Why China’s flex to hurt Australia could backfire

There are signs today that China’s plan to hurt Australia’s most valuable asset is starting to taking effect, but it could come back to haunt the superpower.

China’s efforts over the past week to cool down the skyrocketing price of Australia’s biggest export look as if they may have started to take some sort of effect.

It’s still early days, but the price of iron ore dropped a further five per cent at the end of last week – after the Chinese government set forward a plan to tackle its continually rising price.

The drop is already hitting Aussie mining companies on the ASX today. Rio Tinto fell 0.93 per cent to $122.12, while BHP declined 1.1 per cent to $47.75.

Oh....

— David Scutt (@Scutty) May 23, 2021

Dalian iron ore off another 7% to end the week$AUD#ausbizpic.twitter.com/BntZbi0AJs

Good Morning, Iron ore dropped US$10.75 a tonne or 5.1% to US$200.10 a tonne. Over the course of the week, iron ore fell by US$9.25 a tonne or 4.4%. (CFR Tianjin port).#ironore#ausbiz

— CommSec (@CommSec) May 23, 2021

However, the price of iron ore – a crucial ingredient in steel making and an economic lifeline for Australia – is still high amid huge demand around the globe.

This time last year it was worth about $US60 per tonne. At the end of last week, the same amount was worth over $US200.

As nations look to recover from the pandemic by spending big on infrastructure, they need more steel.

China is clearly aware of this, and has its own huge demand for steel. As a result it has increased its steel production to record levels – giving Australia a much-needed and surprising cash windfall at a time when relations between Canberra and Beijing have been significantly strained.

However, China is looking to do something about this.

In its monthly briefing, the National Development and Reform Commission (NDRC) recommended Chinese firms boost domestic exploration for the steelmaking input, explore overseas ore resources and widen their sources of imports.

RELATED: China’s empty threat to harm Australia

Flaws in China’s plan

Analysts have pointed to flaws in the plan saying China would need to develop hundreds of new mines in a short space of time to keep up with its steel production.

China has been the main driver of global metal markets for more than a decade and they’re showing no signs of slowing down.

Research house Capital Economics estimates that Chinese steel production rose by 7.5 per cent in April compared with March. While Capital Economics believes April’s production level may prove to be the peak, Australia’s miners have seen strong activity continue into May.

However, China is under pressure to reduce its carbon footprint and has promised to take steps to do so, which is at odds with its recent ramp-up in steel production.

Beijing started the year with a plan to drive steel production lower in 2021 to reduce pollution from the sector, which is estimated to account for about 15 per cent of the nation’s total emissions.

This clearly isn’t going to plan, with steel production hitting record levels, but the expectation is that the Chinese government will attempt to put the brakes on booming steel production in the second half of this year.

Given Australia sells over 60 per cent of its iron ore to China alone, this could mean we take a serious economic hit.

Australian mining insiders have told theAFR they are wary of what could happen in the near future if China goes hard on its intervention in the steel market.

Global demand feeds industry optimism

However, they said the level of demand across the rest of the world is so strong that they see no need to panic.

“If China cuts steel production someone else will do it,” a source inside one of Australia’s big miners told the publication.

Feeding that optimism is the fact that the steel market around the world is red hot right now.

European steel giant ArcelorMittal this month lifted its steel prices for the 12th time since November, taking a tonne of hot rolled coil (steel) in Europe to €1050 ($A1655) – up by more than 80 per cent over the past seven months.

RELATED: China to step up domestic iron ore mining

Meanwhile, Nucor, the biggest steel maker in the United States is taking the stock market by storm and struggling to find workers to keep up with its expanding operations.

Even COVID-19-ravaged India is going hard to increase steel exports, which rose about 26 per cent in the March quarter, according to S&P Global Platts.

However, Shiro Armstrong, director of the Australia-Japan Research Centre at the Australian National University, told news.com.au if China and Australia try to diversify away from each other, then it will have serious consequences for both nations.

He said that the idea Australian mines can simply find other nations to make up for the iron trade we do with China “sounds fanciful”.

“It would be unrealistic in the short term, and likely in the medium and long term for both nations because it would come at a cost neither governments or mining companies will be able to bear,” he said.

Government intervention ‘could lead to more uncertainty’

He said the international market between Australia and China is one that has delivered.

“There is not good track record when governments try to intervene in the market, and China’s efforts could lead to more uncertainty and higher prices there,” he said. “None of their policies will work because they would lead to a huge hit to China’s construction sector.”

On the flip side for Australia, he said the demand for iron ore elsewhere in the world simply isn’t there – especially with prices as high as they are now.

The latest figures show that China produces over half of the world’s steel – producing over 996 million metric tonnes in 2019. The next highest was India which produced nine times less – with just over 111 million metric tonnes.

Mr Armstrong said it would be best for the governments of both nations to stay out of the market.

“We’ve had a very beneficial relationship with China that’s driven by market fundamentals. If both countries start looking to retreat from that open market … that’s a pathway to living standards in both countries,” he said.

China’s reliance on Australian iron ore – which has resulted in massive financial windfalls for our biggest mining companies – have come despite trade tensions between the two countries being at an all-time high.

RELATED: Australia has failed on ‘assertive China’

Outright ban is ‘unimaginable’

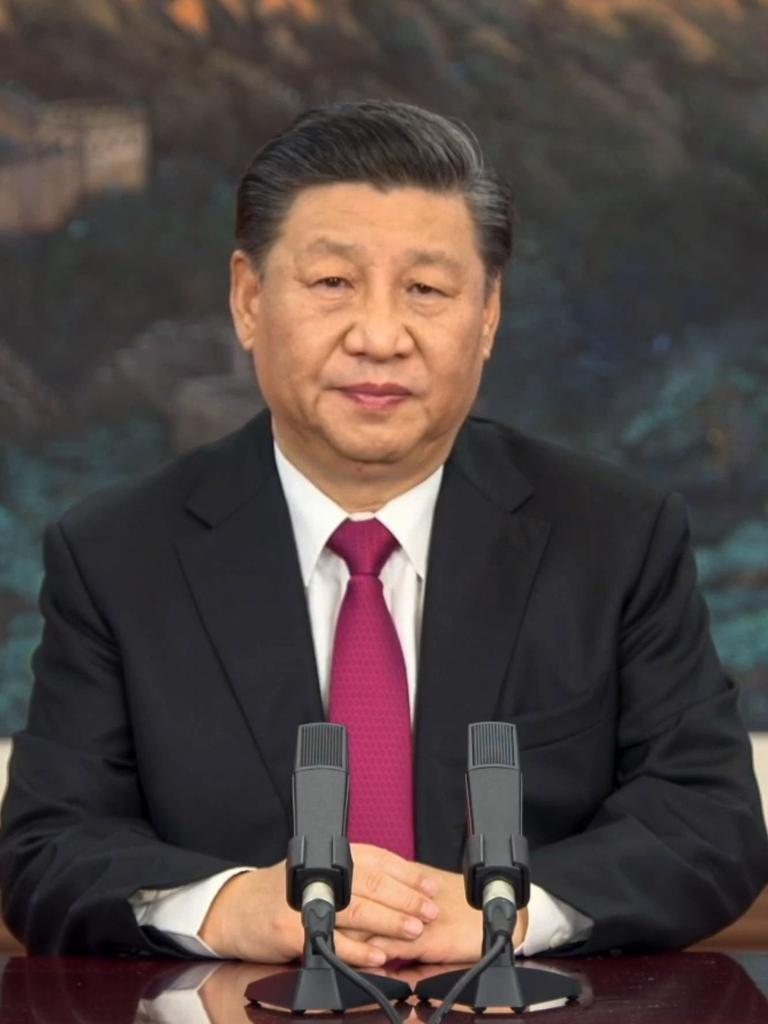

According to Chinese state media, NDRC spokesman Jin Xiandong blamed Australia for damaging trade relations.

“Consequently, we have to make the legitimate and necessary reaction, and Australia should bear full responsibility for such moves,” Mr Jin told the conference.

“We urged the Australian side to treat China-Australian co-operation objectively and reasonably, to treat Chinese companies fairly, end the disruption of bilateral trade and investment co-operation and take actions to bring forward bilateral relations for healthy development.”

But despite Australia and China’s icy relationship, an outright ban on iron ore is “almost unimaginable”.

Instead Beijing could resort to other tactics to make the export of iron ore more difficult for Australia companies, energy research and consultancy firm Wood Mackenzie told Bloomberg earlier this month.

“While an outright ban would be almost unimaginable, various forms of restrictions, delays or increased administrative burdens on Australian iron ore imports could yet happen,” Wood Mackenzie warned.