‘Don’t know what they stand for’: Retail leaders say businesses not economy to blame for failings

We’re in the midst of a retail apocalypse with dozens of chains closing their doors and industry leaders say they know why.

Industry leaders say blaming the flurry of retail chain closures on gloomy economic conditions is a cop out, insisting the mounting failures is simply the result of bad business practices.

Numerous brands have already spiralled into administration in the first month of the decade, dominated by fashion retailers citing poor trading conditions.

But executives and sector commentators attribute a large proportion of the failings to poor strategies and an inability to appeal to consumers.

RELATED: Colette Hayman placed into voluntary administration

RELATED: Kmart boss’ plan to transform Target

Kogan chief executive Ruslan Kogan has carved out a flourishing business selling a range of products online with a focus on electrical goods.

He told news.com.au negative commentary related to business conditions is, and will always be, synonymous with the sector.

“The way that I see it is there’s not doom and gloom out there, there’s just good retailers and there’s poor retailers,” he said.

“There’s businesses that are innovating, creating new products, listening to their customers, finding ways to go into bat for their customers.

“And there’s businesses that are resting on their laurels and they think because they were really profitable 10 years ago that they don’t have to do anything and that it will all continue.”

Mr Kogan said the common trend of the heap of closed retailers is they’ve lost touch with their customers.

“When was the last time you were in a Jeanswest?” he asks of the fashion chain which announced its closure last month. “Where as I bet you’ve been on Asos.com recently.

“Once a business loses touch with their customers and stops making customer-driven decisions, they’re in trouble.”

In the two years when dozens of companies have gone out of business, online furniture retailer Temple and Webster recorded its maiden profit in 2019 and on Tuesday announced another bumper result.

The company’s revenue jumped by 50 per cent to $74.1 million in the six months to December 31, with its share price surging more than 20 per cent higher in response.

Chief executive Mark Coulter said Temple and Webster’s corner of the market was impacted by last year’s housing downturn and generally weaker consumer sentiment.

“However, even though it is a smaller pie there are still winners and there are still losers,” he told news.com.au.

“The winners are the ones who are good retailers and the losers are the ones who are bad retailers.

“You still grow in a declining market, like we are, if you stick to your proposition.”

Mr Coulter says the common link with the failed retailers is the inability to show the consumer what they stand for.

“I’m not sure what you’re doing and I’m not sure what you’re adding to me, it’s just four walls full of product,” he says is the perception of customers when walking into the stores which have now closed.

“If you look at the retailers that are closing or are struggling, they don’t really stand for anything.”

RETAIL TRADE DATA

December’s worse-than-expected retail trade data does, however, shows there is a tangible impact on consumer spending and business conditions.

Australian Bureau of Statistics figures from Thursday revealed monthly spending fell $140 million to $27.77 billion, largely dragged down by bushfires and Australia embracing the November Black Friday sales.

Ernst & Young chief economist Jo Masters said the numbers show “ongoing and considerable pressure in the retail sector”.

“Consumers are clearly taking advantage of sales events, such as Black Friday in November and this is underpinning pricing pressures,” Ms Masters said.

“The drought and the bushfires crisis look to be impacting the retail space, and will likely continue to do so in coming months.”

But it’s not just Kogan and Temple and Webster performing well.

Furniture retailer Nick Scali was bullish of the improving sales conditions when reporting a better-than-expected half-year result this week.

Coles, too, say it will report an increase in its first-half sales, while investment firm UBS upgraded its position on Harvey Norman and JB Hi-Fi shares to “neutral” and “buy” respectively.

LAZY RETAILING

Queensland University of Technology retail expert Dr Gary Mortimer said the cost of business pressures are material but attributes the failings and closures to a short term approach to discounting.

“I often refer to this as lazy retailing,” he said.

“This extensive and long term discounting has simply eroded profits while the costs are going up.

“That long period of intense discounting has also encouraged consumers to never pay full price and equally I think we have consumers that are focused on saving and not spending.”

Dr Mortimer says the increased cost of living has forced Australians to be more frugal and discretionary retailers have run into trouble as a result of this.

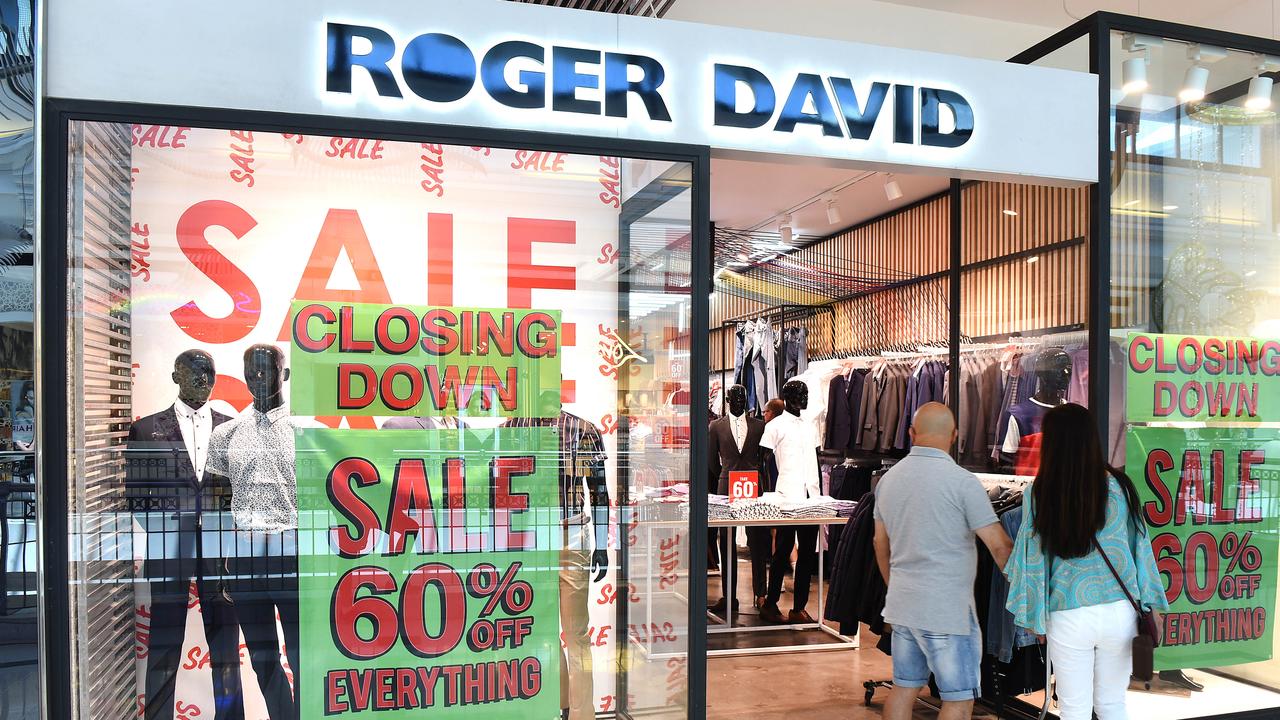

And the now defunct chains such as Ed Harry, Roger David and Harris Scarfe have struggled for relevance and are commonly viewed as outdated.

“That middle tier sector doesn’t have a strong brand position, doesn’t have a strong value proposition and doesn’t have a point of differentiation,” he told news.com.au.

“Which means they generally are forced to compete basically on price, and in those situations it’s a spiral downwards.”

Do you think the failed retailers have the economy to blame or their own business management? Get in touch or comment below | @James_P_Hall | james.hall1@news.com.au