Victoria Supreme Court orders construction company Snowdon Developments into liquidation

A court has ordered another Victorian construction firm into liquidation, impacting 52 staff members and 550 homes.

A court has ordered Victorian construction firm Snowdon Developments to go into liquidation.

The order, given at a Supreme Court hearing on Wednesday morning, comes after the embattled builder went into administration earlier this month over concerns it couldn’t pay its debts.

“I am satisfied for orders to be made for the defendant to be wound up in insolvency,” Judicial Registrar Kim Woronczak said.

The decision impacts 52 staff members, 550 homes and more than 250 creditors owed just under $18 million.

Wednesday’s decision ends any hope that Snowdon Developments can trade its way out of disaster by being saved by a government bailout or being bought out by another builder, which was still a possibility while it was in administration.

Shane Deane and Nicholas Giasoumi of Dye & Co, Solvency and Turnaround, were appointed as liquidators. The two had previously been administrators.

Fifteen creditors took legal action against Snowdon Developments in April with their debts totalling $2.5 million. They demanded the Supreme Court of Victoria impose a winding up order to force the company to go into liquidation “on the grounds of insolvency” after debts remained unpaid for months.

It comes just weeks after a news.com.au investigation revealed that subcontractors and suppliers hadn’t been paid for months while construction sites languished, untouched, leaving several customers in financial ruin.

Stream more business news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

Snowdon’s case was saved for last in the order of hearings and there were so many creditors that the judicial registrar had to read out a list to make sure everyone was in attendance.

Around 50 people watched on as the construction firm’s financial problems were laid bare.

“It is evidently and blatently insolvent, it should be liquidated,” the lawyer for one supporting creditor said.

Danny Didone of Wyndham Law Offices, who represented several clients taking Snowdon to court, said “it’s quite obvious that it needs to be liquidated”.

Mr Didone said his clients were “troubled” and “concerned” that the legal proceedings had been stretched out for three months, with court documents first filed in April.

“We say that’s extreme delay which has prejudiced supporting creditors,” he said.

“Snowdon should have been in a position many months ago to have realised this company should have been wound up, not after three months when this proceeding had commenced,” he added later on.

Several customers of Snowdon had engaged a representative, Keely Duncan of Maloney Anderson Legal, to add them as supporting creditors.

Ms Duncan told the court the long delay for the company to be liquidated meant her clients had missed a key eligibility criteria for the $15,000 and $25,000 HomeBuilder grant.

To meet the criteria for the grant, building had to have begun on their sites within 18 months of entering into the HomeBuilder contract, but Snowdon has left many sites untouched during that period of time.

“Each of those people who have applied for HomeBuilder are now outside of the 18 month period, making it more difficult for them to receive that sum,” Ms Duncan said.

A total of 550 homes have been impacted.

There are 252 customers who paid their deposit but never had any building work undertaken on their site.

A further 268 home buyers are in “various stages of completion”.

Among them is primary schoolteacher Mira Vose and her husband Anthony, both aged 40, who have forked out more than $30,000 so far in progress payments to Snowdon for her new home, meant to cost a little over $200,000.

Their land was titled in September 2020 and building was meant to commence in March 2021 but it wasn’t until June that the slab was put in.

Then, nine months later, in March this year, the frame finally went up.

Now they find themselves with a partially built house that isn’t entirely covered by insurance because Victoria’s Domestic Building Insurance only pays back up to 20 per cent of the building contract price.

“This whole thing has been a complete and utter nightmare,” Ms Vose told news.com.au immediately after the court’s decision.

“We are going to be out of pocket.”

Their house has had its frame built but no roof has been put on for the past four months — which means the couple are worried their frame is now ruined and they will have to repay for the whole thing.

On top of that; “Because it has been so long and prices have gone up for builds”, Ms Vose added.

She is also paying months more of both rent and mortgage, with expectations her home would be completed by March this year at the latest. Now it will be finished by the first quarter of next year if she is lucky.

However, despite all that, she is glad that Snowdon Developments has gone into liquidation.

“Otherwise they are going to keep on prolonging the whole thing. They’ve been promising me a roof for three months,” she said.

“This is so much better than [Snowdon being in] administration, it’s almost been one and a half years. This is a clean cut, we can claim insurance and move on.”

Snowdon’s administrators were expecting the company to be court-ordered into liquidation, with less than two weeks to turn the company around.

In fact, in the courtroom, the lawyer representing the administrators said: “The administrators seek to have the company wound up in insolvency”.

News.com.au previously spoke to one of the joint administrators, Shane Deane of Dye & Co, Solvency, who said the company’s only way out was if the government bailout had pulled through or if another building company bought Snowdon Developments — which he said was extremely unlikely given the current market conditions.

Last week, Mr Deane said “at last count” Snowdon’s debt had snowballed to $17.8 million between its 262 creditors. Of that, the largest debt is around $4 million, to the tax office. There are also three private creditors owed more than $1 million each.

On June 28, Snowdon representatives approached the Victorian Managed Insurance Authority (VMIA) for financial support.

Although the VMIA “listened” they “had no financial options available”, according to administration documents. Snowdon was referred onto the Department of Treasury and local government.

Two days later, on June 30, Snowdon’s directors met with the Department of Treasury.

“The initial response from Treasury was not favourable,” the administrators said.

The next day, they went into administration.

“If it [external funding] was going to be happen it would probably have been done by now,” Mr Deane, the administrator, said.

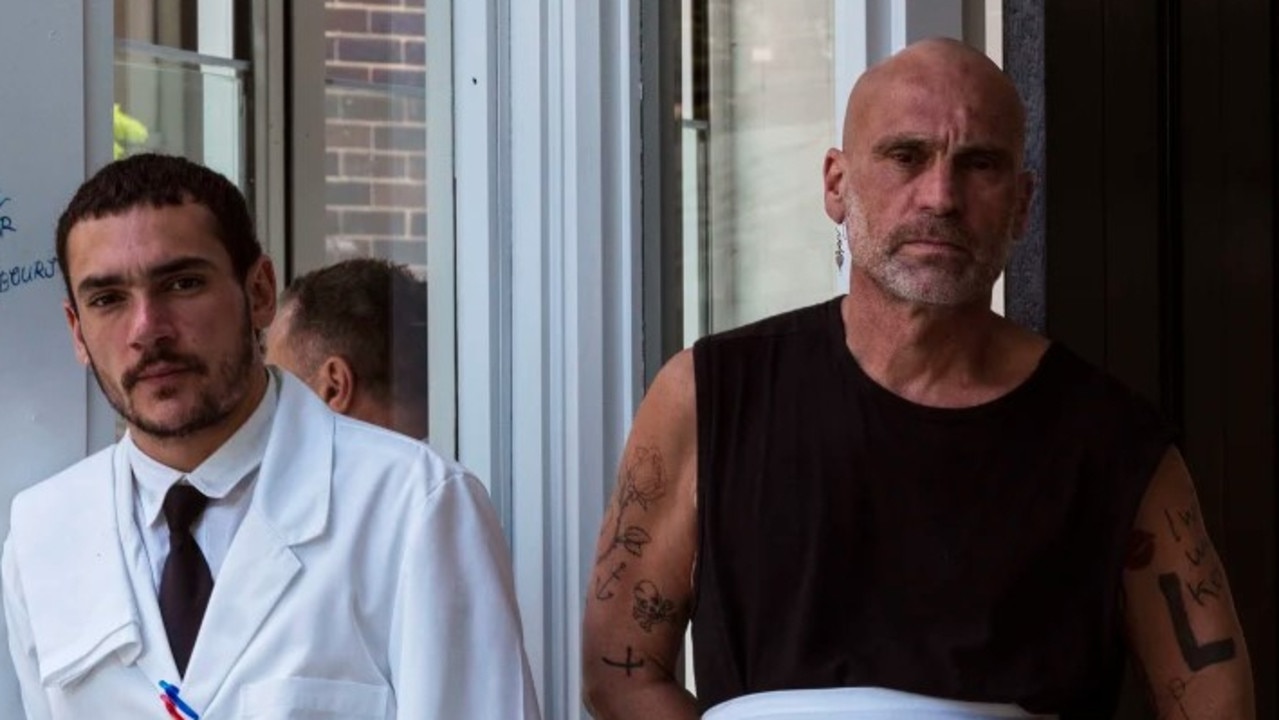

Michael Hassan’s company MD Demolitions was one of the 15 creditors taking Snowdon to the Supreme Court after waiting for more than six months for $103,000 owed to be paid back.

Mr Hassan, with three young kids to support as well as 30 staff who work for him, has visited Snowdon’s Keilor Park office six times trying to get his money.

“There was no money coming into the account to feed the family or pay off the workers,” he previously told news.com.au.

“It’s just sad, I’ve been to the office, I said ‘I’m desperate, I need the money’.

“If I didn’t have financial support behind me, the bank would have taken my property by now.”

For the last three years, the small business owner in his 30s claims he has been enduring late payments from Snowdon but says this was worse.

“It got out of hand so I stopped doing work [for them],” Mr Hassan added.

Snowdon’s liquidation comes after months of building works stalling, suppliers and subcontractors chasing payments and employees not receiving their superannuation. Staff also claimed they had not received their fortnightly pay due on July 4.

Staff had not received their final two weeks’ pay and all 52 were terminated.

alex.turner-cohen@news.com.au

Read related topics:Melbourne