Closing Bell: ASX climbs closer to Christmas with festive Monday gains

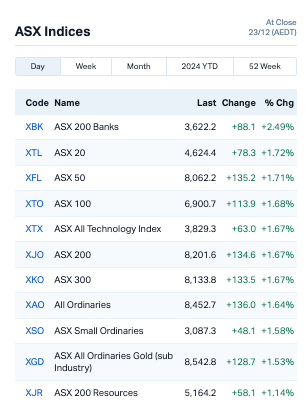

Investors have seemingly been taking advantage of pre-Christmas sales, with the ASX 200 closing to the upside by a very festive 1.67%.

The ASX has renewed its Santa rally closing with strong gains

Financials/banks raked it in, on the whole, with all sectors in the green

News Corp's blockbuster Foxtel deal with DAZN turned heads; Bitcoin… meh

Investors have seemingly been taking advantage of pre-Christmas sales, with the ASX 200 closing to the upside by a very festive 1.67% on Monday.

Just in the nick of time, too, as Aussie shares copped a hiding last week after US Fed boss Jerome Powell decided to speak through the hawkish side of his mouth.

We really shouldn't jinx it – there's a half-market day on Christmas eve before we resume again on December 27. At least JPow and mates have shut up shop for the hols, with the next Federal Open Market Committee meeting not till January 28-29, just over a week after Trump's inauguration.

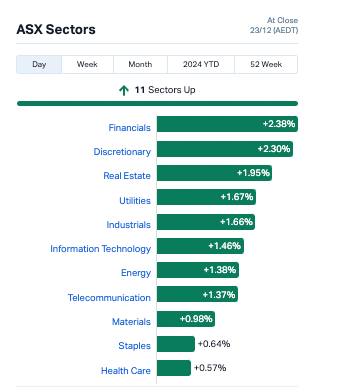

So which local sectors were in form today, then? The short answer – all of them, with all 11 finishing in the green, led by financials, discretionary, real estate and utilities.

Banks were crushing it, with CBA up more than 2.5% and ANZ having climbed 2.2% by about 3.30pm AEDT.

Miners mostly had a decent day, with the exception of Rio Tinto, which trailed by 0.14%.

Probably the biggest News story of the day, though, involved News itself. This publication's parent organisation News Corp, that is – which has agreed to sell local pay TV group Foxtel to the global sports streaming giant DAZN for $3.4 billion. The News Corp (ASX:NWS) share price rallied by 3.3% as a result of the blockbuster deal.

Per The Australian:

Foxtel’s junior partner Telstra, also involved from the start, has offloaded its 35 per cent stake as part of the sale. However, News Corp and Telstra will emerge with a combined 9 per cent stake in DAZN as part of the acquisition.

All the Fox Sports operations will move across to DAZN as part of the deal, although Sky News Australia will continue to be owned by News Corp and will be broadcast by Foxtel.

Under the deal, Foxtel will repay the $578m loan to News Corp in full as well as a smaller loan to Telstra. News Corp will emerge with a 6 per cent stake in DAZN and a board seat. Telstra will take approximately 3 per cent. Foxtel chief executive Patrick Delany will continue to run Foxtel under the ownership of DAZN.

Re the ASX 200's sectors, this is where things stood at the close of play:

Earlier, as reported by Eddy at lunch, over on Wall Street all major indexes rose about 1% on Friday, but it wasn’t enough to make up for the losses earlier in the week.

The big news there was Novo Nordisk's stock diving 20% after a disappointing trial for its obesity drug.

Study showed Novo’s CagriSema helped patients lose 20.4% of their weight over 68 weeks, falling short of the 25% target it had promised.

Meanwhile in the volatile world of crypto, Bitcoin has been taking a fairly a-typical breather after reaching its all-time high just above US$108,000 almost exactly a week ago. It was looking decidedly droopy at the beginning of the day, but since lunch has found about US1,000 down the back of the sofa and is currently trading hands near US$96k again.

Hang on… one portfolio refresh and it just lost US$500… never mind.

The Fed chair's comments regarding the central bank having no interest in (or official capacity to create) a Bitcoin federal strategic reserve haven't helped matters in the land of magical internet money. However, that does not mean that idea – proposed by Trump and other Republicans pre-election – is necessarily dead in the water or couldn't be facilitated independently of the US Federal Reserve by the Trump administration.

Watch this space, especially post January 20…

This is how things looked on the ASX at about 4pm AEDT:

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AMD | Arrow Minerals | 0.002 | 100% | 4,516,772 | $13,223,628 |

| QEM | QEM Limited | 0.055 | 62% | 2,797,761 | $6,488,345 |

| LM1 | Leeuwin Metals Ltd | 0.145 | 45% | 985,328 | $4,685,167 |

| CYQ | Cycliq Group Ltd | 0.004 | 33% | 123,241 | $1,381,550 |

| TX3 | Trinex Minerals Ltd | 0.002 | 33% | 17,500 | $2,742,978 |

| VEN | Vintage Energy | 0.004 | 33% | 11,017,724 | $5,008,594 |

| VFX | Visionflex Group Ltd | 0.004 | 33% | 500,000 | $10,065,974 |

| VPR | Voltgroupltd | 0.002 | 33% | 28,694,073 | $16,074,312 |

| MTM | MTM Critical Metals | 0.1875 | 29% | 17,930,031 | $58,958,273 |

| SRI | Sipa Resources Ltd | 0.018 | 29% | 428,499 | $3,194,214 |

| CZN | Corazon Ltd | 0.0025 | 25% | 389,162 | $2,335,811 |

| ECT | Env Clean Tech Ltd. | 0.0025 | 25% | 354,523 | $6,343,621 |

| MMR | Mec Resources | 0.005 | 25% | 4,587,886 | $7,327,228 |

| TMK | TMK Energy Limited | 0.0025 | 25% | 863,000 | $18,651,130 |

| NFM | New Frontier | 0.016 | 23% | 3,454,279 | $18,898,560 |

| PNT | Panthermetalsltd | 0.011 | 22% | 1,577,202 | $2,118,138 |

| EOF | Ecofibre Limited | 0.034 | 21% | 56,390 | $10,608,469 |

| PAM | Pan Asia Metals | 0.051 | 21% | 169,459 | $8,497,607 |

| COD | Coda Minerals Ltd | 0.084 | 20% | 2,768,683 | $17,421,829 |

| ASP | Aspermont Limited | 0.006 | 20% | 433,332 | $12,350,058 |

| DRE | Dreadnought Resources Ltd | 0.012 | 20% | 2,462,802 | $37,678,000 |

| GCM | Green Critical Min | 0.006 | 20% | 1,793,831 | $9,537,766 |

| MEM | Memphasys Ltd | 0.006 | 20% | 2,926,821 | $8,815,407 |

| TIG | Tigers Realm Coal | 0.003 | 20% | 1,289,908 | $32,666,756 |

| PTX | Prescient Ltd | 0.049 | 20% | 12,052,770 | $33,018,112 |

Arrow Minerals (ASX:AMD) said its Niagara’s bauxite discovery in Guinea just got bigger, now covering 12km². The latest drilling results have confirmed high-grade mineralisation, with grades up to 50% Al2O3. The company said the project is gaining interest from global bauxite giants, and with the world’s highest bauxite prices at US$120/t, the potential could be huge. Arrow’ is also progressing towards a maiden JORC resource estimate and scoping study in mid-2025.

QEM’s (ASX:QEM) Julia Creek Vanadium and Energy Project (JCVEP) has been declared a ‘Coordinated Project’ by Queensland’s Office of the Coordinator General. This milestone streamlines regulatory approvals and sets the stage for an Environmental Impact Statement (EIS) under Queensland’s State Development Act.

Prescient Therapeutics (ASX:PTX) has secured US FDA approval for the phase II trial of PTX-100, its first-in-class Ras pathway inhibitor, targeting relapsed and refractory cutaneous T-cell lymphomas (r/r CTCL). This follows promising phase 1b results, where PTX-100 showed a 42% overall response rate and significantly outperformed standard treatment with a median progression-free survival of 12.2 months.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| C29 | C29Metalslimited | 0.05 | -46% | 1,783,301 | $16,199,506 |

| GCR | Golden Cross | 0.002 | -33% | 3,530,151 | $3,291,768 |

| 88E | 88 Energy Ltd | 0.0015 | -25% | 4,779,737 | $57,867,624 |

| EDE | Eden Inv Ltd | 0.0015 | -25% | 2,521,745 | $8,219,752 |

| FAU | First Au Ltd | 0.0015 | -25% | 500,000 | $4,143,987 |

| MSG | Mcs Services Limited | 0.003 | -25% | 900,107 | $792,399 |

| 8VI | 8Vi Holdings Limited | 0.03 | -25% | 20,003 | $1,676,457 |

| EML | EML Payments Ltd | 0.705 | -22% | 19,655,794 | $342,124,515 |

| MXO | Motio Ltd | 0.028 | -20% | 839,273 | $9,747,619 |

| AOK | Australian Oil. | 0.002 | -20% | 1,520,000 | $2,504,457 |

| CDT | Castle Minerals | 0.002 | -20% | 129,167 | $4,182,035 |

| ZMI | Zinc of Ireland NL | 0.009 | -18% | 64,166 | $6,237,118 |

| CNJ | Conico Ltd | 0.01 | -17% | 1,679,730 | $2,849,848 |

| ENV | Enova Mining Limited | 0.005 | -17% | 6,991,003 | $5,909,576 |

| GES | Genesis Resources | 0.005 | -17% | 63,750 | $4,697,048 |

| HYD | Hydrix Limited | 0.01 | -17% | 3,334 | $3,273,226 |

| IXU | Ixup Limited | 0.01 | -17% | 263,080 | $24,191,831 |

| RMI | Resource Mining Corp | 0.005 | -17% | 404,669 | $3,914,087 |

| IRI | Integrated Research | 0.4575 | -16% | 1,665,676 | $96,657,226 |

| IRX | Inhalerx Limited | 0.032 | -16% | 203,399 | $8,111,033 |

| NWM | Norwest Minerals | 0.017 | -15% | 2,838,556 | $9,702,390 |

| ABE | Ausbondexchange | 0.03 | -14% | 56,350 | $3,943,384 |

| AJL | AJ Lucas Group | 0.006 | -14% | 1,072,268 | $9,630,107 |

| KGD | Kula Gold Limited | 0.006 | -14% | 4,872,416 | $4,502,483 |

| ODE | Odessa Minerals Ltd | 0.006 | -14% | 374,293 | $11,196,728 |

IN CASE YOU MISSED IT

EBR Systems (ASX:EBR) is confident in the approval timeline for its WiSE-CRT System following the completion of its Day-100 PMA meeting with the US FDA. The company is aiming to commercially launch the system in 2025.

Green Technology Metals (ASX:GT1) has secured a letter of interest from Export Development Canada for up to C$100 million in financing for its Seymour lithium project, which is set to become Ontario’s first lithium producer. The company will look to finalise financing arrangements in 2025, alongside permitting and a definitive feasibility study.

QEM Limited (ASX:QEM) has realised a significant permitting milestone for its Julia Creek vanadium and energy project, which has been declared a Coordinated Project by Queensland’s Office of the Coordinator General. It highlights the strategic value and potential benefits of the project, which the company believes addresses urgent needs: long-duration energy storage and domestic fuel security.

MTM Critical Metals (ASX:MTM) has raised $7.5 million at 14.5c per share from institutional investors to accelerate the commercialisation of its FJH technology and advance its Texas-based processing plant. The raise saw two leading Australian funds increase their stakes, Pengana Capital and Terra Capital, solidifying the company’s position as a leader in critical metals processing.

At Stockhead, we tell it like it is. While EBR Systems, Green Technology Metals, QEM Limited, MTM Critical Metals, Singular Health Group, Challenger Gold, Spartan Resources, Trigg Minerals, Eagle Mountain Mining and Legacy Minerals Holdings are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: ASX climbs closer to Christmas with festive Monday gains