Kogan Pantry bare after ‘range consolidation’

KOGAN was going to take on Coles and Woolies but a year on, almost all you can buy is Sodastream products. What went wrong?

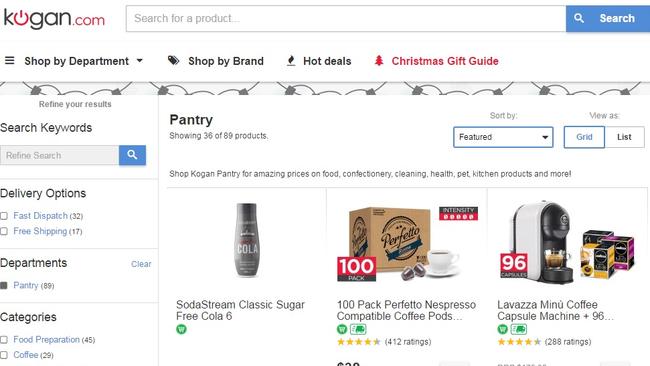

UNLESS you’re after coffee machines and SodaStreams, Kogan’s Pantry is a bit of a fizz.

After launching last year promising to shake up the online grocery market with prices up to 50 per cent cheaper than Coles and Woolworths, the online retailer’s pantry is looking pretty bare these days.

From nearly 600 products at launch, the range has been slashed by more than 85 per cent. There are now only 89 products available. Forty-five of those are SodaStream machines, flavourings or accessories, and a further 37 are Lavazza coffee machines and pods.

That leaves just seven items — none of them food:

• Scholl Velvet Smooth Express Pedi (Pink) $29 (RRP $54.99)

• Scholl Velvet Smooth Express Pedi Wet & Dry $49 (RRP $88.99)

• Scholl Velvet Smooth Electronic Nail Care System (SOLD OUT)

• 320 Finish Quantum Powerball Dishwashing Tabs (4 x 80 Pack) $99 (RRP $148)

• 6-Pack Finish Dishwasher Cleaner 250mL $25 (RRP $76.20)

• 6-Pack Finish Rinse Aid 500ml (SOLD OUT)

• 3-Pack Preen Carpet Cleaner Power Powder 510g $29 (RRP $50.10)

Gone are the “massive brands” like Dove, Colgate, Palmolive, Pringles, Powerade and Gillette that Kogan founder Ruslan Kogan talked up last year, when the site sold 30,000 items within the first six hours of launch.

“It’s an efficiency play and it’s about selling direct to the consumer,” Mr Kogan said at the time. “We knew there was a lot of negative sentiment around supermarkets in Australia, we knew people didn’t like them very much, but we had no idea to what extent. It feels great when we can take it to the big two.”

Speaking to news.com.au late last year, Mr Kogan had toned down expectations, saying the grocery business had been “pretty good”, but “don’t sell your Coles and Woolies shares because of Kogan Pantry”.

But by the time of the company's annual results in August — its first as a public company since listing on the ASX in July — Kogan Pantry didn’t rate a mention.

Kogan beat its prospectus forecasts with a net profit of $800,000, double its forecast of $400,000 and up from a $300,000 loss the previous year. Revenue was up 5.4 per cent to $211.2 million, boosted by $6.5 million from the Dick Smith online business.

At its annual general meeting on Friday, Kogan upgraded its earnings forecast for the current financial year from $6.9 million to between $8 million and $9 million due to “continued strong sales performance”.

Speaking to AAP, Mr Kogan dismissed concerns that the arrival of Amazon in Australia could damage his business.

“Amazon will hurt some retailers no doubt but the ones they’ll hurt are the ones that are selling the same thing as everybody else at fat margins,” he said.

He said Kogan had a large and growing number of higher-margin private label products, including Kogan electrical products and Ovela homewares. Private labels accounted for 37 per cent of the group’s gross sales during the 2016 financial year.

Amazon is rumoured to be pushing back its Australian launch by six months from March to September 2017 so the e-commerce giant can include its Amazon Fresh grocery delivery service in the rollout.

While Amazon reportedly says it will “destroy” the Australian retail landscape, experts have raised doubts about how successful fresh food delivery will be given Australia’s size and population.

Speaking at Wesfarmers’ annual strategy briefing in June, Coles managing director John Durkan warned that Australia was a “completely different market” to the rest of the world.

“Outside of relatively small hubs, it’s very convenient to do your shopping in Australia,” he said. “The density of population and geography allows most people to get to stores very quickly, park, do their shopping and leave.”

IBISWorld figures show online sales have been slow to take off, accounting for just $3 billion of Australia’s $90 billion grocery market. The market research firm projects annualised growth of 12.9 per cent over the five years to 2021-22 to $4.9 billion.

According to consumer research company Canstar, while just one in five shoppers currently buy all of their groceries online, 40 per cent expect to do all of their grocery shopping online in the future.

Woolworths has 42.8 per cent market share, followed by Wesfarmers with 36.6 per cent. Aussie Farmers Direct and Grocery Run each have less than 5 per cent share, according to IBISWorld.

Last week, Canstar named GroceryRun Australia’s favourite online grocer, based on 1500 customer satisfaction surveys. It came as Aussie Farmers Direct offshoot The General Store launched in NSW after debuting in Victoria earlier this year.

In a statement, a Kogan spokesman would not say whether Kogan Pantry was being wound down, but said it had been “undergoing a range consolidation to increase efficiency and provide better deals to consumers” for several months.

“Consumers have voted with their wallets and the most popular items have been bulk packs of items that people need most,” he said. “These usually result in the biggest savings due to the cost reductions associated with logistics fees and freight.

“We will continue to optimise the Kogan Pantry range based on consumer demand.”

Forager Funds Management senior equities analyst Daniel Mueller said it appeared Kogan Pantry lacked the scale to make it work. “With those sorts of low-value, high-volume items, scale is critical,” he said.

“You’ve got a fixed distribution network and you need to fill it up with volume otherwise you just can’t get the margin.”

Mr Mueller said Amazon Fresh would likely face similar hurdles. “Grocery tends to be lower margin than other retail categories. The key there is how can you compete in fresh groceries when you’re running a wholesale distribution model.

“The challenge is can you offer the same range as the supermarket retailers, and let’s not forget they also have an online offering. Woolworths and Wesfarmers are the two biggest online retailers in Australia, which people often forget.”