Lunch Wrap: Miners, energy stocks rally as China gears up to announce fresh stimulus today

ASX kicks off strong with tech stocks soaring, Wall Street rebounding but still in correction, and Spartan merging with Ramelius.

ASX kicks off strongly with tech stocks leading the charge

Wall Street rallies but still in correction, analysts cautious

Spartan and Ramelius merge, energy stocks get a boost

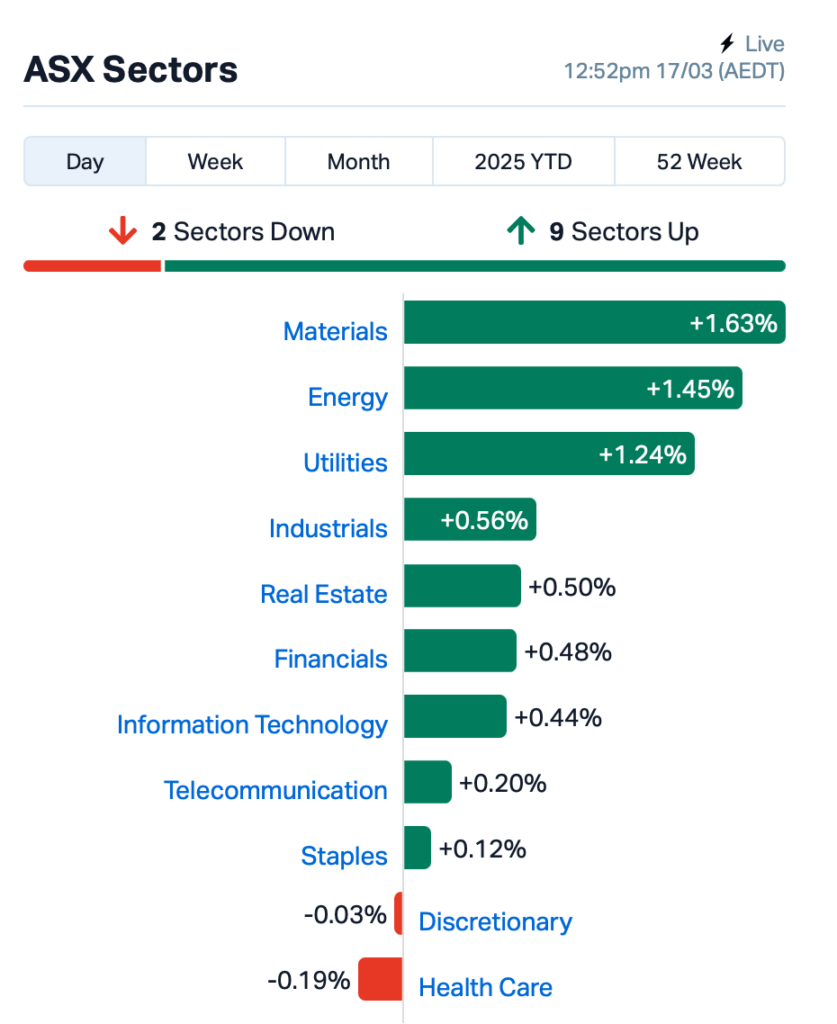

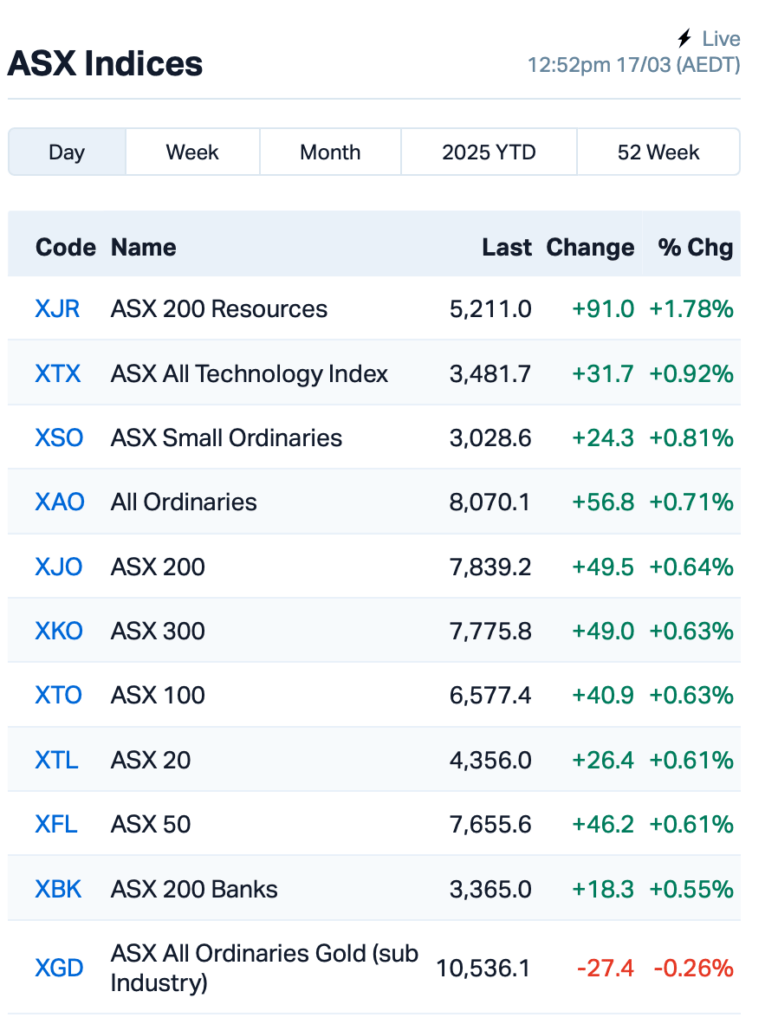

The ASX was looking pretty good this morning, kicking off the week with a nice lift of 0.6%.

Mining stocks were the top performers after China promised a bunch of new measures to ramp up consumption.

Wall Street also had a decent rally on Friday, but its main index, the S&P 500, still ended up in correction territory, down 10% from its recent peak.

“Any day without a Trump tariff comment is a good day for the market,” said Ed Yardeni at Yardeni research firm.

“We will be more inclined to call a bottom when we see the stock market move higher on a day or days when Trump blusters about tariffs again.”

Analysts at Macquarie also remain cautious, warning that unless Trump eases up on trade wars, the US economy could slow further, which would likely drag equity markets down another 20%.

Back on the ASX, China's plans to boost real incomes fired up the market, with Aussie miners leading the charge.

The announcement of new measures (set for later today) to ramp up domestic consumption also added to the positive sentiment.

Rio Tinto (ASX:RIO), Fortescue (ASX:FMG)and BHP (ASX:BHP) were all up on the news.

Energy stocks were also boosted, with Brent trading 2% higher at US$71.75 at the time of writing.

In the large caps space, Spartan Resources (ASX:SPR) surged 9% after confirming its merger with Ramelius Resources (ASX:RMS).

Spartan believes merging with Ramelius makes perfect sense because it will create a top-tier Aussie gold producer with plenty of exploration upside. The combined group will have 12.1 million ounces of gold in resources and 2.6 million ounces in reserves, with plans to boost production to over 500,000 ounces by FY30.

Watch later: Break it Down: Spartan and Ramelius to tie the knot on $2.4b deal

Elsewhere, National Australia Bank (ASX:NAB) announced a leadership shake-up, with its CFO Nathan Goonan resigning and moving over to Westpac (ASX:WBC). NAB's shares were down 1%, and Westpac were up 1%.

In the mining sector, Mineral Resources (ASX:MIN) was up by 8.5% after UBS upgraded it to a "buy" rating, with a price target of $28.60, which implies a 20% upside from where it’s trading now.

UBS pointed out that despite some ongoing governance issues with founder Chris Ellison, the company had addressed those concerns well.

And finally, Paladin Energy (ASX:PDN) had some good news, too, as it was granted an exemption by the Canadian government to maintain a controlling stake in its Patterson Lake South project.

This was a significant development, as non-Canadian mining companies typically need an exemption to control uranium projects in the country.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for March 17th :

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.00 | 100% | 6,012,779 | $28,933,812 |

| TOU | Tlou Energy Ltd | 0.01 | 75% | 2,798,034 | $10,388,675 |

| ALR | Altair Minerals | 0.00 | 50% | 4,015,610 | $8,593,488 |

| SMP | Smartpay Holdings | 0.78 | 46% | 603,947 | $128,230,036 |

| DNA | Donaco International | 0.04 | 42% | 14,741,474 | $37,061,681 |

| BUX | Buxton Resources Ltd | 0.03 | 36% | 1,127,955 | $5,557,062 |

| ALM | Alma Metals Ltd | 0.00 | 33% | 443,875 | $4,759,036 |

| ASP | Aspermont Limited | 0.00 | 33% | 700,000 | $7,410,035 |

| PRM | Prominence Energy | 0.00 | 33% | 1,000,000 | $1,167,529 |

| SCP | Scalare Partners | 0.22 | 30% | 58,497 | $5,755,662 |

| ICE | Icetana Limited | 0.02 | 29% | 183,223 | $6,133,997 |

| BEZ | Besragoldinc | 0.05 | 27% | 1,732,276 | $15,373,091 |

| DTM | Dart Mining NL | 0.01 | 25% | 1,080,292 | $2,751,056 |

| HLX | Helix Resources | 0.00 | 25% | 1,764,891 | $6,728,387 |

| ID8 | Identitii Limited | 0.01 | 25% | 465,750 | $6,193,708 |

| PNT | Panthermetalsltd | 0.02 | 25% | 30,294,004 | $4,814,473 |

| CAE | Cannindah Resources | 0.09 | 21% | 3,648,051 | $52,421,757 |

| NMG | New Murchison Gold | 0.02 | 20% | 19,397,288 | $124,342,951 |

| ECT | Env Clean Tech Ltd. | 0.00 | 20% | 85,000 | $9,117,026 |

| OVT | Ovanti Limited | 0.01 | 20% | 1,424,929 | $13,507,739 |

| SER | Strategic Energy | 0.01 | 20% | 6,666 | $3,355,167 |

| TON | Triton Min Ltd | 0.01 | 20% | 20,300 | $7,841,944 |

| ASV | Assetvisonco | 0.04 | 19% | 917,128 | $23,659,570 |

Altair Minerals (ASX:ALR) has made an exciting discovery at Irka Sur, part of its Venatica West project. The company found high-grade copper across a massive 700m strike, with samples showing copper grades up to 2.9%, plus significant gold and silver. This confirms that the area has huge potential, Altair said, and it's all open for further exploration. The 16m outcrop of exposed porphyry averaged 1.8% copper, with the mineralisation continuing below surface.

Payments fintech SmartPay (ASX:SMP) said it has received two non-binding takeover offers, one from Tyro Payments and another from an international company. Tyro’s offer is to buy all of Smartpay’s shares for NZ$1.00 each, with most of the payment in Tyro shares and some in cash. Both proposals are still early stages and depend on due diligence and final agreements. Smartpay’s board is letting both parties do some due diligence to figure out which offer’s best, but there's no guarantee a deal will go ahead.

Gaming and hospitality stock Donaco International (ASX:DNA) has entered into a deal with On Nut Road Limited (ONR) for a takeover where ONR’s offering $0.045 per share in cash. ONR’s been an investor since 2019 and already holds nearly 13% of Donaco. This offer is a 50% premium on the recent share price. Donaco’s board said it’s all for it and recommends shareholders vote for the deal, but it still depends on an independent expert’s opinion and approval from shareholders and the court.

And Buxton Resources (ASX:BUX) has brought on Gervaise Heddle as non-executive chair. Heddle has a solid track record, having led Greatland Gold through the discovery of the Havieron gold-copper deposit in WA, which saw its share price shoot up over 10,000%. He’ll be bringing his expertise in leading exploration companies and engaging investors to Buxton, which is focused on developing its own early-stage exploration projects like Centurion and Madman in WA.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for March 17 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RFA | Rare Foods Australia | 0.014 | -33% | 361,739 | $5,711,648 |

| AXP | AXP Energy Ltd | 0.001 | -33% | 178,620 | $9,862,021 |

| VFX | Visionflex Group Ltd | 0.002 | -33% | 130,227 | $10,103,581 |

| CR9 | Corellares | 0.003 | -25% | 2,058,706 | $1,870,974 |

| CTN | Catalina Resources | 0.003 | -25% | 41,227 | $5,265,048 |

| AAU | Antilles Gold Ltd | 0.004 | -20% | 15,000,075 | $10,601,880 |

| CZN | Corazon Ltd | 0.002 | -20% | 2,184 | $2,961,431 |

| RLT | Renergen Limited | 0.615 | -18% | 46,884 | $22,744,482 |

| ODE | Odessa Minerals Ltd | 0.005 | -17% | 586,560 | $9,597,195 |

| VMT | Vmoto Limited | 0.078 | -15% | 631,038 | $35,777,858 |

| IXR | Ionic Rare Earths | 0.006 | -14% | 2,169,500 | $36,668,998 |

| MEL | Metgasco Ltd | 0.003 | -14% | 5,234,830 | $5,101,554 |

| PV1 | Provaris Energy Ltd | 0.012 | -14% | 100,173 | $9,703,871 |

| SPQ | Superior Resources | 0.006 | -14% | 2,028,999 | $15,189,047 |

| PFT | Pure Foods Tas Ltd | 0.025 | -14% | 11,000 | $3,927,343 |

| ENV | Enova Mining Limited | 0.007 | -13% | 7,544,843 | $9,845,149 |

| SHN | Sunshine Metals Ltd | 0.007 | -13% | 500,001 | $12,701,158 |

| SHP | South Harz Potash | 0.007 | -13% | 302,901 | $8,660,630 |

| VAR | Variscan Mines Ltd | 0.007 | -13% | 988,768 | $6,262,862 |

| RB6 | Rubixresources | 0.080 | -11% | 3,353 | $5,530,500 |

| SWP | Swoop Holdings Ltd | 0.120 | -11% | 97,800 | $28,742,845 |

| RMX | Red Mount Min Ltd | 0.008 | -11% | 1,893,799 | $4,184,620 |

| 1MC | Morella Corporation | 0.017 | -11% | 122,941 | $6,275,045 |

| AON | Apollo Minerals Ltd | 0.017 | -11% | 886,000 | $17,640,681 |

IN CASE YOU MISSED IT

Perpetual Resources (ASX:PEC) is expanding the exploration program at its Itinga tin project in Brazil after recent sampling confirmed high-grade tin mineralisation, with results exceeding 20% tin. The program will include geological mapping, trenching, and soil sampling to identify priority drill targets amid rising global tin prices.

US midwest natural hydrogen explorer Top End Energy (ASX:TEE) has kicked off an independent assessment of prospective resources at its Serpentine project in Kansas. The company has engaged Teof Rodrigues & Associates to lead the evaluation, which will help guide well site selection and communicate the project's resource potential to stakeholders.

Bubalus Resources (ASX:BUS) has appointed a drilling contractor for its upcoming maiden program at the Crosbie South gold project in Victoria, with drilling set to begin by late April. The 1000-metre campaign will target high-grade rock chip trends (up to 19.1 g/t) and geophysical anomalies, with results expected in the coming months.

At Stockhead, we tell it like it is. While Perpetual Resources, Top End Energy and Bubalus Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: Miners, energy stocks rally as China gears up to announce fresh stimulus today