Coronavirus: Warning of Australian ‘dead malls’ as a result of COVID-19

Shops closed amid the pandemic but some may never reopen leading to fears the “dead mall” phenomenon seen in the US could be in store for Australia.

The sign on the darkened Pandora jewellery store at Sydney’s Top Ryde City shopping centre suggests its closure is temporary. It’s just to support “containment efforts” in relation to COVID-19.

But the fact the brand’s logo has been shoehorned from the store front hints at the truth – this store will never reopen.

Even more worrying for the centre is the hole left by the larger Harris Scarfe department store next door, which closed in March.

Shopping centres were already suffering. The pandemic has been another kick to the guts as wallets tighten and panicked shoppers flee to the safety of online. While many stores are now reopening, some simply won’t and others may succumb in the coming months.

Analysts have said while retailers still love a CBD flagship and make big profits from larger malls, mid-sized and suburban centres are now in the danger zone as big names ruthlessly run the ruler over their branch networks.

Many centres will either have to transform themselves or risk becoming the Australian equivalents of the US’ “dead” or “zombie malls”.

It’s a prediction dismissed by the shopping centre industry that has said Australian centres have advantages over US malls.

RELATED: Stores that may never reopen after pandemic

RELATED: Photo proves 'sad' reality of closing Target store

Nonetheless, some shopping centres are losing major retailers like MKR is losing viewers.

This month, Target said it would close 75 stores, many of those in modest malls. Even before COVID-19, Myer had pulled out of malls in Sydney and Brisbane while Big W has vacated four stores has around 30 left to axe. This week David Jones said it would look to slim down in size.

Dr Mark Cohen, the director of retail studies at Columbia University in the US, and a former retail executive said Australian shopping centres were not immune to the forces that have rattled their US counterparts.

“The view that ‘if we build it, they will come to shop’ for decades resulted in a glut of shopping centres, increasingly undifferentiated and unproductive.”

“Along comes the internet which begins to hollow out the great American shopping centre just the same way the shopping centre hollowed out downtown retailing,” he told news.com.au.

“Then along comes COVID-19 which is going to accelerate customers’ already fevered migration over to e-commerce while at the same time likely hastening the failure of an untold number of already poorly performing retailers – and their already struggling suburban malls.”

‘B GRADE’ CENTRES AT RISK

Of the US’ 1400 centres only around 250 so called “triple A” super-regional malls remain fully tenanted, Dr Cohen said. The other 1000 plus “B” and “C” centres were struggling. If an anchor or two departed the outlook could be grim.

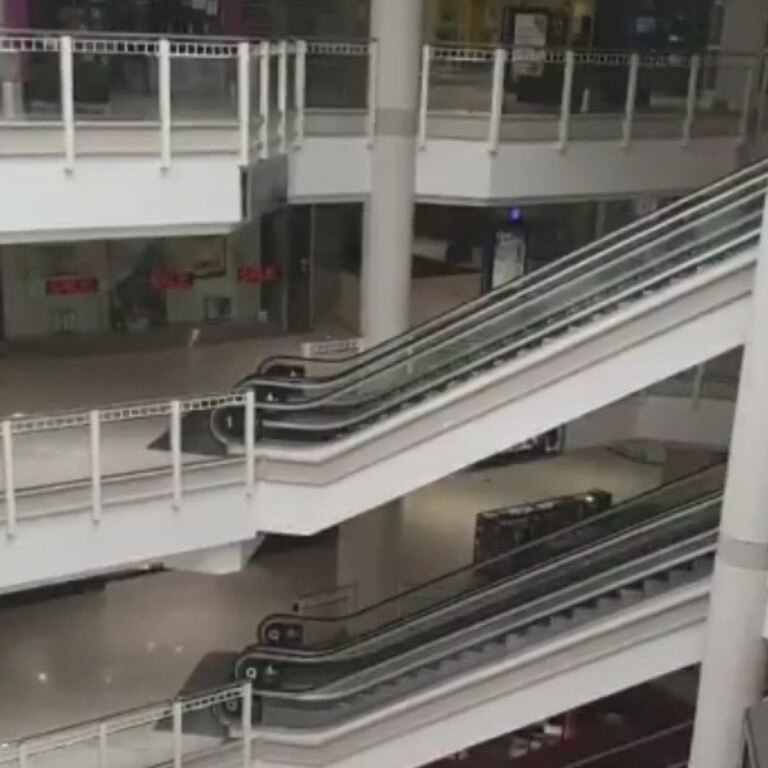

“These are often referred to as zombie malls because they are still open but they look to customers like they are dead or dying.”

The US is famously littered with these eerie, derelict “dead malls”. Some still sport escalators that will never run again and dust piles up on store facades that will never see another shopper.

This outcome seemed ludicrous in Australia, partly because shoppers here had been less enthused by online shopping. Not anymore.

Daniel Agostinelli, chief executive officer of footwear retailer Accent Group said online had gone from 10 per cent of sales to 30 per cent during the pandemic.

The firm behind Athlete’s Foot and Platypus said this month it could close between 50 and 100 stores.

“The only word we can find for this shift is seismic and that will have an impact on how many stores we require,” he told news.com.au.

Mr Agostinelli said that “100 per cent” mid-tier malls could bear the brunt, and he’s urged landlords to reduce rents.

“We call those B grade centres. We’re not sure what the shift to digital will mean for these centres and where this will settle at the end of the day.”

Athlete’s Foot has a shop at Top Ryde City, a centre that is an example of how some malls may have to reinvent themselves. The centre isn’t dead, but it had a near-death experience going bankrupt in 2011.

That was just two years after it opened as a fashion destination with a Myer as well as street wear brands G-Star and Glue.

They’re all gone now, replaced by less familiar names like “Mode Sage” and “Style Avenue.”

Top Ryde City insists it has turned around its fortunes. Its swerved from a focus on fashion to less exciting but more dependable categories like food. One floor of the old Myer is now a Coles; a Kmart has opened.

Current owners Blackstone had been hoping to sell the centre for $700 million, double what they bought it for post collapse, however that plan has stalled. And ominous gaps remain in the centre, particularly on floors furthest from the supermarkets.

SIGNS CENTRES ARE SUFFERING

“A couple of months ago I would never of thought I would’ve been talking about dead malls in Australia but what we’re seeing now may encourage owners of some of these mid-tier assets to think about what their shopping centres may look like in five years”, Queensland University of Technology retail expert Professor Gary Mortimer said.

“If they lose a major anchor tenant like Myer, Harris Scarfe or Target, they might decide they’re too big and knock down half the centre, make it residential.”

He said a preponderance of massage and nail salons, which don’t pay high rent, is never a good sign of a centre’s health.

Even in CBDs, some malls are doing it tough.

“Wintergarden and The Myer Centre in the Brisbane CBD are in strife and have been for some time,” he said.

Both centres still boast big names – H&M, Zara and, of course, Myer – but the further you get from the street, the more shops are shuttered.

The Co urier Mail dubbed the former the “Wintergarden wasteland” of “shop carcasses”. Last month, shopping centre staple Best & Less exited the Myer Centre.

The management of Wintergarden told the Courier Mail difficulties with street access were behind some vacancies in the centre.

Justin Blumfield, the director of shopping centre management at Vicinity Centres which owns the Myer Centre said it would, “continue to be a much-loved destination for people visiting Brisbane’s CBD.

Vicinity also owns Australia’s top performing centres – Melbourne’s bustling Chadstone which raked in $2.3 billion in turnover last year, according to Shopping Centre News.

Westfield centres in Sydney’s CBD, Bondi, Fountain Gate and Chermside as well as Melbourne Central, Sydney’s Broadway and the Gold Coast’s Pacific Fair are also flourishing. But seemingly sniffing the wind, Westfield no longer refers to its malls as shopping centres. They are now “living centres” to instill the idea they are about meeting, eating, and working out rather then just shopping.

ADVANTAGES OF AUSTRALIAN SHOPPING CENTRES

Industry body the Shopping Centre Council of Australia (SCCA) said our centres have some aces up their sleeves. One is they are generally half the size of their US counterparts which means there’s less space to fill. The other is supermarkets – you rarely see one of those in a US mall.

Supermarkets suck in shoppers which return more often. And if a big retailer departs a supermarket can move in – as Aldi is doing in place of Big W’s closed branch in Auburn, Sydney.

“Our centres are vastly different to the US, such as our much higher sales productivity, occupancy rates and share of food tenants,” SCCA Executive Director Angus Nardi told news.com.au.

“We don’t believe so-called dead or zombie malls will be an issue in Australia.”

Some retail watchers are less confident. They note department stores are vast and supermarkets can rarely soak up all the spare space.

In Fairfield, western Sydney, the closed Big W will be replaced not by a grocer, gym or a new food court – but by parking spaces.

If a big store dropped out, said Dr Cohen, “lesser malls are stuck with dark store fronts”.

“In my opinion, from afar, many if not most Australian department stores will fail over time unless they can provide differentiated assortments, great customer service and appropriate price and quality,” he said.

“Most US department stores are failing at this and it will spell their eventual downfall.”

If they do vanish, and online continues to rise, Australian shopping centre owners will have to thing on their feet to stop their location from becoming the next dead mall walking.