Australia is out of recession but how long will the honeymoon last?

Australia has clawed its way out of recession in the last quarter, but all that progress could be ruined with a single wrong step by the Treasurer.

Australia, we’re out of recession. We shrank in the first quarter (Jan, Feb, March). Then we shrank in the second quarter (April, May, June).

That was enough to satisfy a definition of a recession. Now, in the third quarter (July, August, September) the national economy is growing.

We are out of recession. Hurrah! What we have to worry about now is a double dip.

Double dipping, in this context does not refer to your mate who sticks a saliva-shiny carrot stick back in the French Onion dip. It’s when the economy recovers from a recession only to go back in.

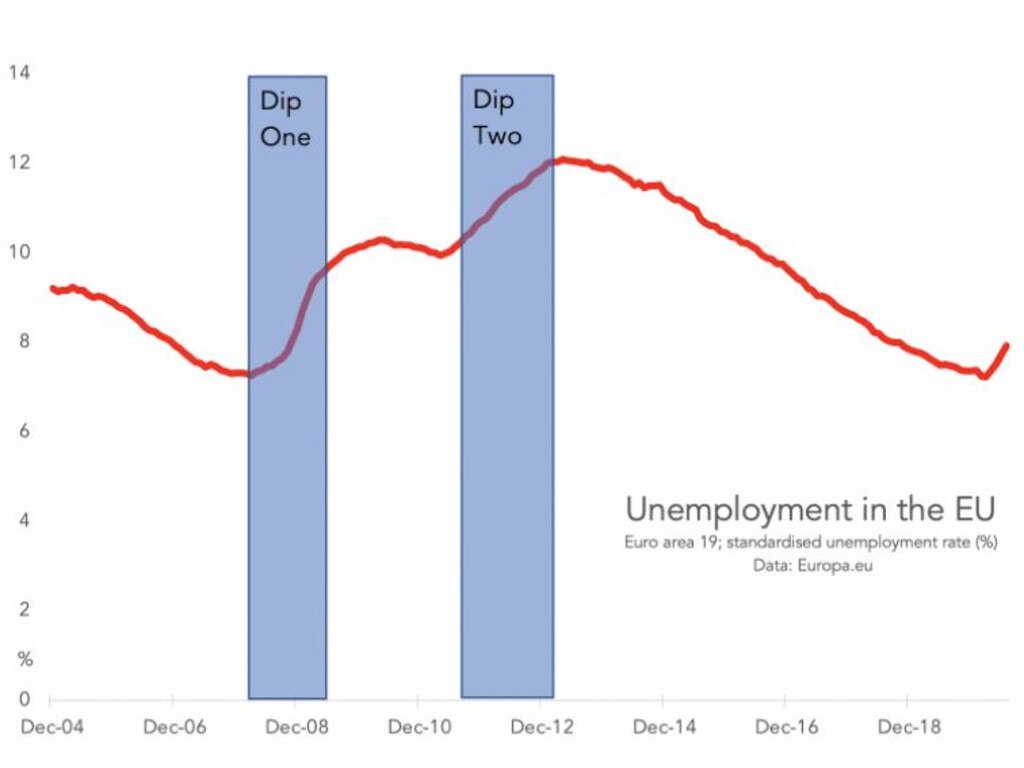

Double dip recessions are common. Europe double-dipped after the global financial crisis. America double-dipped in the early 1980s. And, oh yeah, it also double-dipped at the end of the 1918 Spanish flu pandemic. In fact the original recession in America during Spanish flu was small compared to the one that followed.

“The 1918 recession was mild and quickly reversed, and stands in very sharp contrast to the 1920–21 recession,” say researchers from the Chicago Federal Reserve Bank. (Bear in mind you can’t definitively say the pandemic caused either of those recessions – the end of World War One could be a factor.)

RELATED: Follow the latest coronavirus news

RELATED: Treasurer reveals eye watering figure

RECESSIONS SUCK

Recessions suck. They cause human misery. Families break up. People lose their homes and businesses. Kids go hungry. Lives are wasted in unemployment. This is not just a statistical game we are playing. It matters desperately. In a recession, unemployment rises fast. But it goes back down only slowly. The damage of a six-month recession can take six years to undo. Or more.

What’s so devastating about a double dip recession is that just when the healing is ready to start things get worse again. Check out what happened in Europe after the global financial crisis in the next chart. (The recessions are marked with blue shading). Europe felt bad with unemployment at over 10 per cent. Then the second recession came along and pushed it up to 12 per cent. It took from 2012 all the way to 2020 to get it back to the levels it was at pre-GFC.

RELATED: Treasurer’s budget mistake looms

RELATED: Aussie millionaires claiming JobSeeker

Australia’s first recession in 30 years has been a weird one because it wasn’t caused by bad business conditions or a lack of confidence. Businesses were going along OK before COVID-19 came upon us.

We shut down and we might dare hope that when we open back up fully, it will be as it was. We get a bounce-back from the shutdown that props up growth for a quarter or two. After that, we can return to the so-so growth levels we were getting at the end of 2019.

But the shutdown has changed the economy. It is now more fragile. Businesses have bigger debts. More people are out of work. Confidence is not what it was. And our trading partners are all in the economic hurt locker too.

That alone puts us at risk of another recession. Remember that before coronavirus our economy was growing slowly. Just over 2 per cent a year in total and much less than that per capita. Even a slightly less vibrant environment puts growth at risk.

But the even bigger issue for our economy is the amount of government money that is flowing through it. Business and households are being propped up by government funding in the form of JobSeeker and JobKeeper. We’re not quite sure how dependent on these payments the economy is. We are going to find out the hard way, because they are being removed as we speak. JobSeeker shrank from 25 September and JobKeeper is cut from 28 September.

The government has promised it will eventually start to focus on returning to surplus.

The Treasurer has said the process will begin when the unemployment rate comes back down to six per cent. That could be a disaster.

If he starts slashing spending when the unemployment rate is six per cent, it will probably stay at six per cent, or even get higher.

Previous Treasurers Wayne Swan and Joe Hockey made similar mistakes last decade, obsessing on the return to surplus. They never achieved it, and instead unemployment slowly got worse.

We’ve seen what kind of wages growth we get with unemployment above five per cent: stuff all. We need to get unemployment down to closer to four per cent and make serious inroads into underemployment before the labour market is tight enough to think about surpluses.

Australia has a bounce-back left in it. When Victoria reopens, that will provide some spring and lift. The October economic statistics will show growth as they capture

Victorian retailers and restaurants getting going again. But after that? It could be a bumpy ride ahead.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.