Australia’s absurd reaction to COVID crisis and recession

It’s been one of the toughest years in history but the Lucky Country hasn’t let it get them down – in fact, our behaviour is completely bonkers.

Australia right now reminds me of a rapper’s video from MTV in 2015. We are chucking money around like it is absolutely nothing. It is an orgiastic explosion of hedonistic materialism that would put Lil Wayne to shame.

Rolls Royces? We want ‘em. Seven Rolls Royces were sold in November 2020, compared to literally none in the same month last year. Porsche 911s, Bentley Coupes, and Mercedes AMGs all rolled off the lots in higher numbers compared to November 2019.

We have cash and we are not afraid to make it rain.

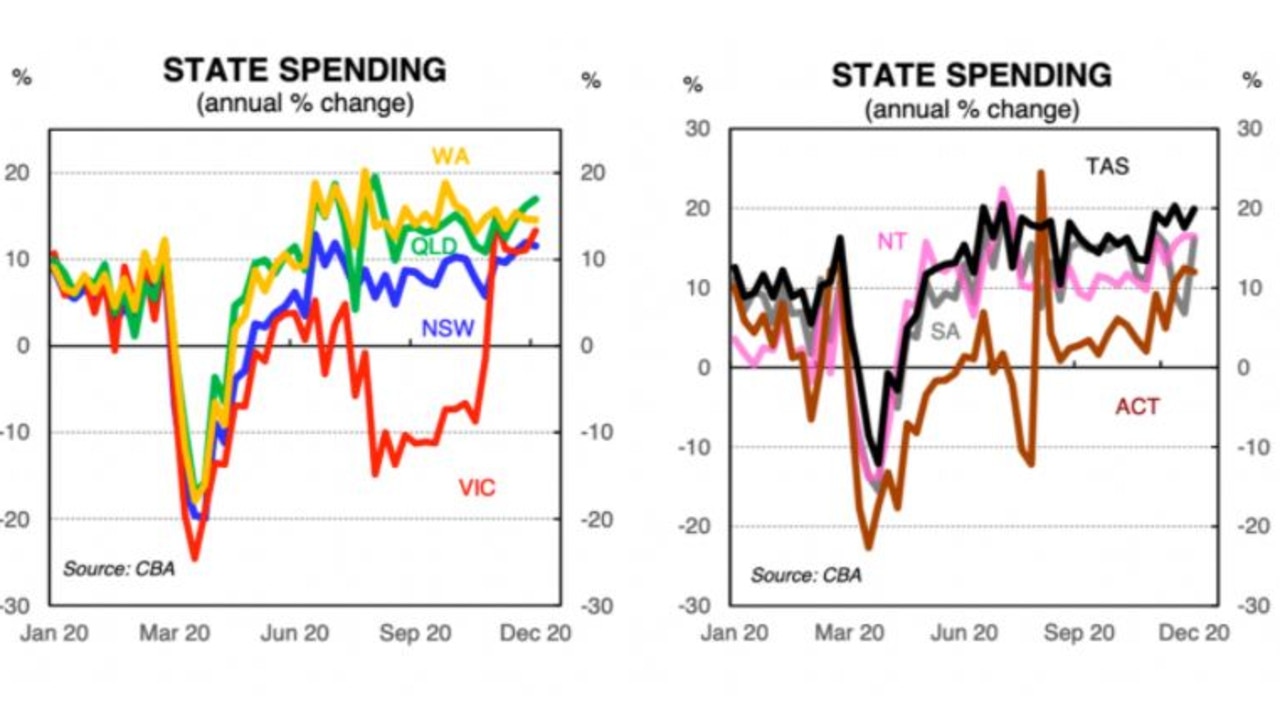

As the next chart shows, every state is spending far more money than in 2019. At least 10 per cent more, and up to almost 20 per cent more in Queensland, NT, South Australia and Tasmania.

RELATED: Bad news for Aussie house prices

What are we buying more of? Things. If you break down spending between goods and services, the data shows we are focused on goods. Aussies are currently filling our houses with stuff bought online. It could be a busy time at the op-shops in six months when we all do a big clean out!

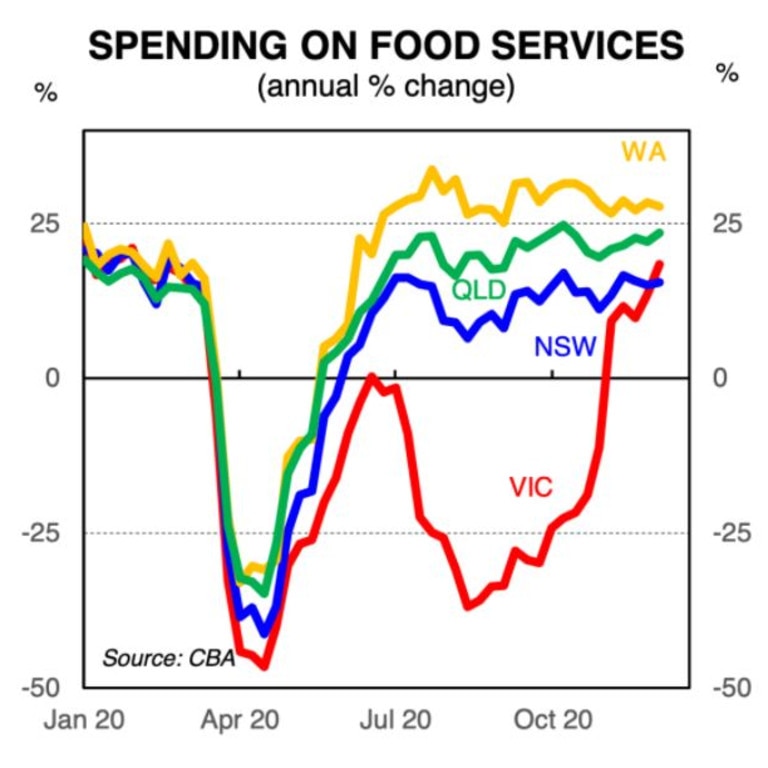

Of course, the lack of spending on services is due partly to Victoria, where services have been closed for most of the year. The rest of the country has apparently spent most of the year in a restaurant, as the next graph shows. Especially WA – since June, West Australians have been enjoying a first-class pandemic full of succulent meals.

RELATED: Best $56 billion Australia ever wasted

In the old Royal Hotel in Perth – once a backpackers hostel – there is now a restaurant called Fleur. Fleur has a caviar menu, and the prices are shocking. A five-gram bump of Uruguayan sturgeon on a little pancake will cost you $30. If five grams is not enough, you can get a 100-gram tin of that same Uruguayan caviar for $400.

RELATED: The one vehicle all Aussies want

Restaurants like that are not supposed to survive if they open in a recession. No caviar restaurants are reported to have survived the Great Depression, for example. People ate sawdust.

But this is not a normal recession and Fleur is apparently thriving. After a bumpy time in March and April it has turned out to be a great time to be a restaurant owner in Perth.

Australian consumer sentiment is at a ten-year high, as measured by the Westpac / Melbourne Institute Index. The highest in ten years.

A reminder: the pandemic is still killing thousands of people a day around the world and vaccines are not even approved, let alone in use. This recovery in Australian optimism is unexpected, complete, and even slightly obscene.

DON’T EVEN GET ME STARTED ON HOUSING

Global ratings agency Fitch sent me an email this week saying that among all the housing markets it tracks around the world, “we expect Australia to see some of the strongest price gains”.

As if Australians would go on a spending spree and not include housing.

House prices are forecast to go up 3-5% in 2021 according to Fitch. That’s huge for a country with slow population growth and high unemployment. Of course, ANZ reckons that forecast is still laughably low. They’re forecasting a 9 per cent rise in house prices next year.

WHAT THE HECK IS HAPPENING?

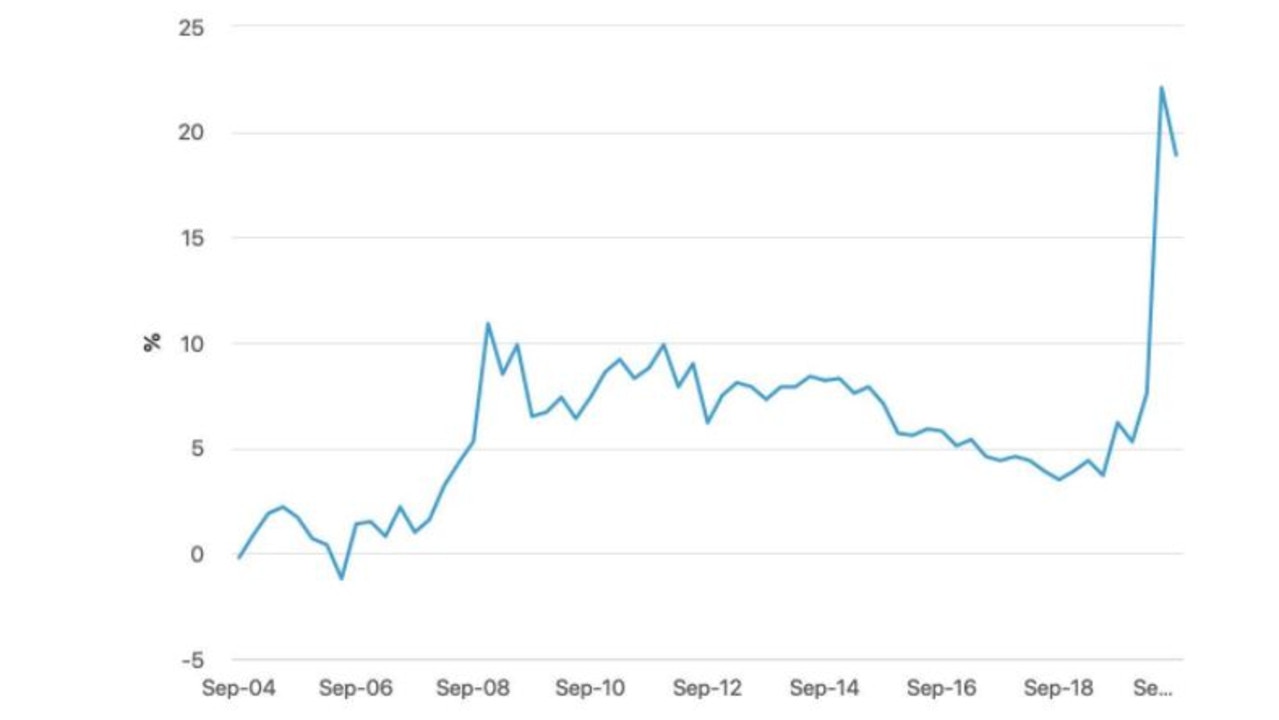

Why are we spending so damn much? Are we running our bank accounts dry? Australia’s saving is through the roof. As the next graph shows we are stacking our bank accounts high.

That’s right, we maxed out spending and saving at the same time.

We can do both because our incomes have gone berserk with JobKeeper and JobSeeker.

When the government spends billions and billions of dollars, it ends up in our hot little hands and changes our lives. That spending has caught some criticism, but not from me. It is one of the big reasons we end 2020 optimistic not pessimistic, rich not poor.

WHAT NEXT?

There’s many lessons here but the simplest one for governments might be the fact they can actually produce prosperity very simply – by putting more money in people’s hands.

This is one of the tenets of basic Keynesianism – government spending matters. Australia’s government is not completely stupid – I’d expect them to spot the correlation between consumer confidence and the fact they are now leading in the polls. Let’s not forget that Prime Minister Scott Morrison started the year in the toilet after bungling the bushfires.

It is safe to predict the government will keep spending at strong levels, leaving debt and deficit rhetoric behind. Which will be the right thing to do so long as the unemployment rate is too high.

The only question is whether they can ever unlearn it, and wean themselves off high spending if we get back to strong labour markets.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.