Eight consecutive months of growth as property prices defy the odds

Prices could hit new highs by October as the property boom continues unabated in one of Australia’s largest cities.

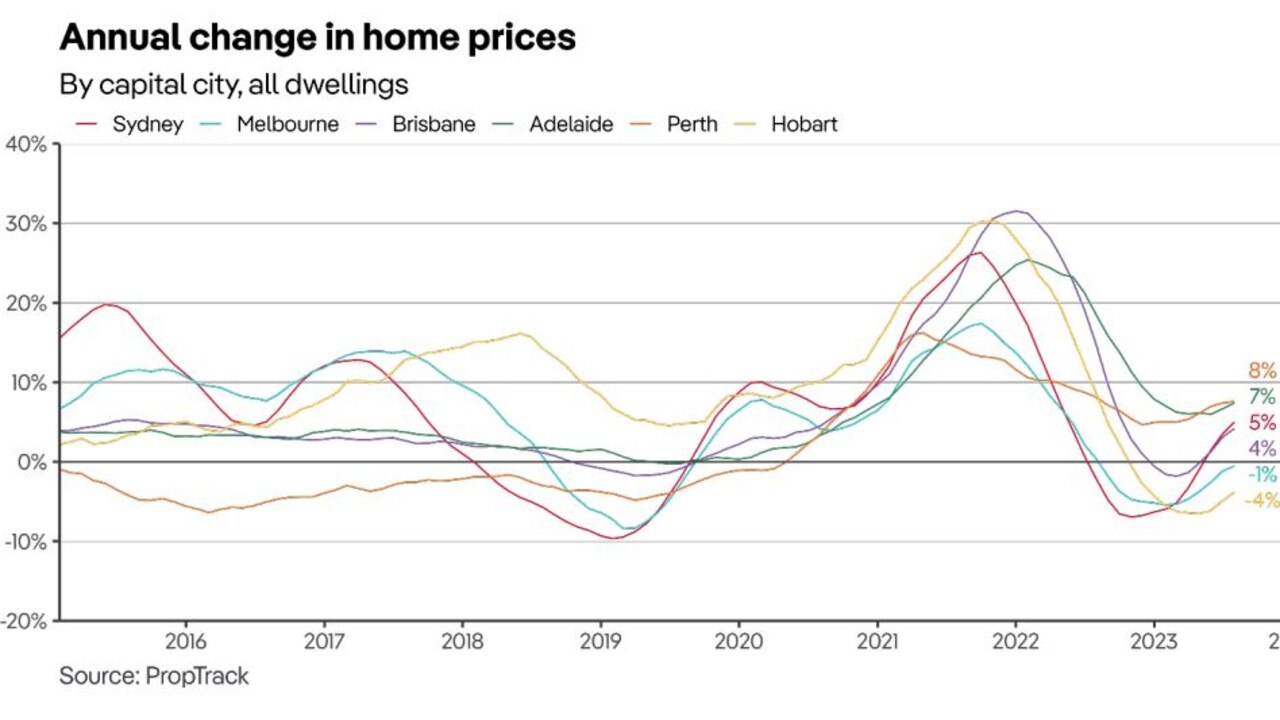

Home prices in Sydney are up five per cent this calendar year and over six per cent since their low in November 2022, new data from PropTrack has revealed.

Sitting just one per cent below their February 2020 peak Eleanor Creagh, PropTrack senior economist told news.com.au: “If Sydney house prices continue to grow in line with their performance this year they could surpass their previous peak by October and end 2023 8.9 per cent higher”.

Some are forecasting Sydney house prices to go even higher with figures from Westpac suggesting they could end 2023 10 per cent above where they started.

The median home value in Sydney currently stands at $1.056 million.

“The Sydney market has gone from strength to strength despite affordability having fallen so sharply,” Ms Creagh said.

Housing affordability has been hurt by rising interest rates, however low levels of properties for sale and low unemployment have combined to push home prices up.

But it’s not all doom and gloom for those in the market for a new home, with stock levels expected to increase now that spring has sprung.

“Sydney and Melbourne are seeing more new listings coming to market and the flow is likely to pick up as spring kicks off,” Ms Creagh said.

“Any uplift would give buyers more choice and potentially more bargaining power than they’ve had.”

But, she added, if interest rates remain on hold at next week’s Reserve Bank of Australia board meeting, it would likely offset the impact of increased supply.

Around the nation, August marked the eighth consecutive month of national house price growth, the longest period of consecutive monthly growth since the pandemic.

During that time, prices rose 23 consecutive months between May 2020 and March 2022.

House prices have now regained most of the falls seen in 2022.

“The reverse has been a lot sharper and quicker than expected,” Ms Creagh said.

All capital cities saw home prices rise in August except Darwin, with home prices in Perth and Adelaide continuing to reach record highs.

Adelaide and Perth are both up over seven per cent for the year, and at 0.64 per cent, Adelaide had the strongest growth in August.

Capital city prices have grown more than regional areas this year, reversing the trend of regional areas booming during Covid.

But of the regional areas, regional SA and Queensland are the best performers, with both reaching new peaks in 2023 according to PropTrack.

More Coverage

Ms Creagh said the mortgage cliff had so far failed to produce many forced property sales.

She said with the nation now passing the halfway point of close to 800,000 Aussies coming off low fixed interest rate mortgages and onto higher variable rate loans, the low unemployment rate meant people were still able to pay their mortgages, even at higher rates.

“That’s not to say that it isn’t painful for a lot of households but households do tend to prioritise mortgage payments over other expenditure.”