Closing Bell: ASX ends three-day win streak as investors await the Fed’s next move

ASX gets smacked by Wall Street sell-off, MinRes tumbles after haul road drama, and all eyes are now on the Fed’s next move.

ASX hit by wall street sell-off and tech tumble

MinRes crashes after haul road drama, gold traders take profit

Fed’s stagflation headache could rock global markets

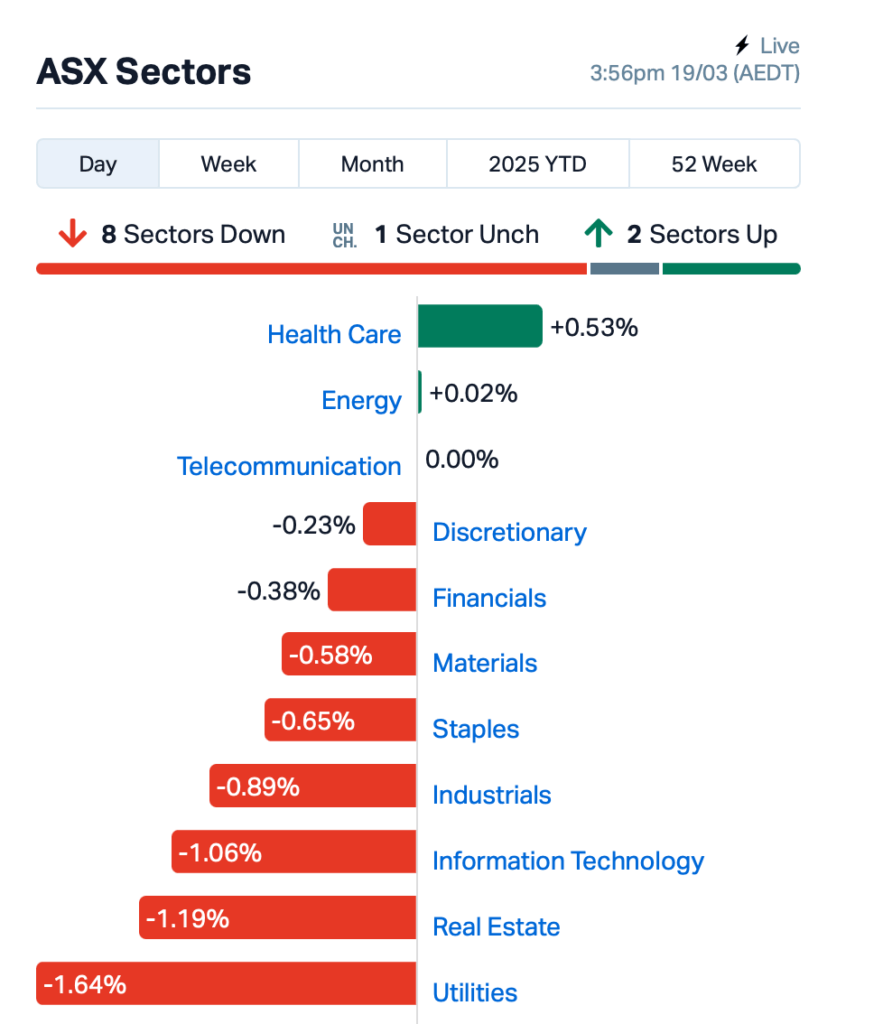

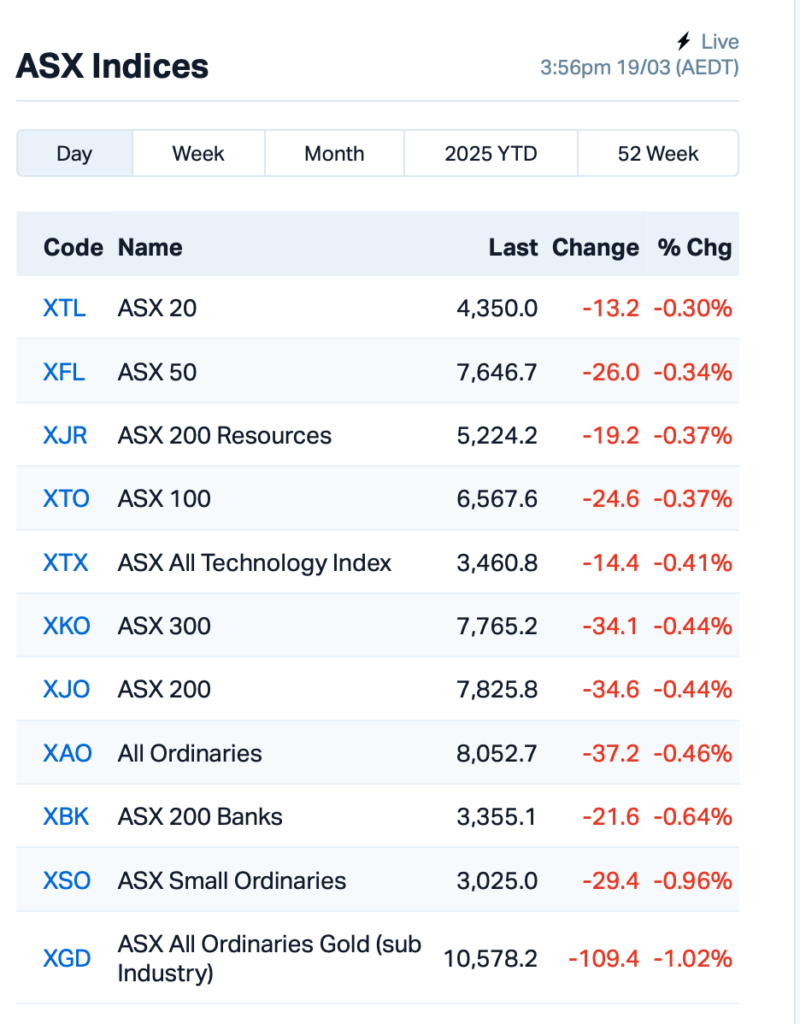

The ASX took a hit on Wednesday, down by 0.41% and snapping a three-day winning streak as risk-off sentiment returned, spooked by a sell-off on Wall Street.

The local market felt the heat from the tech sector in the US, with a particularly rough night for stocks like Tesla, which tumbled 5%.

As fear gripped investors, the VIX index – often seen as the market’s fear gauge – spiked 6%, and gold surged to nearly $US3039 an ounce, its highest point yet.

Traders are now eagerly awaiting the Federal Reserve’s policy decision later today (US time), hoping for any clues on how the US tariffs are affecting the broader economy.

At least on the ASX today, things weren’t as bad as it was for Wall Street.

There were some positive movements, especially in financial stocks, with QBE Insurance (ASX:QBE) up 4%.

In the mining sector, however, record highs for gold triggered some profit taking.

And Mineral Resources (ASX:MIN) was one of the biggest losers in the large end of town, sliding 5% after it halted operations on its crucial Onslow iron haul road following a sixth road train crash.

Meanwhile Data centre play Dicker Data (ASX:DDR) lost 1.65% after CEO David Dicker sold a chunk of his stake to fund a divorce settlement.

And A2 Milk (ASX:A2M) found itself in the spotlight after Barrenjoey downgraded its rating to neutral. Shares were down 1%.

And... while Australian investors are bracing for more market turbulence, the real drama could be unfolding at the Federal Reserve, where the risks of “stagflation” – that nasty combo of high inflation and stagnant economic growth – are looming large.

As the Fed delivers its decision today, the central bank’s next move could determine the direction for the US economy and, by extension, global markets.

“You have inflation stickiness on the one hand," said former president of the Fed’s Kansas City, Esther George.

"At the same time, you’re trying to look at what impact could this have on the job market, if growth begins to pull back.

“So it is a tough scenario for them for sure.”

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Code Description Last % Volume MktCap GGE Grand Gulf Energy 0.002 33% 950,000 $3,675,581 NTM Nt Minerals Limited 0.002 33% 582,967 $1,816,354 AII Almonty Industries 2.250 32% 741,581 $41,605,574 ENT Enterprise Metals 0.003 25% 450,000 $2,356,635 MTM MTM Critical Metals 0.153 22% 6,721,225 $57,291,614 AZI Altamin Limited 0.028 22% 360,365 $13,213,567 NXM Nexus Minerals Ltd 0.073 22% 9,808,766 $29,281,510 TOU Tlou Energy Ltd 0.018 20% 602,624 $19,478,765 AMS Atomos 0.006 20% 55,406 $6,075,092 IPB IPB Petroleum Ltd 0.006 20% 588,658 $3,532,015 SMX Strata Minerals 0.057 19% 2,375,389 $11,208,909 CLV Clover Corporation 0.420 18% 1,251,900 $59,284,766 IFG Infocusgroup Hldltd 0.013 18% 1,549,100 $2,648,691 M2R Miramar 0.004 17% 200,000 $1,369,040 CND Condor Energy Ltd 0.022 16% 584,396 $13,332,648 EGR Ecograf Limited 0.220 16% 1,637,938 $86,285,046 TMS Tennant Minerals Ltd 0.015 15% 105,769 $12,426,575 TKM Trek Metals Ltd 0.038 15% 2,554,087 $17,216,854 ARV Artemis Resources 0.008 14% 9,315,076 $17,699,705 CAV Carnavale Resources 0.004 14% 626,250 $14,315,764 LU7 Lithium Universe Ltd 0.008 14% 963,827 $5,501,857 MRQ Mrg Metals Limited 0.004 14% 7,615,750 $9,542,815 G50 G50Corp Ltd 0.160 14% 207,903 $22,483,672

Tungsten producer Almonty Industries (ASX:AII) has teamed up with American Defense International (ADI) in a strategic partnership to boost its position as a key supplier of tungsten to the US defence and tech industries. ADI, with its strong track record in government relations, will help Almonty strengthen ties with US policymakers and expand in the American market. This partnership aligns with Almonty’s goal of becoming a supplier for the US defence sector.

Clover Corp (ASX:CLV), the natural oils company, has turned things around in the first half of FY25. Revenue shot up 38% to $37.6 million. Clover saw a profit of $2.4 million, compared to a loss the previous year. Clover’s gross margins improved thanks to better product mix and manufacturing efficiency. With cash reserves of $15.4 million, Clover has also kicked off crude oil deliveries from Ecuador and is set for more growth.

Artemis Resources (ASX:ARV) has wrapped up Phase 1 drilling at the Carlow tenement, drilling 1,790m across three top gold targets. The Titan prospect showed signs of gold, with high arsenic levels, which could mean gold's hiding nearby. Drilling also hit promising zones of sulphides at Marillion and Carlow extensions. The samples are off for testing, and Artemis said it’s keen to see if these early signs lead to more gold discoveries.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ADD | Adavale Resource Ltd | 0.002 | -33% | 120,000 | $6,861,838 |

| AXP | AXP Energy Ltd | 0.001 | -33% | 662,240 | $9,862,021 |

| ERA | Energy Resources | 0.002 | -33% | 1,525,753 | $1,216,188,722 |

| VML | Vital Metals Limited | 0.002 | -33% | 486,931 | $17,685,201 |

| VPR | Voltgroupltd | 0.001 | -33% | 440,000 | $16,074,312 |

| AUA | Audeara | 0.027 | -31% | 147,790 | $7,017,441 |

| KCC | Kincora Copper | 0.022 | -29% | 610,998 | $7,471,487 |

| HT8 | Harris Technology Gl | 0.011 | -27% | 225,806 | $4,934,477 |

| PRM | Prominence Energy | 0.003 | -25% | 58,655 | $1,556,706 |

| AZL | Arizona Lithium Ltd | 0.007 | -22% | 25,630,678 | $41,056,331 |

| HCT | Holista CollTech Ltd | 0.024 | -20% | 469,151 | $8,573,001 |

| SP3 | Specturltd | 0.012 | -20% | 1,169,981 | $4,622,252 |

| DTR | Dateline Resources | 0.004 | -20% | 700,393 | $12,827,843 |

| TAS | Tasman Resources Ltd | 0.004 | -20% | 14,748 | $4,026,248 |

| TSL | Titanium Sands Ltd | 0.004 | -20% | 1,232,038 | $11,683,736 |

| ZNC | Zenith Minerals Ltd | 0.045 | -17% | 858,681 | $22,001,837 |

| ALR | Altairminerals | 0.003 | -17% | 1,139,097 | $12,890,233 |

| AYT | Austin Metals Ltd | 0.005 | -17% | 2,805,463 | $7,945,148 |

| CHM | Chimeric Therapeutic | 0.005 | -17% | 1,774,818 | $9,720,899 |

| CUL | Cullen Resources | 0.005 | -17% | 7,780,956 | $4,160,411 |

| EM2 | Eagle Mountain | 0.005 | -17% | 2,360,824 | $6,810,224 |

| HLX | Helix Resources | 0.003 | -17% | 950,947 | $10,092,581 |

| KGD | Kula Gold Limited | 0.005 | -17% | 507,892 | $5,527,522 |

| ROG | Red Sky Energy. | 0.005 | -17% | 270,129 | $32,533,363 |

IN CASE YOU MISSED IT

Legacy Minerals (ASX:LGM) has launched into drilling two major gold-copper targets at its Thomson project in NSW, which share geological similarities with significant discoveries in WA’s Paterson Province. The company is also awaiting assays from over 1000m of previously unsampled core, expected by late March to early April.

MST Access believes accelerating orders for Pure Hydrogen’s (ASX:PH2) heavy hydrogen fuel cell vehicles validate its strategy of providing zero-emission transport solutions with supporting infrastructure. MST values PH2 at 31 cents per share, citing strong order growth, with 28 vehicle sales expected in FY2026 and increasing revenue potential.

Trigg Minerals (ASX:TMG) has signed a binding agreement to acquire antimony-gold projects in NSW, expanding its footprint with assets that host historical high-grade production. The company aims to apply modern exploration techniques to unlock new opportunities, complementing its flagship Wild Cattle Creek deposit.

European Lithium (ASX:EUR) has unveiled historical high-grade rare earth drill results at its Tanbreez project in Greenland, highlighting significant potential for deeper mineralisation. The company is awaiting assay results from its 2024 drilling program and plans further exploration to expand the resource.

At Stockhead, we tell it like it is. While Legacy Minerals, Pure Hydrogen, Trigg Minerals, European Lithium, Vertex Minerals, Island Pharmaceuticals and Hot Chilli are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX ends three-day win streak as investors await the Fed’s next move