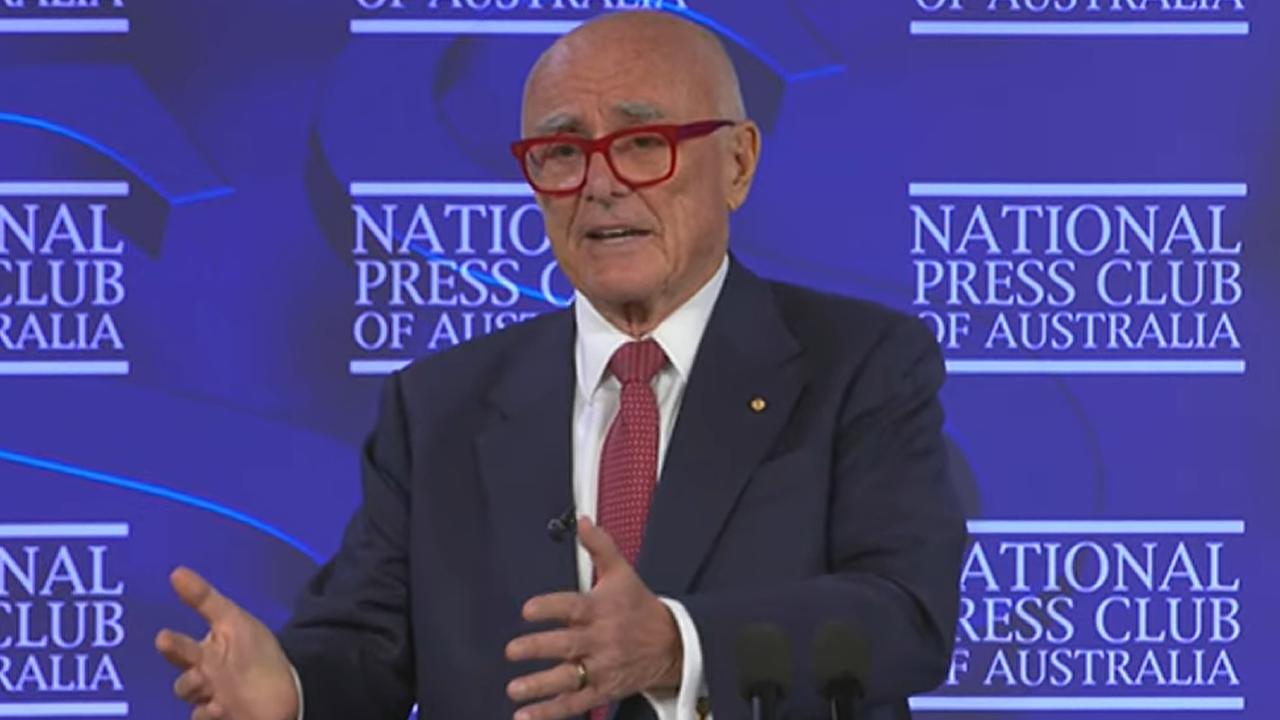

The report into price gouging and unfair business practices was conducted by former Australian Competition and Consumer Commission (ACCC) chair Allan Fels and commissioned by the Australian Council of Trade Unions (ACTU).

Professor Fels found that businesses use eight different pricing practices to “engage in exploitative pricing practices” and are able to do so due to a lack of competition in many parts of the economy, and regulations and laws that have not kept pace with change.

In particular, Professor Fels called out companies in the electricity, banking, airline, supermarket, insurance, telecommunications and childcare sectors as key examples of big businesses engaging in price gouging and where there is a lack of competition.

The eight pricing practices of concern are excuse-flation, rockets and feathers, loyalty taxes, loyalty schemes, drip pricing, confusion pricing, algorithmic pricing and price discrimination.

Excuse-flation

Professor Fels found that businesses were using inflation as a convenient “cover” for increasing prices, even if their own products costs haven’t increased.

He added that businesses sometimes signal to their competitors how much they plan to increase prices by, by citing the inflation figure.

He suggested this type of price signalling should be investigated by the ACCC to prevent cartel pricing behaviour.

Rockets and feathers

The inquiry found that “when costs rise, prices rise faster than they fall when costs fall”.

This is akin to rockets rising fast and feathers falling more slowly and is sometimes also called asymmetric pricing.

“Lamb prices for farmers fell heavily many months before this was passed on in prices. On the other hand, there is some evidence that when lamb prices rose retail prices rose more quickly,” the inquiry found.

“It is very profitable to delay price falls,” Professor Fels told the National Press Club in an address yesterday.

Loyalty taxes

“A ‘loyalty tax’ is a pricing scheme under which customers are lured into purchasing a good or service with a low initial price followed by sharp rises in subsequent years of patronage,” the inquiry found.

Professor Fels added that it is particularly prevalent in industries where switching providers is harder, such as insurance, other financial services and the electricity industry.

Loyalty schemes

Professor Fels also hit out at loyalty schemes such as airline frequent flyer programs.

“The purpose of loyalty schemes is to lock in or at least bias consumer choices to products already chosen,” the inquiry found, and concluded they are designed to lessen competition and lock in customers.

Drip pricing

Drip pricing is the practice of showing consumers a different price at the beginning of the purchase compared to what actually needs to be paid.

For example, when fees and taxes payable on flight tickets or hotel rooms are only revealed at checkout.

“These tactics are designed to obfuscate consumers and make comparisons near impossible,” the inquiry found, adding that “in some cases, drip pricing may breach consumer law if it is misleading or deceptive”.

Confusion pricing

The inquiry also found businesses, especially those selling products with ongoing customer relationships, such as mobile phone or energy plans, also intentionally make it difficult for consumers to understand their pricing structures, which makes comparison shopping difficult.

Professor Fels said “evidence is mounting” that confusion pricing has contributed to the cost of living crisis.

Algorithmic pricing

The inquiry found that with advancing technology, the potential for AI tools to be used in pricing risked reducing competition, especially if competitor companies used the same algorithms to price goods and services.

Professor Fels suggested that increased use of AI in algorithmic pricing posed a new challenge for regulators and may make instances of price collusion “impossible to prove”.

Price discrimination

Price discrimination is when different customers are charged a different price for the same product, and is often based on their capacity to pay more.

Professor Fels pointed the finger at the banking sector.

“There are no price wars in banking,” he told the Press Club.

“Where there is the possibility, however, of a customer switching to a competitor, banks tend to reduce prices just for them whilst retaining higher prices for loyal consumers more. This is unfair.”

Professor Fels concluded his report by making several recommendations including calling on the government to make the ACCC to conduct more price and market investigations, such as the recently-announced inquiry into the supermarket sector.

He also called for naming and shaming of businesses and industries that overcharge to be reinstated, having previously been allowed from 2000-2003 when the GST was first introduced.