Backing Winners: Akora Resources is building its DSO iron dream

Graeme Hunt and Paul Bibby are leveraging their wealth of expertise to help Akora Resources progress its DSO iron studies.

Backing Winners is Stockhead’s regular recap of executives with a solid track record looking to replicate the success of their previous roles.

Today we hear from Graeme Hunt, non-executive chairman, and Paul Bibby, managing director, at Akora Resources (ASX:AKO) who were executives for BHP and Rio Tinto respectively.

Can you tell us about your previous experience with BHP/Rio and some of the key learnings which you brought from there that relate to your work with Akora?

Hunt: My background was as a metallurgist. My father and my grandfather all worked in the steel industry and I studied metallurgy at University of Wollongong and lived near the Port Kembla steelworks. So there’s a long history in that sector.

I have 30 years of experience with BHP and I started in the sintering and ironmaking section of the steelworks where selection and use of iron ore was a big part of my role along with procurement logistics, handling and then use of iron ore in steelmaking was a very big part of my role.

In my time then I was involved in technical evaluation of some of the newer – at the time – iron ore products out of the Pilbara like the Yandi project, I did the technical evaluation of the sintering of that ore.

Many years later, I was actually responsible for the iron ore business and I was in charge of a significant amount of expansion in the Pilbara like Yandi and the introduction of Mining Area C that saw it grow from about 50Mt when I went there in 2000 to where it is today.

Afterwards, I gained experience in developing projects in other parts of the world as the managing director of Lihir Gold.

This included accountability for operations in Africa, exploration and project development in central western Africa, southern Africa and Mozambique, which is not very far away from Akora’a operations.

I think there's relevance to Akora in terms of not just understanding the technology of steel making, iron ore production, etc but really understanding what is necessary to develop a project in a developing country.

Besides understanding iron ore, I’ve also been involved in the energy sector as the chairman, CEO and also managing director for 12 years at AGL Energy.

So the energy transition and what that really means for steelmaking is something that I think I understand very well as well.

Bibby: I started as a cadet metallurgist with Rio Tinto and I spent the first eight or 10 years working across all of the CRA and Rio Tinto operations and commodities.

This gave me experience in aluminium, coal, business analysis, working in different countries and I finished up in iron ore in the Pilbara, which was my last stint with Rio.

As a metallurgist, I was very much involved with mineral processing activities, which was my last role in the Pilbara at Paraburdoo and Tom Price, right through to the production end of these commodities.

I've got experience in the mining activities right through to the port so we can bring this to play as we develop.

I also have had the chance to work in Kalimantan, Indonesia, with Kaltim Prima Coal, and that's where I first really started to appreciate the benefits that a mining project can bring to a developing country.

People in countries like Indonesia and certainly Madagascar, where our project is today, there are very skillful, hardworking people who want to improve the standard of living.

And it's through projects like our iron ore project in Madagascar that that can happen. That's a wonderful driving force and opportunity.

The other thing that I've been very fortunate with my Rio Tinto experience is that I've got to travel the world, not just to nice places like London and America, but right across developing parts of Asia and into China since the mid '80s.

I've spent 20-30 years travelling through these parts of the world, an experience which Graeme shares.

One takeaway from these rapidly growing areas is that while there’s huge demand for all commodities, iron ore is fundamental to the growth of industry and the growth and development of all of these other commodities.

So having an iron ore project is very exciting and we can bring all of these experiences to play in creation and development of our project in Madagascar.

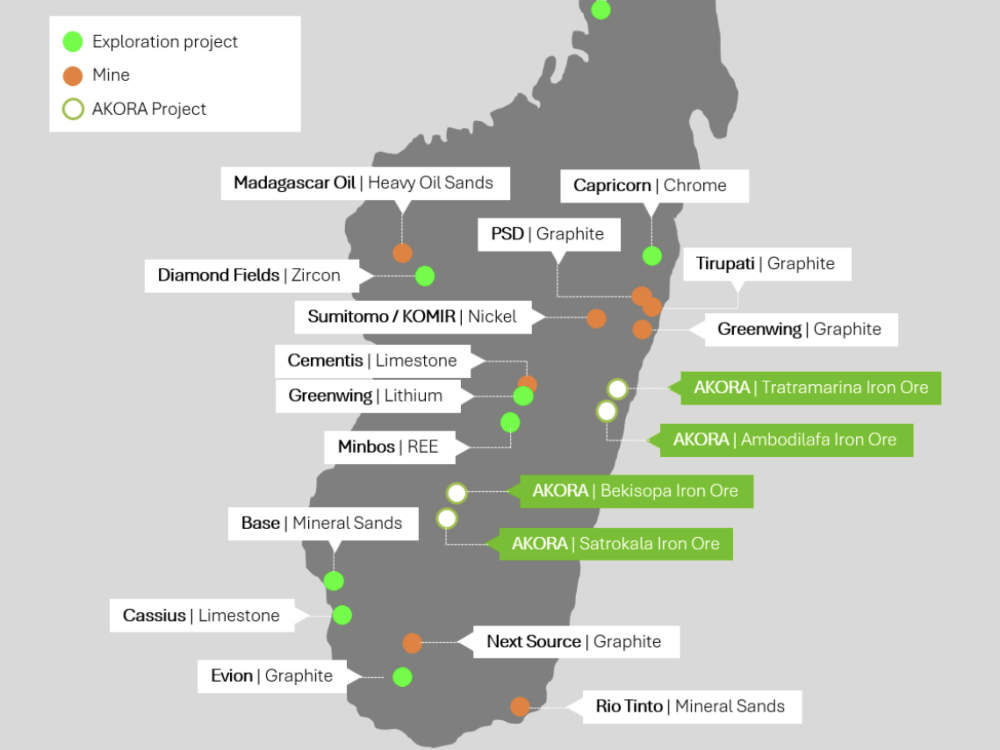

Akora is poised to release a Pre-Feasibility Study for its flagship Bekisopa project in Magadascar. Can you tell us a bit about the project and what we can expect to see?

Bibby: Akora was listed in December of 2020 and the first bit of exploration we did was a ground magnetics survey which identified a very strong magnetic anomaly of over 6km in length on our main tenement.

We then focused on drilling that and have been very successful with the five drilling programs that we've conducted since 2020.

The first two contributed to the definition of the maiden mineral resource estimate and identified two distinct ore bodies, the weathered zone at surface with good grades of direct shipping ore – lumps and fines – and the fresh rock beneath that which hosts the predominantly magnetite orebody.

That has very good grades averaging 32% iron but there's some significant areas where the grades are in the 40% range, which is quite unusual for a magnetite orebody.

This can be upgraded to produce the high-grade, very clean iron concentrate for direct reduction iron pellets, which is what's going to be needed for the green steel future.

The last three drilling campaigns have defined that DSO weathered zone in terms of the extent of the resource, and that contributed to the scoping study, which was delivered in November of 2023 and highlighted very good economics despite a short mine life.

We had a choice between doing what many others do, which is to drill and produce a very large resource, or get into the study phase to understand the project’s potential and be confident that the drilling will continue to prove out the resource.

The reason for doing that is, is that for bulk commodities like iron ore, it's not just about the resource, which is a good one at surface that you get in and start mining straight away.

We had to prove out the logistics, the road and the port and better understand the environmental and community aspect with the first benchmarking of all of those components in the scoping study.

Over the last 12 to 15 months, we have continued that work and refined it to what will be in the PFS that will be delivered at the end of end of March.

The resource has been increased a few weeks ago, showing that we have more indicated tonnes, which will add to the mine life.

We will see a mine life of 6.5 years, which is almost a 50% increase over what we had in the scoping study and the economics will be comparable to the scoping study but with better confidence that the project has a good future.

Additionally, the green steel future of Bekisopa is very significant, it is a very large resource with many decades of potential operation.

The beauty we have with the Bekisopa project is that unlike other magnetite projects which can produce high-grade iron concentrates, we have the ability to have a low capital startup project with the DSO.

It essentially removes the overburden – the DSO – as a product to generate cash flow and used that to fund the future project, which requires more processing equipment and therefore more dollars from cash flow rather than a small company looking to raise money, which is going to be very difficult.

We have the ability with the DSO to get in there, produce, generate cash and then transition to more grinding circuits and magnetic separation circuits to produce a very clean high-grade concentrate from cash flow.

The DSO doesn’t need drill and blast, which results in lower costs.

Once we get into the fresh rock, it is going to be a conventional drill and blast operation where the overburden has been generating cash for us.

What’s the next step for Akora?

Bibby: We need to get to a final investment decision for the DSO in the next year or so.

To do that we've got to do future work on the key elements of the PFS, the larger capital elements, the logistics part – the mining and the processing is conventional very straightforward and well understood and reliable.

We're going to do more studies on the road and the port to really lock those down and be confident of the way forward in terms of the capital and operating costs, but also undertake the ESIA aspects with the community so that they understand what benefits our work will bring as we create new roads and develop the port.

We've got a quite a bit of environmental work to do as we then step out to do full final study to get into FID.

Another key element of work is since September of last year at the Africa Down Under conference in Perth, the Madagascan mines minister and his team came to the conference and said in his presentation that Bekisopa was one of a couple of projects that were well progressed in their exploration and development stage.

That was a very important public statement from the government and I've had follow-up meetings with them.

We are on their priority list as to what the government needs to do to work with us, and similarly, what we need to do and contribute to the country as we develop the project.

We've got a good dialogue and understanding of both of these working together to get to a final decision for an operation.

It prioritises approvals, converting our tenements into exploitation permits, into mining permits. So that's all understood. And work is happening at the company level and the government level to deliver on those.

Hunt: It also defines royalty rates, community contribution regimes, etc. It takes away any uncertainty about what the economics of the contribution, the project and companies need to make to Madagascar as well.

Bibby: Six months ago, the new mining code, which has been put together in the last 18 months with contributions from the World Bank and the mining industry, set the royalty regime at 5%, which is a very good rate.

And as Greame mentioned, when the project is signed off by the government, that 5% gets locked into the first 25 years. So that's the financial stability aspect, which is important.

At Stockhead we tell it like it is. While Akora Resources is a Stockhead advertiser, it did not sponsor this article.

Originally published as Backing Winners: Akora Resources is building its DSO iron dream