Subbie $102k out of pocket as builder collapses

At any given moment, this subbie is owed $500,000, and he lives in fear of other builders going bust.

A tradie left hundreds of thousands of dollars out of pocket from a building firm going bust is calling for greater protections for subcontractors to spare him more financial pain.

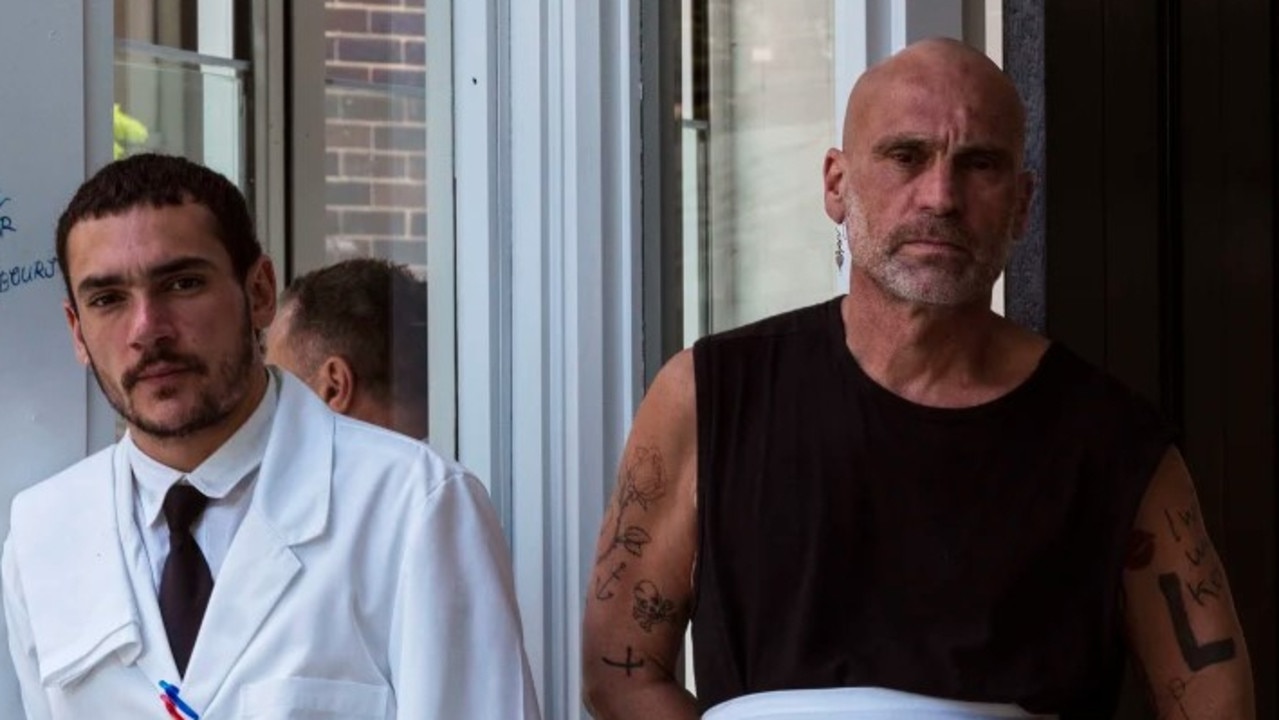

For Tasmanian electrician Kyle Skipworth, at any given moment, he is usually owed around $500,000 in unpaid debts from several builders.

But as building companies drop like flies, leaving a trail of devastated creditors in their wake, he is growing increasingly concerned that every month could be the last for his own business.

Mr Skipworth, a young dad-of-one based in Hobart, is calling for greater protections for ‘subbies’ as they are the ones ultimately left to foot the bill every time a builder collapses.

“Builders have all the power in negotiations. They withhold payment and there is nothing we can do,” he told news.com.au.

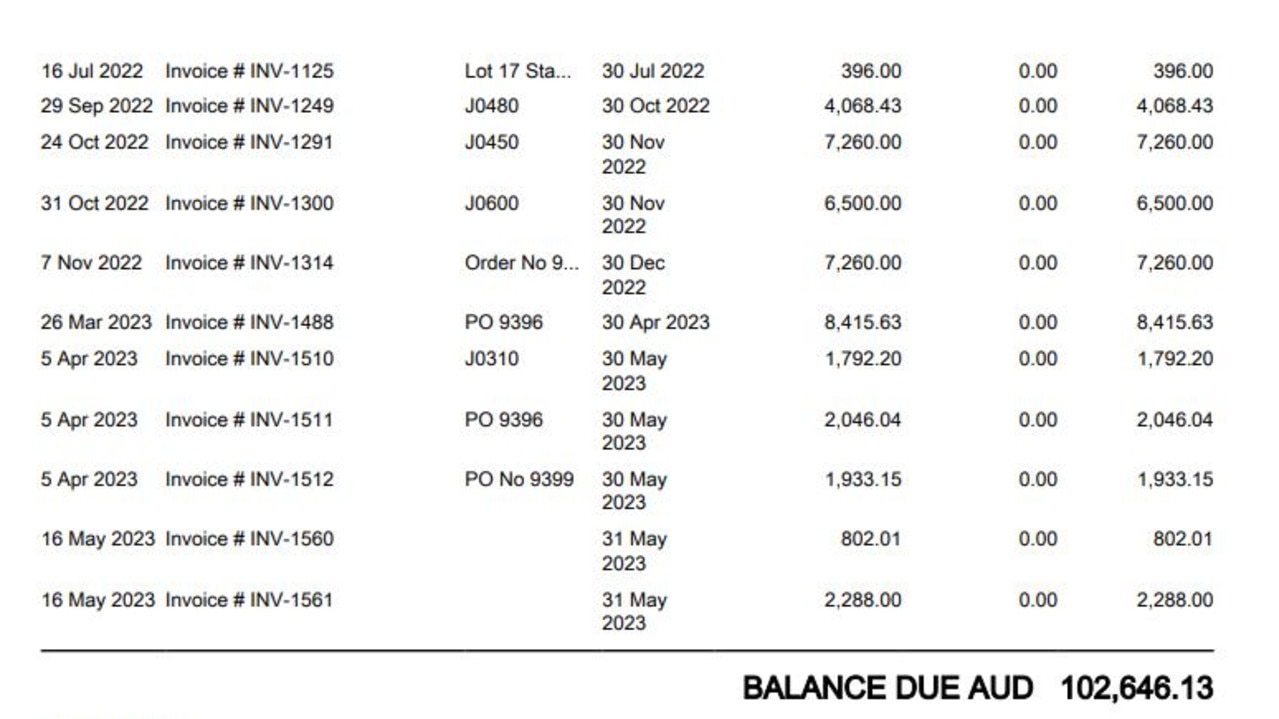

Mr Skipworth, 31, was financially impacted when Tasmanian builder Multi-Res Builders Pty Ltd went into liquidation in May owing $3.5 million.

He wore the loss of $102,000, having to take out a small business loan to keep his company afloat. For the past year he has been paying off the loan, which comes in at $500 a month including interest.

At the moment, he thinks another builder is on the cusp of bankruptcy, after waiting for a $10,000 payment for months.

“I’m usually owed $500,000 between various building companies,” Mr Skipworth told news.com.au.

“It consistently hangs around there, sometimes more.”

For the past few years, Mr Skipworth says he has only paid himself a living wage of $50,000 to get by.

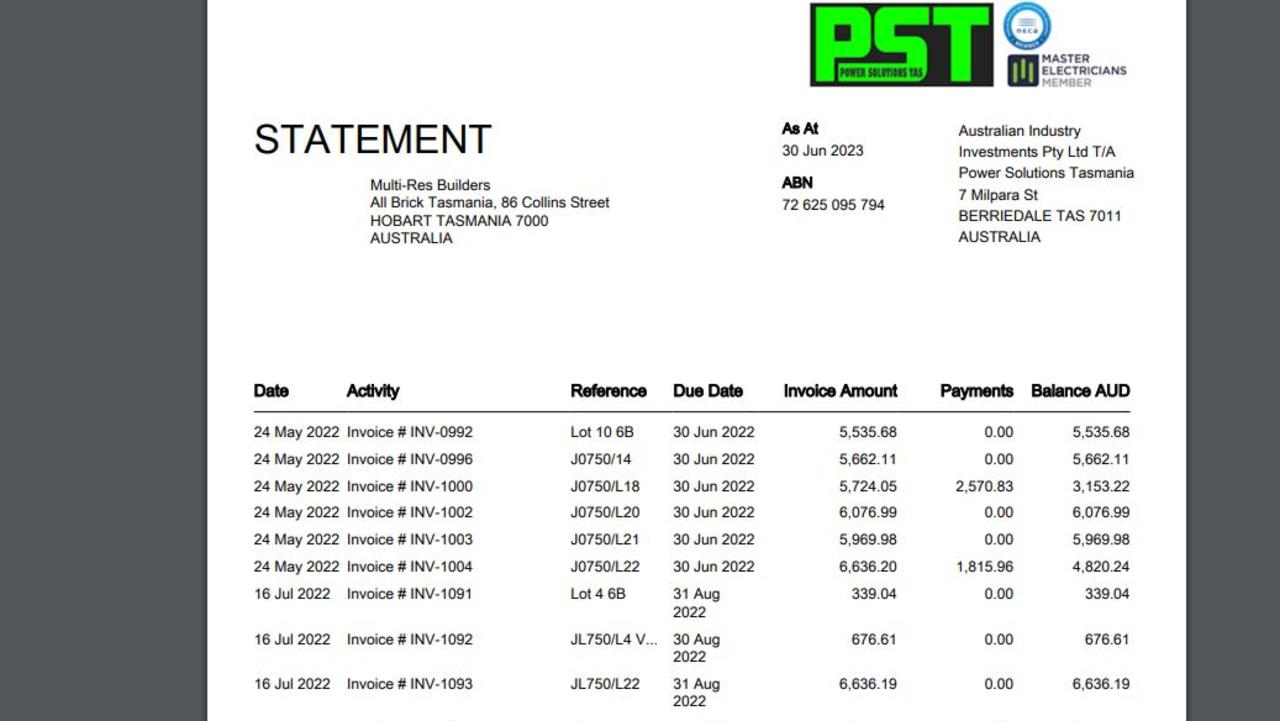

He runs his own electrical company called Power Solutions Tas which wires new building projects and has 16 staff working under him.

Mr Skipworth recalled how he was working for Multi-Res Builders in May last year and “I was two months in before I realised I had a problem”.

“They used the debt as leverage to keep me working,” he explained.

“They just didn’t pay. It was just the promise of payment.”

As a result, the debt continued to pile up, with his invoices going unpaid.

It got to a point where he refused to work for them any longer. For a while, things were at a standstill, until a new subcontractor was brought in to finish the job.

Then in March this year, his worst fears were realised; Multi-Res Builders had appointed liquidators.

“I was disappointed, I’d held hope for 12 months that the company was generally reasonable and would honour their word,” he said.

“When they liquidated I knew then I wasn’t going to get my money.”

Have a similar story? Get in touch | alex.turner-cohen@news.com.au

The crux of the issue, according to Mr Skipworth, is pretty much no safety net for subbies like himself.

“Because contractors have no rights, this is what happens,” he lamented.

“It’s really hard as a contractor because we have no rights unless it’s in a contract.”

But, he explained, putting in strict contract conditions, such as a personal guarantee of payment, would usually result in the building company walking away and finding someone else who would do it without onerous clauses.

“And even if a contract is made, they just pull out, and then it’s up to me to fight them legally,” he added.

The National Electrical and Communications Association (NECA) CEO, Oliver Judd, said cases like this were all too common.

“Whilst we continue to work with government on strengthening security of payment laws, reform cannot come fast enough,” he said.

“We’re hearing stories of more and more families and subcontractors being affected by head contractor liquidations every week.

“It’s now at record levels and the sooner we introduce reform the more people we can prevent from suffering.

“If we continue to drag our feet on this, it will be to the detriment of the entire industry”.

ASIC insolvency statistics show 2213 building companies collapsed during the 2022-23 financial year — a 72 per cent increase on the previous 12-month period.

The alarming trend has been blamed on a “perfect storm” of factors, including fixed price contracts, escalating costs, supply chain disruptions and tradie shortages.

The previous Morrison government’s HomeBuilder grant, which was introduced in June 2020 and handed out $2.52 billion to owner-occupiers who wanted to build or substantially renovate a home, turbocharged the sector.

More than 130,000 customers signed on for the program, with many tradies agreeing to the work under fixed-price contracts that soon became unsustainable as prices began to soar.

This year alone, news.com.au has reported on dozens of major builders that have collapsed.

Australia’s 13th biggest builder, Porter Davis, also collapsed earlier this year, placing 1700 projects and another 779 empty blocks of land in jeopardy across Victoria and Queensland, while more than 1000 unsecured creditors owed a whopping $71 million.

In one week in July, news.com.au reported on a new builder going into external administration every day.

alex.turner-cohen@news.com.au