Online shopping and coronavirus lockdowns mark difficult times for Westfield

A change in the behaviour of Aussie shoppers combined with COVID lockdowns have created horrific conditions for Australia’s most famous malls.

What on earth is going to happen to Westfield?

Is Australia’s great shopping centre powerhouse going to come out of this pandemic the same as it went in? Or is this the beginning of the end?

Will the landlord recently described by one tenant as a “bully boy rent collectors” be reduced to a shadow of its former self?

In some ways, Westfield to be heading back to normal. A truce has been called in their war with major tenant Mosaic brands. Mosaic, which owns Noni B, Rockmans, Rivers and Katies, had threatened to permanently shut hundreds of stores. Instead the shops are now open.

In other signs things are returning to normal, after locking the doors on luggage company Strandbags, over a rent dispute, the bag retailer is up and running again.

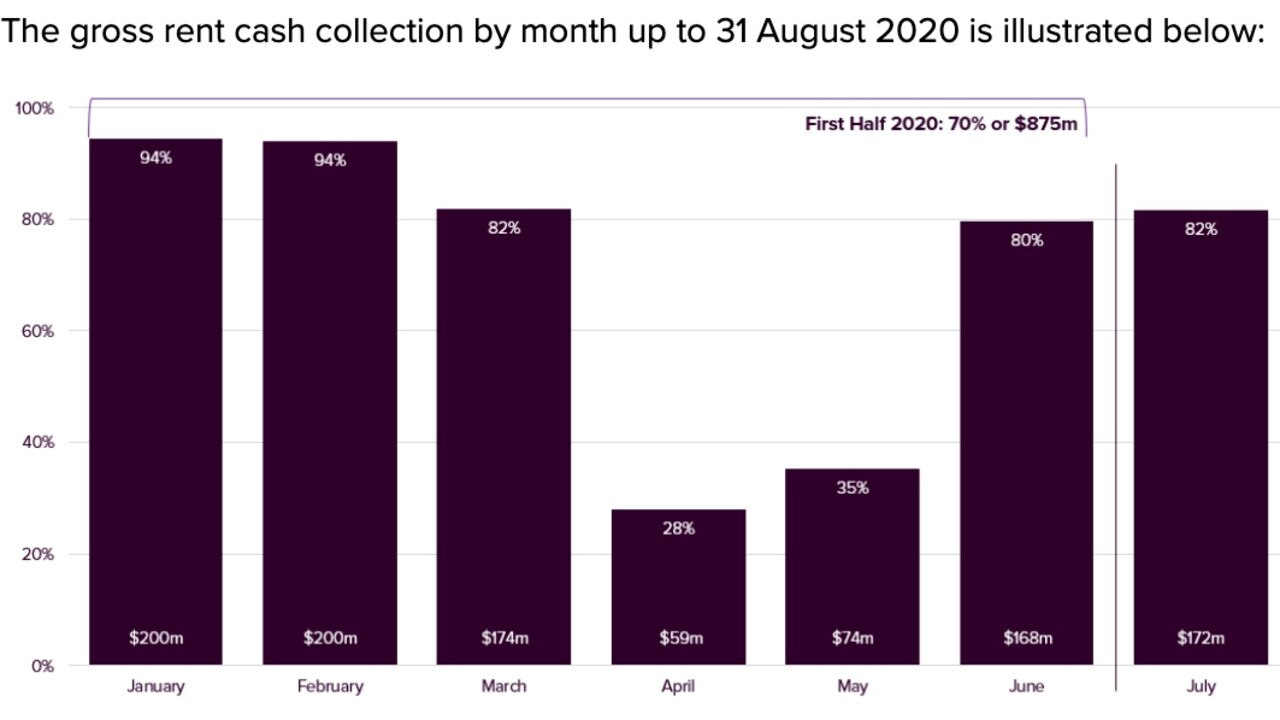

Westfield recently proudly announced to the share market that it collected 86 per cent of its normal rents in August, well up from just 28 per cent in the depths of the national lockdown, as the next graph shows.

RELATED: How long will Australia’s economic bounce last?

RELATED: One question test to tell if you’re broke

Notably, Westfield is still giving some tenants a break on rent. As they say,

“We have supported our retail partners throughout this period on a case-by-case basis. We have done this without receiving financial assistance from Government,” it said.

The share price of the company that owns Westfield malls - Scentre Group - has gone up around 50 per cent the worst moments of April. But it is certainly not back to where it was. It traded at about $4 throughout 2018 and 2019, but it trades at $2.24 at time of writing. That’s a sign investors don’t believe it can snap back to the old normal any time soon.

NEW NORMAL

Some Westfields around Australia are busy. According to a Westfield spokesman, 93 per cent of stores are open and trading, outside Melbourne.

But in Victoria, where lockdown is just beginning to ease, the corridors are empty and many shops are dark.

Empty shopfronts should change the balance of power between retailers and their tenants.

Historically, shopping centres have had more bargaining power than the shops within their walls, which has led to lots of regulation and legislation to try to even things out.

But as the Productivity Commission has pointed out “The basic negotiating balance between landlords and tenants is determined by supply and demand conditions in the market.”

Those have swung. Retailers have much more power now than they did before. Malls hate having vacant shop fronts and right now vacancies are abundant, both in shopping centres and on the high streets. Who would want to go into a retail business right now?

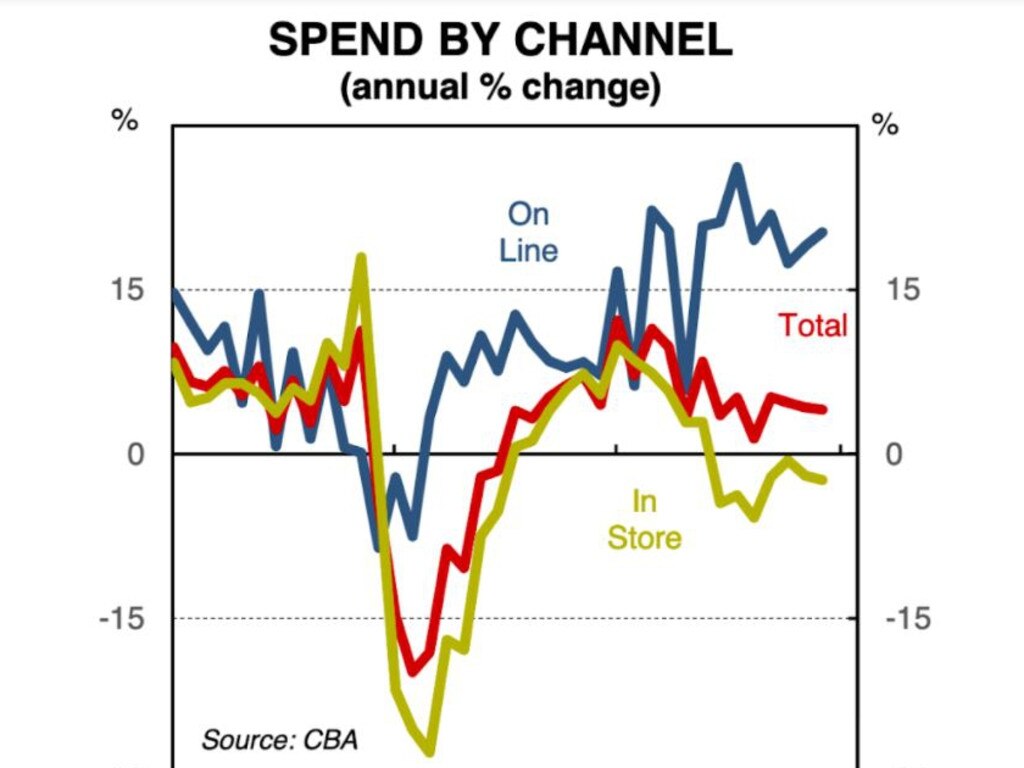

The future of retail is much more uncertain than it was. Any new retailer will start out with a website. As the next graph shows, online shopping is booming,

RELATED: How much you need to survive recession

And with the economy much weaker than before, many existing retailers will probably be closing shops not opening them.

Therefore it will be harder for shopping centres to find new tenants if the current tenants leave. Is Westfield immune to this? It commands premium shopping centres, not dodgy local ones. There will always be someone willing to move into a Westfield Shopping Centre.

But the way the business model works is they don’t want just anyone. Shopping Centres like to attract quality tenants that give the centre the right vibe and attract plenty of foot traffic. The ability of Westfield and other shopping centres to be choosy would be diminished by any weakness in retail. Of course, it’s important to remember that this recession is different to other ones. Government spending has put more money in Australian pockets and that is propping up some retailers. Shops like JB Hi-Fi, Coles and Woolworths are going brilliantly. The usual dynamics of a recession – falling spending and weakening retail – are not present, or at least not yet.

The future of Westfield – and the power they have to pick and choose tenants - depends more

than anything on the Australian economy remaining strong.

Like all of us, they need the government to work hard to keep the economy moving. Like the rest of us, the owners of Westfield will be paying very close attention on Tuesday’s when the government brings down the most important Budget in many years.

Jason Murphy is an economist and author of the book Incentivology.