China’s plan slapped down with incredible 10.3 per cent rise in iron ore price

The Chinese Communist Party will not be happy this morning as its plot to hurt Australia’s biggest money-spinner looks as if it’s not going to plan.

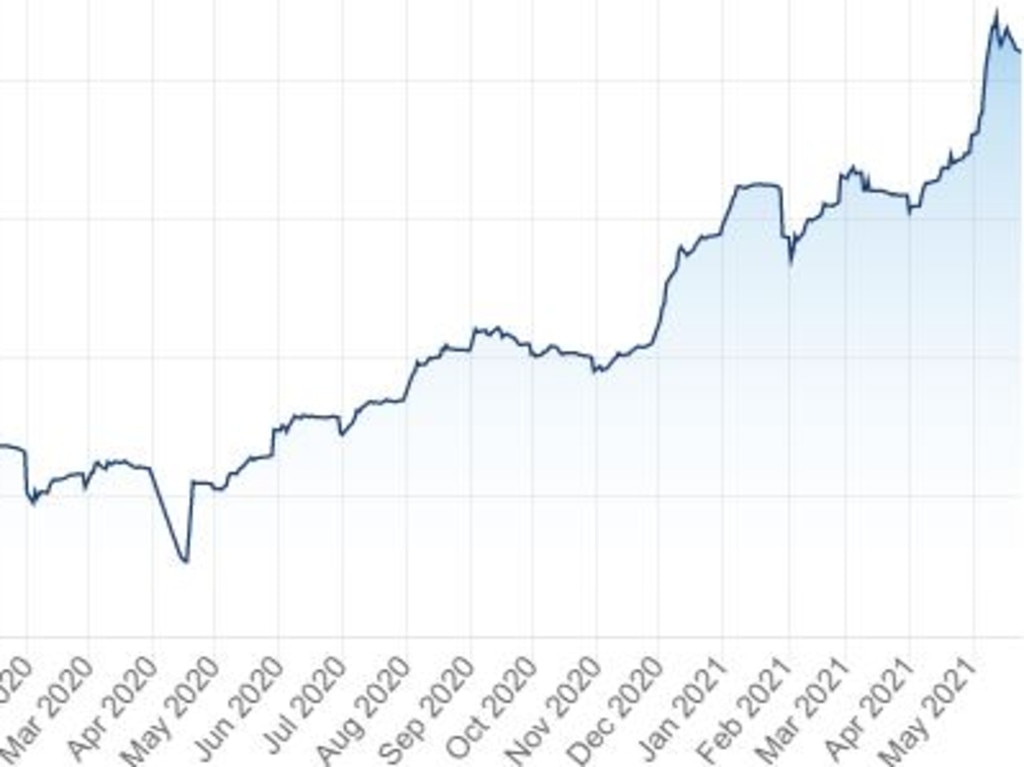

China’s plan to drive down the cost of Australia’s biggest export — currently bringing in $136 billion a year into our economy — is not going to plan, in the short-term at least.

The price of iron ore on Wednesday skyrocketed by a whopping 10.3 per cent to US$209.10 a tonne, according to CommSec. That comes after a 5.9 per cent rise on Tuesday.

This morning, the price continued to climb. It rose by 0.2 per cent or $0.35 to US$209.45 a tonne.

While this is great news for Australian mining companies, it will be the last thing Beijing wants to hear after it recently reaffirmed plans to crack down on the soaring prices of iron ore.

Last month, its National Development and Reform Commission (NDRC), along with four other departments, vowed to severely punish “excessive speculation, price gouging and other violations” that they say helped lift prices.

Iron ore surged by 10.3% or $19.55 to US$209.10 a tonne. (CFR Tianjin port). #ironore#ausbiz

— CommSec (@CommSec) June 1, 2021

This was followed by an 11 per cent slump in the price of iron ore — a valuable commodity China needs to make steel — with some analysts predicting the downward trend.

There have been some scary warnings from economists and Chinese government spokespeople since the price slumped.

NAB head of commodity research Lachlan Shaw suggested that “iron ore may not trade above $US200 again”.

However, Beijing’s plan has hit a major snag in the last couple of days, with the price of iron ore now sitting comfortably above $US200.

China’s plan not working

In a note this morning, the Bank of America suggested China’s plan may simply not work.

“As long as demand globally remains strong (including China) and markets are tight, we think it is unlikely China’s authorities will be able to push prices down on a sustained basis,” it said.

It forecasts iron ore will average $US172.2 a tonne this year; then $US143.8 a tonne in 2022; it sees a slow grind lower through 2025 when it will end below the $US100 mark.

Chinese government mouthpieceThe Global Timeswarned of “Australia’s pain” if iron ore prices dropped.

“While China’s reliance on Australian iron ore will likely continue in the foreseeable future, despite its efforts to diversify sources, sharp drops in iron ore prices would mean heavy losses in export revenue for Australia, which is already seeing declining trade with China in areas such as wine and seafood,” a journalist wrote in an editorial for the newspaper.

MB Fund and MB Super Chief Strategist David Llewellyn-Smith warned it was only a matter of time before China cuts off Australia’s iron ore, and there would be big consequences when it did.

“Nominal growth will be crunched; Inflation and wages will be hit for years; The budget will be a sea of red; Mining stocks will fall; Bonds yields will plunge; AUD will crash,” he said in his publication MacroBusiness this week.

On top of that, Australian house prices “would tumble”, “radically devaluing versus the world via the collapsing currency”.

Why does China need our ore?

Australia’s secret to sustaining some sense of economic normality throughout the pandemic recession has been iron ore.

The vital steelmaking ingredient has rocketed in value in the past year to an all-time high, and China, which makes far more steel than anyone else in the world, can’t stop buying it.

It means that everything we’ve heard about what China has been doing to our exports in the past year, like blocking our barley and wine, has been pretty much pointless from Beijing’s point of view.

Although it’s tough for producers in those sectors, the benefits of an increase in iron ore prices vastly outweigh an any damage done to the Australian economy by attacking other exports.

The windfall from the surging prices was heavily factored into the Morrison Government’s latest big-spending budget and has undoubtedly given Australia a major economic boost in these pressing times.

Ironically, it is mainly, although not exclusively, China’s fault that iron ore prices are so high.

Shiro Armstrong, director of the Australia-Japan Research Centre at the Australian National University, told news.com.au its has been China’s relentless demand for iron ore that has pushed its price up.

RELATED: Why China’s flex to hurt Australia could backfire

RELATED: China’s plan to punish Australia through Brazil

In a bid to recover quickly from the pandemic, China responded with a huge expansion in the availability of credit and a state-directed infrastructure cash splash that saw the demand for steel explode.

The plan was a success and helped China come out of its economic downturn more quickly than other major economies.

However, there have supply issues from other major iron ore producers like India and Brazil – which have both been crippled by the pandemic – meaning China could only find ore of the quality and quantity it needed from Australia.

Flaws in China’s plan

The price of iron ore is dropping as Beijing implores its steelmakers to explore overseas ore resources and widen their sources of imports.

However, analysts have pointed to flaws in the plan saying China would need to develop hundreds of new mines in a short space of time to keep up with its steel production.

China has been the main driver of global metal markets for more than a decade and they’re showing no signs of slowing down.

Research house Capital Economics estimates that Chinese steel production rose by 7.5 per cent in April compared with March. While Capital Economics believes April’s production level may prove to be the peak, Australia’s miners have seen strong activity continue into May.

RELATED: China’s mind-bending megadam plan

However, China is under pressure to reduce its carbon footprint and has promised to take steps to do so, which is at odds with its recent ramp-up in steel production.

Beijing started the year with a plan to drive steel production lower in 2021 to reduce pollution from the sector, which is estimated to account for about 15 per cent of the nation’s total emissions.

This clearly isn’t going to plan, with steel production hitting record levels, but the expectation is that the Chinese government will attempt to put the brakes on booming steel production in the second half of this year.

Given Australia sells over 60 per cent of its iron ore to China alone, this could mean we take a serious economic hit.

Australian mining insiders have told the AFR they are wary of what could happen in the near future if China goes hard on its intervention in the steel market.