Afterpay, Klarna uptake highest in Australia, new report finds BNPL making no profit

An international bank has named Australia for having one of the biggest ‘surges’ in buy now pay later (BNPL) services in the world as bad debts pile up.

An international bank has named Australia for having one of the biggest ‘surges’ in buy now pay later (BNPL) services in the world as bad debts pile up.

The Bank for International Settlements has released a new report which laid bare the state of the BNPL industry.

In an alarming finding, the report’s author claimed that not a single BNPL company – such as Australian company Afterpay and also Affirm and Klarna – has turned a profit for the past half-decade.

“High operating costs, for marketing, administrative and technology expenses among others have prevented these platforms from breaking even since 2018,” the report noted in a blistering analysis.

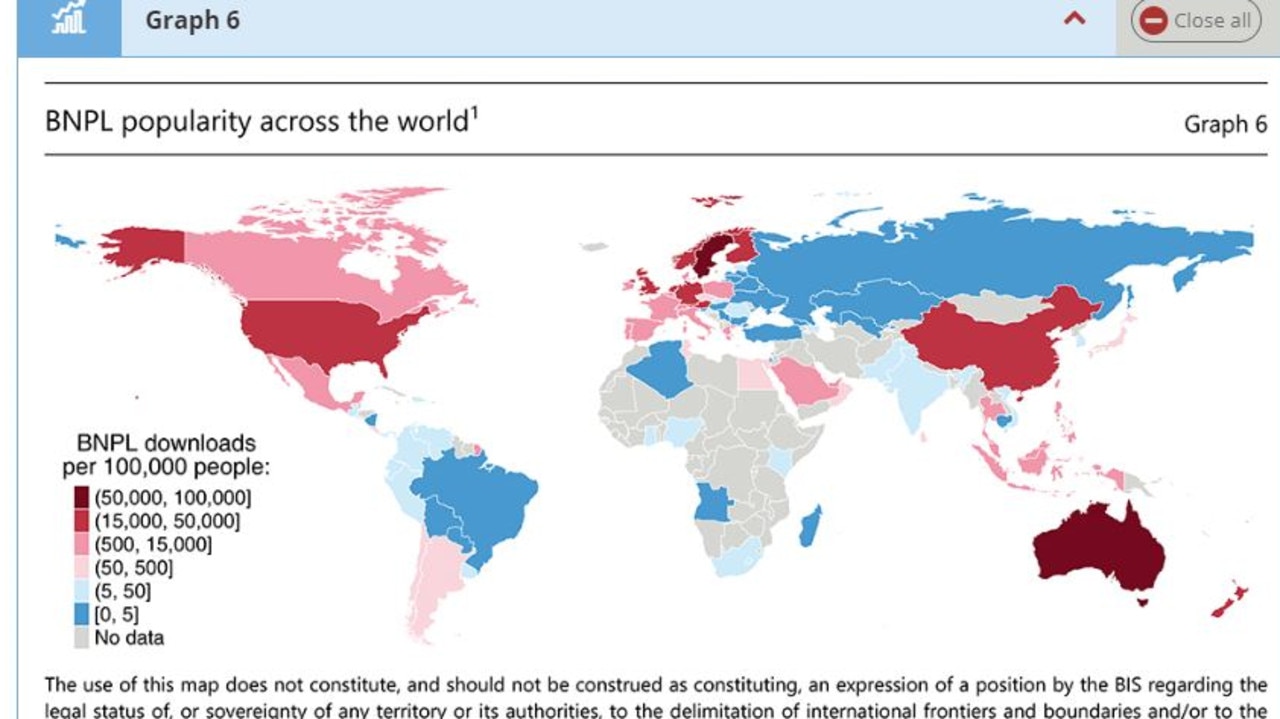

Australia and Sweden are the two nations with the highest rate of BNPL uptake in what was labelled a “surge in popularity”, with a sixfold increase since 2019 to now.

But on the flip side, the study said that Australia’s regulations to curb the wild west of BNPL are world-leading.

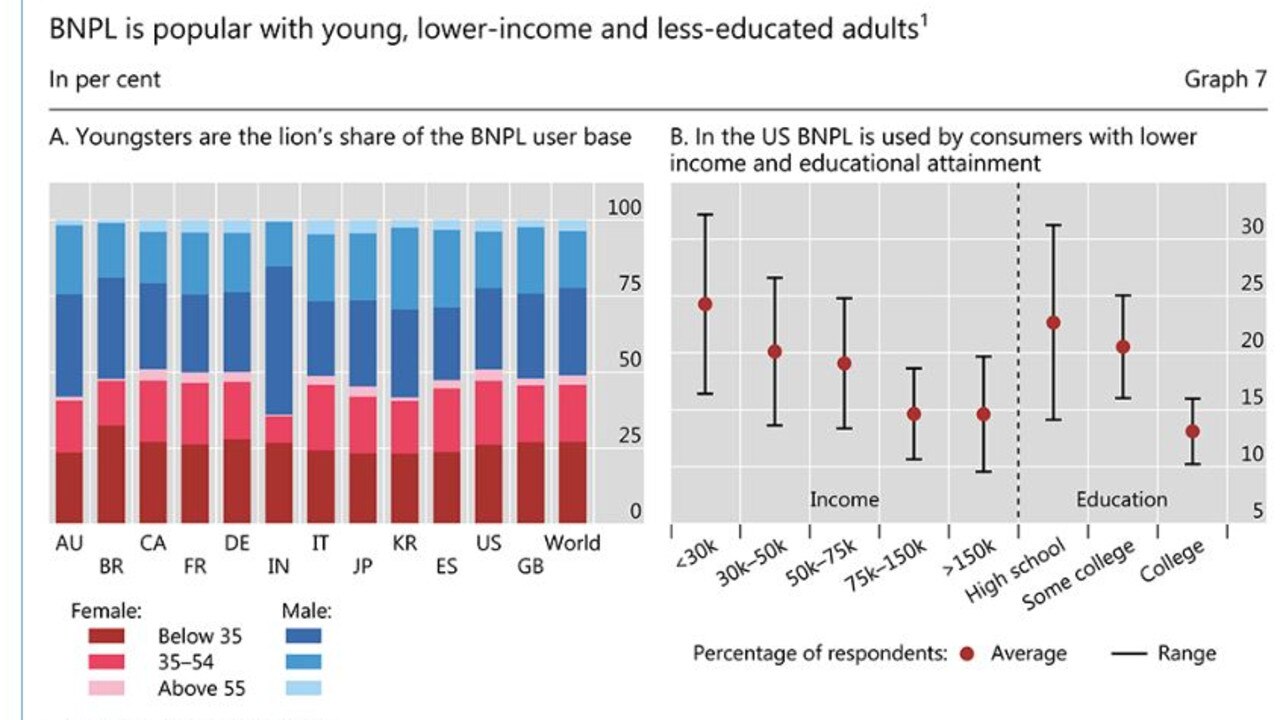

Overall, the report warned that the skyrocketing use of BNPL was a “concern”, as it has lumped people – mostly the young and financially illiterate – with debts they have no way of scraping their way out of.

“The rapid ascent of BNPL could be of concern to public authorities for two reasons: consumer protection issues and the accumulation of credit risk,” the report noted.

It went on to suggest that public authorities should investigate whether these fintechs are “taking advantage” of vulnerable people in society including through “misleading” advertisements and inadequate information about what they were signing up for.

Desperate people tried to take out credit as Covid-19 stimulus packages across the world dried up and turned to BNPL, leading to the explosion in popularity.

But interestingly, the rate of failed BNPL loan payments “spiked significantly” – almost four times higher than the number of credit card loan failures in a sign of one industry being regulated, and the other not.

Tighter regulation of Australia’s BNPL sector, which could see the sector brought under the Credit Act, has been in the works since May this year.

Other countries have also followed in trying to regulate the sector.

The UK is undergoing a consultation with draft legislation, the US has different regulations in each state and the EU has added a revision in its law to protect against irresponsible lending.

Canada, India, Sweden and Singapore have also introduced a clamp down, but with more minor changes than those proposed in Australia.

In April last year, Afterpay reported suffering a $345 million loss. Afterpay chalked up $176.7 million in losses from taking on bad debts.

It comes as BNPL services like Afterpay have been in the public spotlight as it emerged that none of the businesses are that profitable; in fact, many are just losing money.

In February this year, Australian company OpenPay became the first BNPL service to collapse, announcing to the Australian Securities Exchange (ASX) that it had gone into receivership.

In June, Zip hit monthly profitability in Australia, the US and NZ for the first time ever.

Zip Co cut its statutory net loss to $413 million for the year to June 30, down from an eye-watering $1.1 billion the previous year.