Afterpay under fire for withholding $83k from small Australian sneaker business

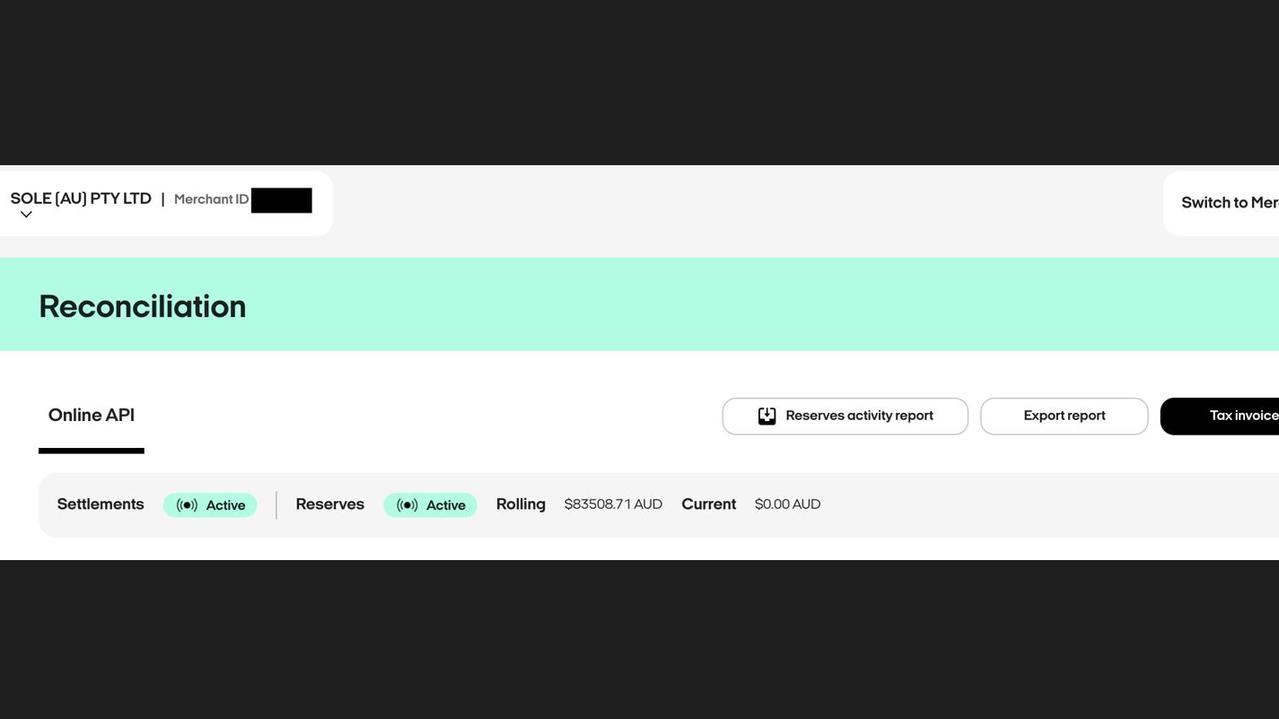

A Sydney retailer is sounding the alarm on Afterpay after the buy now pay later service has withheld $83k of his money for months with no end in sight.

A Sydney retailer is sounding the alarm on Afterpay after the buy now pay later service has withheld $83,000 of his money for months with no end in sight.

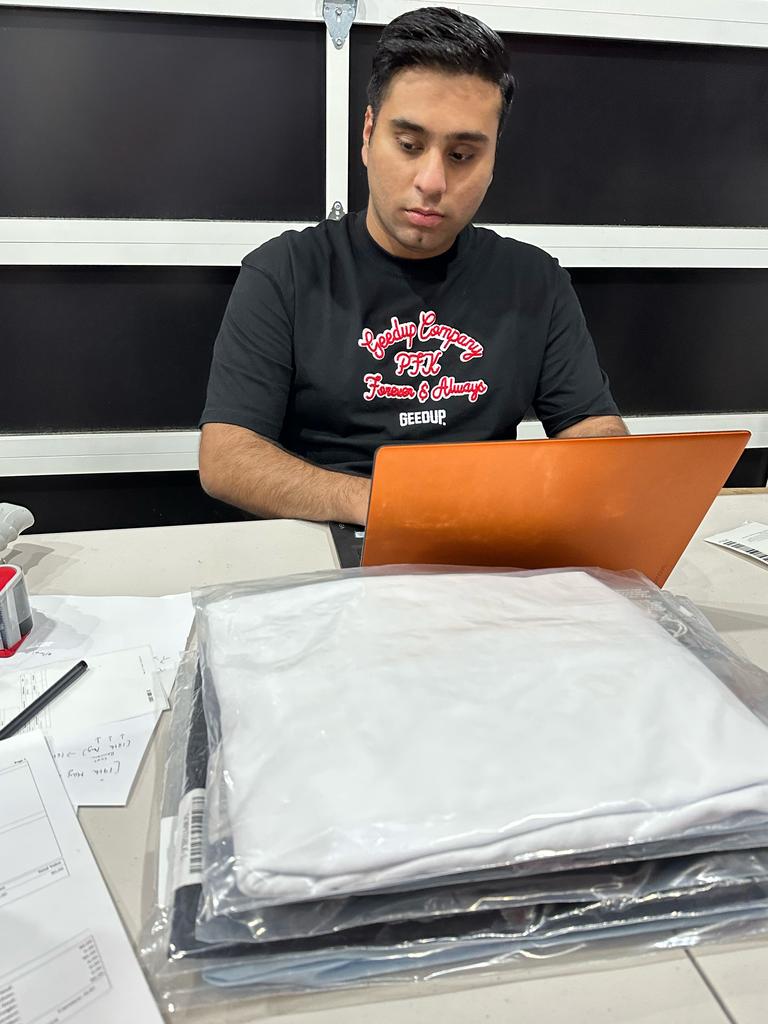

Jiyat Sachdeva is the director of Sole AU, an e-commerce sneaker brand operating out of Sydney, and he has been involved in a spat with Afterpay for the past five months.

He signed his business up to Afterpay in May where he was told he would receive the funds from his sales within one to five business days.

Instead, what has happened is that in the following four months, he has racked up $83,000 in sales, but Afterpay is holding the money indefinitely.

“All their advertising says your customer pays in four instalments, but we pay you the next business day. That’s enticing,” Mr Sachdeva said.

Unfortunately, it hasn’t worked out like that, and despite numerous attempts for the money to be returned to him and even lodging a complaint with the regulator, they aren’t budging.

A clause in the merchant’s agreement means that Afterpay can hold a “rolling reserve” of money if they deem the business poses a higher than normal risk.

“It’s a pretty big, direct impact,” Mr Sachdeva lamented. “We’re going into a loss without receiving that payment. I’m a small business, I’m trying to get out there.”

He says it’s a rort that has netted Afterpay tens of thousands of dollars in interest free cash rightfully belonging to him.

“They’ve basically entrapped us. It’s just ridiculous,” Mr Sachdeva added.

Afterpay would not comment specifically on Sole AU’s case to news.com.au but said “Afterpay may take additional measures to reduce risk exposure for our customers and our business.”

They would not respond to requests for comment regarding if they would pay interest for the time spent holding his funds.

In multiple email chains with his Afterpay account manager, Mr Sachdeva outlined how the “risky” aspects of Sole AU are not in any way the fault of the company’s business model.

“We are NOT a dropshipping business and we do not utilise that business model,” he wrote in a plea to the multi-billion dollar company.

“All our products are 100% authentic and direct from the manufacturers or from authorised resellers of the brand”.

An Afterpay account manager has told him he needs to maintain a return rate of his products at “less than five per cent”.

He has a return rate of 6.2 per cent.

Of the 620 orders he has sold through Afterpay, 40 have been refunded.

The refunds are the result of customer requested order cancellations, change of mind returns, change of size returns, or from the loss of the parcel by Australia Post – none of them to do with the business itself.

“I have 0 chargeback, 0 disputes and 0 Direct Debit Fails received on my merchant account from the time I joined Afterpay,” he added.

Has this happened to you? Get in touch | alex.turner-cohen@news.com.au

Afterpay has been holding a “rolling reserve” of Mr Sachdeva’s money since May despite providing them with proof that no fault lay with the business.

At first, they held the funds for 90 days but upon review, indicated they would continue to hold his sales proceeds for another three months.

The next review is due for mid-November.

“We’re sitting on $80,000 of money we can’t even access,” Mr Sachdeva said.

Afterpay has marked his complaint status as “resolved” when he said it is not resolved at all.

Mr Sachdeva felt it would be a great business decision to work with Afterpay but is unhappy with how they have handled his complaint.

“Sales have been great through Afterpay,” he added.

“It’s boosted sales and added credibility to my brand.” Unfortunately, he is yet to receive the benefit of those sales.

In 2021, Afterpay was bought by a US company called Square for $39 billion. Square has since renamed to Block.

As of 2022, Afterpay claims to have 63,000 retailers using its platform.

In April last year, Afterpay reported suffering a $345 million loss. Afterpay chalked up $176.7 million in losses from taking on bad debts.

It comes as buy now pay later (BNPL) services like Afterpay have been in the public spotlight as it emerged that none of the businesses are that profitable; in fact, many are just losing money.

In February this year, Australian company OpenPay became the first BNPL service to collapse, announcing to the Australian Securities Exchange (ASX) that it had gone into receivership.

In June, Zip hit monthly profitability in Australia, the US and NZ for the first time ever.

Zip Co cut its statutory net loss to $413 million for the year to June 30, down from an eye-watering $1.1 billion the previous year.

Tighter regulation of the BNPL sector, which may see the sector brought under the Credit Act, is in the works.

alex.turner-cohen@news.com.au

Read related topics:Sydney