Aussie online retailer Temple and Webster earnings surge 500% during coronavirus lockdown

Just three years ago, this Aussie online retailer was haemorrhaging cash but today it reported an earnings surge of 500 per cent.

Online furniture retailer Temple and Webster has completed a remarkable transformation from haemorrhaging cash to today reporting an earnings surge of nearly 500 per cent due to the reliance for consumers to shop on the web during the coronavirus lockdown.

Just three years ago, the online-only business had revealed a loss of $44.4 million but its fortunes were beginning to turn by the end of last year when it reported a 50 per cent jump in revenue over a six-month period.

The company has long banked on its customer base — tech savvy Millennials — rolling into maturity with the cash and need to furnish their first homes.

But it couldn’t have envisaged how vital online shopping would become as the pandemic forced the population indoors and bricks and mortar outlets closed down.

“Given what’s happening out there and the terrible situation with covid, there are a lot of people turning to online who are non-Millennials, so it’s not just this group driving the adoption right now,” Temple and Webster chief executive Mark Coulter told news.com.au.

RELATED: Leaders say businesses to blame for failings

“There are a lot of people in all age brackets, income brackets and all demographics that are turning to online out of necessity so it’s our job to make sure they have a great experience.”

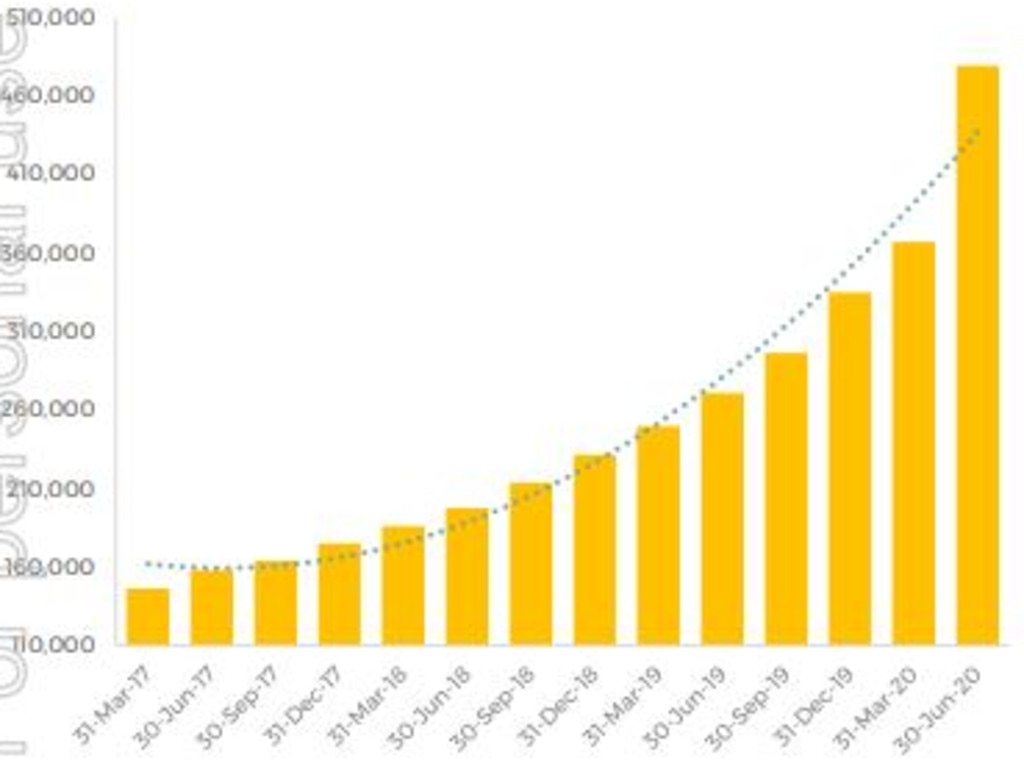

The company’s earnings soared 483 per cent to $8.5 million over the 2019/20 financial year, while revenue jumped 74 per cent to $176.3 million.

Its share price has lifted nearly 200 per cent this year — closing at $8.23 on Tuesday — and Temple and Webster is now worth nearly $1 billion.

A large portion of the whopping result was attributed to its unusual access to Aussies shopping online during the extraordinary period coupled with desperate need for home office furniture.

But its results towards the end of 2019 meant Temple and Webster had the business model in place to capitalise on the e-commerce surge while its competitors were scrambling to pivot to a fully functioning online operation.

“We already had our cost base under control, we already had complete control over the market levers and we already had strong relationships with our product suppliers,” Mr Coulter said.

“We were already in a pretty good position and what that allowed us to do is when we needed to scale quickly, we could.

“E-commerce is a scale game, so you start to see operation leverage because the revenue grows faster than the cost base as opposed to other industries where you need to keep investing in showrooms or stores; you need physical costs to drive that revenue.

“Whereas with online you don’t need to do that, that’s what we’re starting to see now as the revenue growth translates into proper growth.”

The challenge for the market leader now lies in its ability to retain customers as traditional stores reopen, its chief executive told news.com.au.

“If we’ve done a good job in looking after our customers and they’ve had a good experience shopping for their home online with us, then there’s no reason for them to at least consider us when they’re next considering items for their home,” he said.

“Before they may not have, they may have always jumped into their car and gone to the furniture store.

“Whereas now they might think it was really good quality, it’s really good value, service was good and delivery was quick so at least then when they’re coming to buy their next product for their home, we may be in their consideration.”