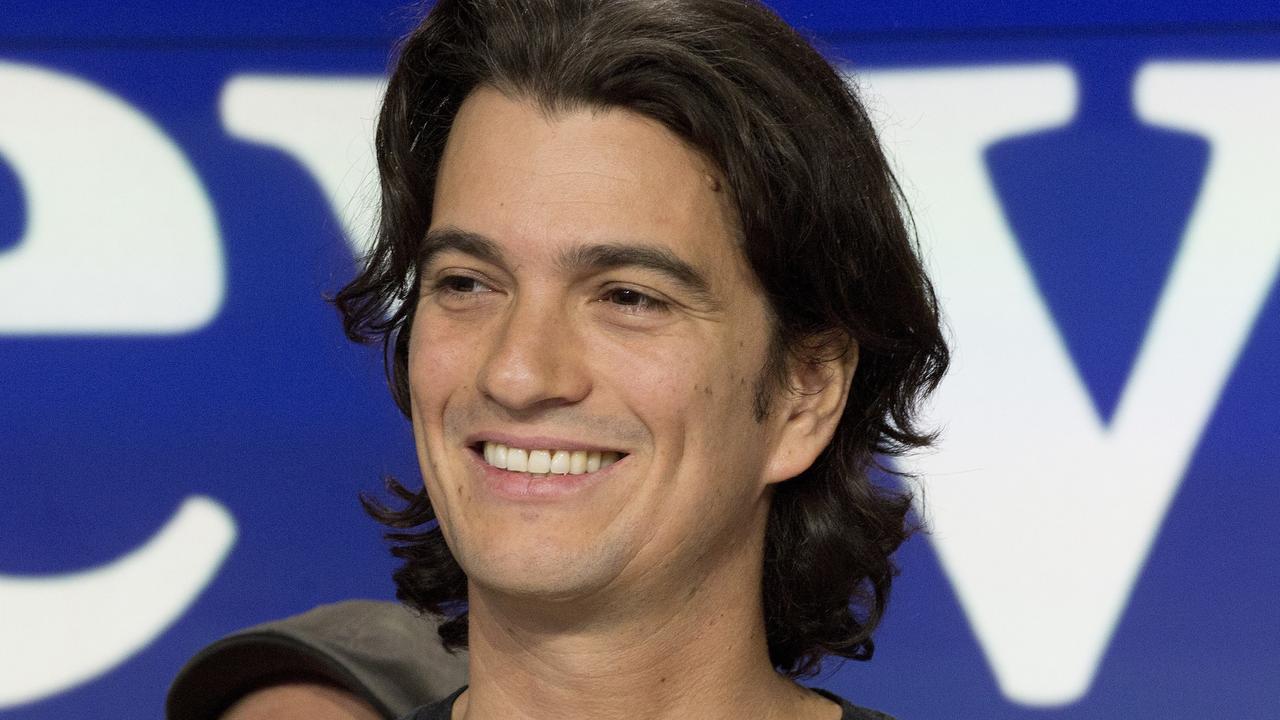

WeWork CEO Adam Neumann leaves company with $2.5 billion

The company’s value has plummeted and about 2000 people have lost their jobs, but the cause of the problems will walk away with a massive cheque.

Controversial WeWork founder and former chief executive Adam Neumann will walk away with nearly $A2.5 billion from the embattled office space-sharing company despite its dramatically shrinking value and about 2000 employees losing their jobs.

Japanese conglomerate SoftBank Group has proposed a package to rescue the once surging company, according to Bloomberg, which includes Mr Neumann selling about $A1.46 billion of stock.

The former boss will also be paid a $A270 million consulting fee from the Japanese firm.

This windfall is coming as WeWork’s value plummets from an estimated $A68.6 billion to its current valuation of just $A11.7 billion.

Mr Neumann will also get a $A730 million credit line from SoftBank to help pay off his loans to JPMorgan Chase, according to the Wall Street Journal.

The catch and arguably good news for SoftBank? Mr Neumann will walk away from his position on WeWork’s board.

RELATED: Neumann says scrutiny was significant distraction for company

RELATED: WeWork co-founder Adam Neumann slammed over payment

RELATED: CEO Adam Neumann’s fatal business mistake cost $16 billion

HOW DID IT GET HERE?

Up until a few weeks ago, Mr Neumann was piloting WeWork towards a giant initial public offering that would have made him a multi-billionaire.

But as investors fell off the hyped company and its launch on the share market was delayed, Mr Neumann’s bizarre and hugely costly decisions left his position as chief executive untenable and he resigned last month.

In September, some bankers had touted WeWork’s valuation as high as $A95 billion, which would have made the former CEO’s 22 per cent stake worth an eye-watering $A20 billion.

But the company had to continually cut its valuation target over doubts about its prospects from potential investors and is now under pressure to postpone its market debut.

WILD ANTICS OF ROCK STAR CEO

Since The Social Network took us behind the curtains of Facebook and Mark Zuckerberg’s rise, the wild antics of young start-up pioneers has been synonymous with parties, warped ambition and lots and lots of money.

But Mr Neumann’s dirty laundry list of bizarre incidents and booze-fuelled anecdotes reach mythological proportions as detailed in a recent report in The Wall Street Journal.

The long-haired CEO once spent an international flight on a private jet smoking marijuana, and when the plane touched down in Israel, crew members found a cereal box stuffed with weed.

When the plane’s owners found out, he ordered the crew to fly home immediately to avoid any drug trafficking offences, leaving Mr Neumann stranded.

The casual drug taking may explain some of his other rumoured thoughts and ambitions, such as his hopes to live forever and wanting to be president of the world.

His eagerness for parties is well-known. Apparently, he would walk around the office barefoot listening to Rihanna and once hosted a “summer camp” for employees outside of London, which was a music festival-themed party where “bartenders handed out free rosé by the bottle”.

Other parties were more inappropriate.

Like the time Mr Neumann reportedly fired 7 per cent of his staff. And once the announcement was made, trays of tequila shots were handed out and Run-DMC’s Darryl McDaniels performed a set as employees danced to It’s Tricky.

The unusual behaviour extends to Mr Neumann’s wife Rebekah, who allegedly had multiple employees fired after meeting them for only a brief encounter because “she didn’t like their energy”.

The Wall Street Journal details plenty more. So the question really shouldn’t be where did it all go wrong? But rather how did Mr Neumann end up ruling one of the world’s most hyped start-ups?

WHAT HAPPENED TO THE PUBLIC OFFERING?

Last month it was reported some investors were worried about scepticism surrounding the company’s business model and wanted its planned IPO to be pushed to 2020.

After WeWork filed to go public recently, it was revealed Mr Neumann had been paid a staggering $US5.9 million ($A8.6 million) by his own company.

The reason for the payment? The use of the word “we”.

The payment came about when WeWork “reorganised and rebranded” as The We Company in January ahead of its initial public-offering filing.

Mr Neumann, 40, owned the trademark “We” through a private company, We Holdings LLC, which then sold the use of the word to WeWork.

The controversial move was panned by a range of experts, including New York University marketing professor Scott Galloway, Axios’ Dan Primack and Trition Research Inc CEO Rett Wallace.

Do you think it’s unfair for Mr Neumann to pocket so much while others are left unemployed? Comment below @James_P_Hall | or get in touch at james.hall1@news.com.au