What impact will a falling population have on Aussie house prices?

Property prices are up – and don’t look set to stop rising. But there’s one key factor that could derail the market completely.

Property markets are hot. I was at an auction the other day where the place sold for $375,000 over the top of the advertised range.

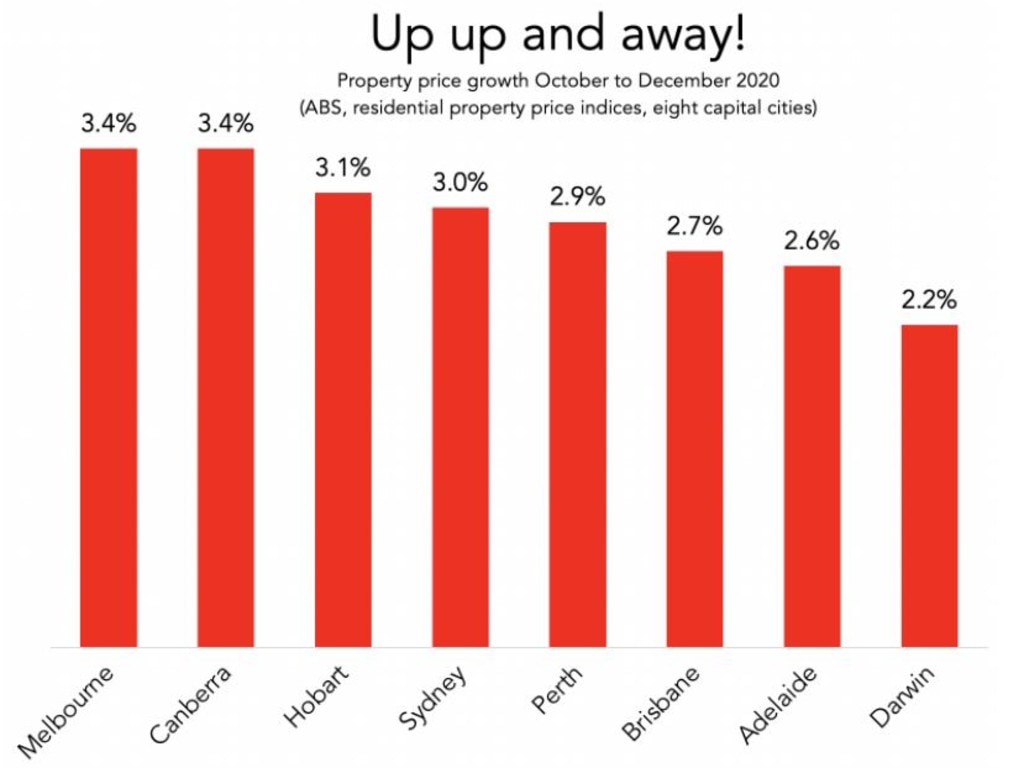

Aussies are making the most of very low interest rates and buying houses in a frenzy. This is driving up prices across the country, as the next graph shows.

RELATED: How much super you need at your age

If you, like me, thought COVID would depress the market, nope. Bizarrely, the city with the fastest house price growth – Melbourne – is also the one with the most empty homes.

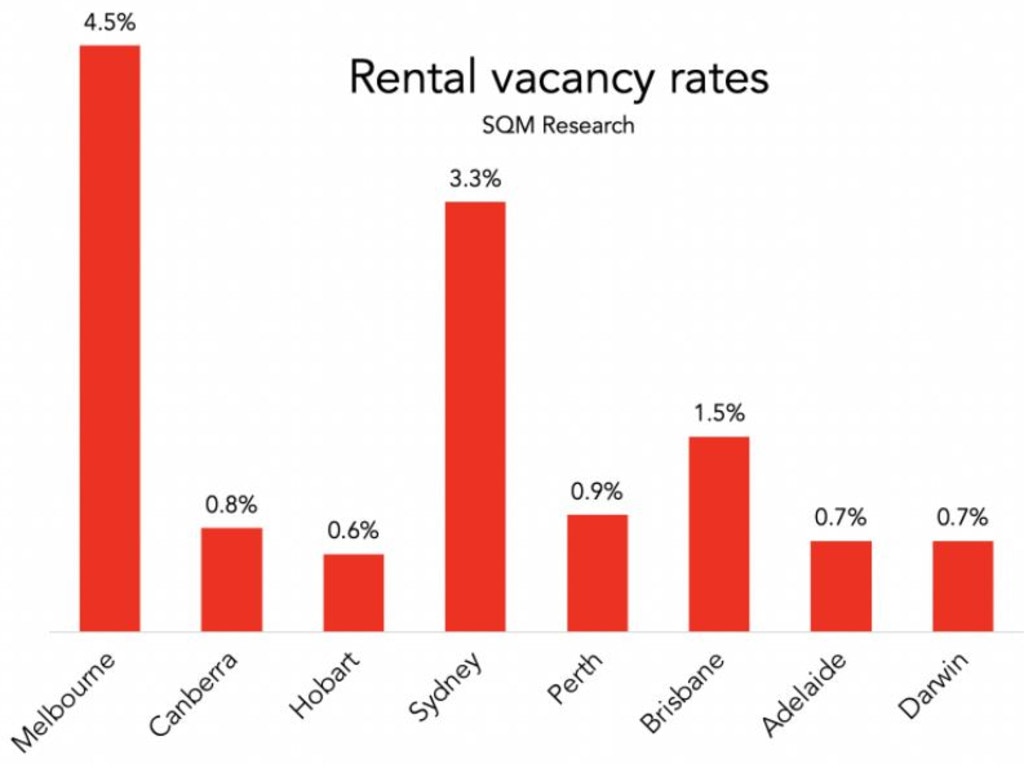

As the next graph shows, Melbourne has the country’s worst rental vacancy rate. 28,000 rental properties sit vacant – which is more than Sydney and over 4 per cent of all rentals in Melbourne.

And yet house prices are rocketing.

RELATED: ‘Hopeless’: $100k can’t buy a house

Sydney’s strong house price growth is also happening despite high rental vacancy, while in Canberra and Hobart strong property price growth looks more logical.

What distinguishes Melbourne and Sydney of course is high rise towers full of apartments which are usually occupied by students, tourists and temporary workers from overseas. Those apartments are more vacant than usual as the borders are closed.

In Melbourne’s CBD, the rental vacancy rate in February was 7.5 per cent, according to SQM. No wonder it seems empty on the streets there.

Still, since December, house prices have kept rising. Property price data company CoreLogic says prices in Sydney have now set a new record.

“The fresh record high is great news for Sydney homeowners, but highlights the challenges for non-home owners looking to participate in the housing market as values rise faster than incomes,” says Tim Lawless, director of CoreLogic.

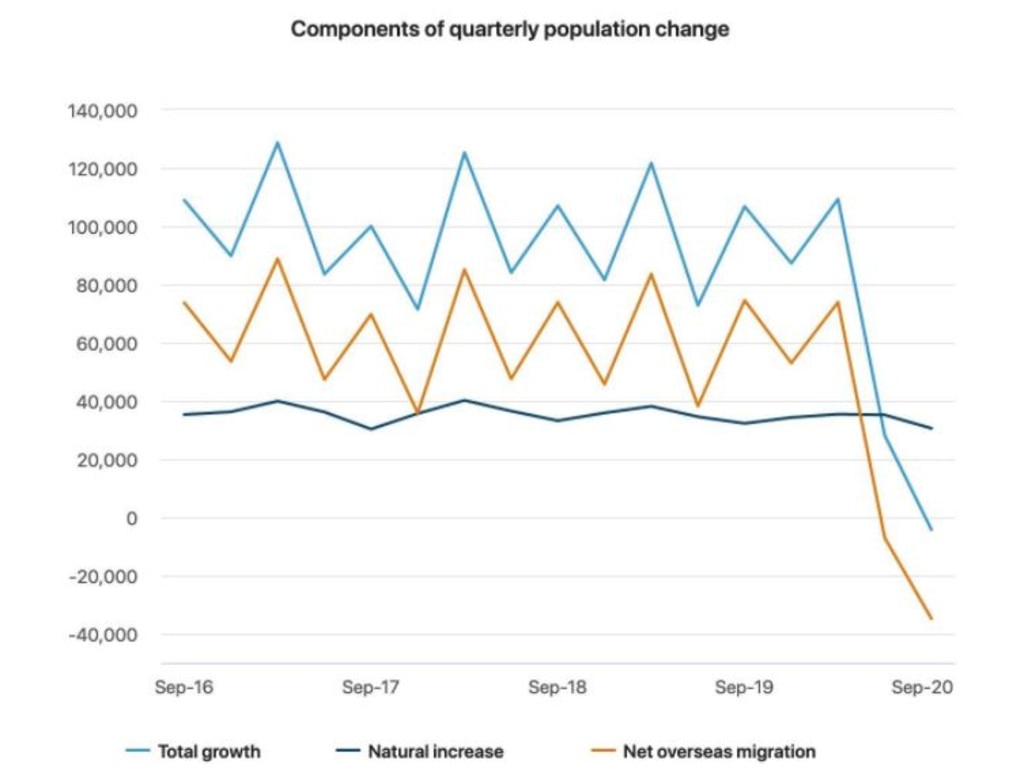

Does this make sense? Because population growth is at its lowest level in a very long time. As the next graph shows, the natural increase is pretty stable. That means the ratio of births to deaths is steady.

But the rate of net overseas migration has plummeted enough to overcome the rate of births, leaving Australia with less people in it than before.

That’s extremely rare.

RELATED: City where houses go for $100k over asking

Australia’s population actually fell in the September quarter. And that’s only counting official migration, not the temporary students and workers who might be present in this country but are not official migrants.

If you consider all of those people who might have returned to their home country, you should reduce the estimated population even more.

Although, don’t forget that when you think about the population of people actually present here, you need to count hundreds of thousands of Aussies who would not usually be here at home, but are now.

There are lots of young Aussies who cut short their gap year, expats who came home from Silicon Valley, and people who would usually be in Bali who are now actually in Australia instead.

The percentage of Australians actually in Australia right now is probably near the highest it has been in decades, and in some cases that means extra demand for housing.

In New Zealand, where COVID barely ever really hit, house prices have risen even more than Australia.

The reason? Almost 15 per cent of New Zealanders live overseas and they have been flooding home to their “100% pure” homeland in 2020, creating huge demand.

The New Zealand situation shows the potential for fresh arrivals to lift property prices and that is something certain interested parties in Australia are well aware of.

The Property Council of Australia desperately wants migration to start up again. It is the peak body for the Property Industry.

Here’s its chief executive Ken Morrison telling the government what to do in a pre-Budget submission: “Measures that support economic activity and job creation are more important than ever. As the RBA has shown, population growth is one of Australia’s big economic engines, so safely restarting net overseas migration must now be a priority.”

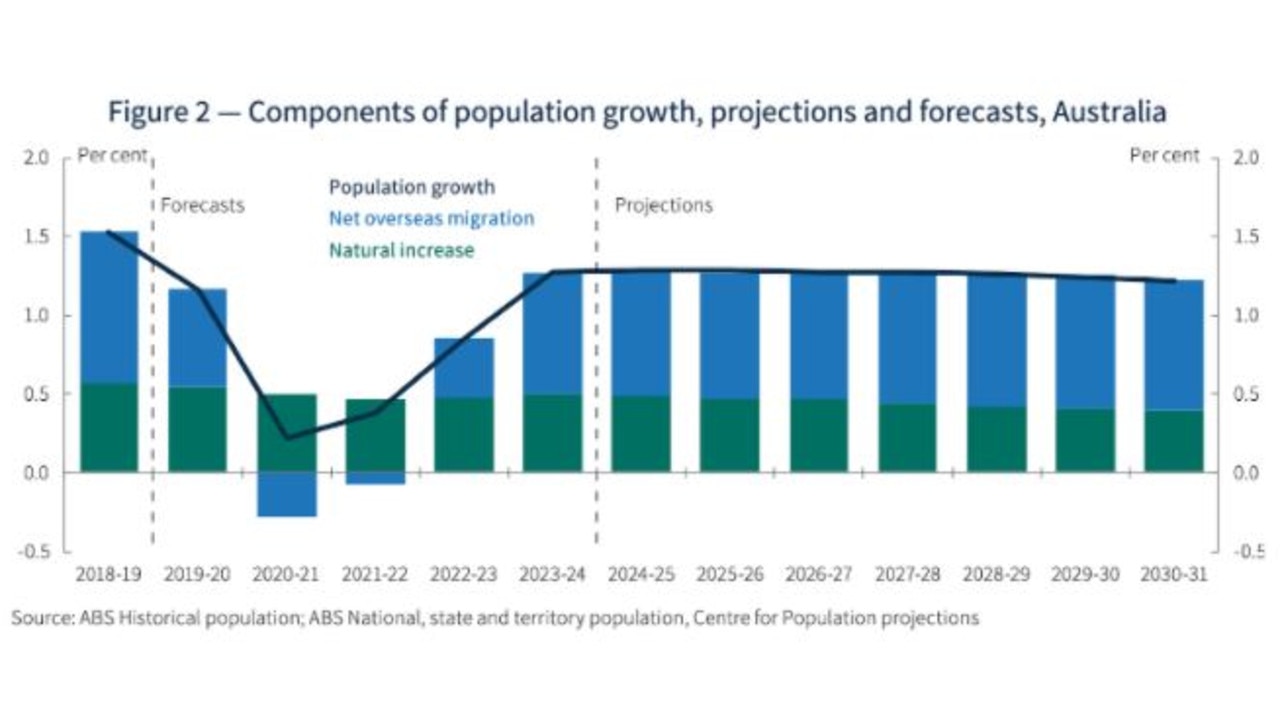

This graph from the Australian Government shows that net overseas migration will take a hit for at least two financial years.

That, and subsequent slow growth, will leave Australia’s population four per cent smaller than it would otherwise have been in 2030-31.

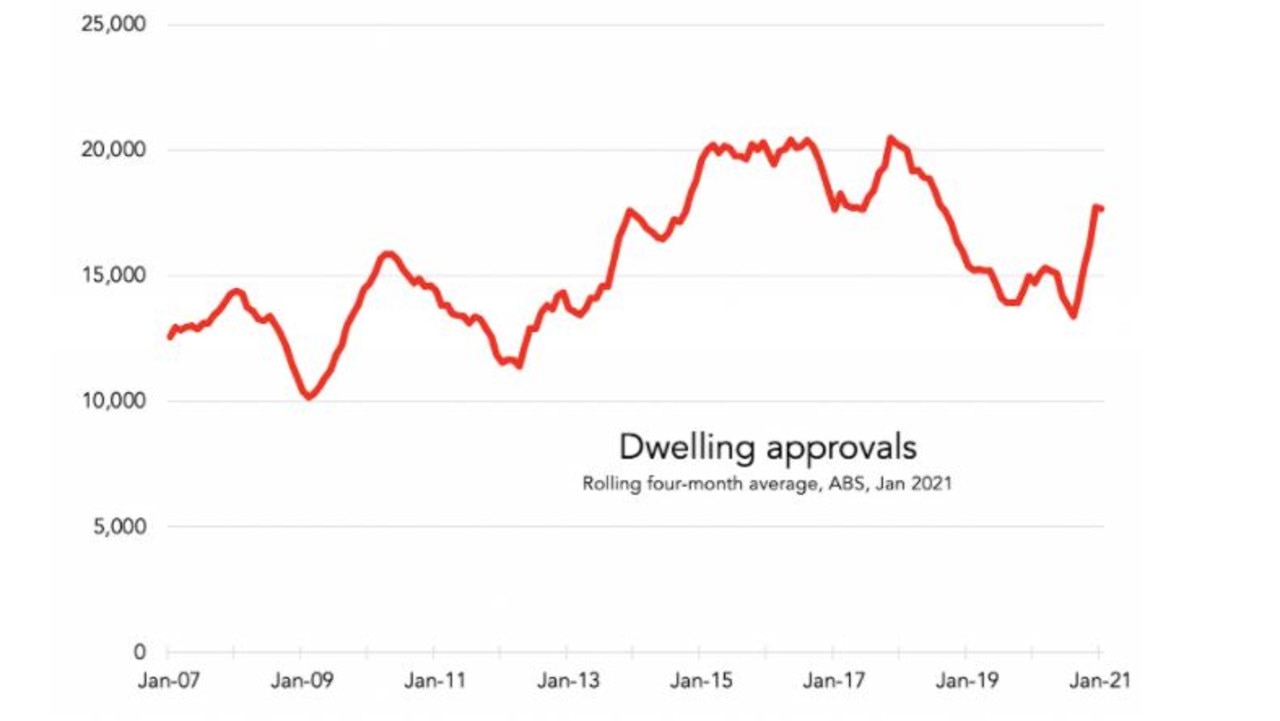

Higher property prices would certainly help encourage builders to get building. But as this next graph shows, dwelling approvals have already shot back up from their COVID lows.

There’s an interesting detail there. The properties being approved at this time are not apartments any more, but overwhelmingly houses.

Post pandemic, people want a bit of space around them, and possibly a spare room to work from home in. The coming property boom won’t be so much about cranes on the horizon as about paddocks being subdivided.

Will there be enough Aussies to fill those houses? And if not, will the government be tempted to ramp up migration to help fill them? I expect there will be a huge debate about migration for the next five years.

Watch this space.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.