Predator and Prey: Could Pursuit Minerals be the next lithium take-over in Argentina?

Rio’s Arcadium deal has resources-sector interest turning to potential future takeovers in Argentina’s ‘Lithium Triangle’ region.

Rio's Arcadium acquisition sparks speculation over other potential take-over targets in the areaÂ

Most of the salars around Arcadium's landholding are already associated with a majorÂ

But there are still a handful of small-cap opportunities with Pursuit Minerals, Galan and American Salars nearbyÂ

Mergers and acquisitions can be a huge value creator for shareholders, especially for those invested in the target firm.

Predator and Prey takes a close look at ASX explorers in the early stages of their journey and why they could be hunted by a larger player.

In October last year, Rio Tinto made a $10b approach for dual-listed lithium producer Arcadium in a bid to consolidate the world’s largest lithium resources as companies struggled through a bear market for the battery metal.

Despite an 80% drop in lithium spot prices, the industry’s second-largest miner made it clear where it saw lithium’s future going over the next decade – up.

Earlier this month, and just a little over four months since the announcement of the transaction, Rio completed the acquisition, giving it control of about 5% of the world’s lithium supply with a broad package of development ready sites in South America and Canada.

It now holds an extensive portfolio of lithium carbonate, hydroxide, spodumene and butyllithium assets in Argentina including the 22.63Mt Olaroz lithium facility as well as the country’s oldest and largest lithium mine at the Fenix project.

Who’s next?

Investors and analysts are now keeping tabs on who might be the next takeover target as lithium in Argentina continues to consolidate.

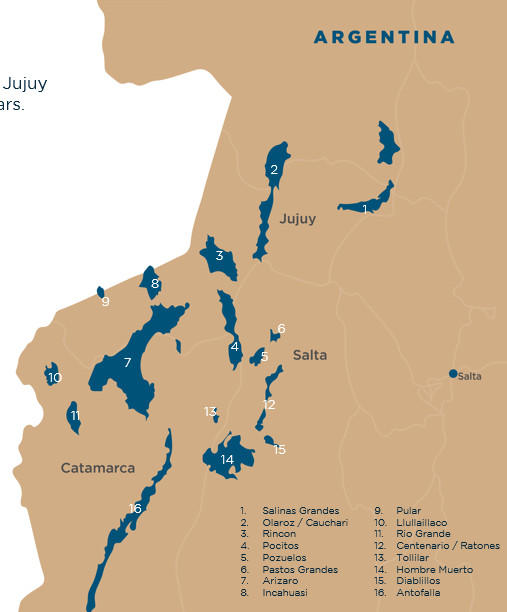

Many of the salars surrounds Arcadium’s landholding are already associated with a major.

For example, in the photo above, number 10 and 5 are majority controlled by Gangfeng, which also has an indirect controlling position of number 6, which is controlled by Lithium Argentina.

Lithium Argentina also controls number 2, alongside Rio Tinto, which also controls most of number 14.

And as recently as December last year, a US$180m acquisition was announced for Lithium Chile’s Arizaro project.

It is also becoming increasingly difficult for miners to enter the Argentinian sector with 20-30% of brine assets already under Chinese control with limited supply that will outpace demand.

But there’s still a handful of small-cap lithium juniors such as American Salars (CSE:USLI), Galan (ASX:GLN) and Pursuit Minerals (ASX:PUR) with high-value projects in a region that's ripe for more corporate activity as large players look to position themselves.

Pursuit's commercial production pathway

Pursuit Minerals (ASX:PUR) has taken meaningful strides towards becoming a commercial producer at its Rio Grande Sur asset in Argentina’s Salta lithium region within the prolific ‘Lithium Triangle’.

Its newly refined large-scale development plan incorporates a modular design strategy under Phase 1, which will see the relocation of its existing 250tpa lithium carbonate plant on site to enable early-stage production, ultimately de-risking the processing methodology to generate near-term cash flow.

The second phase will expand production to 5000tpa at Sal Rio 02 to establish large-scale lithium supply as the market transitions from surplus to deficit in the coming years.

Output will increase to 15,250tpa under Phase 3 by introducing a 10,000tpa expansion at Mito, the target with the biggest upside.

A 339% resource increase late last year put Pursuit squarely on the Argentine map, with the company believing it now commands attention from the major miners (and briners) looking for a significant lithium investment.

Similar strategy to Orocobre

PUR managing director and CEO Aaron Revelle believes the Rio Grande Sur project is attractive enough to be a potential acquisition target.

“Rio Grande Sur is a large-scale, low-cost resource with a conventional processing route using proven technology focusing on lithium carbonate production - very similar to the pathway Orocobre took on its journey to now being part of Rio Tinto,” he told Stockhead.

“We believe we have a best-in-class strategy to technically de-risk the asset and bring online scalable long-term production.

“Our strategy is more appealing to potential partners and acquirers of assets looking to enter the sector to which there is no current producer on the Rio Grande Salar,” he added.

“Prospective acquirers of assets are increasingly focused on production capability at the lower end of the cost curve which is in line with the current prices around ~$10,000 per tonne.

“Whilst many assets are favourable at the heightened prices we saw in 2022/2023 of $80,000 per tonne, the list is considerably smaller at $10,000 per tonne, and Rio Grande Sur fits into this criteria.”

At Stockhead we tell it like it is. While Pursuit Minerals is a Stockhead advertiser, it did not sponsor this article.

Originally published as Predator and Prey: Could Pursuit Minerals be the next lithium take-over in Argentina?