Australian house prices forecast to see their sharpest rise since the 1980s

Those looking to buy a home for the first time are in for a shock, as a new report from a major economist shows a dire outlook for this year.

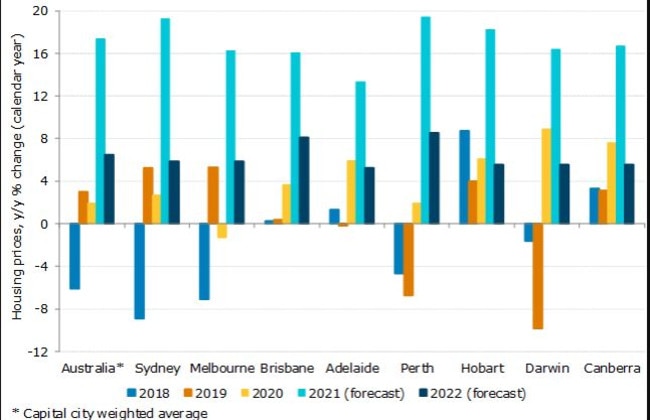

In grim news for Aussies trying to get their foot on the ladder of the property market, house prices are tipped to soar by a massive 17 per cent this year across our capital cities – marking the fastest pace of growth since the late 1980s.

ANZ economists have warned in a new report that Sydney and Perth housing prices are forecast to jump by double digits in 2021.

Sydney, which already has a median house price of almost $1.1 million, is tipped to experience its largest one-year jump in prices since 2015 – a massive 19 per cent rise.

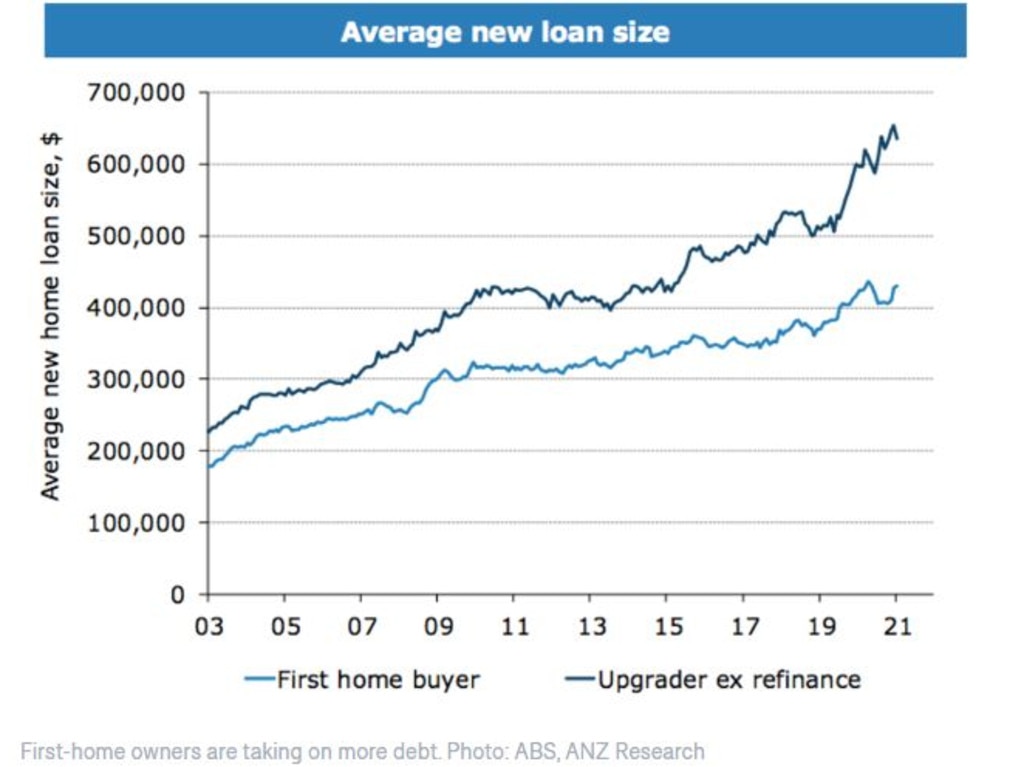

It’s a crushing blow for those looking to buy their first home in the city — some have reached out to news.com.au in recent weeks saying they can’t buy a home in even the cheapest suburbs even with up to $135,000 of savings behind them.

Meanwhile, house prices in Perth are also tipped to jump by 19 per cent this year, followed by Hobart (18 per cent), Melbourne and Brisbane (16 per cent) and Adelaide (13 per cent).

ANZ previously forecast a 9 per cent national rise this year, but a number of factors have sent that up significantly.

The property market is now booming as buyers take advantage of record-low interest rates, very low levels of immigration, government programs and money saved during the coronavirus recession.

“The impact of low interest rates on the housing market has more than offset the headwinds from elevated unemployment and very low population growth,” the researchers said.

“The combination of strong demand and low supply is pushing prices sharply higher.

“Housing construction is also rebounding sharply, helped by the federal HomeBuilder scheme, other government support and low interest rates. There is now a substantial pipeline of activity, and we expect double-digit growth in 2021.”

However, they say there may be a little bit of a reprieve in the rocketing prices next year.

The bank regulator could step in later this year and restrict borrowers from taking on too much debt compared to their incomes, which would slow price growth in 2022.

RELATED: $135k savings won’t buy in ‘worst’ suburbs

RELATED: Sydney family saved $100k but are ‘totally priced out’

It predicts the rise will be averaging 6 per cent across Melbourne and Sydney, with Perth and Brisbane forecast to have increases of about 8 per cent.

However, that rate would be triple the level of expected inflation, and the increase in prices this year alone is likely to set a significant barrier to those trying to get a foot in the door.

The last time house prices nationally lifted so much was in the late 1980s in a property boom that was ended by double-digit interest rates and the 1990-91 recession.

Separate data from CoreLogic found the proportion of properties in the December quarter that changed hands at a profit rose to 89.9 per cent, above pre-pandemic levels, but unit owners were more likely to sell at a loss than house vendors.

It shows that only 4.4 per cent of Sydney houses sold at a loss, compared to 12.6 per cent of Sydney units.

In Melbourne, 2.5 per cent of houses sold at a loss, but 13.5 per cent of units lost money.

Some areas of the big cities saw high levels of loss-making sales, at 31.3 per cent of all sales in Melbourne’s CBD and 21.9 per cent in Stonnington. In parts of Sydney, such as Botany Bay, Strathfield and Parramatta, the share of sales at a loss was above 17 per cent.

RELATED: Impact of falling population on house prices

CoreLogic’s head of research Eliza Owen said property values rose across each state and territory through the December quarter, and the value of profits also increased substantially.

She said total gains from resales in the December quarter rose to $31.9 billion, up from $24.8 billion in the previous quarter, while combined losses from resales also shrank from $1.2 billion to $1 billion from the September to December quarter.”

“The results are particularly significant given the uplift in sales volumes in the three months to December, much of which was driven by an increase in transaction activity across Melbourne,” Ms Owen said.

“Sales and listings increased remarkably across the city, as the economy emerged from the weakness associated with the extended lockdowns.”

The skyrocketing price predictions are good news for those who already own a home, but are they a sign that the market is starting to become a bubble?

The Federal Government doesn’t think so. The Treasury’s deputy secretary Luke Yeaman told a Senate estimates hearing yesterday the department was watching property market carefully but there were no signs of a bubble forming, nor a decline in lending standards.

He said the fall in interest rates over the past year had meant housing affordability was roughly in line with levels over the past five years overall.

Higher house prices were actually boosting the overall economy, he said.

“At this stage … the support the strong housing market is providing for consumers, through to household wealth, we see as a sign of strength in the recovery,” he said.