China’s plan to hurt Australia’s iron ore exports hits major new snag

Absolutely nothing is going China’s way in its plan to hurt Australia’s biggest export, as the superpower is served another major blow.

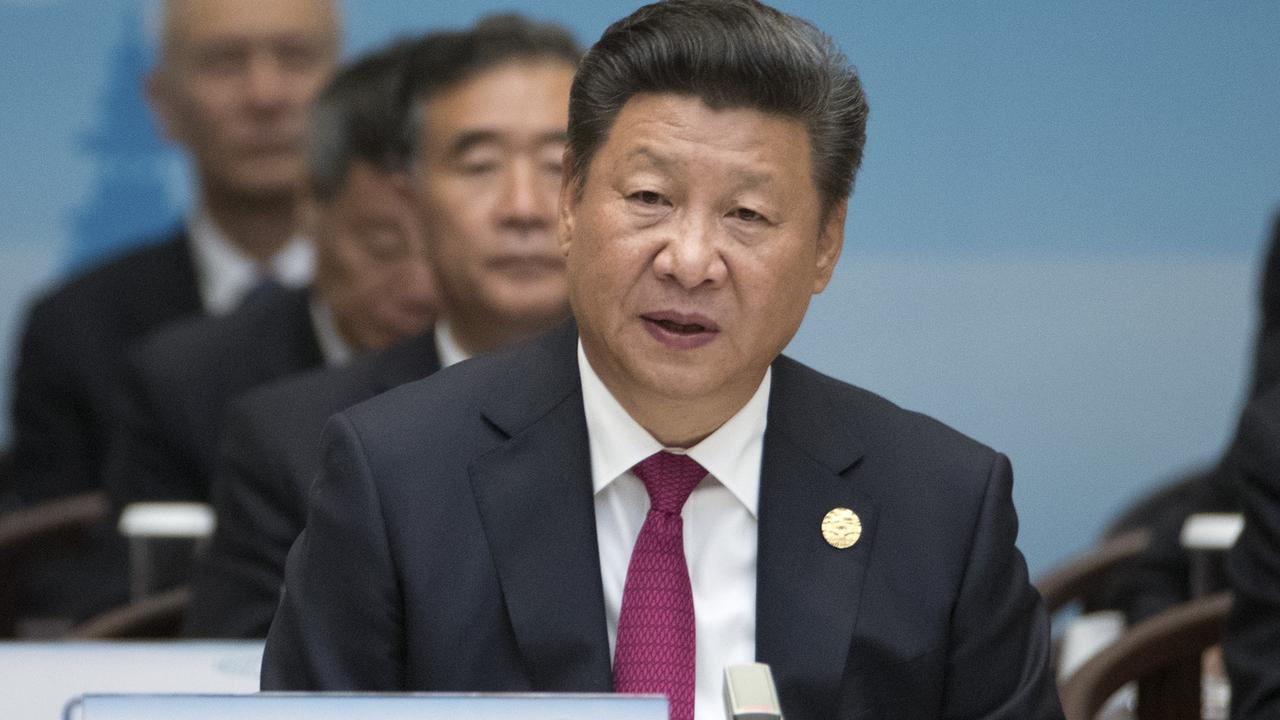

The free market can be a brutal and unforgiving place even when you’re as powerful as the Chinese Communist Party.

This week has made it painfully clear that their plan to drive down the price of Australia’s number one export has backfired — and now they’ve been hit with another devastating supply issue that is likely to drive prices up even further.

Iron ore — a critical ingredient in steelmaking — is now fetching an eye-watering US$217 a tonne after a week of sustained gains. That is more than double the price of what it was a year ago.

This comes despite more tough talk and threats via Chinese state media this week to send Australia into a “wintry period” by wiping more than $81 billion from our economy.

The CCP now reckons that by using the latest technology in scrap steel recycling, it can cut our iron ore exports to them in half in the next ten years.

RELATED: China warns of economic ‘winter’ for Australia

RELATED: China’s ‘frustrating reality’ cruelly exposed

That would be potentially devastating for the Australian economy, as China is still currently buying huge amounts of Australian iron ore.

In the first five months of the year China snapped up 444.9 million tonnes. Over 2020, China bought 81 per cent of all the iron ore Australia shipped overseas.

The export brings in about $136 billion to Australia’s economy a year, and is by far Australia’s largest and most valuable export.

Just over two weeks ago, the price of iron ore dipped below $US200 a tonne after hitting a record high in mid-May, driven by concerns China would intervene to stop speculative behaviour.

Some experts feared a downward slide was on the cards, but this week it has taken a spectacular rebound to another level.

As mining companies prepare to give out big dividends to shareholders and prices continue to climb, China has been hit by yet another problem.

Global supplies of iron ore were already tight, which is a key factor in its rising value amid record demand from China.

China’s iron ore port inventory hit a four-month low last week, while weekly shipment arrivals fell.

But the situation is tipped to get even worse for Beijing in the coming weeks, as the world’s second biggest iron ore exporter, Brazil, is facing more problems.

Brazil’s Vale SA has now halted production at two mines and decommissioned a dam over safety concerns. The closures will reduce its output by 40,000 iron ore tonnes a day, it said.

The Latin American nation’s output was already suffering because of a dam collapse and the pandemic, but this added spanner in the works means it may take much longer for the mining industry there to get back on its feet.

RELATED: Incredible figures show trade between China and Australia

This is the last thing China needs to hear as it looks to turn away from Australia’s supplies amid trade tensions.

Another issue is that the steel industry is booming like never before as the global economy recovers from the pandemic — with mills in turn making huge profits.

Steel in the US has tripled in 12 months as the swifter-than-expected economic recovery caught producers by surprise, while in China futures reached a record after authorities pledged to lower output in a push to control emissions.

“The sharpness and speed of the moves has been something like I’ve never seen before,” Phil Gibbs, an analyst at Keybanc Capital Markets told Bloomberg.

“I’ve been covering this space now close to 15 years, so I’ve seen some pretty crazy runs.”

This unexpected boom makes it almost impossible for China to stop buying Australia’s iron ore in the short term as it looks to continue its record steel output.

The sharp rebound through the start of June has forced a rethink of just how effectively China can tamp down soaring prices.

“The jawboning from China has historically not had much success,” Tribeca Global Natural Resources portfolio manager Ben Cleary told theAustralian Financial Review.

“All the fundamentals are pretty strong. Steel producer margins are at multi-decade highs and I can’t see demand dissipating anytime soon. We’re at the start of fiscal stimulus, not the end, so I think over the northern hemisphere summer, things should remain quite strong.”