ASX Lunch Wrap: ASX rebounds as mystery Macau investor emerges as Star’s white knight

The ASX has bounced back a bit with energy and mining stocks rallying, while a mystery Macau investor scoops up Star Entertainment.

ASX rebounds, led by energy and mining stocks

Mystery Macau investor scoops Star Entertainment

Westpac consumer sentiment drops after holiday splash

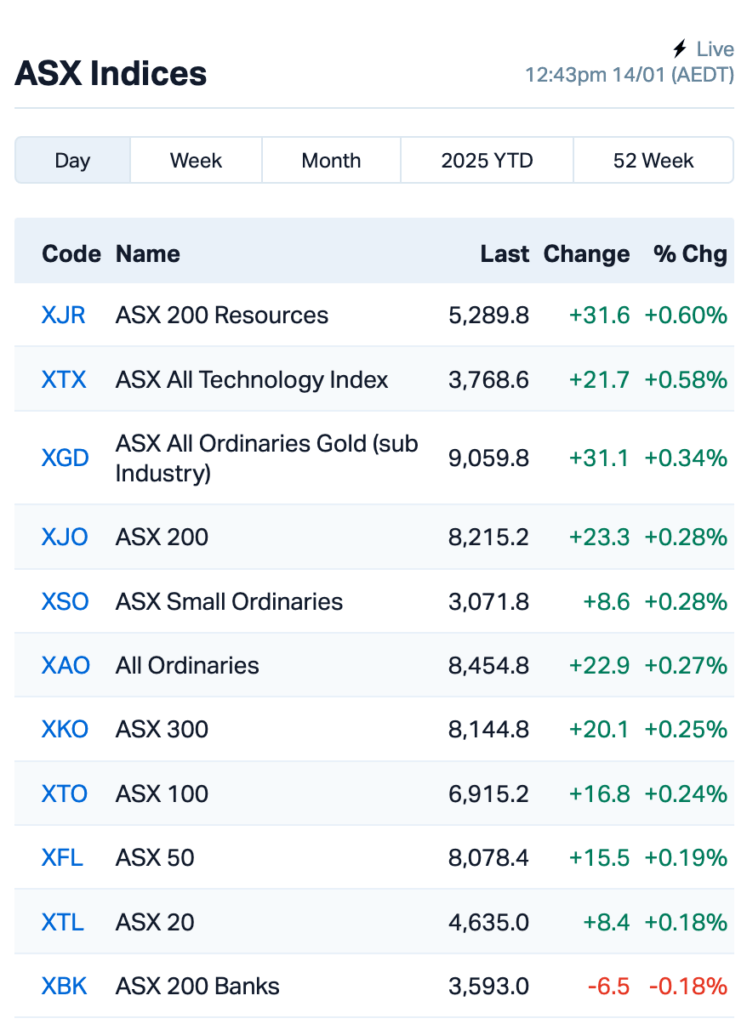

The ASX seems to have regained its swagger this morning, with the S&P/ASX 200 Index kicking off the session with a 0.7% bump.

This came as bargain hunters jumped back in the game on Wall Street overnight, swooping in after the market hit a two-week low.

Around 380 stocks in the US S&P 500 index climbed, with oil stocks and banks leading the charge.

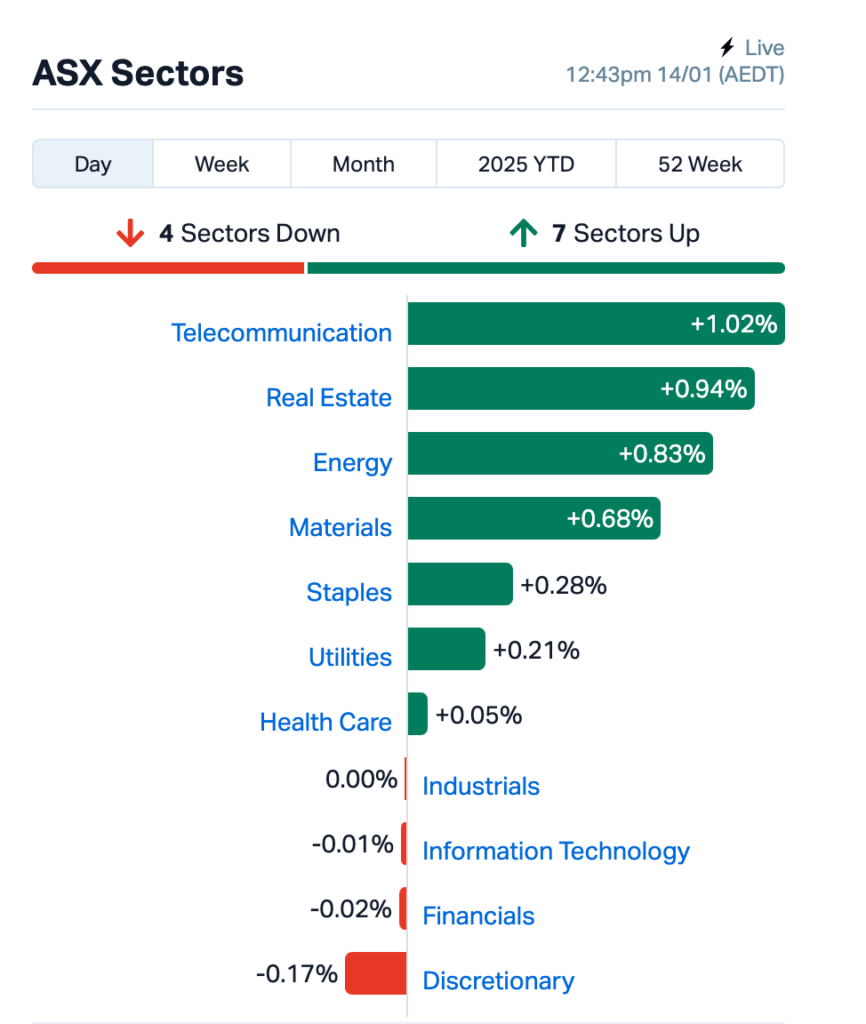

On the ASX this morning, seven out of 11 sectors were in the green:

Energy stocks got a nice lift as Brent crude kept climbing, fuelled by fresh US sanctions on Russia. Ampol (ASX:ALD) shares were up almost 2%.

Mining stocks weren’t about to be left behind, either. Iron ore futures only made a modest move higher, but it was enough to boost heavyweights Fortescue (ASX:FMG) and Rio Tinto (ASX:RIO).

Elsewhere, a mystery Macau businessman, Wang Xing Chun, has emerged as a potential white knight for Star Entertainment Group (ASX:SGR), after he quietly acquired shares since September. According to a filing today, Wang now holds 6.52% of Star's register.

The irony here is hard to ignore, as Star was recently investigated for potential money laundering linked to Macau/China-based junkets. SGR's shares rallied by 12%.

Meanwhile, Westpac’s Consumer Sentiment Index has dropped by 0.7% to 92.1 in January, according to data today.

This suggests the holiday spending hangover is real, and some consumers might be taking a hard look at their finances after the festive season.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for January 14 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| WLD | Wellard Limited | 0.145 | 99% | 5,239,814 | $38,781,273 |

| LNR | Lanthanein Resources | 0.003 | 50% | 500,655 | $4,887,272 |

| LNU | Linius Tech Limited | 0.002 | 33% | 507,754 | $9,226,824 |

| NPM | Newpeak Metals | 0.017 | 31% | 3,661,734 | $4,186,933 |

| CMD | Cassius Mining Ltd | 0.014 | 27% | 4,668,077 | $5,962,049 |

| PLN | Pioneer Lithium | 0.220 | 26% | 186,968 | $5,562,232 |

| LMG | Latrobe Magnesium | 0.015 | 25% | 3,063,100 | $28,182,449 |

| AUK | Aumake Limited | 0.005 | 25% | 160,392 | $12,042,769 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 193,140 | $12,000,000 |

| MRQ | Mrg Metals Limited | 0.005 | 25% | 14,172,926 | $10,906,075 |

| RAN | Range International | 0.005 | 25% | 121,991 | $3,757,161 |

| TFL | Tasfoods Ltd | 0.017 | 21% | 1,024 | $6,119,337 |

| 1AD | Adalta Limited | 0.018 | 20% | 806,624 | $9,471,871 |

| TMK | TMK Energy Limited | 0.003 | 20% | 1,888,995 | $23,313,913 |

| BDG | Black Dragon Gold | 0.063 | 19% | 1,153,819 | $16,057,201 |

| FGR | First Graphene Ltd | 0.063 | 19% | 755,809 | $35,509,444 |

| AI1 | Adisyn Ltd | 0.083 | 19% | 3,540,853 | $43,210,121 |

| FXG | Felix Gold Limited | 0.135 | 17% | 830,283 | $37,795,419 |

| CCX | City Chic Collective | 0.113 | 17% | 4,161,611 | $36,975,148 |

| GTR | Gti Energy Ltd | 0.004 | 17% | 575,485 | $8,888,849 |

Agribusiness firm Wellard (ASX:WLD) doubled after striking a deal to sell its last livestock vessel, the M/V Ocean Drover, for US$50 million. The buyer is Meteors Shipping, a Turkish agribusiness Wellard has worked with before. After the sale, Wellard said it plans to wind down its ship operations.

Linius Technologies (ASX:LNU) has appointed Ben Taverner as its new CEO, starting February 1, 2025. With over 20 years' experience in sports and tech, Taverner has worked with big names like IMG, Juventus, and KORE. Current CEO James Brennan will step down but stay on during the transition.

MRG Metals (ASX:MRQ) has secured the Corridor Central 11142 Heavy Mineral Sands (HMS) Mining Licence, approved by Mozambique’s Mineral Resources Minister. The licence covers the high-grade Koko Massava deposit, with a JORC Resource of 103Mt at 6.6% total heavy minerals. The Corridor South HMS licence is almost finalised, with a JORC Resource of 257Mt at 6.0% THM. This sets the stage for mining to begin in 2025.

City Chic Collective (ASX:CCX)’s stock shot up 17% despite a 3.6% drop in revenue for the second half of 2024. US sales were down 22.4%, but the Aussie and Kiwi market grew by 2.8%. The company said it’s refocusing on high-value customers and slimming down its global ambitions. Investors seem to like it, for now.

Energy Transition Minerals (ASX:ETM) saw a nice 7% jump after announcing a trip of its management team to Greenland to "foster relationships" with the local government.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for January 14 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MRD | Mount Ridley Mines | 0.002 | -33% | 166,668 | $2,335,467 |

| EDE | Eden Inv Ltd | 0.002 | -25% | 123,202 | $8,219,752 |

| OB1 | Orbminco Limited | 0.002 | -25% | 9,597,266 | $4,333,180 |

| PSL | Paterson Resources | 0.012 | -20% | 77,000 | $6,840,568 |

| AVE | Avecho Biotech Ltd | 0.002 | -20% | 20,000 | $7,923,243 |

| H2G | Greenhy2 Limited | 0.004 | -20% | 376,274 | $2,990,921 |

| LM1 | Leeuwin Metals Ltd | 0.100 | -17% | 3,570 | $5,622,201 |

| 1TT | Thrive Tribe Tech | 0.003 | -17% | 79,983 | $6,095,169 |

| BP8 | Bph Global Ltd | 0.003 | -17% | 85,995 | $1,419,924 |

| CYQ | Cycliq Group Ltd | 0.005 | -17% | 120,000 | $2,763,100 |

| ENV | Enova Mining Limited | 0.005 | -17% | 401,000 | $5,909,576 |

| ERA | Energy Resources | 0.003 | -17% | 251,669 | $1,216,188,722 |

| GLA | Gladiator Resources | 0.010 | -17% | 3,801,929 | $9,099,562 |

| LML | Lincoln Minerals | 0.005 | -17% | 30,319 | $12,337,557 |

| NTI | Neurotech Intl | 0.041 | -16% | 840,680 | $51,063,974 |

| SKK | Stakk Limited | 0.006 | -14% | 4,264,995 | $14,525,558 |

| MKL | Mighty Kingdom Ltd | 0.007 | -13% | 14,000 | $1,728,507 |

| BTM | Breakthrough Minsltd | 0.070 | -11% | 105,202 | $3,284,329 |

| EQN | Equinoxresources | 0.120 | -11% | 365,559 | $16,719,750 |

| IXU | Ixup Limited | 0.008 | -11% | 1,244,237 | $18,287,873 |

| LU7 | Lithium Universe Ltd | 0.008 | -11% | 51,500 | $7,073,817 |

| TYX | Tyranna Res Ltd | 0.004 | -11% | 111,036 | $14,795,664 |

IN CASE YOU MISSED IT

Gold, critical metals and base metals explorer Everest Metals Corporation (ASX:EMC) has received an R&D cash refund of $128,000 today from the Australian Taxation Office. The refund relates to the company’s work in FY2024 on rubidium and lithium extraction at its Mt Edon critical minerals project south of Paynes Find in Western Australia.

Everest plans to use the cash rebate for ongoing test works and a planned scoping study. The company is also currently conducting metallurgical research and development test work in collaboration with Edith Cowan University’s Mineral Recovery Research Centre.

Silver market darling Sun Silver (ASX:SS1) has flexed its value today after sharing with the market a 102m at 111g/t silver equivalent intercept from its Maverick Springs silver-gold project in Nevada, US.

The drill result comes from hole MR24-199, which is located outside of the current resource boundary – signalling the potential for growth at the project. Maverick Springs today commands an inferred resource of 195.7Mt at 40.25g/t silver and 0.32g/t gold for 253.3Moz contained silver and 2Moz contained gold.

South American explorer Brazilian Critical Minerals (ASX:BCM) says it is laying the foundation for an anticipated scoping study at its Ema project after releasing an updated resource estimate of 350Mt at 778ppm TREO.

More than 30% of this starter zone resource – 126Mt at 772ppm TREO, to be exact – sits in the indicated category. BCM plans to release the scoping study this quarter alongside continued conversion drilling results. This starter zone resource also only represents 14% of the available tenement area, giving the explorer plenty of confidence for potential future growth.

Argent Minerals (ASX:ARD) is beating its chest after identifying new drilling target zones at its Trunkey Creek project in New South Wales after flaunting high-grade rock chips measuring up to 63.1g/t gold. As well, reinterpreted IP and new detailed ground IP has earmarked high resistivity areas coincident with historical workings.

“We are extremely pleased to have received further high-grade geochemical results, highlighting significant gold mineralisation potential at Trunkey Creek,” ARD managing director Pedro Kastellorizos said.

At Stockhead, we tell it like it is. While Everest Metals, Sun Silver, Brazilian Critical Minerals and Argent Minerals are Stockhead advertisers, they did not sponsor this article

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as ASX Lunch Wrap: ASX rebounds as mystery Macau investor emerges as Star’s white knight