Lunch Wrap: ASX volatile as Nasdaq smashed; MinRes tumbles 7pc after haul road mishap

The ASX has taken a hit as Wall Street’s nerves spread. Meanwhile the Fed is likely to keep things steady, and MinRes and Wisetech face a rough day.

ASX slips as Wall Street’s panic hits hard

Fed Reserve could stay tight as US stocks cool off

MinRes and Wisetech face a tough day

The ASX was trading amid volatility this morning, swinging between modest gains and losses as Wall Street’s nerves set off a wave of panic.

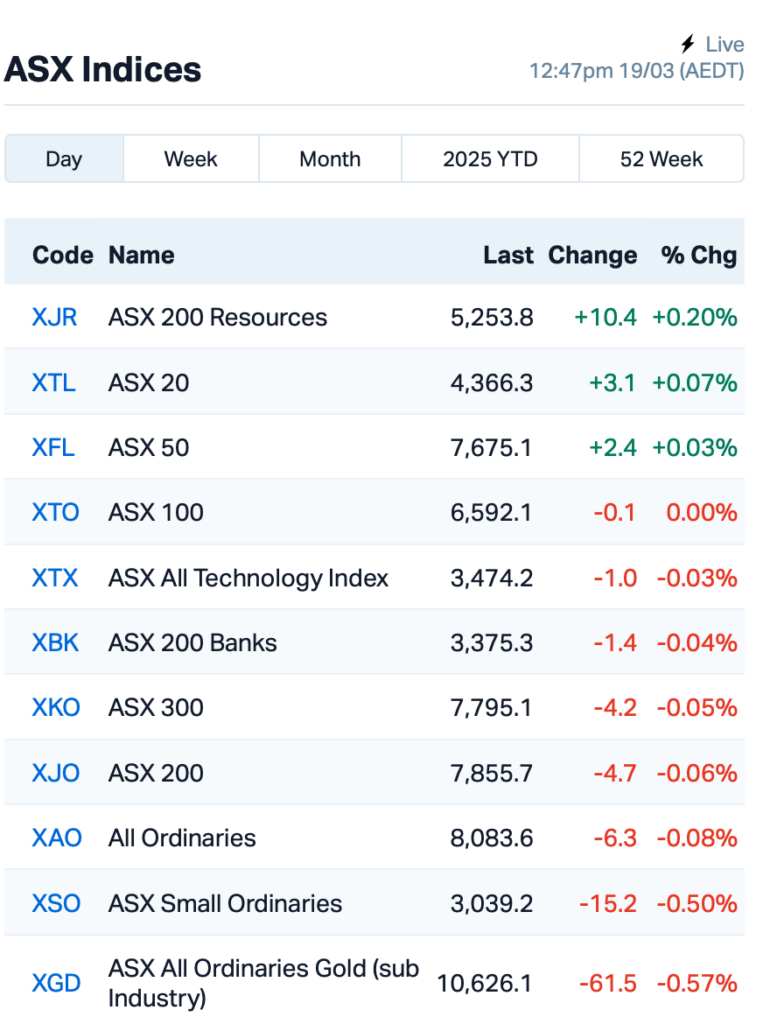

At about 1pm AEDT, the benchmark S&P/ASX 200 index was down by 0.05% after a sharp early slide.

It all started on Wall Street overnight, where tech stocks were smashed. Tesla took a 5% hit as the market’s fear gauge, the VIX, spiked 6%, and the Nasdaq slid 1.7%.

Oil also dropped as worries about a global crude surplus outweighed the growing tensions in the Middle East.

Gold, the ultimate safe haven, hit a new high as investors scrambled for safer ground. It’s trading at US$3031.80 at this time of writing.

Just month ago, US stocks were hitting new highs, with everyone expecting Trump’s policies to boost growth. But now, that optimism is fading fast as the economy cools and big AI bets sour.

“The markets are going to remain choppy up until whatever decision is made on April 2,” said Rhys Williams at Wayve Capital, referring to President Trump’s impending tariff exemption deadline.

Meanwhile, the Federal Open Market Committee (FOMC) meeting kicked off last night, and all eyes are now on what happens when it wraps up with a policy decision later today (US time).

The big question is whether the Fed will cut rates, but it’s highly likely it won't at this stage, sticking with the “wait-and-see” approach for now.

“Sticky inflation and higher inflation expectations raise the bar for Fed cuts,” said Lauren Goodwin at New York Life.

Back home, Aussie tech stocks on the ASX have mirrored the US sell-off.

Data centre giant NextDC (ASX:NXT) dipped by 1.5%, but the headline was focused on WiseTech Global (ASX:WTC), which once again is grappling with some unwanted attention over the personal relationships of its founder, Richard White.

Wisetech's board has just released an independent review, and has found that White didn’t fully disclose these relationships, which raised governance concerns.

The board said it will now be doing a full review of the company’s policies, including its code of conduct, and will appoint an additional independent director soon to meet ASX rules. Shares were flat.

Still in the large-caps space, Mineral Resources (ASX:MIN) plunged 7% after a series of crashes on its crucial haul road.

MinRes said it has paused haulage on the Onslow Iron haul road after WorkSafe WA issued a notice on March 18, regarding safety controls for its road train operations.

This follows the latest incident on March 17, where the rear two trailers of a road train tipped over, although the operator was unharmed.

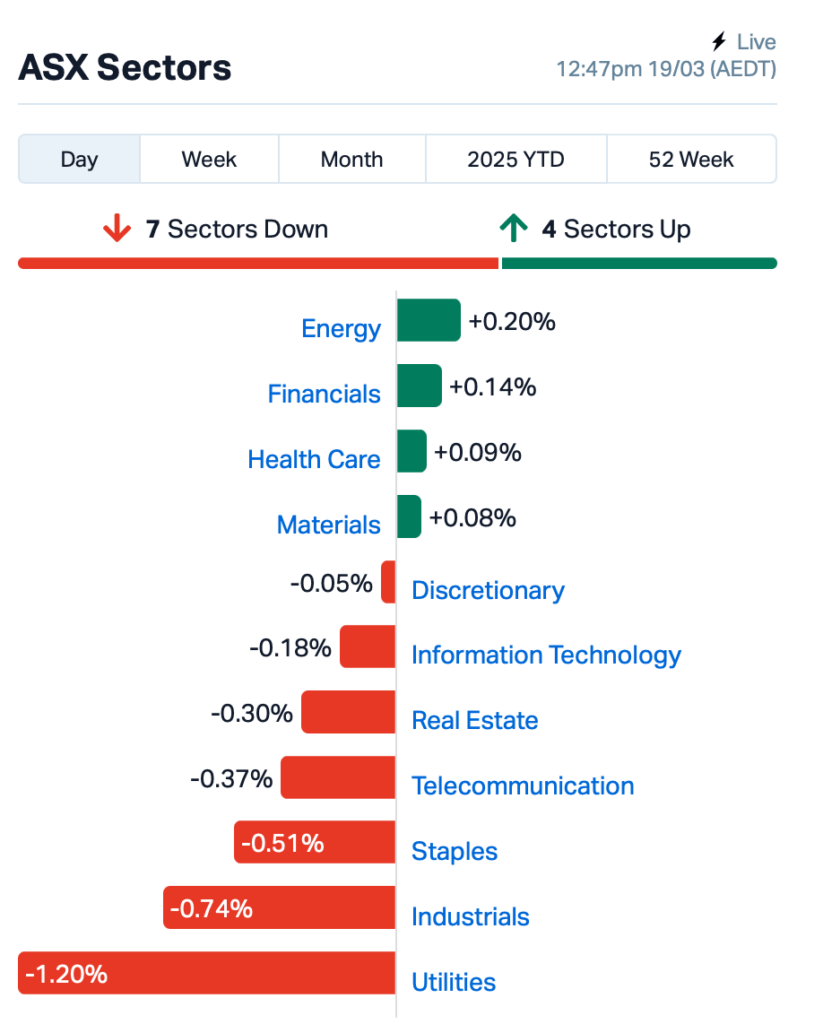

And so, this is where we stood at about lunch time, AEDT:

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for March 19 :

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| NXM | Nexus Minerals Ltd | 0.090 | 50% | 7,392,182 | $29,281,510 |

| AXP | AXP Energy Ltd | 0.002 | 33% | 50,000 | $9,862,021 |

| GGE | Grand Gulf Energy | 0.002 | 33% | 950,000 | $3,675,581 |

| AZI | Altamin Limited | 0.030 | 30% | 278,556 | $13,213,567 |

| AII | Almonty Industries | 2.200 | 29% | 693,550 | $41,605,574 |

| 1AD | Adalta Limited | 0.010 | 25% | 3,524,467 | $5,145,782 |

| ICE | Icetana Limited | 0.022 | 22% | 2,003,694 | $7,886,568 |

| NIM | Nimy Resources | 0.068 | 21% | 1,085,180 | $11,655,160 |

| EGR | Ecograf Limited | 0.230 | 21% | 1,045,062 | $86,285,046 |

| TOU | Tlou Energy Ltd | 0.018 | 20% | 499,096 | $19,478,765 |

| HE8 | Helios Energy Ltd | 0.012 | 20% | 576,111 | $26,040,494 |

| LCY | Legacy Iron Ore | 0.012 | 20% | 50,004 | $97,620,426 |

| TFL | Tasfoods Ltd | 0.006 | 20% | 4,099,294 | $2,185,478 |

| BVR | Bellavistaresources | 0.395 | 20% | 312,042 | $33,291,243 |

| NVQ | Noviqtech Limited | 0.055 | 20% | 528,446 | $11,570,681 |

| CLV | Clover Corporation | 0.420 | 18% | 1,014,185 | $59,284,766 |

| TKM | Trek Metals Ltd | 0.039 | 18% | 2,245,946 | $17,216,854 |

| IFG | Infocusgroup Hldltd | 0.013 | 18% | 1,549,100 | $2,648,691 |

| LYK | Lykosmetalslimited | 0.013 | 18% | 382,813 | $2,071,911 |

| GES | Genesis Resources | 0.007 | 17% | 874,721 | $4,697,048 |

| IPT | Impact Minerals | 0.007 | 17% | 82,402 | $18,583,247 |

| M2R | Miramar | 0.004 | 17% | 200,000 | $1,369,040 |

| MTM | MTM Critical Metals | 0.145 | 16% | 4,389,273 | $57,291,614 |

Tungsten producer Almonty Industries (ASX:AII) has teamed up with American Defense International (ADI) in a strategic partnership to boost its position as a key supplier of tungsten to the US defense and tech industries. ADI, with its strong track record in government relations, will help Almonty strengthen ties with US policymakers and expand in the American market. This partnership aligns with Almonty's goal of becoming a supplier for the US defence sector.

iCetana (ASX:ICE) has secured a $1.7 million deal for its AI software, marking a big win with Iraq’s Baghdad Safe City project. The order, coming after successful testing in Iraq, includes features like facial recognition, fire detection, and licence plate recognition for Arabic plates. The contract is for a perpetual licence plus the first year’s maintenance, with the deployment expected in Q4 FY25. This is Icetana's largest order to date and opens doors for future growth in Iraq.

Nimy Resources (ASX:NIM) has locked in Raglan Drilling for its upcoming Phase 2 drilling program at the Block 3 gallium discovery in WA. The goal is to expand the mineralisation and establish a maiden JORC resource, which will help Nimy tap into growing demand for gallium, a critical metal now under Chinese export controls. The drilling will be funded by Nimy’s recent share placement and will support its partnership with US minerals specialist M2i Global, aiming to secure gallium supply for the US and its allies.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for March 19 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ADD | Adavale Resource Ltd | 0.002 | -33% | 120,000 | $6,861,838 |

| ERA | Energy Resources | 0.002 | -33% | 569,358 | $1,216,188,722 |

| VML | Vital Metals Limited | 0.002 | -33% | 462,745 | $17,685,201 |

| VPR | Voltgroupltd | 0.001 | -33% | 440,000 | $16,074,312 |

| AUA | Audeara | 0.027 | -31% | 22,437 | $7,017,441 |

| PRM | Prominence Energy | 0.003 | -25% | 50,000 | $1,556,706 |

| CUL | Cullen Resources | 0.005 | -25% | 7,579,956 | $4,160,411 |

| AZL | Arizona Lithium Ltd | 0.007 | -22% | 23,370,185 | $41,056,331 |

| VKA | Viking Mines Ltd | 0.007 | -22% | 615,555 | $11,953,326 |

| HCT | Holista CollTech Ltd | 0.024 | -20% | 468,524 | $8,573,001 |

| SP3 | Specturltd | 0.012 | -20% | 1,169,981 | $4,622,252 |

| TSL | Titanium Sands Ltd | 0.004 | -20% | 546,300 | $11,683,736 |

| CXU | Cauldron Energy Ltd | 0.009 | -18% | 50,000 | $16,075,451 |

| RML | Resolution Minerals | 0.009 | -18% | 2,341,348 | $3,280,905 |

| RBX | Resource B | 0.030 | -17% | 25,000 | $4,146,641 |

| ALR | Altairminerals | 0.003 | -17% | 1,139,097 | $12,890,233 |

| CHM | Chimeric Therapeutic | 0.005 | -17% | 315,306 | $9,720,899 |

| EM2 | Eagle Mountain | 0.005 | -17% | 2,001,062 | $6,810,224 |

| HLX | Helix Resources | 0.003 | -17% | 950,947 | $10,092,581 |

| IAM | Income Asset | 0.021 | -16% | 22,499,190 | $23,271,771 |

| AQX | Alice Queen Ltd | 0.006 | -14% | 137 | $8,028,230 |

| AVE | Avecho Biotech Ltd | 0.006 | -14% | 1,113,376 | $22,185,079 |

| MGU | Magnum Mining & Exp | 0.006 | -14% | 154,000 | $5,665,530 |

| TMK | TMK Energy Limited | 0.003 | -14% | 32,328,908 | $32,772,828 |

IN CASE YOU MISSED IT

Vertex Minerals (ASX:VTX) has purchased an Aramine L350D Loader to be added to its underground fleet at the Reward gold mine. The loader, designed for small-scale gold mining, has a 4-tonne carrying and loading capacity and will be fitted with remote operation capabilities to support long hole stoping in unsupported ground.

Island Pharmaceuticals (ASX:ILA) is raising $2.72 million through the exercise of 45.35 million listed ILAO options, which expired on 14 March 2025. Funds will support ongoing clinical trials for ISLA-101, its lead antiviral asset for the prevention and treatment of dengue fever.

Hot Chili (ASX:HCH) has expanded drilling at the La Verde copper-gold porphyry discovery, now covering a 1000m by 550m area with 27 RC drill holes completed to date for 8162m. Assay results for 15 holes are pending, and mineralisation remains open in all directions, with deeper diamond drilling being planned.

At Stockhead, we tell it like it is. While Vertex Minerals, Island Pharmaceuticals and Hot Chilli are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX volatile as Nasdaq smashed; MinRes tumbles 7pc after haul road mishap